Transfer from card to card without commission - which banks send money for free through their payment services

Funds transfer operations between plastic card holders are a common service. Transactions are secure - the sender does not need to carry a wallet with cash. Banks support instant money transfers between their customers. Some transactions are not subject to commission. They are made between the holder of the donor - a card from which free debiting of funds is possible, and plastic, to which the money is transferred.

How to transfer money to a card without commission

A card-to-card transfer fee will generally be charged by banks in most cases. The issued plastic may well turn out to be an anti-donor - that is, the credit institution prohibits transferring funds from it to other accounts / cards for free. In order to conduct mutually beneficial cooperation with the bank, make transactions without problems and pay high interest rates, you should study the technical side of the issue and follow the rules:

- Familiarize yourself with the contract, which should indicate the prices for all types of operations.

- The issuing bank can link, at the request of the client, several cards to one of his accounts. Internet banking must be connected. You can use it through the website of the credit institution and / or its mobile application. With its help, the client has the right to move the amounts he needs between his accounts, transfer funds free of charge to holders of plastic issued by the same financial institution.

- When making transactions, credit card holders should be careful to avoid overdraft - overspending using borrowed money from a financial institution.

- Clients of one bank can transfer money from card to card without commission. You can do this in any convenient way:

- Through an ATM. You need: the card number of the recipient of funds and your own card. Insert it into the receiver of the device, enter the pin code, follow the instructions of the system. Complete the transaction process, request a check, check the balance and account balance.

- Through the bank's website using the card-to-card form. You will need the card numbers of your and the recipient of the funds, you may need CVC2 or CVV2 - three numbers located on the back of your plastic.

- Using the Internet bank, using a mobile application or through the portal of a financial institution. You should register a personal account on the website of the credit institution that issued the card. The sender is authorized by receiving a code on his mobile number, which is entered in the field of the Internet bank login form.

- Having made a visit to the branch of the credit institution that issued the card, through the cashier.

- By calling the support hotline (if such a service is provided).

Intrabank transfer

Interbank transfer from card to card without commission is a type of operation that should not be confused with card-to-card transactions: their mechanisms are different. The first ones are made through an intermediary - the Central Bank of the Russian Federation, the second ones are similar to buying by card - such a money exchange is called an account replenishment. It is also not produced directly, but thanks to the work of international payment systems: MasterCard, Visa. Today they have an alternative. Clients of Russian banks can purchase the product of the MIR national payment card system.

Internal transfers from card to card without commission in most cases are carried out using the card and phone numbers of the owners. Additional information - BIC, OKPO of the bank, purpose of payment, full details of the recipient's account - the sender will not need to enter: all the information that is necessary to process the transaction request is already in the system.

Transferring money from a card to a Sberbank card

You can transfer funds from one card to another issued by Sberbank using traditionally known methods. Here is their list:

- Through the mobile application Sberbank Online. You will need a smartphone connected to the Internet, and the installed program. Instruction:

- The bottom menu is the "Payments" option - the "Sberbank Client" tab.

- Enter the last name, first name, patronymic of the recipient, his phone / card number, the amount you want to transfer in the search box.

- Click the "Translate" button.

- Via internet banking. You will need a computer connected to the Internet, registration in Sberbank Online. Instruction:

- Select the menu item "Transfers and payments" - the tab "Transfer to a Sberbank client".

- Decide on the type of operation: by phone number or by card number.

- Fill in the fields and click Submit.

- Confirm the transaction by entering the code that will be sent to your mobile phone in the field.

- SMS command. You will need the simplest cell phone and connecting the full package of the Mobile Bank SMS service. Send a message to number 900: TRANSFER (recipient's phone number transaction amount).

- Through a Sberbank ATM. You will need a donor card and the plastic number of the recipient of the money. Insert the card into the device, select the menu item "Payments and transfers" - the option "Transfer of funds". Follow the prompts. In order to control the expenditure of funds, check the balance of the account by requesting a receipt printout.

Sberbank customers will without fail pay a commission when transferring money from their card to plastic, which was issued by a branch of the same credit institution located in another region. Interest-free transactions are possible in the following cases:

- between cards and accounts of one client;

- from plastic to an account and vice versa if they are issued/opened in the same division of a financial institution;

- from one card to another, if both are issued by Sberbank offices located in the same region.

Transfer of funds without interest from a card to a Tinkoff card

The bank does not have its own branches and is engaged in remote servicing of citizens. The terms for receiving funds when transferring from one plastic to another range from a few seconds to two days, depending on the type of payment system, and money goes from / to MasterCard even longer - it is possible to increase the completion period of the operation up to 5 days. You can make a transfer to a Tinkoff card without commission in 3 cases:

- From Tinkoff Black debit to plastic issued by another credit institution.

- From one card to another between Tinkoff clients.

- On Tinkoff Black plastic. You can transfer money from a card issued by any third-party bank.

A user of a remote Tinkoff bank can make a transfer from card to card without commission in the following ways:

- Through personal account:

- Select the tab "Payments and transfers" in the menu - the option "From card to card".

- Enter your card details and recipient details in the field of the electronic form.

- Confirm the operation using the code that will be sent to your cell phone in an SMS message.

- Via ATM:

- Insert the card into the ATM acceptor.

- Enter your PIN.

- Follow the prompts of the system.

- Specify the recipient's card number and the amount of money you want to transfer, confirm the operation.

- Take the check and check the balance of the account.

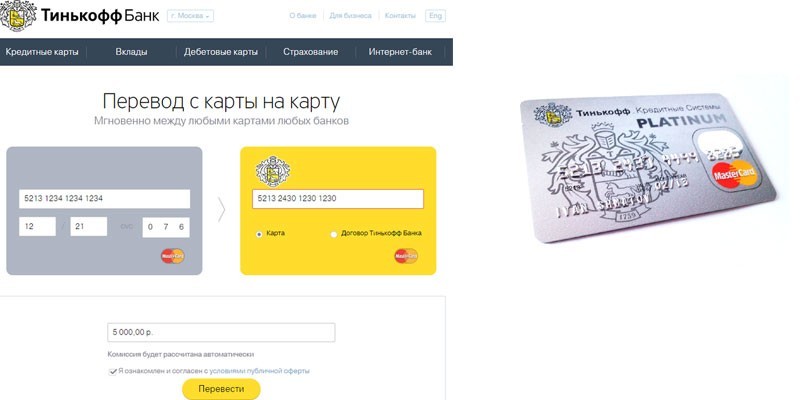

- Through the Tinkoff Bank website using the electronic card-to-card form:

- Select the blue menu "Payments" - the link "Transfers from card to card".

- Fill in the empty form fields with the required data.

- Specify the recipient's phone / plastic number, the amount you want to transfer.

- Confirm your acceptance of the terms of the public offer - check the box at the bottom of the page.

- Click the "Translate.

- Call the Tinkoff support operator by clicking "Online call to the bank" and ask him to transfer money, providing the necessary information.

Transfers between cards of different banks without commission

Many banks offer cardholders of third-party financial institutions to use the option of free c2c replenishment of credit and debit cards issued by them through their official websites. Here is their list:

- Binbank. The maximum amount of 1 transaction is 85 thousand rubles, the monthly plastic replenishment limit is 599 thousand rubles.

- Tinkoff Black. The transfer cannot exceed 75 thousand rubles. for 1 time and 300 thousand rubles. per month.

- touch bank. Replenishment limits: 75 thousand rubles. per day, 0.5 million rubles. monthly.

- RocketBank, "Cozy Space" tariff. The minimum account replenishment amount is 5 thousand rubles. Transaction restrictions: no more than 65 thousand rubles. for 1 operation and 600 thousand rubles. for 1 month.

- Payment card "Beeline". The maximum volume of 1 operation is 125 thousand rubles, not more than 550 thousand rubles. monthly. The minimum transfer amount is 3 thousand rubles, the system writes off 50 rubles of commission if the sender transfers less.

- Payment card "Corn". Transactional restrictions: no more than 125 thousand rubles. for 1 operation and 550 thousand rubles. monthly. The minimum amount of replenishment is 3 thousand rubles. The commission for transferring smaller amounts is 50 rubles.

- Moscow Credit Bank (hereinafter - MCB). Limits: 100 000 rub. for 1 time, 150,000 rubles. per day, 1 million rubles. within a month.

- Raiffeisenbank. Favorable non-cash transfers without commission through the R-connect mobile application and Internet banking: the amount of 1 transaction should not exceed 150,000 rubles, the daily transaction limit is 300,000 rubles, the monthly limit is 0.6 million rubles.

- Sovcombank. Limits: no more than 75,000 rubles. for 1 time and 0.5 million rubles. - monthly.

- Alfa Bank. Restrictions: the maximum amount of 1 transaction is 100,000 rubles, the monthly volume of transfers should not exceed 1.5 million rubles.

- Baltinvestbank. The maximum amount of a daily transfer is 75,000 rubles, monthly - 300,000 rubles.

- Ural Bank for Reconstruction and Development (hereinafter - UBRD). Limits: no more than 50,000 rubles per transaction, the maximum transaction volume is 300,000 rubles. per day and 0.6 million rubles. per month.

- Russian Standard Bank. Restrictions: no more than 50,000 rubles. for 1 transaction, the maximum monthly volume is 0.6 million rubles.

- Promsvyazbank (hereinafter - PSB). Limits: no more than 150,000 rubles / month.

- Bank Zenith. Restrictions: up to 300,000 rubles / month.

- VTB Bank of Moscow. The maximum amount of transfers: daily - 100,000 rubles, monthly - 1 million rubles.

If the “Interest on the balance” option is enabled, you can perform not only an interest-free c2c replenishment, but also a completely free interbank transfer of funds to Beeline and Corn payment cards, to plastic issued by the following financial institutions.