Consumer loan Raiffeisenbank: conditions, interest rate

Raiffeisenbank has been on the credit market for over 20 years. During this period, it has firmly established itself in the twenty largest banks in the country and ranks 7th in terms of the number of loans issued to individuals. The bank is considered a reliable, and most importantly, a stable partner, so there are a lot of people willing to take out a loan from Raiffeisenbank.

Each borrower tries to find the best loan conditions for himself. The first thing he pays attention to is interest. Consumer loans from Raiffeisenbank are issued at a favorable annual rate of 14.9-19.9%.

For comparison, the same loan from Sberbank can be obtained at a rate of 16.9-22.9%.

In addition to optimal interest, the bank is characterized by the following advantages:

- the minimum time for making a decision on an application is from 1 to 48 hours;

- no commissions for opening and maintaining a credit account;

- lack of collateral - no pledge or surety is required;

- free issuance of a debit card;

- possibility of free early repayment starting from the first month.

Lending terms

Consumer programs differ depending on the categories of persons who can issue them. There are four types of them in the Bank:

- for customers who use the Premium package of services;

- for persons who are participants in the salary project;

- for employees of partner companies;

- for borrowers who do not belong to the above categories (Personal loan).

They differ in the maximum value of rates and the number of documents required for registration. Thus, the rates for salary clients vary from 14.9 to 16.9%, depending on the term of the agreement, while the maximum interest rate for a Personal Loan can reach 19.9%.

Minimum amount cash is 90 thousand rubles, and maximum - 1.5 million rubles.(2 million rubles for salary clients). The contract is drawn up for a period of 12 to 60 months.

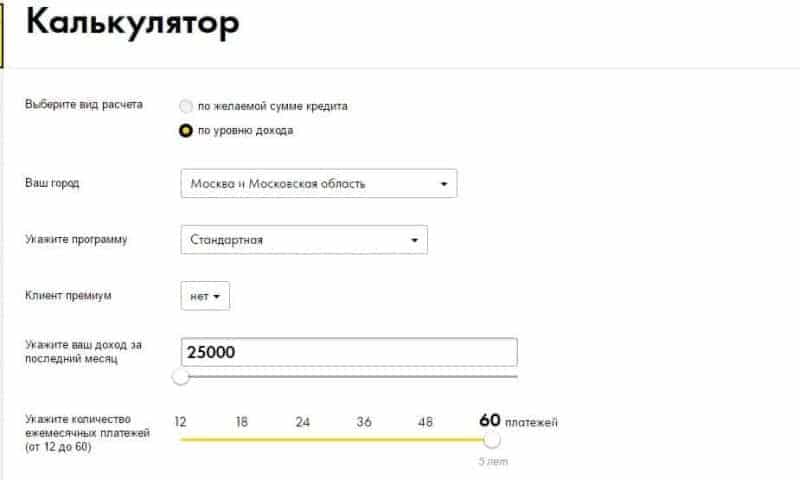

On the official website, you can calculate a Raiffeisen loan with a preliminary monthly payment. The calculator takes into account the initial conditions: the place of registration of the borrower, the availability of insurance and the loan program. For example, under the standard program without insurance, a loan in the amount of 100 thousand rubles. will cost 9023 rubles monthly for 1 year. The total overpayment will amount to 8299 thousand rubles.

Loan processing procedure

Citizens of the Russian Federation who have reached 23 years of age, but not older than 67 years old at the time of the last payment under the loan agreement, can apply to the bank for cash. The registration and permanent work of the borrower must be in the village where the Raiffeisenbank division is present. A potential client must work for at least 6 months at the current place of employment and have an income of 15 thousand rubles. There are two ways to apply for a loan:

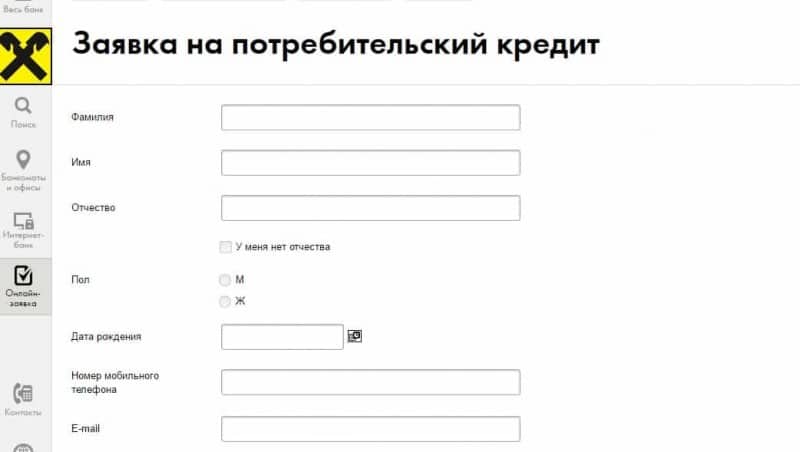

- online application for a cash loan from Raiffeisenbank;

- filling out an application together with a credit manager at a bank branch.

The questionnaire consists of several sections:

- Personal information (name, gender, date and place of birth, marital status and children).

- Contacts (mobile phone numbers, residence and registration addresses).

- Information from the place of work (name, registration address and stationary number of the company, as well as seniority, income level and position).

- Credit and property data.

Together with the application to the bank, you must provide a passport, a document confirming income (acceptable in the form of a bank), a copy of the work book. For salary clients, one passport is enough.

The result is communicated to the client's mobile phone or email. In case of a positive decision, a bank employee contacts the borrower for further recommendations for action. The amount that Raiffeisenbank has determined as acceptable (based on customer data) is transferred to the credit account within one business day.

Using credit

A consumer loan must be repaid on a monthly basis by depositing an amount not less than indicated in the payment schedule. You can deposit funds to your account free of charge in the following ways:

- through ATMs Cash-in;

- transfer from another account opened with Raiffeisenbank in the Raiffeisen Connect system;

- use of Raiffeisenbank terminals or cash registers (if specified in the agreement, otherwise a commission will be charged).

- it is also possible to pay with an additional commission through self-service terminals, cash desks of other banks or by wire transfers.

It is recommended to make monthly payments 5 working days before the date specified in the agreement so that the funds can be credited to the account and there is no delay. Penalties for late repayment of debt include a penalty for each day of delay in the amount of 0.1% of the payment amount.