Bps sberbank login to your personal account. Internet banking from BPS-Sberbank: many opportunities, but there are also paid ones

Tests the "Internet Bank" service from various credit and financial institutions. Today we will explore the capabilities of the service from BPS-Sberbank.

To plug this service can be online. To do this, you will need a passport (you will need to enter an identification number).

Service home page

So, once on the start page of the "Internet Bank" system, you can find out the following information ...

... find out the location of the nearest bank branch ...

And…

- see bank news

- transfer money from card to BPS-Sberbank card (or - to MasterCard cards any bank). The main thing is that the 3D-Secure service is connected to the card

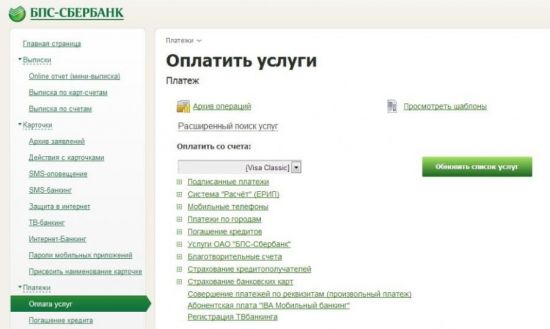

Let's finish our acquaintance with the start page and go to the application to get acquainted with it and its capabilities. The main page looks like this ...

- "Fast Payments"

- Bank News

- "Currency rates"

- "Information about cards"

- "Personal menu"

- Main menu systems

First, consider "Personal menu"

For any operation, you can view a receipt, print it and save it, or send it by mail.

"Payment management"... At this point, you can edit your quick payments, both signed and last paid.

"Automatic payment"... We will not dwell on auto payment, but note that this the service in BPS-Sberbank is paid.

When you click on the card, actions appear in front of you that can be performed.

Also on the main page there is a block "Help", where you can find out the bank's tariffs, and read the user manual.

Let's go to the main menu of the system. It includes the following sections:

- Payments and transfers

- Cards

- Deposits and accounts

- Loans

- Closed accounts

In the same section, you can find a filter for squeaking the required payment.

Section "Maps" we considered above, so we will not repeat ourselves and go further.

"Deposits and Accounts"- at this point you can open new contribution and follow the existing ones ...

"Closed accounts"... This section lists all accounts closed less than 6 months ago, for which you can view a full statement.

We have compiled a list of transactions (if any) that are considered when testing the Internet Banking service:

- Create auto payment

- Payment history

- Free payment

- One-button payment

- Transfer from card to card

- Opening a deposit

- Credit application

- Communication with the bank

Create auto payment

You can create auto payments in the "Interner-Bank" system. To do this, go to the "Automatic payment" section, select the desired payment and draw up a schedule.

Payment history

The payment history can be viewed in the section "Operations history". Each check can be viewed in detail, downloaded, printed and sent by mail.

Free payment

The system has the ability to make a "Custom payment", but the bank will take a commission for it.

Create a list of your payments

To create a list of your payments, you need to add it to "Fast Payments". After making any payment, you need to click the button "Add to" Signed payments " or Last Paid.

One-button payment

In chapter "Payments and transfers" there is a service One-button payment.

Transfer from card to card

You can make a transfer both to your own card and to the card of another BPS-Sberbank cardholder, or in general to the card of another credit and financial institution. Both cards must be a payment systemMasterCard!

When transferring to another client of the bank, you need to know the details of the recipient's card.

When transferring to a card of another bank, you need to specify the card details:

- from which the payment is made

- to which funds will be credited

Bank feedback

You can contact the bank as follows:

General impression

The Internet Banking system from BPS-Sberbank has a huge amount of functionality. True, there is also an incomprehensible section - "The history of statements." We ourselves did not figure out what should be indicated there, so we had to call the bank.

By the way, the bank takes a commission for many payments - it turns out that this is not such a free service.

To summarize:

Connection

- Connection is via the Internet - 2 points

- Connection is carried out as soon as you register - 2 points

- You can use the service immediately - 3 points

Convenience

- Login and password are required to enter - 2 points

- To pay for mobile, Internet provider and utility services, you need to make 3 transitions each - 1 point

- There is quick access to frequently used functions (quick payments, last paid) - 2 points

- Session passwords come via SMS - 2 points

- You cannot manage limits - 0 points

- The balance is available on the main page - 2 points

- You can change the password in the system - 3 points

Payments

- You can create auto payments - 2 points

- There is a payment history. There is a search for payments - 2 points

- There is a function "Free payment" - 3 points

- You can create "Quick Payments" and rename existing ones - 2 points

- Payment is made in real time - 5 points

- There is a function "Payment with one button" - 1 point

Translations

- You can make transfers to cards of your bank - 2 points

- Data required for transfer - card number and card validity period - 3 points

- Transfer speed - within an hour - 2 points

Deposits

- You can open a deposit in the Internet bank - 1 point

- You can top up deposits in the Internet Bank - 1 point

- You can transfer a deposit to a card in the Internet bank - 1 point

Loans

- Cannot be submitted online - loan application - 0 points

- To obtain a loan, you need to contact a bank branch to draw up and sign documents - 0 points

- You can repay loans through the Internet bank - 1 point

Additional features

- No online application for card reissue - 0 points

- You can block the card online - 2 points

- You can connect SMS - notifications - 3 points

- Checks are kept. They can be downloaded, printed, sent - 2 points

- When working with a card, the location of the bank branch and the operating mode are indicated - 2 points

- You cannot order the card online - 0 points

- Can connect and disconnect 3-D Secure - 3 points

- There is information about exchange rates, branches and ATMs - 2 points

Feedback

- For communication with the bank, 5 communication channels are provided - 5 points

- Waiting time for an answer to a general question - 56 seconds - 5 points

- Waiting time for a technical question - 56 seconds - 5 points

Errors

- There were no mistakes - 5 points

Personal opinion

- Overall impression of use - 4.5 points

The result of testing the Internet banking system from BPS-Sberbank - 83.5 points out of 100 possible

| Evaluation Criteria for Internet Banking | ||||

| connection | ease of connection (availability) | 1. 2/1 | max 7 | |

| 1.online, offline | ||||

| 2.immediately or after a while | 2. 2/1 | |||

| 3. How long does it take to use the service | 3.up to 20 minutes - 3 | |||

| up to 40 minutes - 2 | ||||

| up to an hour - 1 | ||||

| more than an hour - 0 | ||||

| convenience | 1.authorization mechanism | 1. 2/1 | max 16 | |

| (login and password are enough to enter or you need something else) | ||||

| 2.convenient navigation, the number of transitions to complete the operation: | 2.1 transition - 3 | |||

| - pay for mobile | 2 transitions - 2 | |||

| - pay for a communal apartment + electricity | 3 transitions - 1 | |||

| - pay for the Internet | over 30 | |||

| 3.have quick access to frequently used functions | 3. 2/0 | |||

| 4.session passwords (cards, SMS) | 4.sms - 2 | |||

| cards - 0 | ||||

| 5.the ability to manage limits | 5.yes / no 2/1 | |||

| 6.balance on the main page | 6.yes / no 2/1 | |||

| 7.convenience of changing, password recovery | 7.Online -3 points, go to the bank (ATM) - 0 points | |||

| Functionality | payments | 1.the ability to create an auto payment | 1.any payment without restrictions - 2 | max 15 |

| there are restrictions - 1 | ||||

| no such function - 0 | ||||

| 2.presence of payment history | 2.search through history + setting the time period + visualization - 2 | |||

| 3.Availability of the free payment function | 3. 3/0 | |||

| 4.the ability to create a list of your payments, rename (templates) | 4.the ability to create a list of your payments (1), the ability to rename (1) | |||

| 5.the passage of the payment in real time | 5.plus 5, if delay then 0 | |||

| 6.one button payments | 6. 1/0 | |||

| translations | 1.to your bank card | 1. 2/0 | max 9 | |

| 2.data required for translation | 2.card number - 5, card numbers and expiration date - 3, everything else - 0 | |||

| 3.speed of translation (time) | 3.in an hour - 2 | |||

| during the day - 1 | ||||

| the next day - 0 | ||||

| deposits | 1.the possibility of opening a deposit | 1. 1/0 | max 3 | |

| 2.replenishment of the existing deposit | 2. 1/0 | |||

| 3.the possibility of transferring to the card | 3. 1/0 | |||

| credits | 1. online application | 1. 1/0 | max 7 | |

| 2. online receipt | 2. 5/0 | |||

| 3.payment of the loan | 3. 1/0 | |||

| additional features | 1.online - application for card reissue | 1. 2/0 | max 18 | |

| 2.Online card blocking | 2. 2/0 | |||

| 3.Ability to enable / disable SMS notifications | 3. 3/0 | |||

| 4. confirmation of payment (checks) (stored + can be printed / sent to the mail) | 4.there are checks (1), can be sent to the post office (2) | |||

| 5.work with the map | 5.search for the nearest branches (ATMs / POs) + detailed information on them + the ability to build a route - 3 | |||

| 6.Online card order | 6. 1/0 | |||

| 7.Connection to 3-D Secure technology | 7. 3/0 | |||

| 8.information (courses, branches, ATMs) | 8. 2/0 | |||

| Feedback | 1.connection with the bank (channels) | 1.1 point for each channel (maximum 5 points) | max 15 | |

| 2.connection with the bank (response time): general question | 2.up to 5 minutes -5 points | |||

| up to 30 minutes - 3 points | ||||

| over - 0 points | ||||

| 3.connection with the bank (response time): technical question | 3.up to 5 minutes -5 points up to 30 minutes - 3 points over - 0 points | |||

| number of mistakes | 1.number of errors | 1.0 errors - 5, 1 error - 3, more than 1 error - 0 | max 5 | |

| personal opinion | 1.general impression | 1.maximum 5 | max 5 | |

| Maximum points | max 100 | |||

BPS Sberbank - official mobile banking for Sberbank clients from the Republic of Belarus. This application provides the ability to conveniently manage personal finances. It provides round-the-clock access to accounts, loans and deposits, and also helps to check card balances and transfer funds to cards of Belarusian and foreign banks.

Internet banking

You can use BPS Sberbank anywhere in the world. The application completely replaces bank terminal and helps to carry out operations with finances without visiting bank branches. Using the corresponding menu items, you can buy currency, make a transfer, set limits on cards and accounts, contact the support service, find the nearest ATM and even get statistics on expenses.

Yes, the application not only performs the functions of mobile banking, but also serves as your personal finance manager. By monitoring the statistics, you can find out where the main part of the monthly budget "goes" and reduce unnecessary expenses.

Payment for services

Like any other mobile banking for Android, BPS Sberbank allows you to pay for utilities, services mobile communications, internet, television and other services from more than 50,000 partners of the company. With it, you can even pay taxes, state duties and fines.

Key features

- allows you to manage cards, deposits and accounts in BPS Sberbank;

- provides detailed statistics of expenses on accounts;

- serves to pay for utilities, fines, mobile communications and the Internet;

- has a nice interface in corporate light green colors;

- makes it possible to manage limits and block cards;

- includes a map with the location of the nearest ATMs;

- works even with relatively old versions operating system Android.

A special Internet banking service from BPS-Sberbank Belarus allows the user to remotely control their own accounts, as well as conduct various Bank operations without leaving your computer.

Advantages

Internet banking allows an ordinary bank client to experience a whole range of advantages of the service:

- there is no need for a personal visit to a bank branch, you can forget about hours-long queues and carry out most of the routine operations at home, the main thing is to be able to access the Internet. This is very convenient, especially if it takes too long to get to the nearest branch;

- the service allows you to make money transfers, pay for utilities, communications, the Internet;

- in case of loss or theft of the card, it can be instantly blocked;

- personal account of BPS Sberbank is reliably protected from fraudulent actions via the Internet using the SSL protocol;

- there is always the opportunity to use the online chat, which provides the user with the ability to quickly resolve an important issue for him at any time;

- making payments through a personal account, it is possible not only with the use of Sberbank BPS cards, but also cards of other banks;

- the possibility of ordering cards linked to any of the current accounts is available;

- there is a convenient function for tracking overdraft finances;

- work with Yandex.Money is available (even the wallet identification, which allows you to increase its limits, can be done through your personal account);

- there is access to information not only on open, but also on closed deposits or accounts;

- you can see all the addresses of Sberbank in Belarus.

Cooperation with BPS-Sberbank of Belarus has many advantages

Functionality

Thanks to a large number functions BPS Sberbank online allows you to perform many different functions.

Financial transactions:

- payment for telephony, utilities, Internet access through the ERIP system, etc .;

- various payments to the accounts of individuals and legal entities;

- money transfers between users of Sberbank BPS cards and accounts in other banks;

- depositing funds towards repayment of loans;

- obtaining information regarding the balance and movement of finance on any of the existing accounts;

- formation of bank statements;

- viewing reference data on exchange rates, is there a nearby Sberbank in Minsk, where are ATMs and other information useful to the bank's client.

In addition, the personal account will allow users to activate a number of the following banking services:

- SMS notifications, which have long been practiced by Sberbank of Russia, informing customers about what is happening with their accounts, which significantly increases the security and guarantees the safety of accounts.

- "One-button payment" - allows you to make recurring payments in one click using a saved online form, greatly saving the user's time.

- "Automatic payment" - allows the bank to independently carry out payment transactions without the client's instructions for certain transactions. The list of such payments is determined by the user independently and, if desired, can be changed.

- Provide additional payment security with Verified by Visa and MasterCard SecureCode for monetary transactions only by confirmation with a one-time password, which the client receives via SMS to personal number phone.

Internet banking i.bps-sberbank.by allows performing various operations on deposits, including opening and replenishing deposits, as well as transferring finances to metal accounts (it is a unique online service of BPS-Bank).

It is also allowed to maintain full control through the internal security system of accounts and cards:

- changing the password to access your personal account;

- implementation or cancellation of card blocking;

- selection of additional methods of confirmation of the performed operation;

- viewing the authorization log and statements of accounts and deposits;

- selection of services displayed by default on the main page of your personal account.

A complete list of BPS-Sberbank branches is provided on the website

Service cost

The Sberbank card in Belarus allows you to use Internet banking services for free, however, the functionality is significantly limited. It is also allowed to connect a paid service, which costs 7.5 rubles per year.

When choosing free service only the following services are available to the user:

- information and reference system;

- "Automatic payment";

- SMS notifications;

- security systems Verified by Visa and MasterCard SecureCode.

If a client enters into an agreement for a comprehensive service in the bank, then he will have access to all the previously described services. Therefore, 7.5 rubles is quite an acceptable cost for complete operational freedom throughout the year.

Internet banking connection

To gain access to online services, it is enough to be a client of the bank. Usually holders of payment cards get access. Most often it is salary cards, which are used to pay for the household needs of citizens.

Access to the service is opened to the cardholder after the conclusion bank agreement in any of the offices. Registration is allowed without a personal visit to the bank branch. To do this, as a client of the bank, you will need to enter the bpsb.by website. At the same time, no additional programs are required to be installed, a computer with any modern browser installed is enough.

Client registration

To register a personal account, you will need to click on the "Sberbank-online" button on the bank's website, which is located in the upper right corner. In the window that appears, click on registration. The e-mail is entered in the registration form, mobile number and personal data of the client.

Registration in Internet banking

After pressing the "Continue" button, you will need to enter your username and password. The procedure ends with confirmation using a code automatically sent by the bank to the previously specified phone number. After confirmation, you can log in to the system.

Registration form

Payment for services

To pay for services through Internet banking, you need to log in to your personal account. Then, you should go to the section of payments and transfers. Further, from the proposed list, a service is selected for which payment is required. After that, it remains only to follow the instructions of the system.

For example, payment health insurance is carried out as follows:

- it is necessary to select an item to pay for health insurance;

- the type of payment is set in the window that appears. Let it be "Payment of the first installment of the insurance premium";

- further, a write-off card is selected from which payment will be made and the name of the company with which the DSMR agreement is concluded;

- the required amount and the payer's data are indicated, after which you need to click "next";

- after checking the correctness of the information entered, you can end the operation by entering the confirmation code and pressing the payment button.

A generated check will appear in the window that appears. It can be printed, sent to an e-mail box, or saved on a computer in PDF format. Also, the performed operation can be added to quick payments to facilitate subsequent payments.

bps sberbank internet banking - personal account

BPS Sberbank Online - Internet banking in the Republic of Belarus. It is an intuitive web interface for communication between a client and a bank from anywhere in the world where there is access to the World Wide Web. This article explains how to register and log in. With development banking The Internet banking service has become widespread. Sberbank offers its customers a convenient system that allows them to make payments, transfers and many other operations without leaving home. Those who want to always have a bank at hand should get internet banking.bps sberbank internet banking login

Logging into the BPS-Sberbank Internet banking system is done by entering your username and password in a special form, which is located on the Sberbank Online page:

https://i.bps-sberbank.by or click on the login form

If you need to change your password or username, you need to follow the link "Change username and password" and then go through the process of replacing the data.

Registration and login to the system is carried out at i.bps-sberbank.by. To start the registration procedure, under the login and password entry form, click on the "Registration" link.

Support

![]()

kkabinet.ru

Bps Sberbank online, internet banking, Belarus

Internet banking BPS Sberbank online is a practical and fast solution for instant payments for services and control of your expenses. For BPS Sberbank clients online login it will not be difficult to enter your personal Internet banking account - you only need to enter basic data to access the service, since all information about the client is already in the bank's database. The user gets the opportunity to automate monthly payments, view expense details, make money transfers and other financial transactions with their accounts.

How to register in BPS-Sberbank onlineInternet banking BPS Sberbank online You can enter your personal account via your phone or computer. For the mobile version, you will need to install the BPS online iOS / Android application, and to access the control financial assets in BPS Sberbank online, you need to go to the official website through a browser and register:

The use of Internet banking BPS Sberbank online simplifies procedures remittances, utility bills, purchase of goods. To enter the Bps Sberbank online system, you only need a username and password, but the implementation financial transactions and movements on the user's accounts, it is necessary to confirm the operation by the client via SMS.

Why do you need BPS Sberbank online internet banking

The main task of the personal account of BPS Sberbank online is to facilitate access to its financial resources... Inconvenient location of the ATM in relation to the place of residence / work, queues at bank branches - all this complicates an operational decision financial issues reducing the level of comfort. Therefore, mobility and easy but secure access are the tasks that the bps internet banking service solves. Convenient options are offered for the owner:

On the BPS Sberbank website there is an online section for making an application for home insurance, summer cottages, and accident insurance. By clicking on the insurance, you can calculate its approximate cost, and if the conditions suit you, you can issue it and pay without contacting the Bps Sberbank bank branch online.

BPS cards of Sberbank

BPS Sberbank online is aimed at a certain range of solutions to the client's financial issues. All cards are accompanied additional service and round-the-clock service, provide the opportunity to create a personal online banking account. Works with standard views payment systems Visa, Belcard, MasterCard. Analyze your capabilities, prospects and choose convenient and relevant BPS Sberbank cards specifically for your needs.

When an online agreement is concluded between the official employer and BPS Sberbank, employees of the institution receive income on the bank card. For clients, you can take advantage of special conditions when applying for a loan, as well as the absence of the need to confirm their income.

For personal use and access to comfortable conditions of service, personal is used. In addition to the main function of paying for purchases and services, the BPS Sberbank card online provides the service:

- "MOTSNAYA" from Belkart Maestro combines payment functions and participation in the BPS Sberbank discount program online, allows you to make contactless payments via the terminal;

- "Belavia" from Visa - the ability to accrue bonuses when making payments for goods and services;

- Platinum from Visa - contactless, additional assistance functions, the ability to work with the BPS Sberbank card online in other countries;

- Classic from Visa, Standard from MasterCard - provision favorable conditions when booking rooms and air travel.

Pension

A feature of BPS Sberbank online is the accrual of an additional 3% per annum every month on the balance. This will allow you to make savings without making any efforts, without filling out documents and appeals to the bank. Money can be withdrawn from the card at any convenient time - you do not lose own funds only getting extra interest. Calculation and accrual are carried out automatically in Sberbank.

Credit

The size of the limit for the client's settlements is determined individually, to receive it, you need to leave an online application at BPS Sberbank online, confirm your income with a certificate. After consideration of the application, the amount of the overdraft will be indicated and issued (produced for more than two days). For salaries provided special conditions.

For traveling

For travel and comfort, the MasterCard series has been created, expanding the possibilities for recreation and organizing solutions to everyday issues:

- World ComPass - returns 0.8% of purchases, allows you to participate in the SkyClub program for saving miles, provides auto assistance and insurance, CONCIERGE - PACKAGE;

- World ComPass Premium - returns 0.9% of paid services and purchases, includes and World benefits ComPass.

Choose your practical option at BPS Sberbank - for payments, savings, bonuses or getting discounts in partner stores. Use plastic cards BPS of Sberbank online for payments by the terminal at the cash desks of stores, and virtual ones for payments on Internet resources.

More detailed information can be found on the official website of Sberbank.

bps-sberbank.info

registration and login

BPS Sberbank Online - Internet banking in the Republic of Belarus. It is an intuitive web interface for communication between a client and a bank from anywhere in the world where there is access to the World Wide Web. This article explains how to register and log in.

Possibilities:

- Search for the nearest branches and ATMs

- View exchange rates

- Information about the customer's cards, accounts and loans

- Obtaining a statement for a certain period

- Repaying loans and making payments

- Transfer between your cards and to cards of clients of other banks

- Setting up automatic payments

BPS Sberbank Online: new user registration

Clients of BPS-Sberbank who have a valid bank card and a phone number of a Belarusian mobile operator (or an identity document) can register in Internet banking.

Registration and login to the system is carried out at i.bps-sberbank.by. To start the registration procedure, under the login and password entry form, click on the "Registration" link.

At the first stage of registration, you need to enter your mobile phone and number payment card or the identification number of the client's identity document. After specifying the necessary information, click "Continue".

At the second stage, come up with a username and password, a payment password and confirm the data with the code from the SMS message that should go to your phone specified in the previous step.

There are hints next to each data entry field, read them carefully, and you can't go wrong.

Check the box next to I agree with the Sberbank Online service agreement, Mobile bank"In OJSC" BPS-Sberbank "and click the" Register "button.

After registering, you will be taken to the main page of your personal account.

BPS Sberbank Internet banking: login

Consider the functionality of your personal account.

Home page

The main page of BPS Sberbank Online contains a list of cards, accounts, loans and deposits available to the client.

Payments and transfers

This section consists of 2 subsections: Transfers and Payments.

With the help of the services "Transfer between your cards" and "Transfer to a bank client" you can transfer money from one of your cards to another or a card of a client of another bank, respectively.

The subsection "Payments" consists of: "Payment with one button" (payment for several services within 1 operation), "Arbitrary payment by details", "Payment for services in Sberbank Online" (payment of the bank's RBS - remote banking service), access to the ERIP system (Unified calculation and information space).

Shown below is the Custom Payment and One Button Payment window.

This is how "RBS Payment" and the ERIP Settlement System look like.

Cards

This section contains information on active cards, their balances. You can make one of the cards a settlement, set up an SMS alert and block the card.

Deposits and accounts

All current accounts and deposits (deposits) of the client are located here. You can see the balance for them, make a statement and replenish the account.

Loans

The section "Credits" displays the amount of the next payment and the full amount to be paid. The menu functionality allows you to repay the loan (monthly payment).

Closed accounts

Accounts closed within the last 6 months are displayed.

When using Internet banking BPS Sberbank Online, remember that you need a user ID (login) and password to enter the system. If you are asked for other information (number bank card, mobile phone, personal data), immediately exit Sberbank Online and contact the bank.

You can call the BPS Sberbank Contact Center by phone:

- 148 - from stationary and mobile networks of the Republic of Belarus

- (+37529) 5-148-148 - from abroad

prosberbank.com

Internet banking BPS Sberbank difficulties with entry

BPS-Sberbank draws attention to changes in the operation of Sberbank Online from July 12, 2018. The changes relate to the method of confirming payments and are aimed at strengthening security measures when using the remote service system.

Thus, the user of the remote banking services the payment confirmation method will be automatically reconfigured, assuming the use of session keys. Keys will be sent to users in sms-message format to the phone number specified during registration in the system. It is possible to change the registered number by contacting a branch of the Bank (you must have a passport with you) or, if you have Consent to carry out the identification and authentication procedure and successfully complete it, by contacting the Bank's Contact Center at single number 148 (5 148 148 for Velcom, MTS, Life subscribers).

WHAT TO DO IF THE INTERNET / MOBILE BANK "SBERBANK ONLINE" DOES NOT WORK?

Also, BPS-Sberbank OJSC informs that within the framework of strengthening the security policy of the Sberbank Online system, the following changes will be introduced from June 29, 2018:

1. After entering the wrong password three times when entering Sberbank Online or an additional password during the operation, the system locks the user account for 2 hours. The user has the opportunity to re-enter his personal account after 2 hours or restore access to his personal account by re-registering with Sberbank Online.

2. If the current password for entering the Sberbank Online account does not meet the complexity requirements, the user will be prompted to change the password when trying to enter Sberbank Online, but the user will not be able to enter his personal account. "

3. If the login for entering the Sberbank Online account does not meet the complexity requirements, the user will be asked to change the login when re-registering. "

4. Login and password for entering Sberbank Online must meet the following complexity requirements:

Login requirements

Length from 5 to 30 characters.

Letters must be from the Latin alphabet only.

Cannot consist of numbers alone.

Not case sensitive.

Password requirements

A strong password must meet the following requirements:

include at least 1 digit;

at least one uppercase letter and one lowercase letter (at least two letters in the password)

the password must not contain more than 3 identical characters in a row;

the password should not contain more than 3 characters located side by side in the same row of the keyboard;

the password cannot be the same as your username;

You can also use characters such as: “!”, “@”, “#”, “$”, “%”, “^”, “&”, “*”, “(”, “) When creating a password ”,“ _ ”,“ - ”,“ + ”,“: ”,“; ”,“, ”,“. ”.

If you use the same login and password to LOG IN to your personal account of the Sberbank Online system, then you need to change the password for safe use of the system. To do this, please follow the link - https://i.bps-sberbank.by/onlineRegistrationPage.xhtml.

The bank apologizes for any inconvenience caused.

* Dear users, If you have any difficulties with accessing the Internet / mobile bank "Sberbank Online", please describe your problem in the comments below.

belbankir.by

Login and registration of your personal account in BPS Sberbank Internet banking! Leading bank of the Republic of Belarus!

Internet banking BPS-Sberbank is a special service that allows you to remotely control your account and conduct various banking operations.

- no need to pay a personal visit to bank branch and queue up for most operations, the main thing is to provide access to the Internet. Branches are not always close to home, so the service saves time;

- through this service, you can transfer money, pay for communal services, including water, electricity, communications, the Internet, etc.;

- you can instantly block the card if it is lost or stolen;

- your personal account is reliably protected from online fraudsters by the SSL protocol.

How to connect the service?

To connect Internet banking, you need to contact the nearest bank branch. You need to have your passport with you. An employee of the department will offer you to write an application for connecting the service. Your further actions.

BPS Bank is a system of remote customer service from BPS-Sberbank operating in Belarus. Internet banking gives Belarusian customers the opportunity to use all the services of the bank and control accounts and cards online. All operations are carried out in your personal account, below it will be described how to register, enter your account and use it.

Login and account registration

Until 2015, bpsb operated a different banking system, after which it switched to the same service that operates in Russia - Sberbank Online.

Only a client who has an account or card in the BPS will have access to the personal account. There are two ways to become a user:

- By concluding an agreement with the bank. You only need to take your passport with you.

- Registration without visiting the branch on the lender's website.

In the case of visiting a branch, a bank manager will issue a temporary password and login after submitting an application.

When registering on the site, you need to click on "Register" and enter:

- Identification number of the card or account.

- Mobile number to which session codes and passwords will be received in the future to confirm operations.

By clicking on "Continue", a password will be sent to the specified number. By entering it into the line on the site, the identity of the client will be confirmed, and access will be open. Now you need to enter the LC.

The generated password is not secure. The user needs to change it in the future by creating a new, complex combination.

The entrance to the BPS personal account is carried out on the main page of the official website www.bps. sberbank. by. No special software or devices are required for authorization.

Recall that by entering the wrong password several times, access to account will be blocked for several hours.

Using the BPS cabinet

There are two options for connecting to the LAN:

- Is free.

- For 7.5 rubles per year (BYN version).

In the free subscription option, the client gets much fewer options. He can only:

- Receive information about bank accounts and cards.

- Use auto payment and SMS notification.

- Confirm transactions by entering one-time passwords.

It is impossible to make payments on your own - only through automatic debiting Money... This is only suitable for those who need to make recurring payments.

Therefore, paying for such a small amount is worth it - the user will have access to all the functionality of the cabinet for a year.

The system is not much different from the Sberbank Online service operating in the Russian Federation. The account allows individuals:

- Manage your accounts and cards.

- Transfer funds to private and legal entities to cards and accounts of BPS-Sberbank and other financial institutions.

- Open and replenish deposits, withdraw money to non-identified metal accounts.

- Pay for services and purchases in online stores - housing and communal services, communications, the Internet, fines and taxes, etc.

- To issue loans and make payments on them.

- View information about accounts, credit and debit cards, deposits, as well as information on the balance of funds and transactions.

- Receive payment documents and generate documentation from them.

- View reference information about the exchange rate, the location of ATMs and branches of the financial institution, current promotions and programs, etc.

- Activate and deactivate bank services, order and block cards.

- Change account settings: login data to the personal account, make visible strictly defined services, view the log of user authorizations, etc.

- Take out insurance and make payments on it.

- SMS notifications about transactions.

- Auto payment for specific transactions without a client's order (for this, the user must submit a list with payments and recipients).

- A service similar to the previous one - “One-button payment”. In one click, periodic payments are made, which are predefined in the personal account, i.e. without visiting the bank.

- Approval of payments by entering one-time passwords sent via SMS to the user number (different service names are provided for Visa and MasterCard cards).

All operations are carried out in 4 sections:

- "Payments and transfers".

- "Deposits and Accounts".

- "Cards".

- "Loans".

Here you can not only carry out transactions, but also view information on executed in this moment banking products and already closed accounts. The main page of the cabinet already contains information about cards, deposits and accounts.

You can familiarize yourself with the terms of service for an individual on the bank's website by opening the section "Individuals" and going to the subsection "Payment for services using remote channels". Here you will find instructions on how to work with the service, the maintenance procedure, answers to basic questions and recommendations for ensuring account security.

The work of the cabinet is protected by the SSL protocol. Check the address bar when entering the site - a lock icon should appear. This means that the data transmission is secure.

By setting up the "Pay with one button" function, you can make payments for similar transactions every month.

The function of adjusting the visibility of products is purely aesthetic, allowing you to remove unnecessary information from the cabinet interface.

Note that you can get a mini-statement in your account, for the formation of which you need to draw up a report on personal account... To do this, click on the "Statement" tab in the LC and enter the following data in the fields that open:

- The beginning and end of the period for which the report is needed.

- The card or account for which the statement is issued.

Checks and statements can be sent by email, saved in PDF and printed. The subsection “ Calculated sheets"Will be useful to those who are planning to conclude any deal in the near future. For example, if the employer signs an agreement with the BTS.

You can create template payments by entering parameters in the “Fast Payments” subsection.

Important! You can link the Yandex.Money electronic wallet to your account or card (this service is part of Sberbank). To do this, you will need to go through the identification procedure. Transfers from the wallet are possible to cards:

- Visa.

- MasterCard.

- Belkart.

There are mobile app BPS Bank. You can download it for Android and iOS from the PlayMarket and AppStore stores, respectively.

Important! A useful section called financial manager, can be found by opening the section "My Finance". He will analyze the available profit for all active accounts, cards and loans.

If it is decided to terminate cooperation with the bank, the client only needs to submit an appropriate application for the closure of all products and services. After that, access to the LC will be closed.

So, access to the account is provided to persons who already have any banking product. The service is convenient and concise, offering all the possibilities for managing your funds and services.