Minimum tax under the simplified tax system (simplified taxation system)

Paying taxes is the most relevant topic for entrepreneurs. She is especially worried about novice businessmen who are just trying to figure out the list of new responsibilities they received in connection with gaining the status of an individual entrepreneur. However, not everything is so difficult. Today the overwhelming majority of individual entrepreneurs exist and are in this regime. Therefore, now I would like to talk about the minimum tax under the simplified taxation system and other nuances related to this topic.

Income minus expenses

This is the name of the type of "simplification" that obliges individual entrepreneurs and companies to pay the minimum tax. The STS "income - expenses" (hereinafter referred to as the abbreviation DSM) is more difficult for novice businessmen to understand. Therefore, many, not really understanding the topic, make a choice in favor of the regime referred to as the 6% STS. In this case, everything is extremely simple: the entrepreneur pays 6% of the profits of his enterprise as a tax.

What about another case? If a person chooses VHI, then his tax can vary from 5 to 15 percent. In general, first of all, an entrepreneur must find out the rate established for his type of activity in the region of its implementation. And the exact value is determined by performing some calculations. And it is worth talking about this in more detail. But first, a few words about advance payments. This is an important nuance that cannot be ignored.

Advance payments

Every person who pays the minimum tax under the simplified tax system according to the indicated regime will regularly encounter them. The entrepreneur must make a so-called "advance payment" on a quarterly basis. That is, every three months he transfers an advance payment to the budget. The amount to be paid is calculated on an accrual basis from the very beginning of the year. And you need to list it before 25 days from the end of the quarter.

At the end of the year, the remainder of the tax is calculated and paid. At the same time, a tax return is filed. Individual entrepreneurs must do this by April 30th. For LLC, the maximum term is March 31st.

Payment

It is performed on a quarterly basis, as well as at the end of the year. With the simplified tax system “income minus expenses”, the minimum tax is calculated simply. First, the profit from the beginning of the year to the end of a certain period is summed up. Then, all expenses for the same time period are subtracted from the resulting value. And after that, the amount received is multiplied by the tax rate.

If a person calculates an advance payment for the second, third or fourth quarter, then at the next stage he needs to subtract the previous advance payments from this value.

As for calculating the tax at the end of the year, everything is also simple here. A person determines the minimum tax under the simplified tax system and compares it with the amount of the tax that was calculated in the usual way.

Minimum tax

With the simplified tax system, it is calculated at a rate of 1%. When is it paid? Far from being the most favorable.

1 percent tax is charged when the amount of the entrepreneur's expenses exceeded the income he received. That is, in the event of a loss. It is clear that in such situations there is simply no basis for calculating the standard tax of 5-15%. And at the same time, being at a loss, a person will still have to pay one percent as prescribed by law.

There is another case as well. 1% is paid if the amount of the single tax, which was calculated from the difference between expenses and income at a 15 percent rate, does not exceed the minimum tax for the same period.

Advances and minimum tax

It is worth touching on one more nuance related to the topic under consideration. It often happens that an entrepreneur at the end of each quarter pays advance payments for a single tax, and at the end of the year he is charged a minimum of 1%.

This situation can be dealt with by resorting to one of two methods.

The first method involves the payment by the entrepreneur under the simplified tax system of the minimum tax and the crediting of the advances already made earlier for the future period. Moreover, for this, you do not need to do anything additionally, since the offset occurs automatically, since the KBK with the minimum tax of the simplified taxation system does not differ. It is the same for both tax and advance payments.

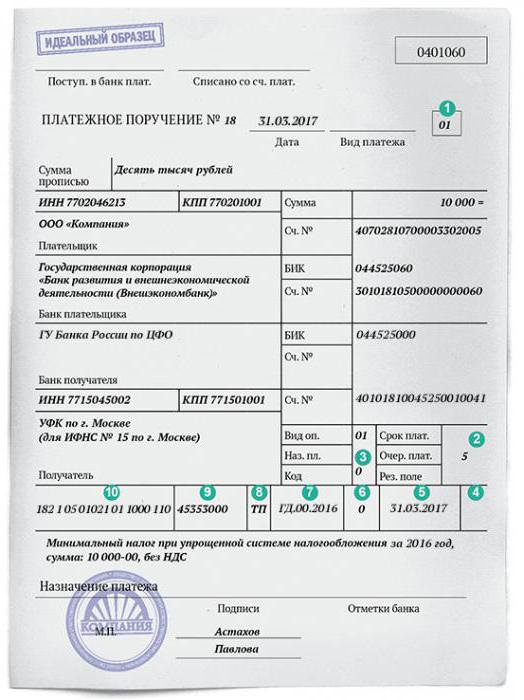

Now about the second method. It consists in crediting the paid advances by the entrepreneur against the minimum tax. And in this case, the notorious KBK will be different. So you will need to write a statement on the offset of advances, to which copies of payment orders and details are attached. Before that, you need to submit an annual declaration so that information about the taxes paid by a person is reflected in the inspection base.

Example

Well, the above has provided enough information that can help you understand the topic regarding the minimum tax under the simplified tax system (income minus expenses). Now you can go to the example.

Let's say an entrepreneur has completed the reporting period with an income of 2,000,000 rubles. At the same time, his expenses amounted to 1,900,000 rubles. is 15%. The following calculation is made: 2,000,000 - 1,900,000 x 15% = 15,000 rubles. This is the tax amount corresponding to the general procedure. But in this case, the loss is obvious, so the minimum tax will be applied to the entrepreneur. It is calculated as follows: 2,000,000 x 1% = 20,000 rubles.

It can be seen that the minimum tax of 20,000 rubles is an order of magnitude higher than the amount due according to the general rules. But the entrepreneur must transfer this amount of funds to the treasury.

Good to know

Much has been said about what is meant by the minimum tax under the simplified tax system. Income minus expenses is a convenient mode, it just needs to be figured out. And now I would like to pay special attention to some of the nuances that an entrepreneur will need to know.

As already mentioned, the difference when deducting the accrued amount from 1% can be included in the expenses for the next period. It is worth knowing that this procedure does not have to be carried out immediately. It is allowed to exercise this right for the next 10 years.

You can also make the transfer both complete and partial. But if the entrepreneur received losses in several periods, then their accrual will be done in the same order.

It happens that an individual entrepreneur decides to terminate his activities. If the loss was not returned to him, then the assignee will use it. This is usually done by including this amount in production costs. But it is worth knowing that this scheme cannot be implemented if a person switches to a different tax regime.

By the way, with regard to payment. From January 1 of this year, 2017, new KBKs are used. For a fixed contribution to the Pension Fund, the requisite 18210202140061100160 is valid. For an additional one - 18210202140061200160. You need to be careful, since the KBKs are almost identical and differ only in one digit. For FFOMS, in turn, the KBK 18210202103081011160 is valid.

You can pay for them online. To do this, you need to go to the official website of the tax office. Navigation on it is simple and straightforward, so any ordinary user can figure it out. The main thing is then, after completing the online payment, to save the electronic receipts. Of course, they will be saved in the archive anyway, but it is better to immediately put them in a separate folder.

When you don't have to pay anything

There are also such cases. They should also be noted with attention, talking about the minimum tax on expenses under the simplified tax system.

The fact is that many people open individual entrepreneurship, but do not conduct any activity. In this case, at the end of the tax period (the terms were mentioned above), they submit a zero return. If a person had no profit, then there are no advance payments and fines. The only sanction that can be imposed is 1,000 rubles for late reporting.

You do not need to do any calculations in drawing up the declaration either. All lines, which usually indicate the amount of revenue and expenses, are dashes. The revenue is zero, which means that the tax is the same.

But! Every entrepreneur must pay fixed contributions. Even if he does not conduct activities. To date, the amount of annual contributions is 27,990 rubles. Of these, 23,400 rubles go to the Pension Fund, and 4,590 rubles to the FFOMS.