How is ENVD calculated? Corrective Factors of ENVD When the approved K2 comes into effect.

The values of the basic profitability coefficient K2 (K2) UTII-imputed for calculating the UTII tax is established by the representative bodies of regions, territories, municipal districts, urban districts, legislative (representative) government bodies of federal cities of Moscow (since 2014, UTII has not been applied) and St. Petersburg. All regional legislation is presented here by links to the official website of the tax office.

Also UTII can be conducted. I think this is the best in terms of price / quality ratio. The first month is free.

All K2 / k2 UTII of all regions of Russia are relevant for 2019-2020:

| Region |

|---|

| 01 Republic of Adygea |

| 02 Republic of Bashkortostan |

| 03 Republic of Buryatia |

| 04 Republic of Altai |

| 05 Republic of Dagestan |

| 06 Republic of Ingushetia |

| 07 Kabardino-Balkar Republic |

| 08 Republic of Kalmykia |

| 09 Karachay-Cherkess Republic |

| 10 Republic of Karelia |

| 11 Komi Republic |

| 12 Republic of Mari El |

| 13 Republic of Mordovia |

| 14 Republic of Sakha (Yakutia) |

| 15 Republic of North Ossetia-Alania |

| 16 Republic of Tatarstan |

| 17 Tuva Republic |

| 18 Udmurt Republic |

| 19 Republic of Khakassia |

| 20 Chechen Republic |

| 21 Chuvash Republic |

| 22 Altai Territory |

| 23 Krasnodar Territory |

| 24 Krasnoyarsk Territory |

| 25 Primorsky Territory |

| 26 Stavropol Territory |

| 27 Khabarovsk Territory |

| 28 Amur Region |

| 29 Arkhangelsk region and Nenets JSC |

| 30 Astrakhan region |

| 31 Belgorod region |

| 32 Bryansk region |

| 33 Vladimir region |

| 34 Volgograd region |

| 35 Vologda region |

| 36 Voronezh region |

| 37 Ivanovo region |

| 38 Irkutsk region |

| 39 Kaliningrad region |

| 40 Kaluga region |

| 41 Kamchatka Territory |

| 42 Kemerovo region |

| 43 Kirov region |

| 44 Kostroma region |

| 45 Kurgan region |

| 46 Kursk region |

| 47 Leningrad Region |

| 48 Lipetsk region |

| 49 Magadan region |

| 50 Moscow region |

| 51 Murmansk region |

| 52 Nizhny Novgorod region |

| 53 Novgorod region |

| 54 Novosibirsk region |

| 55 Omsk region |

| 56 Orenburg region |

| 57 Oryol region |

| 58 Penza region |

| 59 Perm Territory |

| 60 Pskov region |

| 61 Rostov region |

| 62 Ryazan region |

| 63 Samara region |

| 64 Saratov region |

| 65 Sakhalin Region |

| 66 Sverdlovsk region |

| 67 Smolensk region |

| 68 Tambov region |

| 69 Tver region |

| 70 Tomsk region |

| 71 Tula region |

| 72 Tyumen region |

| 73 Ulyanovsk region |

| 74 Chelyabinsk region |

| 75 Trans-Baikal Territory |

| 76 Yaroslavl region |

| 77 Moscow city |

| 78 Saint Petersburg |

| 79 Jewish Autonomous Region |

| 86 Khanty-Mansi Autonomous Okrug-Yugra |

| 87 Chukotka Autonomous Okrug |

| 89 Yamalo-Nenets Autonomous District |

| 91 Republic of Crimea |

| 92 Sevastopol city |

How to calculate a difficult K2?

For example: a children's goods store, Andreevskaya Street in Biysk (Altai Territory). Calculation of the coefficient of basic profitability K2 - the following coefficients should be multiplied: coefficient "A", taking into account the type of settlement in which entrepreneurial activity is carried out (0.9 - Biysk) x coefficient "B", taking into account the types of activity (1 - shop) x coefficient " B ", taking into account the range of goods sold (depending on the range of goods sold - 0.35 - children's products) x coefficient" D ", taking into account the amount of income depending on the place of business inside the city of Biysk (depending on the location of the retail space - 0, 8 - Andreevskaya Street)

Note: the indicator "sales floor area" is determined by the area actually used for trade (this is a part, not the entire lease area).

Article 346.29. Object of taxation and tax base

1. The object of taxation for the application of the single tax is the imputed income of the taxpayer.

2. The tax base for calculating the amount of the single tax is the value of imputed income, calculated as the product of the basic profitability for a certain type of entrepreneurial activity, calculated for the tax period, and the value of a physical indicator characterizing this type of activity.

(as amended by Federal Law of 31.12.2002 N 191-FZ)

3. To calculate the amount of the single tax, depending on the type of entrepreneurial activity, the following physical indicators are used that characterize a certain type of entrepreneurial activity, and the basic profitability per month:

(Clause 3 as amended by Federal Law of 17.05.2007 N 85-FZ)

4. The basic profitability is adjusted (multiplied) by the coefficients K1 and K2.

(as amended by Federal Law of 21.07.2005 N 101-FZ)

5. Abolished. - Federal Law of 21.07.2005 N 101-FZ.

6. When determining the value of the basic profitability, the representative bodies of municipal districts, urban districts, legislative (representative) government bodies of federal cities of Moscow, St. Petersburg and Sevastopol may adjust (multiply) the basic profitability specified in paragraph 3 of this article by an adjustment coefficient K2.

(as amended by Federal Laws of 29.07.2004 N 95-FZ, of 29.11.2014 N 379-FZ)

Corrective coefficient K2 is defined as the product of the values established by regulatory legal acts of the representative bodies of municipal districts, urban districts, laws of cities of federal significance Moscow, St.

(the paragraph was introduced by the Federal Law of June 18, 2005 N 64-FZ, as amended by the Federal Law of November 29, 2014 N 379-FZ)

The paragraph is no longer valid. - Federal Law of 22.07.2008 N 155-FZ.

7. The values of the correction coefficient K2 are determined for all categories of taxpayers by the representative bodies of municipal districts, urban districts, legislative (representative) government bodies of federal cities of Moscow, St. Petersburg and Sevastopol for a period not less than a calendar year and can be set in the range from 0.005 to 1 inclusive. If the normative legal act of the representative body of the municipal district, urban district, the laws of the cities of federal significance Moscow, St. According to the Code, from the beginning of the next calendar year, then in the next calendar year, the values of the correction coefficient K2 that were in effect in the previous calendar year continue to apply.

(as amended by Federal Laws of 31.12.2002 N 191-FZ, of 29.07.2004 N 95-FZ, of 17.05.2007 N 85-FZ, of 29.11.2014 N 379-FZ)

8. Abolished. - Federal Law of 21.07.2005 N 101-FZ.

9. If, during the tax period, the taxpayer has changed the value of the physical indicator, the taxpayer, when calculating the amount of the single tax, takes into account the specified change from the beginning of the month in which the change in the value of the physical indicator occurred.

10. The amount of imputed income for the quarter during which the organization or individual entrepreneur was registered with the tax authority as a single tax payer is calculated starting from the date the organization or individual entrepreneur was registered with the tax authority as a single tax payer.

The amount of imputed income for the quarter during which the taxpayer was deregistered due to the termination of business activities subject to the single tax is calculated from the first day of the tax period until the date of deregistration with the tax authority specified in the notification of the tax authority on the deregistration of an organization or individual an entrepreneur registered as a single tax payer.

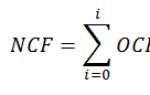

If the registration of an organization or an individual entrepreneur with the tax authority as a single tax payer or their removal from the specified registration was not made from the first day of the calendar month, the amount of imputed income for this month is calculated based on the actual number of days spent by the organization or individual entrepreneur entrepreneurial activity according to the following formula:

where VD is the amount of imputed income for the month;

DB - basic profitability, adjusted by the coefficients K1 and K2;

FP is the value of a physical indicator;

КД - the number of calendar days in a month;

КД1 - the actual number of days of entrepreneurial activity in a month as a single tax payer.

(Clause 10 as amended by Federal Law of 25.06.2012 N 94-FZ)

11. Values of the correction factor K2 are rounded to the third decimal place. The values of physical indicators are indicated in whole units. All values of the value indicators of the declaration are indicated in full rubles. Values of value indicators less than 50 kopecks (0.5 units) are discarded, and 50 kopecks (0.5 units) and more are rounded to the full ruble (whole unit).

(Clause 11 introduced by Federal Law of 22.07.2008 N 155-FZ)

Article 346.30. Taxable period

The tax period for the single tax is a quarter.

Article 346.31. Tax rate

(as amended by Federal Law of 13.07.2015 N 232-FZ)

1. The rate of the single tax is set at 15 percent of the amount of imputed income, unless otherwise established by paragraph 2 of this article.

2. Regulatory legal acts of representative bodies of municipal districts, urban districts, laws of federal cities of Moscow, St. in respect of which a single tax may apply.

Article 346.32. Procedure and terms for payment of the single tax

1. Payment of the single tax is made by the taxpayer based on the results of the tax period no later than the 25th day of the first month of the next tax period to the budgets of the budgetary system of the Russian Federation at the place of registration with the tax authority as a single tax payer in accordance with paragraph 2 of Article 346.28 of this Code ...

(as amended by Federal Law of 25.06.2012 N 94-FZ)

2. The amount of the single tax calculated for the tax period is reduced by the amount:

1) insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory health insurance, compulsory social insurance against industrial accidents and occupational diseases, paid (within the calculated amounts) in the given tax period in in accordance with the legislation of the Russian Federation;

(as amended by Federal Law of 02.06.2016 N 178-FZ)

2) expenses for the payment in accordance with the legislation of the Russian Federation of benefits for temporary disability (except for accidents at work and occupational diseases) for the days of temporary disability of the employee, which are paid at the expense of the employer and the number of which is established by Federal Law of December 29, 2006 N 255-FZ "On compulsory social insurance in the event of temporary disability and in connection with maternity", in the part not covered by insurance payments made to employees by insurance companies that have licenses issued in accordance with the legislation of the Russian Federation to carry out the corresponding type of activity, according to contracts with employers in favor of employees in case of their temporary disability (with the exception of accidents at work and occupational diseases) for days of temporary disability, which are paid at the expense of the employer and the number of which is amended by Federal Law of December 29, 2006 N 255-FZ "On compulsory social insurance in case of temporary disability and in connection with motherhood";

3) payments (contributions) under voluntary personal insurance contracts concluded with insurance organizations that have licenses issued in accordance with the legislation of the Russian Federation for the implementation of the corresponding type of activity, in favor of employees in case of their temporary disability (with the exception of accidents at work and occupational diseases) for days of temporary disability, which are paid at the expense of the employer and the number of which is established by Federal Law of December 29, 2006 N 255-FZ "On compulsory social insurance in case of temporary disability and in connection with motherhood." These payments (contributions) reduce the amount of the single tax if the amount of insurance payment under such contracts does not exceed the amount of temporary disability benefits determined in accordance with the legislation of the Russian Federation (except for accidents at work and occupational diseases) for the days of temporary disability of the employee, which are paid at the expense of the employer and the number of which is established by the Federal Law of December 29, 2006 N 255-FZ "On compulsory social insurance in case of temporary disability and in connection with motherhood."

(Clause 2 as amended by Federal Law of 25.06.2012 N 94-FZ)

2.1. The insurance payments (contributions) and benefits specified in paragraph 2 of this article shall reduce the amount of the single tax calculated for the tax period, if they are paid in favor of employees employed in those areas of the taxpayer's activities for which the single tax is paid.

In this case, the amount of the single tax cannot be reduced by more than 50 percent by the amount specified in this paragraph.

Individual entrepreneurs who do not make payments and other remuneration to individuals reduce the amount of the single tax on paid insurance contributions for compulsory pension insurance and compulsory health insurance in a fixed amount.

(as amended by Federal Law of 30.11.2016 N 401-FZ)

(Clause 2.1 was introduced by the Federal Law of 25.06.2012 N 94-FZ (revised 03.12.2012))

3. Tax declarations based on the results of the tax period shall be submitted by taxpayers to the tax authorities no later than the 20th day of the first month of the next tax period.

UTII is understood as a single tax on imputed income, it was introduced in 1998. Organizations and individual entrepreneurs can switch to this type of taxation at their own request, although more recently the special regime was compulsory.

In order to calculate UTII, you need to know the tax rate, business income of the organization or individual entrepreneur, as well as deflator coefficient... The latter is calculated in different ways, and if K1 depends on the decision of the Ministry of Economic Development, then K2 must be determined by acts at the place of registration of the organization.

K1 Is a deflator, thanks to which you can take into account the prices of various goods and services for the previous year. K2 on the contrary, it is a deflator of the underlying business profitability. This indicator is used in order to adjust the factors that affect the income indicator depending on a certain type of activity.

Here are just some of the factors that can affect the odds:

- the amount of profit for a specific period of time;

- availability of transport and its quantity;

- the area of information stands located on the street and used to advertise goods;

- peculiarities of the territory in which entrepreneurs carry out their activities;

- the regime in which organizations operate;

- seasonality of work and so on.

Application

Don't think that two different odds are used in the same way. So, the use of the first coefficient is due to the value of the tax itself: payments sent to the budget are calculated not from the income that the entrepreneur was able to receive for a certain period of time, but from the so-called imputed income - from that which the organization will receive for a specific period of time.

Don't think that two different odds are used in the same way. So, the use of the first coefficient is due to the value of the tax itself: payments sent to the budget are calculated not from the income that the entrepreneur was able to receive for a certain period of time, but from the so-called imputed income - from that which the organization will receive for a specific period of time.

As for the very size of income for each activity, the legislators do not change it, preferring to simply adjust the coefficients K1 and K2. K1 increases the tax of the organization or individual entrepreneur, taking into account inflation.

If K1 is valid throughout the country, then K2 is established every year by local authorities. There is a fundamental difference between K1 and K2 - so, K2 acts primarily in order to reduce the total amount of tax that is supposed to be paid.

It is clear that different types of activities can generate different incomes, so levying the same tax is at least unfair. To regulate taxation, local legislation uses just K2.

The value of the regulating coefficient K1 in 2020 is 2.009. As for the decreasing coefficient K2, it is set by the municipal authorities, so sometimes it is not easy to find information about it. But this year it will vary in the range from 0.005 to 1.

UTII should be paid every quarter, and before that it should be calculated using the formula:

tax for 3 months = imputed income for the same period + rate

The rate should be found out in the region in which the organization is registered. As a rule, almost everywhere it is equal to 15%, but the authorities can lower this figure to 7.5%.

If we are talking about imputed income for 12 months, then three indicators are needed to calculate it: K1, K2 and the profitability of the organization for the month.

As for the amount of imputed income, it can be calculated as follows:

imputed income for three months = basic profitability calculated for 1 month * amount of physical. indicators for 3 months * K2 * K1

It also happens that the organization does not immediately switch to UTII, but does it, for example, in the middle of a quarter. In this case UTII will be calculated starting from the date when the organization was registered:

imputed income for the month when the organization was registered = basic profitability accrued for 1 month * physical. indicator per month * (the number of days that the company was registered on UTII / total number of days in a month) * К2 * К1

Now let's look at a few examples. The option will be considered at mid-quarter.

A certain individual entrepreneur sells goods at retail through a store. The area of the store is 50 sq. M. The rate is 15%. At the same time, the basic profitability of this entrepreneur is 1,800 rubles for each square meter.

A certain individual entrepreneur sells goods at retail through a store. The area of the store is 50 sq. M. The rate is 15%. At the same time, the basic profitability of this entrepreneur is 1,800 rubles for each square meter.

The K1 coefficient is 2.009. As for the K2 coefficient, the local authorities estimated it at 0.5.

Suppose that the company switched to taxation of UTII on January 23 of the current year. Then the tax for this month should be calculated in 9 days, but for the next two months - in full.

1800 * 50/31 * 9 * 0.5 * 2.009 = 26 246.61, where

1800 Is the basic rate of return per sq. M., 50 - the total area of the store, 31 - the number of calendar days in January, 9 - the number of days for which the tax should be calculated, last 2 indicators- coefficients K2 and K1.

In order to calculate income for the next two months, you need:

1800 * (50 + 50) * 0,5 * 2,009 = 180 810

To get the total amount of income, you need to add the two resulting indicators for incomplete January, as well as full February and March. The result will be:

25 018 + 172 350 = 207 056,61

To obtain UTII, we multiply the total amount of income by the local rate. It turns out:

207056,61 * 15% / 100% = 31 105,8

Approximately also UTII can be calculated if the company stopped using this type of taxation in the middle of the quarter.

Minimum and maximum size

| Bottom frames | 0,005 |

| Upper frames | 1 |

When the deflator coefficient rises or falls, it is especially strongly reflected in the PI. The thing is that it is individual entrepreneurs who pay insurance premiums to the FFOMS and the Pension Fund of the Russian Federation in fixed amounts, which is spelled out in Article 14.

Information on the odds is presented in this news release.

Coefficient K2

This coefficient very important when calculating tax. Unlike the same coefficient K1, which by its principle is corrective and largely depends on inflation, the coefficient K2 is primarily a downward one and is used to level the business used in different regions of the country.

Of course, it is very difficult to compare revenue, for example, in a small stall of a small village and a store in the center of the capital. That is why this coefficient was called a decreasing one; it can vary in different indicators, which, nevertheless, should not exceed one. The K2 coefficient is taken depending on the economic state of a particular region of the country at the moment.

Coefficient K2 may change over time - for example, if the economic condition of the region has become better or worse. So, if the K2 coefficient this year is 0.7, then when reduced to 0.6, it will save small businesses a decent amount on taxes.

K2 is annually approved by local authorities until November 20 for next year, so if it is necessary to revise it and apply to local authorities for a decrease, then this must be done as soon as possible so that the coefficient starts working as early as next year.

To determine the coefficient, you need to clearly know and understand the following:

- the type of activity that you are engaged in, since sometimes you need to include the range of goods sold;

- the exact according to which the activity is carried out;

- the number of employees.

When an organization fills out a declaration, the K2 indicator must be indicated in column 9 of section 2. It should be borne in mind that the coefficient can be set for a long time without a time frame.

As for the documentation that sets the reduction factor, it may come into force no earlier than a month after it is published, and no earlier than January 1 of the subsequent tax period.

K2 indicators depending on the type of activity

| P / p No. | Types of entrepreneurial activity | The value of the coefficient K2 |

|---|---|---|

| 1 | Provision of consumer services | 0,85 |

| 2 | Provision of veterinary services | 1 |

| 3 | Provision of services for the repair, maintenance and washing of vehicles | 1 |

| 4 | Provision of services for the provision of temporary possession (and use) of parking spaces for motor vehicles, as well as storage of motor vehicles in paid parking lots | 1 |

| 5 | Provision of road transport services for the carriage of goods | 1 |

| 6 | Provision of road transport services for the carriage of passengers | 0,9 |

| 7 | Retail | from 1 and below |

Changes 2020-2021

From January 1, 2020, individual entrepreneurs will not be able to apply UTII, as well as the patent system, if they sell three groups of goods that are subject to mandatory labeling. These include medicines, footwear, fur coats and other products made from natural fur (paragraph 12 of article 346.27, paragraph 38 of paragraph 2 and paragraph 1 of paragraph 3 of article 346.43 of the Tax Code as amended by Law No. 325-FZ).

If at least one unit of such a product is sold, the right to UTII will be lost. If the entrepreneur applied UTII, then he switches to the general tax regime.

As follows from the Federal Law of September 29, 2019 No. 325-FZ, with On January 1, 2021 UTII is completely canceled in the Russian Federation.

Taxation in the form of a single tax on imputed income is a special tax regime and is applied on the basis of chapter 26.3 of the Tax Code. Its essence lies in the calculation and payment of UTII in accordance with the size of the established imputed income that does not depend on the income received by the taxpayer. This system is used for both legal entities and individual entrepreneurs.

When calculating the tax is applied coefficient K1, the size of which is being revised at the legislative level. In 2020, this deflator coefficient was increased on the basis of the Order of the Ministry of Economic Development dated October 21, 2019 No. 684.

Additional coefficient K2 approved by local laws.

What is K1 for UTII?

Annually for a calendar period for UTII payers, the value of the deflator coefficient K1 is set. Its size takes into account the change in consumer prices for goods, works and services, which was noted in the previous year.

К1 is determined annually by the Ministry of Economic Development. According to paragraph 4 of Art. 346.29 of the Tax Code, this coefficient is multiplied by the basic profitability of the taxpayer.

How did K1 change according to UTII?

For 2015, the K1 value was set at 1.798 and did not change until 2018. By order of the Ministry of Economic Development of October 21, 2019 No. 684, a new indicator of this coefficient was established.

The size of the K1 coefficient is the same for all regions of Russia, in 2020 is 2.009.

For comparison, we present a table of changes in K1 for calculating UTII for the period from 2013 to 2018.

Why does the coefficient affect the tax amount?

As you can see, compared to 2019, the increase was almost 4.94%, which was the result of an increase in the tax burden of businessmen. But analysts point out that such an increase is quite expected, since no changes have been made to K1 since 2015.

The profit of organizations and individual entrepreneurs that use the UTII taxation system allows you to increase contributions to the budget. Such a measure should not hurt the business as a whole, but will bring a tangible replenishment of the budget, which is directed to socially significant tasks.

The change in the coefficient K1 for calculating the tax affects the amount of UTII due to be paid to the budget.

The calculation formula is as follows:

UTII tax = Basic profitability × (FI 1 month + FI 2 months + FI 3 months) × К1 × К2 × Tax rate (15%),

where FP are physical indicators (depending on the area of the premises, the number of employees or vehicles).

Therefore, with an increase in K1, the amount of tax increases.

How do the amounts of tax payable change? Calculation example

- Consider a situation where an individual entrepreneur is located on UTII, carrying out retail trade in a trading floor with an area of 29 sq. M. Provided that he does not have employees, the basic profitability per month is set at 1800 rubles, K1 = 2.009, K2 = 0.8.

For the 1st quarter of 2020, the amount of imputed income will be as follows:

1800 × (29 + 29 + 29) × 2.009 × 0.8 = 251,687.52 rubles.

Tax amount: 251,687.52 × 15% = 37,753.13 rubles.

For comparison, let's take the same conditions, but the K1 coefficient for 2019, which was 1.915.

1800 × (29 + 29 + 29) × 1.915 × 0.8 = 239 911.2 rubles.

Tax amount: 239 911.2 × 15% = 35 986.68 rubles.

The difference amounted to 1,766.45 rubles, which is 4.94%.

- The second example is related to the business of providing freight services. The basic profitability is set at 6 thousand rubles per unit of transport. The individual entrepreneur has 6 cars at its disposal, which are involved in the provision of the service. K1 = 2.009, K2 = 1. The whole quarter worked at UTII.

Taxable base: 6,000 × (6 + 6 + 6) × 2.009 × 1 = 216,972 rubles.

The amount of UTII for 2020: 206,820 × 15% = 32,545.8 rubles per quarter.

In 2019, with K1 = 1.915, the tax amount was 31,023 rubles per quarter.

When calculating UTII, when activities were not carried out for a full quarter, it is determined in proportion to the days actually worked.

This is a preferential tax regime for small businesses, which will end in January 2021. The Ministry of Finance believes that budget revenues from imputation are too insignificant against the background of other tax regimes.

But while UTII is still in effect, organizations and individual entrepreneurs can take advantage of the benefits of this tax system. After all, tax is levied here not on real, but on the assumed (imputed) income of the business.

What is taken into account when calculating the tax on imputed income

To calculate what the UTII tax will be for 2020 by type of activity, you need to know what is taken into account when determining imputed income. Since the real proceeds from sales and services are not taken into account, other indicators are used here:

- basic profitability (DB);

- physical indicator (FP);

- coefficients K1 and K2.

The first two indicators for UTII by the Tax Code of the Russian Federation remain unchanged. But the coefficients are a variable, and the amount of tax paid on UTII depends on their size.

Coefficient K1

First, let's talk about the correction factor K1. This indicator is intended to take into account inflation, i.e. rise in prices for goods and services.

К1 in Russia changes annually, it is approved by the order of the Ministry of Economic Development. The correction factor is valid in all regions and municipalities of the Russian Federation.

How the coefficients K1 and K2 are used in calculating the tax

And now we will show with a specific example how the tax on UTII is calculated, taking into account the coefficients.

The organization sells office supplies in Kirov. In this case, the physical indicator for UTII is a square meter of retail space. We indicate all the components of the calculation formula:

- trading floor area - 64 sq. m;

- basic profitability per 1 sq. m - 1 800 rubles;

- K1 UTII 2020 - 2.005;

- K2 (from the decision of the Kirov City Duma) - 0.4.

We multiply all the indicators: 64 * 1,800 * 2.005 * 0.4 = 92 390.4 rubles. It is assumed that this is the kind of imputed income the store receives in a month. We multiply the tax base by the UTII rate of 15% and find out the amount of the calculated tax - 13 858.56 rubles. And taking into account the fact that the tax is paid per quarter, we get 41,576 rubles.

Now suppose this store does not sell office supplies, but furniture. K2 from the decision of the Kirov City Duma in this case is already 0.7. K1 UTII 2020 remains unchanged - 2.005. This means that the tax for the quarter will already amount to 72,757 rubles, i.e. 31,000 rubles more.

In order not to make such calculations manually, we recommend using our free

Please note: in the examples, we indicated the calculated tax on UTII. However, it can be due to insurance premiums that employers pay for employees and individual entrepreneurs for themselves.

It is calculated not from the actually received income, but on the basis of imputed or pre-calculated by the state. One of the elements of the calculation formula is the base rate of return for different types of activities. The basic profitability on UTII for 2020 (table) is published in the Tax Code of the Russian Federation, we will show how to use it to calculate the tax payable.

What is taken into account when calculating imputed income

The UTII regime in 2020 for individual entrepreneurs and LLCs is attractive because the income assumed or imputed by the state is often lower than that actually received by the taxpayer. Accordingly, the lower the estimated income, the less tax payable.

Basic profitability (DB) is the amount of income in rubles that is assumed to be received by the taxpayer. For example, one employee in the field of personal services brings in an income of 7,500 rubles a month, one square meter of sales area - 1,800 rubles, and one vehicle - 6,000 rubles.

Figures of basic profitability in the Tax Code of the Russian Federation are indicated for one unit of a physical indicator (FP) - an employee, square meter, unit of transport, etc. * 7 500) 22 500 rubles per month. Of course, in practice, three workers in personal services bring much larger sums, but this imputed income is taken into account for calculating the tax.

Thus, the calculation of UTII for a taxpayer is based on two main elements of the formula:

- basic profitability (DB);

- physical indicator (FP).

In addition, there are two more coefficients in the formula that adjust the calculated imputed income:

- К1 -, which takes into account the growth of consumer prices (for LLC and for individual entrepreneurs in 2020 it is 2.005).

- K2 is a regional coefficient, which is set by the local administration, and can reduce the amount of the calculated imputed income (ranges from 0.005 to 1).

In full, the formula for calculating UTND 2020 (tax amount per month) will be as follows:

DB * FP * K1 * K2 * 15%

Basic profitability for UTII by type of activity

In article 346.29 of the Tax Code, two main elements of the formula for calculating the UTII tax in 2020 for individual entrepreneurs and organizations are given in one table.

Now, based on these data, it is easy to calculate UTII in 2020 for different types of activities.

An example of calculating the tax on UTII

Let's go back to the formula for calculating UTII for individual entrepreneurs in 2020 (for organizations it is similar).

DB * FP * K1 * K2 * 15%

Example

A private seamstress in Yaroslavl is engaged in sewing clothes at home. Let's calculate what tax on UTII for individual entrepreneurs in 2020 she will have to pay.

Tailoring is a household service, so the basic profitability here is 7 500 rubles. The seamstress works by herself, therefore the physical indicator is 1 ... Coefficient K1 in 2020 for all UTII payers is the same - 2,005 ... Coefficient K2 for the calculation formula is taken from the decision of the Municipality of Yaroslavl, it is equal to 0, 519 .

We substitute all these values in the calculation formula: 7,500 * 1 * 2.005 * 0.519 * 15% = 1170.66 rubles per month or 3,512 rubles per quarter.

Suppose the seamstress has a lot of customers, so she decides to open a tailor shop and hire 4 workers. In this case, only the FP indicator will change in the calculation formula - instead of 1 it will become equal to 5 (the entrepreneur himself plus 4 employees). Then the tax will be 5,853.34 rubles per month, and 17,560 rubles per quarter.

Reduction of the calculated tax due to contributions

Individual entrepreneurs and organizations working on UTII can reduce the calculated tax at the expense of the individual entrepreneurs paid for themselves and / or for employees.

The tax period (the period for which the tax is calculated) for UTII is one quarter. for rent no later than the 20th day of the month following the reporting quarter (April 20, July, October, January). The tax can be paid 5 days later (April 25, July, October, January, respectively).

In order to be able to reduce the calculated quarterly tax, you must pay part of the annual contributions of the individual entrepreneur for yourself by the end of this reporting quarter. For example, to reduce the tax for the 1st quarter, contributions must be paid no later than March 31st.

As a reminder, an entrepreneur can pay contributions to his pension and health insurance at any time and in any amount until December 31. However, if you pay contributions for yourself only once a year, then the calculated tax can be reduced only for the quarter in which they were paid. With regard to contributions for employees, their employers are required to pay monthly, so the tax can be reduced every quarter.

Another important nuance - if the individual entrepreneur works on his own, then the calculated quarterly tax is reduced by the entire amount of contributions paid. If the entrepreneur has employees working on UTII, then the tax can be reduced by no more than half. The same rule applies to organizations.

Let's see how the tax is reduced due to contributions on the example of a seamstress from Yaroslavl. In the 1st quarter, when the seamstress worked alone, she paid for herself a part of the annual contributions of the individual entrepreneur in the amount of 5,000 rubles. The contributions were paid on March 10, i.e. within the reporting quarter. When filling out the declaration for the 1st quarter, the entrepreneur indicates the amount of the accrued tax (in our example, 3,512) and the contributions paid. Reducing the tax on contributions (3,512 - 5,000<0), т.е. платить в бюджет на ЕНВД для ИП в нашем примере не придётся вообще.

But if there are workers in the 2nd quarter, the situation is different. Although the individual entrepreneur paid contributions for himself (also 5,000 rubles) plus 28,000 rubles of contributions for employees, the calculated quarterly tax of 17,560 rubles can be reduced by no more than half. That is, despite the fact that the sum of the individual entrepreneur's contributions for himself and the employees is 33,000 rubles, which is more than the calculated tax, 17,560/2 = 8,780 rubles will still have to be paid to the budget.

If you still have questions or want advice from a professional, we can offer free advice on taxation from 1C.