Taxes

According to tax legislation, when purchasing their own home, some new residents can take advantage of benefits - the so-called property tax...

Paying taxes is the most pressing topic for entrepreneurs. It is especially of concern to novice businessmen who are just trying to figure out...

The procedure for accrual, calculation and payment of property tax for individuals is regulated by the Tax Code of the Russian Federation (Articles 399-409). In this regulatory...

Who is under 24 years old. If the deduction is returned for treatment services for relatives, then additional documents must be provided...

Real estate sellers, having received income from a transaction, are required to pay personal income tax in the amount of 13%. Tax collection is a strictly controlled procedure...

In practice, not all individuals can implement this due to mistakes made that contradict current legislation. To...

Every commercial enterprise strives to achieve profitability of its business and generate taxable profits. Base interest rate...

How can I get back some of the money spent on the operation? Read the official rules below. In accordance with the Tax Code of the Russian Federation, an employed citizen...

Many Russians are aware of the fact that the state returns to citizens part of the funds spent on the purchase of housing. But often even those who have long...

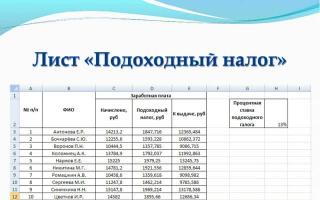

If I were an accountant, then without hesitation I could tell you what income tax on wages is and how to calculate it. But I'm a lawyer and...

The gratuitous transfer of property, movable or immovable, from one person to another is called a donation. Because, according to the law, an item received as a gift...