Refinancing a mortgage at VTB 24

The main difference between mortgages and other types of lending is its long term. The mortgage for the purchase of housing is issued for 10-30 years. Naturally, over time, the conditions that were attractive at the time of registration of the transaction lose their relevance and economic profitability.

The possibility of refinancing a mortgage taken from VTB 24 in 2018 is an excellent chance to significantly change the existing parameters of the loan (currency, duration, total overpayment, etc.).

Refinancing conditions VTB 24

Conditions for each refinancing application are selected individually.If you have an outstanding mortgage in other banks, VTB 24 offers you refinancing on more favorable terms:

- reduction of the current rate to 9.5% (reduction and consolidation of interest for the entire duration of the new agreement is made after the signing of all documents and registration of a mortgage on real estate);

- the ability to convert foreign currency loans into the ruble equivalent;

- the term of the agreement - up to 30 years (the ability to reduce monthly payments by increasing the loan term);

- the maximum loan amount is up to 30,000,000 rubles, but not more than 80% of the appraised value of the collateral.

Relending at VTB is carried out in the following areas:

- refinancing of military mortgages (NIS state program);

- standard home loans from other financial institutions.

Refinancing a mortgage at VTB24 with a decrease in the current interest rate is available for salary and corporate clients of the financial institution.

The Bank tries to make the refinancing process as clear and transparent as possible for its potential and existing clients. Therefore, for each specific case, consulting services are provided by specialists.

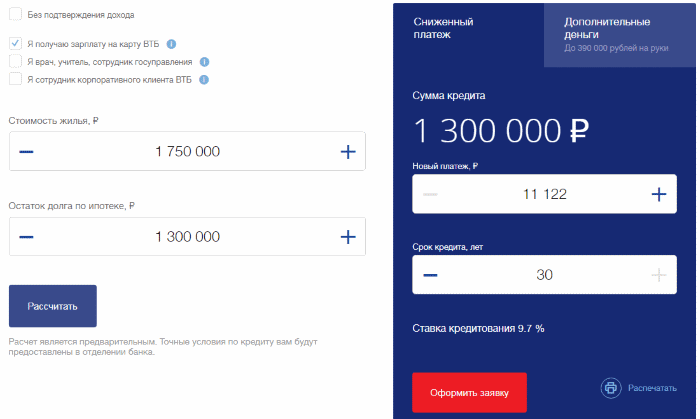

Refinancing calculator

The amount of payment and rate depends on several conditions.

The amount of payment and rate depends on several conditions. Every potential borrower understands that refinancing will have a positive effect on his financial position. But few people can really imagine what changes will occur according to current indicators:

- the amount of the monthly payment;

- loan terms;

- total loan overpayment.

To enable customers to see the possible changes with their own eyes, VTB 24 has created a special online program presented on the bank's official website.

- the estimated value of the registered property;

- the remainder of the debt on a housing loan, issued in a third-party financial organization;

- the presence of circumstances affecting the decrease in the interest rate (VTB 24 salary card, employee of a corporate client, etc.).

The calculator will calculate the new payment based on the maximum possible duration of the mortgage. If the borrower wants to shorten the term, he can adjust it by observing the automatic change in the amount of the monthly loan installment.

Bank requirements

Unlike a standard home loan, where the main requirements are imposed on a potential borrower, mortgage refinancing at VTB 24 also presupposes that the mortgage itself meets certain criteria.

Consider the basic rules for on-lending provided for by the bank's financial policy.

To the borrower

To obtain approval for on-lending at VTB 24 Bank, you must meet certain criteria:

- Russian citizenship.

- Age - from 21 to 65 years (for women, the upper age limit is 60 years).

- The presence of a residence permit in any region of the Russian Federation (both temporary and permanent are acceptable).

- The ability to document the level of your monthly earnings.

- Availability of documents confirming permanent employment (employment contract or book).

To a refinanced mortgage

- The money under the contract must be spent on the purchase of housing in a new building or in the secondary market (loans for housing under construction and not commissioned are not suitable).

- Absence of current delay in monthly payments at the time of submission of an application for refinancing (it is allowed to have several delayed payments for up to 5 days within the last 12 months).

- Refinancing is possible if at least six months have passed since the signing of the current mortgage agreement, and at least 3 months are left until the expiration date.

Required documents

The main condition for starting the mortgage refinancing process at VTB 24 is the provision of all the necessary documents.

- passport;

- documents confirming the level of the borrower's income;

- copy of the work book or contract;

- military ID (for men);

- a package of documents for an open housing loan (loan agreement, life and health insurance papers, as well as collateral);

- certificate of registration of ownership of the purchased housing;

- a certificate from a third-party bank about the balance of debt and the absence of delays in current payments.

VTB clients who have housing loans from third-party financial institutions and are applying for refinancing must provide all the documents on the list, with the exception of papers on the amount of earnings.

Refinancing

Contact VTB and reduce your overpayment in three steps!

Contact VTB and reduce your overpayment in three steps! Step-by-step instructions to understand how the refinancing process takes place at VTB 24:

- Contacting the bank (you can also order a call back from a VTB 24 specialist and fill out an online application on the official website).

- Preliminary consultation - an employee of the financial institution will select the optimal refinancing program, make preliminary conclusions about the correspondence between the borrower's personality and the collateral.

- Filling out an application for on-lending (a sample for drawing up will be provided by a bank employee).

- Waiting for a decision.

- Provision of documents for mortgage real estate.

- Registration of a mortgage and signing of all necessary papers.

- Paying a mortgage loan at a third-party bank.

- Drawing up a mortgage on real estate and registration with Rosreestr.

- Change in interest rates and adjustments to the payment schedule.

Repayment methods

Repayment of debt on a refinanced loan at VTB 24 Bank is no different from repayment of a regular loan. The payer can choose the only payment method convenient for himself or change it depending on the circumstances:

- online banking "VTB-Online";

- branded ATMs;

- payment terminals of third-party companies (QIWI, Eleksnet, etc.);

- transfer system "Zolotaya Korona" (payment acceptance points are located in retail outlets of mobile operators);

- branches of the Russian Post;

- other credit and financial organizations.

Before using one or another option for repaying a debt, check the amount of the commission charged for the payment transaction, as well as the time the payment was credited.

Video: Pros and Cons of Mortgage Refinancing.

Conclusion

Some borrowers are afraid to go through the entire loan process again. This is a fundamentally wrong decision, because a decrease in the interest rate on a long-term loan even by 1% significantly reduces both the total overpayment and the monthly payment.

Refinancing a mortgage at VTB 24 is quite simple. The number of required documents and certificates is minimal, and the period for consideration of each application does not exceed 5 days.