Who checks the activities of the homeowners association. - Recommendations for members of audit commissions carrying out inspections of the financial activities of HOAs

Each resident of an apartment building may face problems regarding its management, the correct organization of its operation.

In addition, questions may arise regarding cleaning adjoining territory, repair of building structures.

Dear Readers! The article talks about typical solutions legal issues but each case is different. If you want to know how solve exactly your problem- contact a consultant:

It's fast and IS FREE!

The owner of the premises is not able to resolve all the issues related to the problems of operating an apartment building alone, so joining a partnership formed by the owners may be the way out.

What it is

Often, residents of an apartment building regard the actions of the HOA, its chairman regarding financial transactions not meeting the requirements of the charter.

They believe that the cost utilities high, overpriced estimated cost for the production of repairs in the driveway, the quality of the work performed does not meet the requirements building codes and rules.

Questions regarding the requirements of the owners of the premises are resolved by the Audit Commission.

According to the definition given in the regulations, it is the supervisory authority exercising control over the financial and economic activities of the organization.

The Audit Commission is empowered to carry out inspections at any time during current year.

In accordance with the standards, the auditing commission checks the activities of the partnership annually, after which its results are presented to the general meeting.

In addition, an estimate is subject to presentation, drawn up on the basis of income received and funds spent, and a report, which indicates the size of contributions and payments made to it.

They are established by the board and approved at the general meeting. The estimate is drawn up by the board of the HOA in accordance with the provisions.

It allows you to set the amount of payment, which is paid monthly by each owner of the premises.

In addition to her, the estimate includes the costs of cleaning the local area, maintenance in good condition engineering systems heating, water supply and sewerage, gas supply, repair work in individual building structures.

It includes the costs that are established by the standards of legislative acts, the charter of the HOA. The norm is laid down in the provisions.

Legal acts

In addition to it, a number of provisions are enshrined in the charter, separate regulations, developed on the basis of the above.

The Audit Commission is elected for two years, after which it is disbanded. For the implementation of activities in subsequent years, its composition is re-elected.

According to generally accepted rules, the owners of the premises donate contributions to the partnership, the basis and objectives of the audit by the audit commission are to establish their spending in accordance with the articles provided for in the estimate.

Election process

The members of the Audit Commission are elected at the general meeting of the owners of the premises by voting.

As a rule, it includes outsiders who specialize in the field of finance, the owners of premises that are not its members.

The number of members of the audit commission is established by the general meeting, based on the provisions of the charter.

A chairman is elected from among its members to represent the interests of the audit commission to members of the HOA, its board and chairman.

Concerning legal status, then the composition can include both legal entities and individuals.

A prerequisite is that they reach the age of majority, their recognition by medical and social expertise as capable.

Video: cost estimate of HOA and housing cooperative

Commission position

In each partnership, an act "" is developed, which is the main document that defines its rights and obligations.

The act is approved by the general meeting, which is given the opportunity to make amendments, proposals and comments on its provisions.

The regulations on the audit commission are approved by the general meeting in the manner prescribed by the charter.

Audit of HOA

The Audit Commission is empowered to demand any documents regarding economic or financial activities organizations.

If violations are revealed during the check, then she calls a general meeting. The issue of the competence of the board or its chairman is put on the agenda.

In this case, the meeting is presented with documents confirming the fact of violations committed by them.

Who can initiate

Individual members of the HOA are wondering how to check its financial activities.

Each member has the right to initiate the start of the audit if he has any doubts about the financial economic activity.

He must write a request for the implementation of the audit, which is submitted to the audit commission.

If desired, the above person can organize the collection of signatures of other members so that his claims are not individual in nature, but are dictated by public opinion.

Where does the activity begin

To verify the activities of the HOA, the audit commission must draw up a work plan.

On the basis of the submitted application, the Audit Commission requests documents from the Management Board concerning financial or economic activities.

As noted above, the board is obliged to submit the documents required for the audit in order to clarify the fact stated in the request.

The duties of the chairman include checking the validity of the requirements and comments that are set out in the petition of the residents of the apartment building.

It is carried out for 5 days, after which the chairman gives a written answer.

He has the right to send a request to the utilities serving the house for information regarding the issues that arise during the audit.

Based on the results of the audit, the audit commission draws up an act, which is signed by the chairmen of the commission, its chief accountant. If there are objections or comments, then they are indicated in the act.

In addition, business paper in writing, which is submitted to the chairman of the audit commission.

She is attached to the materials collected during the audit, because it is an integral part of the act.

What are the rights and obligations

For the proper performance of the functions assigned to it, the audit commission is endowed with the right to demand:

| From the board of the partnership, its chairman, chief accountant, officials enterprises supplying resources to an apartment building, utilities documents and materials necessary for the inspection | they must be submitted within 10 working days, counted from the date of receipt of the request |

| Convening an extraordinary meeting of the board and general meeting its members | if in the course of the inspection violations are found that are directly related to economic, financial activities, the rights and interests of the owners of premises, offenses that contribute to the creation of a threat to the interests of the HOA, which require urgent resolution of issues within the competence of the board, its chairman |

| Explanations from the board | its employees involved, including officials on issues that are within the powers of the audit commission and the employee |

The Audit Commission resolves the issue of convening an extraordinary meeting of HOA members by voting.

At the same time, she may demand that proposals and comments be included in the agenda of the issue. Her demands must be submitted to the board in writing.

She must substantiate her demands, otherwise, her actions are regarded as unlawful.

According to generally accepted rules, the board convenes a general meeting of the organization's members within 10 days.

The countdown is carried out from the date of receipt by the board of the decision of the audit commission on its extraordinary convocation.

The Board may refuse to convene it, but the measure is associated with the consideration of the case about its activities in court.

Her responsibilities include the implementation of scheduled and unscheduled inspections. Usually, scheduled inspections can be held every quarter, after the end of the current year, unless otherwise provided by the charter.

As for the unscheduled ones, they are carried out at the request of the owners of the premises and other interested parties. For example, management company for the delivery of water to an apartment building.

The audit commission can carry out the audit of financial activities on its own.

But the legislator allows to involve involved persons, specialists with appropriate qualifications.

Doing basic work

As a rule, the income of the HOA consists of contributions paid by the owners of the premises, compulsory payments, and other types of income included in the charter.

For example, rent for use non-residential premises apartment building, government subsidies allocated from federal budget to maintain the house in proper condition, grants.

During the audit, the tariffs assigned by the board for the owners of premises as rent, utility bills are checked. They may differ from the tariffs assigned by the municipality.

The spent funds must correspond to the items of expenses provided for in the charter of the partnership.

The Audit Commission carries out activities aimed at:

The audit committee should check the availability of estimates of income and expenses, which are approved by the general meeting.

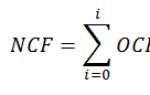

They must comply with the budgeting rules. Each calculation made must be justified by calculations with reference to the formulas approved by the Ministry of Finance of the Russian Federation.

It is also necessary to check the reports of the board to make sure that the funds generated in the partnership are spent correctly.

Sample report

There is no single report form approved by the legislator, therefore the reports of the audit commissions have some difference.

They should be drawn up according to the rules of registration financial documents... Practice shows that the best form is a tabular form that is easy to read.

It can consist of an explanatory note and tables, which is convenient for understanding and assimilation.

The input section of the explanatory note states:

It must contain reliable facts, documented.

For example, by the conclusion of a specialist in the field that is subject to verification, explanatory notes officials responsible for the material part.

In the main part explanatory note a detailed description is given:

The report is accompanied by documentary materials concerning the committed violation, their copies, certificates, explanatory notes.

If there are controversial situations regarding the consistency of results audit on the facts of violations and the provisions on the audit commission, it is necessary to be guided by the instructions of the current regulatory legal acts in its implementation.

Measure of responsibility

As a rule, the audit committee is solely responsible to the general meeting of the owners of the premises.

The commission is accountable to him, therefore, every year after its expiration, it submits a detailed report on the work carried out.

It indicates the amount of funds received from the owners of the premises, their spending on the needs of the common property.

In addition, it reports at the end of the quarter, if the charter provides for quarterly audits on the implementation of the financial and economic activities of the HOA.

When unscheduled inspections are carried out on the basis of statements by the owners of the premises, the report is submitted immediately after its completion.

In all of the above cases, an inspection report with all accompanying documents is attached to the report.

And in conclusion, it should be noted that it is advisable to elect persons who have the qualifications of a lawyer and an accountant as a member of the audit commission.

Conducting an audit requires the competence of persons in matters related to the legal preparation of documents and drafting accounting... The measure is aimed at the competent execution of the audit.

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and WITHOUT DAYS.

Homeowners' Association - non-profit organization, pursuing for its own purposes the joint management of owners of common property in an apartment building. The management of the HOA is obliged to act within the framework of the legislation of the Russian Federation. The partnership must regularly send reports with the help of which supervisors monitor the organization's work and identify errors. Gross violations cause unpleasant consequences for the owners and the entire partnership.

Types of reporting on HOA

Fellowship like entity, is obliged to report annually on the results of its work. A request for information can come both from the owner of the premises, by sending an appropriate appeal, and from higher authorities.

Internal reports

Provided to owners of residential premises at the annual meeting, which is held in accordance with Art. 45 LCD RF, in the second quarter of the year following the reporting one.

IMPORTANT! The main function is to prove the competence and legality of the actions of managers in the field of residential building management.

Chairman's report

The chairman's activity report is based on data on the work done and the fulfillment of the duties established job description, which include:

- Management of the board.

- Budgeting income and expenses, cash flow control.

- Control over the fulfillment of the terms of the agreement between the HOA and contractors, resource supplying, service organizations.

- Accounting and tax reporting, providing data to the IFTS.

- Reception and dismissal of workers.

- Control over the maintenance of public property in proper form, for example, make a decision to start repairs, check the elevator, etc.

Each partnership, based on its goals and problems, approves its job description.

Board report

The HOA board is created to assist the chairman in fulfilling his responsibilities for managing the MKD, their functions are similar. In accordance with clause 4 of Art. 151 ZhK RF, management can dispose of collective funds in accordance with the approved budget. The partnership income is formed from:

- payments and contributions from owners;

- received government subsidies, including for the maintenance and operation of apartment buildings, the provision of utilities;

- proceeds from financial and economic activities (FCD);

- miscellaneous income.

The income is spent on the general expenses of homeowners' associations for maintenance, repair, management, maintenance of the house, the salaries of hired workers, and part of the funds is sent to specialized funds.

Based on the available data on the estimated revenues and costs, the board forms an estimate of the homeowners' association, the report on the implementation of which is submitted to the general meeting.

The main reason for declaring bankruptcy is the homeowner's debts to resource-supplying organizations, which apply to the court with a statement of claim in order to recover unpaid funds.

Responsibility of HOA

The investigation examines the chairman's activities for deliberate bankruptcy. If violations of the law by the head are revealed, measures of administrative and criminal liability will be taken against him. under Articles 160 "Appropriation and Waste", 285 and 286 "Abuse and Excess of Authority" of the Criminal Code of the Russian Federation.

If the guilt is not proven, the partnership will answer for its obligations with its own property (transport, office equipment, bank accounts, real estate), which will be sold, and the funds will be sent to pay off debts.

Responsibility of owners

The owners of residential premises are responsible for the debts of the HOA in the event that the reason for their occurrence is the non-payment of utilities by the owners themselves. In this case, the resource supplying company will take legal measures to collect debts: limiting the supply of a resource or going to court.

Homeowners' reports are classified as internal to the general meeting and external to supervisors. Any citizen has the right to receive information on the results of the work of the managing organization, after sending a corresponding request.

The inspection of the HOA is carried out annually by the audit commission or an independent audit firm.

State supervisory authorities check the work of the organization by studying the reports received, as well as unscheduled, on the basis of complaints from citizens. If a violation of the law is proven, then the partnership is held accountable.

In order to collect debts from HOAs, they send statement of claim v arbitration court, which assigns an audit of the FHD to find out the reasons for the formation of debt. Often, the partnership does not have the means to solve its problems and is liquidated with debts.

A partnership of owners is an organization that performs a number of important functions. Employees and board members of the HOA are engaged in several activities at once in order to maintain an apartment building in excellent condition.

Such an association is a non-profit organization. Despite the fact that almost every responsible person has access to finance and has the ability to dispose of them, the community does not function for the purpose of enrichment, but conducts a stable activity of managing the fund's resources for the benefit of residents.

The tasks of the HOA include competent and honest management of an apartment building. In some cases, such an organization has the opportunity to receive financial resources through doing business or through participation in a state program, but all the proceeds cash should be aimed at improving the living conditions of the owners, and not for the personal enrichment of board members or certain members of the cooperative (in front of residents?).

Homeowners' association is a legal entity. This organization is obliged to pay taxes, since in the implementation of its activities it uses the labor of hired workers (?). Any community of residents can open an HOA. When choosing money management methods, it is advisable to make sure that there are competent and interested participants in home improvement.

Financial

Responsibilities of the HOA includes a monthly collection of a predetermined amount of owners' funds... This event is necessary to maintain the residential building and the adjacent territory in optimal condition.

To increase your budget, you can rent common areas that are not used by the owners. Such decisions can be made by members of the board, but before that they must consult with the owners of residential real estate at a general meeting.

Economic

The main activity of the HOA is the direction financial resources to conduct maintenance, construction of additional structures important for the owners. The tasks of the organization include the timely repayment of utility bills, the elimination of all debts, remuneration of employees and firms with which appropriate agreements have been concluded (about what accounting, legal and technical services for HOAs and who the housing association services are provided to, read).

The main activity of the HOA is the direction financial resources to conduct maintenance, construction of additional structures important for the owners. The tasks of the organization include the timely repayment of utility bills, the elimination of all debts, remuneration of employees and firms with which appropriate agreements have been concluded (about what accounting, legal and technical services for HOAs and who the housing association services are provided to, read).

It's not just about maintaining a presentable appearance at home, but also the maintenance of communications, systems important for residents (read how to write a statement to the HOA about a roof leak, flooding an apartment and other problems).

The HOA employees are assigned certain responsibilities, including minor renovation work, cleaning the territory, keeping green spaces in optimal conditions, if any, as well as monitoring the implementation of important functions.

Other types of work

Housing inspection

This organization has the authority to audit the activities of the HOA. Usually the supervision of the activities of the owners' partnership carried out when the facts of dishonesty or waste of funds are revealed... Often, the members of the association independently report to this service their suspicions about the unjustified waste of financial resources or the concealment of income.

Prosecutor's office

Upon receipt of a substantiated complaint about the activities of HOA employees, the prosecutor's office assigns employees to conduct an audit. In order for prosecutors to pay attention to a specific complaint, it is necessary to tell in detail about the violation of the rights of residents by the board of the HOA. You can indicate both the fact of a systematic deviation from the established rules, and a one-time gross violation.

Audit

If residents of an apartment building notice that the data in the payment documents does not correspond to the estimate, express reasonable suspicions of theft or embezzlement, they can use audit services. This event can be held both at the initiative of a group of residents, and with the appropriate decision of the housing inspection.

If residents of an apartment building notice that the data in the payment documents does not correspond to the estimate, express reasonable suspicions of theft or embezzlement, they can use audit services. This event can be held both at the initiative of a group of residents, and with the appropriate decision of the housing inspection.

If you suspect that the board of a particular partnership of owners is engaged in inappropriate activities, you can check online whether a particular organization is allowed to perform certain actions or this moment employees are using their powers illegally.

- You should go to the OKVED website, determine a specific city, enter the name of the organization.

- Add specific information if necessary.

- Having found the HOA you are interested in, you can see the entire list of activities allowed for this association.

Step-by-step verification instructions

Each member of the HOA is a client of this organization, has the ability to inspect the activities of its employees. One of the most popular control options is the creation in accordance with Article 150 of the RF LC.

Article 150 of the LC RF. Auditing commission (auditor) of a homeowners' association

- The audit commission (auditor) of a homeowners' partnership is elected by the general meeting of the members of the partnership for no more than two years. Members of the board of directors may not be members of the audit commission of a homeowners' partnership.

- The audit committee of the homeowners' association shall elect the chairman of the audit committee from among its members.

- The audit commission (auditor) of the homeowners' association:

- conducts at least once a year audits of the financial activities of the partnership;

- submit to the general meeting of the members of the partnership a conclusion on the results of the audit of the annual accounting (financial) statements of the partnership; submit to the general meeting of the members of the partnership an opinion on the estimate of income and expenses for the corresponding year of the partnership and a report on financial activities and the amount of mandatory payments and contributions;

- reports to the general meeting of the members of the partnership on its activities.

The composition of this commission includes tenants who are not members of the board of housing cooperatives. The Audit Commission has the ability to control the activities of the board members, but cannot influence the final decisions.

After filing a complaint with the relevant authority, an expert assessment is carried out, in which specific facts of violation of the legislation of the Russian Federation or the terms of the contract are revealed. Usually, penalties are imposed, but in some cases criminal proceedings are opened.

You can check the activities of the HOA yourself. Review the inventory, check out accounting reports(?). Check all the listed expenses with documents confirming the fact of carrying out certain works.

If the services of subcontractors were used to carry out repairs or perform other functions, inquire official information about such companies can be found through the USRR. If there is any doubt about the honesty of the HOA board, you need to order an audit, which reveals the facts of abuse of authority, waste and appropriation of funds.

Reasons for initiating a criminal case

There are factors, guided by which, you can apply for the initiation of a criminal case:

- Violating the rights of residents or performing actions that do not comply with the law. First of all, the court considers cases in which the actions of the board and other employees of the HOA caused significant harm to the residents multi-storey building or caused losses for the owners.

- Conducting officially unregistered activities. In connection with non-payment of taxes for the income received, liability is incurred for all persons involved in the offense.

Conclusion

If illegal actions of the board are detected, the fact of embezzlement of funds, it is necessary to check the HOA. The authorized organizations will find out the list of violations, determine the responsibility for the perpetrators. When contacting the prosecutor's office, housing or tax office you can find out the reason for the poor quality of maintenance of a residential building, prevent further offenses.

If you find an error, please select a piece of text and press Ctrl + Enter.

The audit methodology for non-profit organizations - homeowners' associations should be developed by an auditing organization to systematize approaches to organizing an audit. This technique can be used as a basic guide to auditing and other non-profit organizations in the field of housing and communal services. Auditing firms conducting audits can use this methodology when developing in-house standards and guidelines that establish binding general and specific principles and approaches to auditing in the field of housing and communal services.

Structurally, the methodology includes several sections (Fig. 16.1). In sect. Method I presents the preparatory stage, in Sec. II - "Gathering information and audit evidence, systematization of verification materials "describes some technical aspects practical application provisions and approaches of the methodology, methodological approaches to the collection of audit evidence, sect. III discloses approaches to assessing audit results.

Rice. 16.1.

During preparatory phase Along with the execution of the usual for any inspection work on drawing up a plan, program, letter of consent to conduct an inspection, drawing up and signing a contract, work is being performed that differ depending on which inspection is primary or repeated. At initial check a preliminary assessment of the activity should be carried out, the conditions for verification should be agreed. At re-check it is necessary to familiarize yourself with the materials of the previous audit, evaluate how corrections were made and the auditor's recommendations were implemented. Sources of information are estimates of the current and past period, calculations of income and expenses, registers analytical accounting, analytical registers, reporting, regulations.

Special check section - verification of the validity of estimates of income and expenses of homeowners' associations and their implementation... When calculating income from the sale of services, municipal tariffs are used.

Even if the HOA does not have any commercial activity, savings are generated in the amount of about 10% of the annual aggregate payment of tenants. For a house with 450 apartments, this is about 800,000 rubles. The auditor should give an opinion on the optimal setting of fees for homeowners, the effectiveness of the use of temporarily available funds. In particular, it is necessary to establish whether temporarily free funds bring income, where they are stored, whether the conditions are optimal for their storage and ensuring profitability.

During the check HOA estimates auditors, as independent professionals, check the financial statements, carry out an examination of payments and contributions of HOA members for the economic feasibility of items of expenditure, consult on accounting, tax, management accounting, legal issues.

A special section of the check is audit of income sources of homeowners' associations, which, in accordance with the Housing Code of the Russian Federation, are:

- from compulsory payments, entrance and other fees of members of the HOA;

- subsidies for maintenance common property in an apartment building, carrying out repairs, providing certain types utilities;

- income from business activities;

- miscellaneous income.

The auditor should check the legality of the entrepreneurial activity carried out by the TOK. As a non-profit organization, the HOA has the right to conduct entrepreneurial activity only insofar as it serves the achievement of the goals for which it was created. At the same time, the legislation of the Russian Federation establishes restrictions on the entrepreneurial activity of certain types of NCOs. In particular, the list of types of economic activities that a HOA can be engaged in is closed and includes:

- maintenance, operation and repair real estate in an apartment building;

- construction additional premises and objects of common property in an apartment building;

- lease, lease of part of the common property in an apartment building.

The auditor also checks the accuracy of taxation of profits, since the HOA is a payer of income tax on the basis of Art. 246 of the Tax Code of the Russian Federation. To this end, it is advisable to qualify the above types of income for the purposes of taxation of profits. According to Art. 247 of the Tax Code of the Russian Federation, income tax is subject to income tax, reduced by the amount of expenses incurred. In this case, paragraph 2 of Art. 251 of the Tax Code of the Russian Federation provides for a number of incomes that are not taken into account when determining the tax base, such as earmarked income from the budget to budget recipients, earmarked income for the maintenance of non-profit organizations and their statutory activities, received free of charge from other organizations and (or) individuals and used by these recipients for destination.

The auditor should check the accuracy of referring to targeted receipts for the maintenance of the partnership and the conduct of its statutory activities HOA income... In particular, entrance fees, membership fees, share contributions, as well as donations recognized as such in accordance with The Civil Code RF. Particular attention should be paid to the fact that contributions must be made in accordance with the legislation of the Russian Federation. The auditor determines whether all contributions paid by members of the HOA (owners of premises in an apartment building) are earmarked income and are not subject to taxation. To this end, it is advisable to check the correctness of registration of entrance and other contributions of HOA members, mandatory payments. Despite the fact that the activities of house management, maintenance, operation and repair of common property are statutory for HOAs, compulsory payments cannot be recognized as targeted receipts for the maintenance of NPOs and the conduct of statutory activities, since the list of targeted receipts is closed and does not provide such income as compulsory payments of members of the HOA.

The auditor should check the validity of the membership of the HOA members of the mandatory payments and contributions established by the management bodies of the HOA related to the payment of expenses for the maintenance and repair of common property in an apartment building, as well as payment of utilities, which can be classified as compulsory payments, contributions, but not as admission or membership fees. It is required to establish the procedure for the formation and amount of such payments and contributions of members of the HOA, whether it is determined by the management bodies of the HOA in accordance with its charter (clause 8 of Art. 156 of the RF LC). In this case, the amount of payment for utilities is calculated based on the volume of consumed services determined by the readings of metering devices, and in their absence - based on the consumption standards approved by local authorities (clause 1 of article 157 of the RF LC). The payment of the members of the HOA or the housing cooperative for the maintenance and repair of residential premises, which includes payments for services and work on the management of an apartment building, maintenance, current and major repairs of common property in an apartment building, as well as payments for utilities are qualified as proceeds from the sale of work , services.

From the legislative definition of the HOA it follows that the HOA is created for the joint management of a complex of real estate in an apartment building, ensuring the operation of this complex, therefore, the HOA provides the owners of premises in an apartment building with services for its management and operation. If there are owners of premises in an apartment building who do not wish to join an HOA, then the law obliges the partnership with them to conclude agreements on the maintenance and repair of common property in an apartment building (item 2, article 138 of the RF LC). In accordance with these agreements, the owners pay for housing and utilities (clause 6 of article 155 of the RF LC). Such receipts can be unambiguously classified as proceeds from the provision of HOA services. Moreover, these payments for organizations - owners of premises in the house will be the cost of paying for operating, utilities, reducing tax base for income tax. Moreover, they cannot be taken into account on the basis of paragraphs. 29 p. 1 of art. 264 of the Tax Code of the Russian Federation as targeted membership fees to non-profit organizations.

The auditor must check the elements of mandatory payments of HOA members from the point of view of taxation of HOA income for the elements included in it (payment for the maintenance and repair of housing, for utilities). At the same time, the auditor should bear in mind that the services and work on the management of an apartment building, maintenance, current and overhaul of common property in an apartment building are the types of economic activities that, in accordance with the Housing Code of the Russian Federation, are allowed to be conducted by a HOA. Therefore, the recognition of HOA income in the form of maintenance and repair fees as taxable sales proceeds appears to be legitimate and fair. But at the same time, the HOA has the right to take into account the justified and documented costs associated with the maintenance and repair of property as part of expenses, which should be checked by the auditor.

When checking the payment for utilities, it should be borne in mind that the HOA, created to ensure the operation of the house, does not itself provide utilities, but concludes contracts with utilities in the interests of the owners of premises and is only an intermediary in the transfer of money to utilities organizations that provide utilities tenants. The partnership pays for these services from funds received in the current account in the form of utility bills, acting on the terms of the representative office. The auditor should find out whether it is reflected in the statutory documents that the HOA is engaged in collecting and directing funds for house maintenance, and not in the provision of utilities. Since the HOA does not provide services, there is no taxable income. According to Art. 41 of the Tax Code of the Russian Federation income an economic benefit is recognized in monetary terms, or in kind, taken into account when it is possible to assess it and to the extent that such benefit can be estimated. Acting only as a transit organization, the HOA does not receive economic benefits.

You should check the amount of money collected from residents on the basis of invoices issued by organizations directly providing utilities. It should be borne in mind that if the collection of funds is carried out in the amount of the services actually consumed by the tenants, then these amounts are not included in the income of the HOA for the purposes of taxation of profits. However, in the event that the funds collected from the residents exceed the amounts of utilities actually used by them, as well as when these funds are used for other purposes, these funds are considered as income of the HOA.

The functions of the HOA are planning, organizing and carrying out major repairs of an apartment building, in this regard, when checking the reporting, the accuracy of the formation of a reserve for repairing an apartment building should be audited, and the procedure for planning and spending funds should be established. The auditor should establish whether an estimate is being made for overhaul how education is regulated reserve fund for repairs, is there a decision of the general meeting of the HOA members, the competence of which includes these issues in accordance with housing code(subparagraph 5, paragraph 2, article 145 of the LC RF). The costs of creating a reserve for the upcoming house renovation do not reduce the tax base for income tax, since the costs of house renovation can be taken into account only after their actual implementation on the basis of paragraphs. 49 p. 1 of art. 264 of the Tax Code of the Russian Federation as other costs associated with production and sale.

A special section of the audit is the audit of income from renting out common property and their use. A homeowners' association has the right to provide for use or limited use a part of the common property in an apartment building, rent out a part land plot, basements, if this does not violate the rights and legitimate interests of the owners of premises in an apartment building (subparagraphs 1 of paragraph 2 of article 137 of the RF LC). It should be borne in mind that these incomes are non-operating (clause 4 of article 250 of the Tax Code of the Russian Federation) and are subject to taxation.

The next section of the audit should be tax audit issues. The special status of HOAs determines the specifics of VAT taxation. The emergence of the object of taxation with this tax depends on the qualification of the HOA's activities in the quality of the provision of services. House management, maintenance, repair of common property qualifies as the provision of services, which causes the obligation to calculate and pay VAT.

When checking personal income tax, it should be borne in mind that the partnerships from which taxpayers received income are tax agents and are required to calculate, withhold and pay the amounts of personal income tax.

If the partnership hires individuals for labor and civil contracts, then you should check the correctness of taxation of these payments. In particular, payments and other remuneration paid from membership fees, payments of residents, are subject to insurance premiums in Pension Fund RF, Fund social insurance RF, Federal fund obligatory health insurance and territorial compulsory health insurance funds.

The audit should establish the presence of registered HOAs Vehicle, check the accuracy of their vehicle taxation.

The homeowners' association is not the owner housing stock an apartment building, since the apartments belong to their owners, therefore there is no legal basis for calculating the property tax by the HOA.

In addition, the HOA has the right to switch to a simplified taxation system if the level of income does not exceed the established level.

The auditor must distinguish taxable and non-taxable income among the income items of the HOA budget. It should be borne in mind that a taxpayer - a non-profit organization has the right, when determining the tax base for income tax, not to take into account the income attributable to paragraph 2 of Art. 251 of the Tax Code of the Russian Federation to earmarked receipts, if the receipt data are received free of charge, are of a targeted nature, the HOA is used for the intended purpose. Moreover, earmarked income should be used either for the maintenance of this HOA, or for the conduct of its statutory activities.

An important condition for exemption of earmarked income from taxation with income tax is the separate accounting income (expenses) received (generated) within the framework of earmarked income, which should be checked during the audit. If, during the audit, the auditor found a violation of at least one of the above conditions, then the income received by the taxpayer does not apply to earmarked receipts and must be included in the tax base for corporate income tax.

On the the final stage the availability of audit evidence for all stages of the audit is established, an opinion of the audit organization is formed on the reliability of the reporting, an audit report is prepared for the client, a letter on the results of the audit is carried out.

If there are errors within the materiality level, the auditing firm decides to issue a modified conditionally positive auditor's report. If the level of identified errors exceeds the level of materiality declared in the plan, then the auditor is recommended to draw up a negative audit report with the citing in it the facts that led to such a conclusion (violation of the law, failure by the board to fulfill the tasks assigned to it for the management and maintenance of an apartment building, etc.). Registration of a refusal to express an opinion on reliability accounting statements partnerships can be with incomplete submission of documents and accounting data for the audited period.

The auditor must provide evidence that the partnership is not threatened with bankruptcy or other serious circumstances that are incompatible with the continuation of its activities. Inspection should be performed in accordance with Federal Rule (Standard) audit activity No. 11 "Applicability of the going concern assumption of the audited entity".

The specificity of each measure of the methodology is enshrined in the standard "Objectives and Basic Principles Associated with the Audit of Accounts of a Homeowners Association".

The audit should be planned based on the audit firm's understanding of the HOA. In the course of planning, it is advisable not only to draw up model plan and the audit program, but also identify specific problems that should be resolved during the audit, such as: compliance with legislation on social guarantees residents, especially in the category of socially unprotected ( large families, disabled people, pensioners); accounting, taxation earmarked funds; usage economic opportunities partnerships for the formation of additional sources for financing the charter activities of the partnership at the expense of income from the lease of property, land, walls, roofs; accuracy of tax calculations; protection of property and tax incentives provided by the legislation of the Russian Federation.

Elected management bodies of the HOA are responsible for the accuracy and validity of the information provided in the financial statements, tax calculations. In addition to the requirement to comply with the legislation on accounting and taxes, the board of the partnership is obliged to fulfill the statutory requirements for protecting the property interests of homeowners, to submit to the meeting of owners a detailed report on its activities, confirmed by an auditor.

Auditing does not exempt the management of the HOA from responsibility for the performance of its inherent duties and functions, stipulated by the charter of the partnership, which is regulated by the auditing standard "Rights and obligations of audit organizations and economic entities."

The provisions of Law No. 307-FZ on the responsibility of an audit organization for the formation and expression of a professional opinion on the reliability of the financial statements of a partnership in accordance with the level of materiality should be supplemented with the requirement for the need to express an objective opinion on the fulfillment of the requirements of the charter of the partnership to protect the legitimate property interests of homeowners.

During the inspection, the following should be checked:

Income, expenses of the organization.

Their estimates. Are they correctly drawn up and justified, both as a whole and for individual works.

How the estimates are brought to the owners for their consideration and approval, in a timely manner or not.

The reliability of reporting on estimates.

Before carrying out a documentary check, it is necessary to request all documentation and access to it.

Moreover, if a planned audit is carried out, then all financial and economic documentation will be required. In the event of an unscheduled inspection, it is sufficient to provide evidence of a possible or detected violation.

Then the materials are studied. You can also involve outside experts in the analysis of documents. In difficult issues, when the competence of the members of the audit commission is lacking, this is the best option.

They can consist of membership fees, compulsory payments, as well as from other receipts, for example, rent, subsidies (benefits specific categories citizens and the like).

The tariffs used for housing and utilities are being checked. Municipal tariffs are not binding on the partnership.

Then the expenses are checked, both for statutory activities and for commercial ones. If there is one. All the profits earned should be spent only on the implementation of the statutory tasks of the HOA.

At the next stage, an audit of the cash desk is carried out. The funds received, deposited in cash and received from the current account are checked.

For verification, a cash book, cash reports, a general ledger, forms for settlements with the population, etc. are provided.

Checking the current account:

Reliability, legality of transactions.

How are the transactions carried out on the account reflected, their expediency.

Bank statements and documents attached to them, general ledger, "51 accounts" are used for the analysis.

Then checked accountable persons, mutual settlements with them. At the same time, the expediency of these costs is established:

Whether the disbursement of funds corresponds to the list of persons to whom it is permitted.

Does this expense correspond regulations whether the documentation for issuing money is being drawn up correctly.

The need is checked travel expenses, the correctness of spending travel, paperwork.

Checked expense reports and other documents related to the issuance of funds.

Then the documents on remuneration are checked:

Accounting sheets;

Settlement statements;

Orders and other materials related to the acceptance of dismissal, movement of personnel;

Staffing table;

The movement of materials in the partnership, their purchase and write-off is checked.

After the completion of the audit, an act of verification of the HOA by the audit commission is drawn up.

Reporting of the audit committee

After the audit, the RK forms two documents. The first is an act of the Homeowners' Association Audit Commission, which records the results of the inspection, the presence or absence of violations, and which ones. The audit report of the HOA by the audit commission at the end of the year contains the following information:

The composition of the commission.

The time of the audit.

Who was at that time the chairman of the board of the HOA.

What exactly was checked.

Are there any violations, and what.

How the money was spent.

Signatures of the persons who carried out the audit.

Based on the act, a report is drawn up by the homeowners association's audit commission. It is communicated to the owners at a general meeting.

The audit report contains all information on the economic and financial activities of the partnership, including:

The duration of the reporting period.

Chairman of the Board, Chief Accountant during this period, their data (full name).

The number of board meetings held that were considered.

Approved estimates when approved by the owners.

Receipt of money, sources of income, a list of them.

How the money received was spent.

Are there any irregularities in finances and business activities.