Mortgage property insurance procedure – 4 main stages + cost of the service

You will learn what determines the cost of property insurance for a mortgage, how to correctly calculate insurance for an apartment and what list of documents will be needed to complete this procedure.

15.06.2018 Alla Prosyukova

Mortgage lending is rapidly gaining momentum. According to Sberbank, the growth rate is about 12% per year. Hand in hand with a mortgage comes collateral insurance. The best lawyers are involved in drawing up the insurance rules, prescribing in them, first of all, what will allow the insurer to get the maximum profit.

In order for mortgage insurance to be really beneficial for the borrower, you need to know some of the features of the process. It is sometimes difficult for an ordinary borrower to figure out all the nuances on their own.

The new article of our portal will definitely help in this!

From it you will learn:

- why insure mortgage real estate;

- what type of insurance is cheaper and why;

- how much full insurance will cost and learn how to calculate the cost of the policy yourself.

Join now!

What does mortgage insurance provide?

All three participating parties are interested in mortgage insurance: the lender, the borrower, and the insurer. Let's see what the benefits of each of them are.

The creditor bank insures itself against non-repayment of loans issued. A mortgage is a long-term loan. The amounts are estimated in millions of rubles. It is impossible to calculate all the risks for 10-30 years, which means that the creditor should protect himself. The main role in this is given to insurance.

Most borrowers believe that collateral insurance is a waste of money. The recipient of the loan every penny in the account. However, remember that "the miser pays twice." It is insurance that will allow the borrower to fulfill his obligations to the lender in case of force majeure and loss of collateral.

And finally, insurance companies. They work for the purpose of making a profit, its main part is the difference between insurance premiums and payments made to compensate for damage upon the occurrence of an insured event.

To understand what amounts we are talking about, I prepared a sample of 3 leaders in the mortgage insurance market:

I think the benefit of insurers is obvious!

What are the types of mortgage insurance?

Collateral property is insured either for the amount of borrowed funds or for the full estimated value of the collateral object.

Making a policy for the amount of the loan is the most popular form among Russian mortgage lenders. This is explained by its lower price compared to insurance against the cost of the assessment.

Initial data:

- Sberbank mortgage;

- the object is purchased on the secondary market;

- the cost of the apartment is 5 million rubles;

- the amount of the loan is 1 million rubles;

- loan term 10 years;

- the borrower is a 35-year-old woman living in Kazan.

The cost per year from the market value of the collateral is 7500 rubles, from the loan amount - 1521 rubles.

However, when choosing the type of insurance, one should take into account not only the cost of the service, but also the procedure for compensation in the event of an insured event.

So, in the event of a fire and the complete loss of collateral, if the insurance is issued for the amount of the loan, then payments to the bank will be made in the amount of the balance of the debt on it. In such a situation, the borrower is not only left without an apartment, but also loses money already paid to repay the loan.

If the policy is issued for the full price of collateral real estate, then after repayment of the loan obligation, the borrower receives the difference between the insurance indemnity and the balance of the mortgage debt.

How to calculate property insurance

The cost of insurance is usually 0.1-0.5% of the loan amount or the appraised value of the apartment (if the borrower decides to insure the full value of the purchased property). The value of % depends on the year of construction and design features (material of walls, ceilings) of the collateral.

The final cost of home mortgage insurance is additionally influenced by many different factors:

- characteristics of the collateral object (for example, an insurance policy for a wooden house will, by definition, cost more than new buildings);

- age, gender of the borrower;

- his profession;

- requirements of the lending institution.

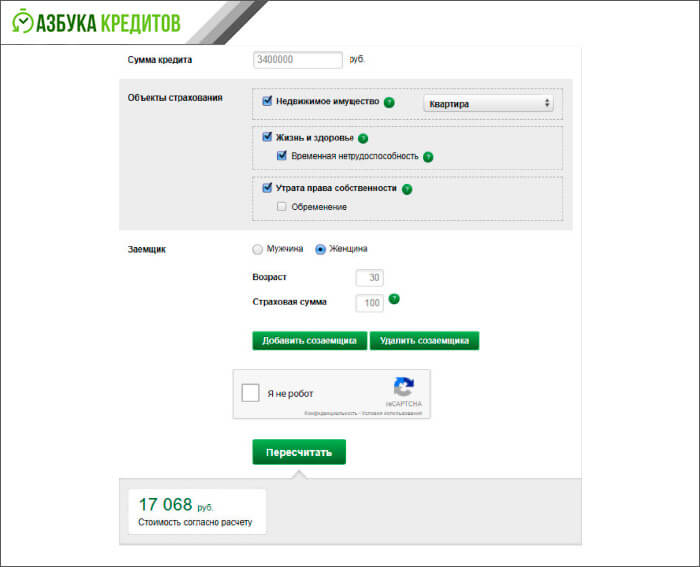

Calculate the approximate price of the policy yourself using online calculators and special formulas.

When using a calculator, everything is extremely simple! You must enter the requested information line by line and click the "calculate" button.

Online calculator

Online calculator There is a desire to use the manual method - do the calculations in 2 stages, using the calculation formulas:

- basic cost of insurance B=S+I*S;

- annual insurance premium. CP=B*k/100.

Let's consider a conditional situation.

Let's say we have the following initial information:

Using the data in the table, we will calculate the basic sum insured by substituting the required values into the first formula.

We get:

B \u003d S + IxS \u003d 2000000 + 0.1 * 2000000 \u003d 2200000 rubles.

Then we calculate the price of the policy using the 2nd formula:

SR \u003d 2200000 * 0.3 / 100 \u003d 6600 rubles.

So, in the first year we will have to pay 6600 rubles.

In a similar way, the cost of any subsequent insurance year is calculated from the balance of credit debt.

Real estate insurance procedure - 4 main stages

Property insurance is a mandatory procedure when obtaining a mortgage.

In order for the registration of insurance to go “without a hitch”, I advise you to familiarize yourself with its algorithm in advance.

Stage 1. Choosing an insurer

As of January 1, 2018, there are 222 insurance companies (ICs) operating in the Russian Federation. With such a variety, it is not easy to make the right choice.

- having a license;

- reliability;

- financial stability.

Check the availability of a license on the website of the Central Bank of the Russian Federation in the register of subjects of insurance business. It is important that you have a license for the type of service you need.

The reliability of the insurer will tell his business reputation, the period of existence in the insurance market, the composition of the founders and investors. Only professional, responsible companies can operate for more than 3-5 years.

And if the founders and investors are large firms or banks, then this not only gives solidity, but also serves as a serious "safety cushion" both for the insurance company itself and for its customers.

When making a choice, collect customer reviews about the candidate, check out his ratings.

Speaking about financial stability, I do not urge to analyze the multi-page accounting and management reports of the insurer. It is enough to find out whether the insurance company was subject to sanctions for non-compliance with the regulations. And again, there is information about this on the website of the Central Bank of the Russian Federation.

Want to get all the information at once? Use specialized Internet resources. Personally, I like insur-info.ru and insur-portal.ru. These are sites about insurance, where all the necessary and, importantly, up-to-date information is collected together.

Stage 2. Preparation of documents

Having decided on the insurance company, collect the package of documents necessary for the conclusion of the contract. Its composition is better to check with your insurer.

The standard list consists of:

- Passport of the borrower.

- Appraiser's report.

- Loan agreement + payment schedule.

- Technical passport.

- Extracts from USRN.

Important! The statement is valid for 30 days. from the date of its issuance.

Stage 3. Registration of an insurance contract

Before signing the contract, carefully read all its clauses. An integral annex to the contract is the "Insurance Rules" - a document that describes in detail all the nuances of the relationship between the insured and the insurance company. After its thorough study, there should be no “white” spots in it for you.

- list of insured risks;

- what events do not apply to insurance;

- methods and terms of notification of the occurrence of an insured event;

- possible reasons for the insurer's refusal to pay out.

This knowledge will help you avoid unpleasant surprises and disputes later.

Check out the video for more helpful information.

Stage 4. Payment of the insurance premium

After the papers are drawn up, it remains only to pay the insurance premium by making a one-time payment of the full cost for all years at once or by paying annual payments.

Each method has its pros and cons:

Which is better, you choose!

Is it possible to refuse apartment and life insurance?

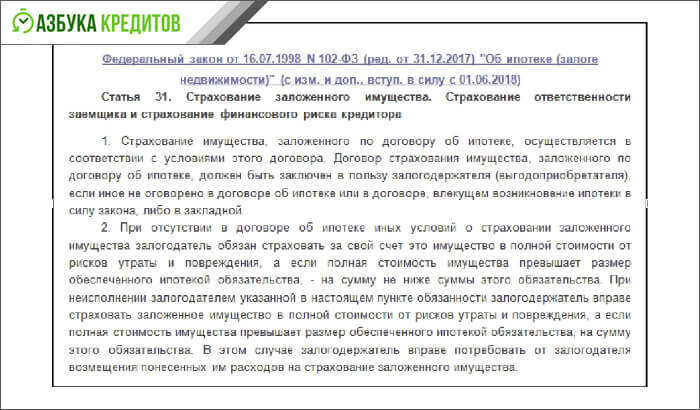

Mortgage insurance is a must. This is explicitly stated in the Mortgage Law.

The obligation to insure collateral is regulated by art. 31

The obligation to insure collateral is regulated by art. 31 Therefore, not insuring a mortgage apartment will not work. Moreover, you will have to draw up a policy annually during the entire term of the loan agreement.

But to insure your life is a voluntary matter! Nobody has the right to force you to pay for such a policy. Feel free to opt out of it. However, first I recommend that you find out what countermeasures the lender can take to your refusal.

Often there is a special clause in the contract for this case. As a rule, for non-registration of life insurance, an increase in the interest rate on the loan is provided.

Did you find such a clause in your contract? Do not despair, first calculate what is best for you: save on the policy, but pay a loan at an increased rate, or insure life, leaving the same conditions on the mortgage.

Suppose the borrower is a woman of 32 years old, professional activity not associated with risks, plans to buy an apartment for 2.5 million rubles, taking a mortgage of 1.5 million rubles from Sberbank for this. for a period of 10 years at 10% per annum. According to the terms of the loan agreement, in case of refusal of life insurance, the bank will raise its rate to 11%.

Let's do the calculation:

So, for 10 years, with an increase in the rate by 1%, the girl will overpay the creditor 100,687 rubles. At the same time, life insurance for a year would cost her 2,550 rubles. Of course, it is more profitable to issue a policy than to pay a loan at an increased percentage.

The calculations were made using online calculators.