How to quickly block a Sberbank card

A debit or credit card of Sberbank can be blocked automatically, at the initiative of the bank or client. The Bank has the right to block the card account in case of suspicious financial activities of the client, arrest of his accounts, overdue loans, unauthorized overdraft outside the Russian Federation. The card is automatically blocked by the ATM after three incorrect PIN codes. Blocking at the initiative of the client is a way to protect his funds from illegal access by other persons in case of loss or theft of the card, to ensure their safety in other emergency situations. This must be done as soon as possible.

If a bank card is stolen or lost, the only way to save funds on it is to immediately block the card account so that someone else does not use it. The client can temporarily block the card if he does not know where it went and hopes that it will be found. The bank provides several options for blocking the card account, one of which the holder must choose:

- Temporary blocking - in cases when the client does not know the location of his card, but he hopes to find it.

- Blocking forever - if there are no funds on the account, and its owner is no longer going to cooperate with a credit institution.

- Blocking forever with card reissue is used in cases when there is money on the card account, the client plans to continue cooperation with the bank and use the money.

Sometimes a situation arises when it is not a bank card that is lost, but the phone attached to it. If the Mobile Banking option is enabled, you should also change the phone number.

How to block

There are several ways to block a debit or credit card account. Depending on the urgency of the problem, as well as the situation in which its holder is, he can use the most accessible way at the moment.

By phone via support

You can call customer support using one of two numbers:

- 88005555550 - reference

- 88002003747 - servicing bank card holders

In this case, you will need to say the holder's full name, card number, code word. If he has forgotten the code word, it will be necessary to additionally indicate the passport data, the address of permanent registration (the data entered in the contract).

You can block the card account in the tone mode of the phone through the answering machine, by selecting the necessary sections of the menu at the prompt. The account will be blocked immediately, but after that you will need to go to the bank branch and apply to ban all transactions on the account. If this is not done within the specified period, account operations will be resumed before the client's written application is received by the bank.

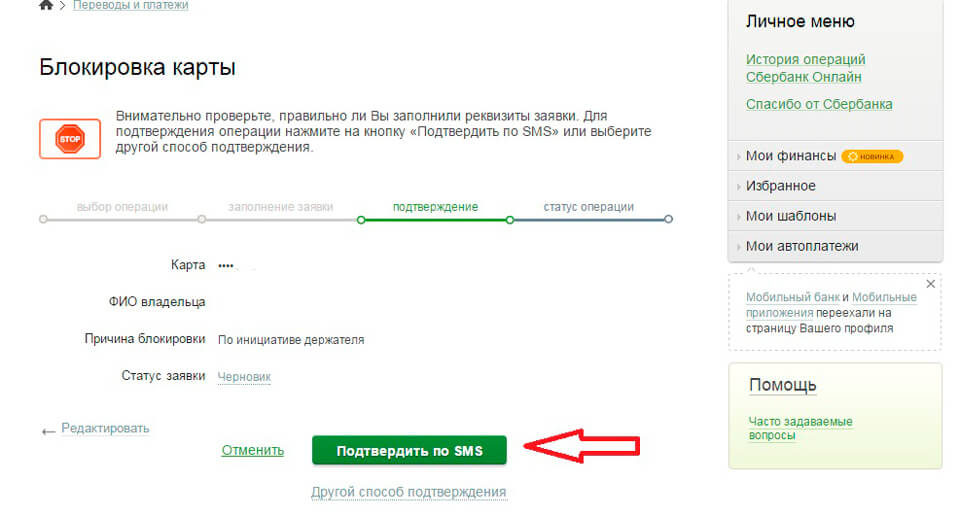

In your personal account

Using a credit or debit (salary) card, it is convenient to manage funds through your personal account in Sberbank Online. If the client has access to the Internet, you can quickly block the account in your personal account.

The user needs:

- Login to your account

- Click on the required card

- In the menu of actions on it, select the option "block"

- In the list of reasons for blocking, indicate the

The same steps can be performed from a smartphone.

In the Mobile Bank

When the “Mobile Bank” service is activated, the client can simply block the card by sending an SMS to the number 900 with the text “Blocking” (“block” or “03”). Then there is a space, the last four digits of the card number, a space, a reason code, choosing one of the following:

- 0 - lost

- 1 - stolen

- 2 - stuck in an ATM

- 3 - another reason

For example, the text: "Block_2002_1" is a command to block the card due to theft. In response, an SMS with a confirmation code will be received from number 900. It should be sent to the same number in a reply SMS. After that, the account will be blocked immediately. After these steps, you do not have to apply to the bank with a written application. When issuing a credit or debit card, it is recommended to immediately connect the "Mobile Bank".

UBRD credit card 120 days without interest

Credit limit:

RUB 300,000

Grace period:

120 days

from 27%

from 21 to 75 years old

Consideration:

Service:

1,500 rubles

Visa Classic 100 days without%

Credit limit:

RUB 1,000,000

Grace period:

100 days

from 14.99%

from 21 to 65 years old

Consideration:

Service:

From 1190 rubles

Credit card 110 days without%

Credit limit:

RUB 600,000

Grace period:

110 days

from 29%

from 23 to 67 years old

Consideration:

Service:

0 rubles

Tinkoff Platinum credit card

Credit limit:

RUB 300,000

Grace period:

55 days

from 15%

from 18 to 70 years old

Consideration:

Service:

590 rubles

In Sberbank branches

If the card is lost or stolen during working hours, it is most convenient to go with a passport to one of the nearest bank branches. There, contact the operator, tell the code word, plastic number, apply for the prohibition of any transactions on the card account. After such actions, the account will be blocked immediately. If desired, at the same time, you can:

- order another card

- withdraw money from the account

- transfer them to another bank account in the same or in another bank by paying a commission

The department also draws up an application to change the phone number attached to the card, in case of its theft or loss.

Who else has the service available

In addition to the owner and the bank, the card can be blocked by another individual. Let's say a person found bank plastic and decided to block it. He calls the support service, reports the card number and other data indicated on it. The card account will be blocked. After that, he can hand over the plastic to the operator of the nearest branch. The bank will notify the client about blocking the account by SMS or by phone. The client's debit or credit account will be blocked until he contacts a Sberbank branch.

How to unblock

The process of unblocking the card account is more time-consuming compared to blocking it. To unblock an account, you need to submit a written application to the Sberbank branch and wait until it is considered and a decision is made. It will take some time. It is possible that the application will be lost or will be considered for a long time. It is much easier to use the service of reissuing a card due to its blocking by paying the required commission. The new plastic will be available in 3-10 days.

Ways to withdraw money from a blocked card

The bank card is just a tool used by the client to manage the money that is on the card account. Blocking it means that the action of this instrument for the disposal of funds is suspended. There are several ways to withdraw money if the card is blocked.

- In case of temporary blocking, you can receive money from the account through the personal account of the Sberbank Online website if you have another account of this bank. You need to do the following:

- temporarily unblock the card

- transfer funds from it to another account in full

- block an old account without money on it and without the right to restore it

- cash out through an ATM with another card

- If it is impossible to temporarily unblock the card online, you should contact one of the Sberbank branches with a passport. The specialist identifies the client and draws up an application for issuing money through the cashier. When performing such an operation, a bank commission is possible. Through the cashier, you can replenish a blocked account, and withdraw money from it.

- Through the contact center for the service of cardholders. If the card has been blocked at the request of the client, he just needs to call the hotline, explain the reason and ask to unblock the account. To do this, you will need to provide data to identify it.