Mortgage loan restructuring in VTB 24

Unlike other banks, VTB24 does not set official strict requirements for borrowers by age, place of work, etc. The official website states: in order to restructure a mortgage in VTB-24, the borrower must:

a) have a permanent residence permit in the region of presence of the VTB24 branch;

b) confirm your income with a 2-NDFL certificate or in the form of a bank (part-time work is also taken into account).

The application can be submitted both at the branch and on the official website of the bank: www.vtb24.ru.

The bank makes a decision within 4-5 working days.

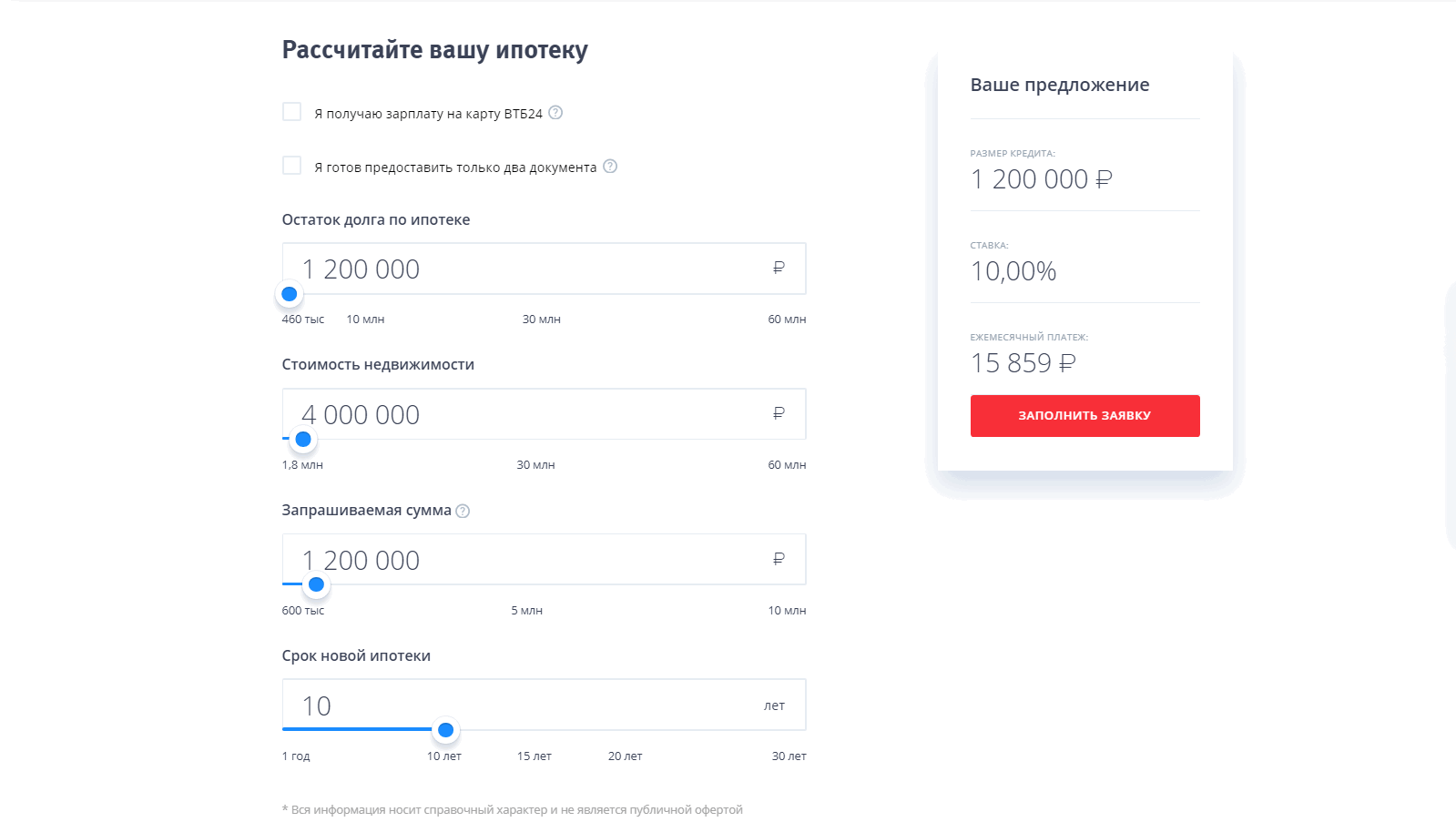

The list of documents required for restructuring is presented in the screenshot below:

Documents for mortgage restructuring in 2017 with the help of VTB

Terms of mortgage restructuring in VTB

VTB24 is distinguished by a wide range of parameters and conditions for mortgage restructuring. The basic conditions for the contract are as follows:

- interest rate varies within 9,70% - 10,70% ;

- credit term from 1 year to 30 years;

- will give you from 600.000 to 30 million rubles.

In fact, the interest rate is fixed at several values and does not depend on conditions such as the amount of the loan and the term. Here play the role of the guarantee that the client provides for the bank:

- Salary VTB24 will receive a loan at 9.70% per annum.

- An ordinary client who has provided all the necessary documents will receive 10% per annum.

- And if you can apply for restructuring with only two documents (passport and SNILS), then your rate will be increased to 10.70% per annum.

Currently, the bank has a special offer: until December 30, 2017, you can apply for a mortgage restructuring with an interest rate of 9.45% per annum. To do this, you need to be a payroll employee of VTB-24 and take out comprehensive insurance.

Example 1 You took a VTB24 mortgage and wanted to arrange a restructuring. Your old loan amounted to 1,700,000 rubles, of which you managed to pay 150 thousand. You will definitely get 10% per annum. If you set the loan term for 15 years, then you will have to pay 16.442 rubles per month, and if for 20 years, then 14.765 rubles per month.

Example 2 Your apartment costs 2.750.000 rubles. You made a down payment of 412,500 rubles and took out a mortgage from VTB-24 for 2,312,500 rubles. At the same time, you receive a salary in the same bank. Having paid 200,000 rubles there, you decided to issue a mortgage restructuring. Your rate will be 9.70% per annum. If you take a loan for 10 years, then your monthly payment will be 27.568 rubles, and if for 15 years, then you will have to pay 22.315 rubles per month.

The exact amount of monthly payments can be calculated using the calculator on the official website of the bank www.vtb24.ru.

You should not become a payroll employee of VTB-24 just for the sake of getting a lower interest rate. As calculations show, the difference in monthly payments at 9.70% and 10% is in most cases 300-500 rubles, and under conditions of a short restructuring period, this difference will be felt even less.

Mortgage calculator on the official website of VTB24

Is it possible to repay a restructured mortgage in VTB-24 ahead of schedule?

Yes, you can repay the restructured loan ahead of schedule without restrictions: at least in full, at least in parts. The bank does not charge any fees for this transaction. Before that, you need to issue an order using the VTB24-Online service and change the terms of the loan repayment: reduce the term or amount of the monthly payment. Then you need to deposit the amount of your choice using one of the following methods:

- through an ATM;

- in the VTB24 branch;

- using the VTB24-Online service;

- using the service "Zolotaya Korona - Repayment of loans".

Notes.

- For early repayment at a bank branch and through the Golden Crown, a commission is taken.

- Payments at ATMs and at VTB24 branches are credited in 1 day, with the help of the Golden Crown - up to three days, and through VTB24-Online - repayment occurs instantly.

- For early repayment using the "Golden Crown" account details will be required.

Is it possible to use government assistance in restructuring a mortgage in VTB?

Yes, in 2017 VTB has a mortgage restructuring program with the help of the state. The essence of the program: if you took a mortgage in any bank, paid it in good faith, but at some point your financial situation deteriorated sharply, the state will cover part of your debts to the bank with the help of VTB24 funds.

Below is a complete list of conditions under which you can qualify for government support:

- the total family income has fallen by 30% or less, or each family member has less than two subsistence minimums from the total family income (the subsistence level in the given region is taken into account);

- you have paid your mortgage regularly for a long time;

- you are overdue on payments for more than one, but less than three months;

- the price of your apartment is no more than 60% of the average market value in the region;

- living area does not exceed 100 sq. meters for an apartment and 150 sq. meters for the private sector;

- each family member has no more than 30 square meters. meters;

- you have no other home or you own no more than ½ share of another home.

- families with minor children;

- families with adult full-time students;

- families with disabled children and directly disabled adults;

- employees of state institutions;

- employees of the Academy of Sciences and companies associated with the Academy of Sciences;

- employees of city-forming enterprises.

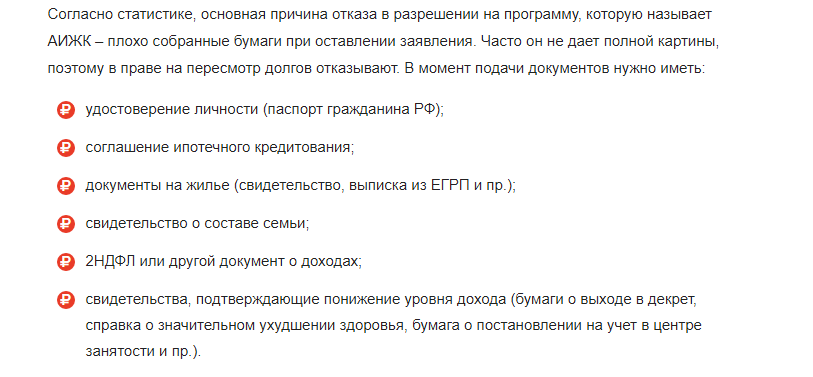

However, it is not enough to comply with these conditions - you still need to draw up a whole bunch of papers and come with them to the Agency for Housing Mortgage Lending (AHML). It is there that you will be able to apply for mortgage restructuring in VTB24.

Documents for restructuring a mortgage with state support

We advise you to collect as many documents as possible that will confirm that your income has decreased. As a rule, AHML rejects applications on the basis of poor documentary base of the applicant for restructuring, and these documents will significantly increase the likelihood of a positive decision.

How will mortgage conditions change after the restructuring at VTB24 with state support?

Mortgage restructuring in VTB24 with the help of the state can be carried out in one of the following ways:

- you will have your monthly payments halved for up to 1 year;

- you will be able to pay only interest on the mortgage for six months without repaying the principal debt;

- you can extend the mortgage term for up to 10 years;

- your interest rate will be reduced to 12% per annum.

All costs of the bank where you took out a mortgage will be covered by VTB24. In 2017, VTB24 can provide up to 600,000 rubles, which will cover part of your mortgage debt (however, this preferential payment cannot exceed ⅕ of your mortgage loan).

VTB mortgage restructuring: reviews and criticism

On the banki.ru portal, VTB24 is ranked 8th in the national rating, having collected more than twenty-seven thousand reviews. The feedback card file is periodically updated with fresh impressions of new customers, and based on numerous reviews over the past two months, you can get a general idea of the mortgage restructuring in this bank.

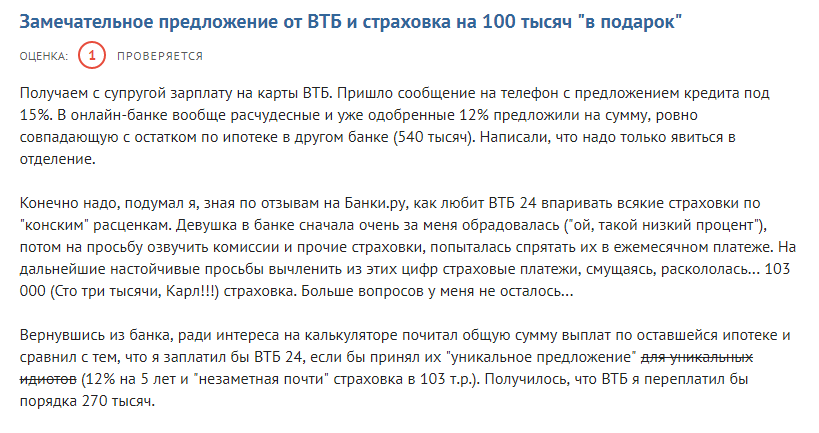

Very many, if not all, reviews of mortgage restructuring turned out to be negative. A significant part of the reviews is devoted to the restructuring of the VTB24 internal mortgage (when the client once issued a mortgage at one percent, and now, having learned about the bank's new tariffs with a lower rate, he wants to switch to this mortgage product). It turns out that the bank simply does not give the opportunity to reissue the contract on new terms, using various pretexts and tricks: either on the last day it turns out that without insurance, the restructuring will not be approved, then at first they approve the application, and then they begin to remain silent and evade the approval of the restructuring.

So, on October 14, 2017, val44era writes that VTB24 agrees to restructuring its own mortgage at a lower rate, while “sucking in” life insurance in the amount of 103 thousand rubles! As a result, it turns out that after the restructuring, monthly payments (taking into account the cost of insurance scattered over them) turn out to be more than before the restructuring.

Val44era is outraged by the trick of the bank to lure out money with an imaginary restructuring

It should be noted that the actual mortgage products in VTB24 received on the site banki.ru, albeit a few, but positive reviews.

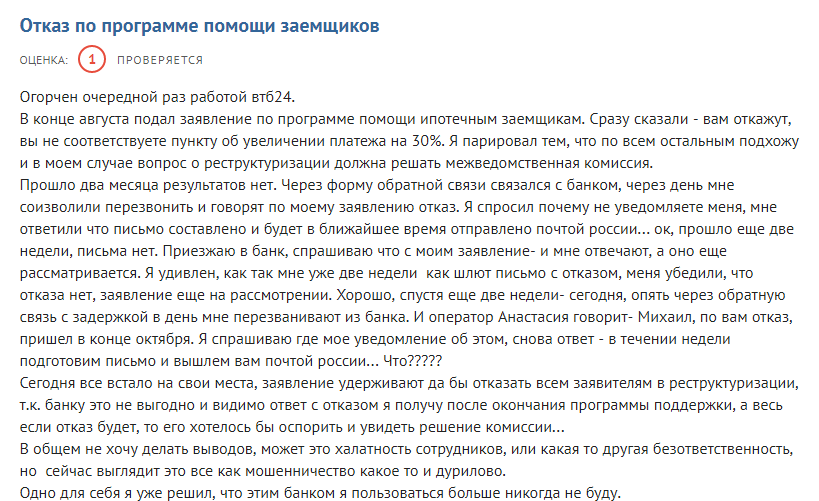

The restructuring of the mortgage in VTB24 with the help of the state is also far from ideal. Clients complain that they never receive this support, and user mihalych_ writes (reviewed on November 23, 2017) that the bank refuses to support clients, but does it in a tricky way: it delays the refusal letter so that the client receives it after the end of the action support program and was no longer able to challenge the decision of the bank.

Michalych_ believes that VTB24 is deliberately playing for time with the refusal to restructure in order to avoid the possibility of challenging its decision

Alexandrina90 a little earlier (November 15) also noticed that VTB24 did not announce its decision for a long time - more than a month and a half:

Another review confirming that VTB24 is taking time to consider documents for mortgage restructuring

However, to most of these reviews, the bank writes clerical answers of the same type, which, as a rule, boil down to the fact that the bank has the right to refuse and not to voice the reasons for a negative answer.