Determination of the opening balance. Concept, essence and types of balances

Accounting balance - you will find an example of filling it out in the article - this is not only a document for a report to the IFTS, it is also a source of data for analyzing the current activities of the enterprise and making forecasts. How to fill balance sheet no mistakes? What form should I use? Which companies are entitled to fill out a simplified balance sheet form? We will consider the answers to these and other questions in the material below, and also study the step-by-step instructions for filling out each line of the form using an example.

Why do you need a completed balance sheet: an example

The 2018 balance sheet is a document that summarizes the accounting records of financial indicators activities of the organization for a certain period. Despite the fact that the 2018 form of the balance sheet, which is relevant for the Russian Federation - it will be possible to download a free form further directly from the article - is filled with data for very specific dates, the comparison of these data reflects their dynamics over time.

A competent reading of the 2018 balance sheet form provides a fairly broad information of an economic nature to the interested user. These users include, first of all:

- owners of the organization;

- financial and economic service of the enterprise;

- IFTS;

- state statistics bodies;

- banks from which the company receives loans;

- investors;

- sponsors;

- counterparties with whom the current interaction is carried out;

- administrations of the regions where the enterprise operates.

The balance sheet of the 2018 sample, as well as the balance sheet for 2017, allows you to see not only the specific financial and economic situation at the reporting date, but also to analyze its change in comparison with the data for past years. And taking into account long-term development plans, it makes it possible to make a forecast of the enterprise's activities and, accordingly, a forecast balance sheet.

For external users, as a rule, it is enough to present the balance sheet on the form of 2018 with a certain frequency (month, quarter, year). They may be satisfied with the standard reporting form, which is used for submitting a report to the IFTS and state statistics bodies, but options for transforming the data into other reporting forms similar to the balance sheet of 2018 are possible.

For internal purposes, the main of which is the current analysis of activities and the timely adoption of measures to adjust the work of the enterprise, the balance sheet - form 1 on the form of 2018 - can be drawn up at any frequency and in a very wide range of its types.

Thus, the value of the balance sheet goes very far beyond the boundaries of the usual accounting records created for the IFTS. Therefore, special attention should be paid to filling it out and knowing how to draw up the balance sheet correctly.

Forms in which the formation of the balance sheet is possible

For presentation as official reporting, the balance sheet has a certain form. For the internal needs of the organization, it can have many modifications, depending on the purpose and on the type of data for its compilation:

- data can be taken either on certain dates (balance sheet), or by turnover for a period (turnover balance);

- initial data can be either only accounting, or only inventory, or accounting, which are confirmed by the results of the inventory;

- data can be taken into account either with the inclusion of regulatory items (depreciation, reserves, margin), or without them;

- the balance sheet can be drawn up in relation to only one of the activities of the enterprise;

- the balance can be either full or abbreviated (simplified) form;

- the balance can be drawn up in the form of equality between assets and the sum of capital and liabilities, or it can take the form of equality between capital and the difference between assets and liabilities;

- the balance can be done both for one organization, and include data for several enterprises (summary and consolidated balance sheets);

- in relation to the event, there may be opening, liquidation, separation, consolidation balances;

- the balance can be preliminary, forecast, intermediate, final.

And this is not a complete list. possible options drawing up a balance sheet for the organization to solve its internal tasks. However, the fundamental approaches to filling out this form are preserved regardless of the way in which the original data is reflected in it.

How to draw up a balance sheet - 2018 for the IFTS: rules and techniques

The complete balance sheet contains the entire list of items that are recommended to be highlighted in the corresponding sections of the balance. However, an enterprise can exclude from this report items for which it does not have data, and, conversely, include additional items in it if this will increase the reliability of the reporting.

The complete form has a box to reflect the notes for each article. The enterprise decides for itself whether it needs to use this column. Obviously, it becomes necessary for any deviation from the standard recommended form of the form.

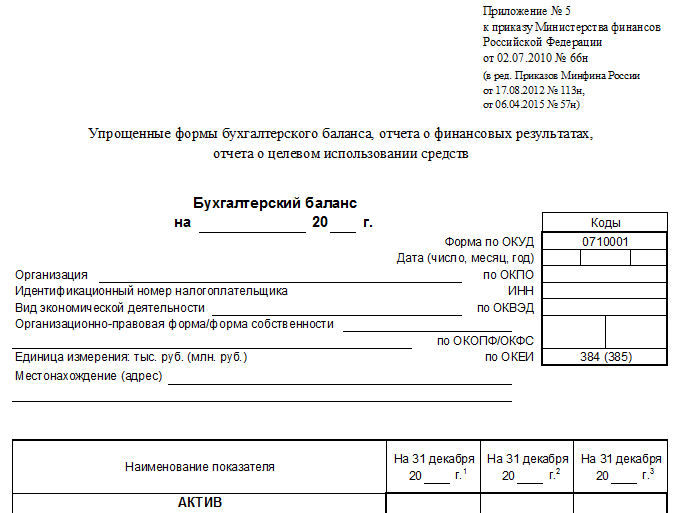

In an abbreviated (simplified) form, which can be used by some legal entities that meet certain requirements, if they find it possible to present statements in a simplified form, there are no division into sections and columns for notes, and the articles are combined for the purpose of aggregation of indicators.

Read about which legal entities can create accounting in a simplified form.

How to fill in the balance sheet? The basic rules governing the procedure for drawing up the balance sheet 2018 for the purposes of official reporting are contained in PBU 4/99, approved by order of the Ministry of Finance of the Russian Federation dated 06.07.1999 No. 43n. They boil down to the following:

- the source of information for the preparation of the balance sheet is accounting data;

- credentials must be formed according to the rules of the current PBU and in accordance with the accepted at the enterprise accounting policies;

On the specifics of accounting policies for application of the simplified tax system read in the article "The order of accounting under the simplified tax system (2018)" .

- credentials must meet the requirements for completeness and reliability;

- an enterprise with branches compiles a single balance sheet for the organization;

- the data reflected in the balance sheet must be neutral and correlated with the data of previous periods;

- the selection of items in the sections of the balance sheet is carried out according to the principle of materiality;

- the reporting period for the balance sheet is a calendar year;

- assets and liabilities reflected in the balance sheet should be subdivided into short-term and long-term (existing less than and more than 12 months, respectively);

- offset between the items of assets and liabilities is not done, if it is not provided for by the PBU;

- the property is assessed at its “net” value (less regulatory clauses);

- the accounting data of the annual report must be confirmed by an inventory.

Read more about the organization of inventory in the material "How to take an inventory before annual reporting" .

What does the abbreviation TZR mean (decoding) and others

- TZR - transportation and procurement costs.

- OS - fixed assets.

- R&D - research and development work.

- Intangible assets - intangible assets.

- WIP - work in progress.

- RBP - deferred expenses.

- Goods and materials - commodity material values.

- FSS - Social Insurance Fund.

General rules for filling out the balance sheet

The balance sheet is filled in on the basis of information about the balances on the accounting accounts as of the reporting date. These balances are reflected in the balance sheet in accordance with the objectives set for a specific report.

How to make a balance sheet - step-by-step instruction with examples will be given below . With regard to data on financial results (retained earnings / uncovered loss) the current balance sheet is drawn up, as a rule, with the inclusion in reporting period the full number of months of the year for which it is formed. This is due to the fact of the generally accepted monthly closing of financial results accounts.

The data in the balance sheet is shown most often in thousands, less often in millions of rubles.

The division of assets and liabilities into long-term and short-term is provided for by the structure of the balance sheet. In his asset for this, 2 sections are allocated: outside current assets(long-term) and current assets (short-term). The liability is subdivided into three sections, two of which are liabilities sections, divided by circulation time (long-term and short-term). The third section of the liability reflects data on equity capital that occupies a special position in the structure of the balance sheet.

The reflection of information on specific lines of the balance sheet has its own characteristics. Let's figure out what is important when filling out the balance sheet - an example with a decryption:

- data on the cost of fixed assets (including those intended for renting) and intangible assets are shown, as a rule, after deducting depreciation;

- information on R&D, tangible and intangible exploration assets is filled in only if such assets are available, while search assets are shown net of depreciation;

- data on financial investments representing loans issued, cash investments in banks (deposits), deposits in other organizations, in securities, are divided depending on their maturity into long-term and short-term and are shown, respectively, in different sections of the asset, while amounts are carried net of any allowance for impairment losses financial investments;

- information on deferred tax assets and liabilities present in the lines of the asset (non-current assets) and liabilities (long-term liabilities) of the balance sheet is filled out only by those organizations that apply RAS 18/02;

- data on stocks, including balances on accounts of materials (with inventory), goods, finished products, WIP, RBP, are reduced by the amount of created reserves for impairment of goods and materials and the amount of the trade margin, if goods are accounted for with it;

- receivables and payables, which are amounts that someone owes to the company and which the company owes to someone (counterparties, budget, funds, employees), are shown on a gross basis and are reflected, respectively, in the assets and liabilities of the balance sheet as part of short-term liabilities; at the same time, receivables are reduced by the amount of created reserves for doubtful debts and data recorded on other lines of the balance sheet (financial investments);

- the reflection in the balance sheet of VAT on advances can occur in different ways, depending on the accounting policy adopted at the enterprise;

- monetary funds (cash, non-cash, foreign currency) are shown in the total amount minus deposits accounted for in the lines of financial investments;

- sum additional capital if it is present in the accounting, it is divided into two lines, depending on whether it is associated with the revaluation of property;

- financial result (retained earnings or uncovered loss) in annual balance represents the result of activities for a final number of years (after the balance sheet reformation), and in the interim reporting consists of two figures (the financial result of previous years and the financial result of the current period), while regardless of the reporting period, it can be negative;

- data on borrowed funds are divided into long-term and short-term liabilities according to their remaining maturity and are shown in different sections of the liability, while the accrued interest on long-term loans is included in short-term debt;

- in a similar manner, depending on the remaining period of use, for long-term and short-term liabilities with reflection in different sections of the liability, the estimated liabilities are divided, which correspond to the amounts of the created reserves for future expenses;

- data on deferred income additionally includes information on the amounts of targeted financing;

- all sections of the balance sheet, with the exception of the section "Capital and reserves", have a line for reflecting other assets or liabilities, intended for entering into it data that has not found a place in other lines of the corresponding section, or for those data that the organization has decided to show separately.

When compiling an abbreviated (simplified) balance sheet, a number of items highlighted in full form are combined into articles with new names:

- under the item "Tangible non-current assets" one sum is shown information about fixed assets and unfinished capital investments, which in the full form of the balance sheet is divided into 4 items: "Intangible exploration assets", "Tangible exploration assets", "Fixed assets", " Profitable investments in value ";

- the article "Intangible, financial and other non-current assets" combines data on the value of intangible assets, R&D, unfinished investments in intangible assets, information on long-term financial investments and deferred tax assets;

- the article "Financial and other current assets" together provides information on short-term financial investments, VAT on acquired values and receivables;

- the item “Capital and reserves” combines information on the authorized, additional and reserve capital, redeemed own shares, data on the revaluation of property and on retained earnings (uncovered loss);

- the item “Other long-term liabilities” together shows data on deferred tax liabilities and long-term estimated liabilities;

- in the item "Other current liabilities" one amount shows data on deferred income and on short-term estimated liabilities.

Accounting balance: how to fill in item by item

To fill in balance sheet items, data on balances formed as of the reporting date are taken from specific accounting accounts. Applied to current edition the chart of accounts of accounting, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, when filling out the complete balance sheet form 2018 - which can be downloaded for free in our article - the balances of the following accounts are used:

- for the item "Intangible assets" - the total balance of account 04 minus the total for account 05, while for account 04 the data that fall into the line "Results of research and development" is not taken into account, and for account 05 - the numbers related to intangible search assets ;

- for the article "Results of research and development" data on R&D expenditures are selected, reflected in the balance on account 04;

- for the articles "Intangible exploration assets" and "Tangible exploration assets", data on development costs are taken natural resources from account 08 minus the depreciation related to these assets, recorded, respectively, on accounts 02 and 05;

- for the item "Fixed assets", the data is determined as the difference between the balances of accounts 01 and 02 (while on account 02, figures related to material exploration assets and income investments in material assets are not taken into account), to which the amount of capital investment costs accounted for in the accounts is added 07 and 08 (except for the figures included in the lines "Intangible search assets" and "Tangible search assets");

- for the article "Profitable investments in value" the difference between the balances of accounts 03 and 02 in relation to the same objects is taken;

- for the item "Financial investments" in non-current assets, data on long-term amounts (with a maturity of more than 12 months) are selected on accounts 55 (in relation to deposits), 58, 73 (on loans issued to employees), which are reduced by the amount of reserves for long-term investments(account 59);

- for the article "Deferred tax assets»The account balance 09 is taken;

- for the item "Inventories" the amount is formed by adding the balances of accounts 10, 11 (both accounts minus the reserve accounted for in account 14), 15, 16, 20, 21, 23, 28, 29, 41 (minus account 42, if accounting of goods is carried out with a surcharge), 43, 44, 45, 46, 97;

- for the item "Value added tax on acquired values", the balance on account 19 is taken;

- for the article " Receivables"The debit balances of accounts 60, 62 are summed up (both accounts minus reserves formed on account 63), 66, 67, 68, 69, 70, 71, 73 (minus data accounted for under the item" Financial investments "), 75 , 76;

- for the item "Financial investments (excluding cash equivalents)" in current assets, data on short-term amounts(with a maturity of less than 12 months) on accounts 55 (in relation to deposits), 58, 73 (for loans issued to employees), which are reduced by the amount of reserves for short-term investments(account 59);

- for the item "" the amount is obtained by adding the balances of accounts 50, 51, 52, 55 (excluding deposits), 57;

- for the article "Authorized capital (share capital, statutory fund, deposits of comrades) ”data is taken as account balance 80;

- for the article " Own shares redeemed from shareholders "the balance of account 81 is taken;

- for the item “Revaluation of non-current assets”, data on the balances on account 83 relating to fixed assets and intangible assets are selected.

- for the item "Additional capital (without revaluation)", the data is formed as balances on account 83 minus data relating to fixed assets and intangible assets;

- for the article " Reserve capital»The balance on account 82 is taken;

- for the article " Undestributed profits(uncovered loss) "the balance on account 84 is included in the annual balance sheet, and when preparing interim reporting, two balances are added: on account 84 (financial result of previous years) and 99 (financial result of the current period of the reporting year), while the amount can be formed as by addition and by subtraction;

- for the item “Borrowed funds” in the “Long-term liabilities” section, from the balances on account 67, long-term (with the remaining maturity of more than 12 months) debt on loans and borrowings is selected, while interest on long-term borrowed funds should be taken into account as part of short-term payables;

- for the item "" the account balance 77 is taken;

- for the item "Estimated liabilities" in the section "Long-term liabilities", data on long-term reserves are selected from the balances on account 96, the period of use of which exceeds 12 months;

- for the item "Borrowed funds" in the section "Short-term liabilities", the balances on account 66, interest on long-term borrowed funds accounted for in the balances on account 67, and that debt on long-term loans and loans (account 67), which at the time of drawing up the report became short-term (less than 12 months left until its maturity);

- for the article " Accounts payable»Credit balances on accounts 60, 62, 68, 69, 70, 71, 73, 75, 76 are summed up;

- for the item "Deferred income", the balances of accounts 86 and 98 are added;

- for the item "Estimated liabilities" in the section "Short-term liabilities" from the balances on account 96, data on short-term reserves are selected, the term of which is less than 12 months.

To fill in the combined items of the reduced balance, the balances of the following accounts are used:

- for the item "Tangible non-current assets" the amount of balances on accounts 01 and 03 minus the balance on account 02 is determined, which is then added to the balances on accounts 07 and 08 related to non-current assets;

- for the item "Intangible, financial and other non-current assets", the difference in balances on accounts 04 and 05 is summed up with data on long-term amounts on accounts 55 (in relation to deposits), 58, 73 (on loans issued to employees), reduced by the amount of reserves for long-term investments (account 59), with the balance on account 09 and with data on unfinished investments in intangible assets and R&D, reflected on account 08;

- for the item "Financial and other current assets", data are combined on accounts 19, 55 (excluding long-term deposits), 58 (for short-term investments) with a decrease in the amount of reserves related to them (account 59), 60, 62 (both accounts minus reserves formed on account 63), 66, 67, 68, 69, 70, 71, 73 (net of the amounts of long-term loans), 75, 76;

- for the item "Capital and reserves" the total amount of balances on accounts 80, 81, 82, 83, 84 is determined;

- for the item "Other long-term liabilities", the balances of accounts 77 and 96 are combined (in relation to reserves with a term of more than 12 months);

- for the item "Other short-term liabilities", the balances of accounts 86, 96 (in relation to short-term reserves) and 98 are summed up.

Articles "Stocks", " Cash and cash equivalents"," Long-term borrowed funds"," Short-term borrowed funds "," Accounts payable "are filled in according to the same accounts as similar items in the full balance sheet.

Balance sheet: an example of filling out the general form

An example of a balance sheet completed by specialists is of interest to many accountants, both beginners and experienced, especially if a difficult situation arises.

Examples of the balance sheet with the entered indicators can be seen on the websites of almost all reference and legal systems. In addition, an example of a balance sheet is a form filled in automatically by an accounting program. However, form 1 form filled out in this way - Balance sheet for 2018 requires its verification. To carry out such a check and competently set up its filling in the program, it is necessary to understand the entire mechanism of forming the balance sheet.

Consider how to draw up a balance sheet using an example, according to accounting data, the financial result for which is formed after carrying out the necessary routine operations and balance reformation.

Let's pretend that it comes about an organization engaged in production and wholesale trade. The specifics of her credentials are due to the fact that she:

- has fixed assets and intangible assets;

- makes capital investments;

- has financial investments;

- creates reserves for depreciation of goods and materials and financial investments, reserves for doubtful debts;

- forms a reserve for the payment of vacations;

- takes loans from banks;

- refunds VAT;

- receives reimbursement of payment costs sick leave from the FSS;

- applies PBU 18/02;

- has a profit for previous years;

- has a loss based on the results of work for the current year.

We will display its accounting data as of the reporting date in the form of a table with a breakdown by accounting accounts in relation to the current edition of the chart of accounts of accounting, approved by order of the Ministry of Finance of the Russian Federation of October 31, 2000 No. 94n.

The table will contain detailed data on debit and credit balances, which for simplicity of presentation are not broken down by subconto and rounded to thousands of rubles without decimal places.

|

Accounting account number |

Debit balance |

Credit balance |

Note |

|

Fixed assets |

|||

|

Depreciation of fixed assets |

|||

|

Intangible assets |

|||

|

Depreciation of intangible assets |

|||

|

Capital investments |

|||

|

Deferred tax assets |

|||

|

Material stocks |

|||

|

Allowance for impairment of inventories |

|||

|

VAT on purchased assets |

|||

|

Unfinished production |

|||

|

Selling expenses |

|||

|

Cash on current accounts |

|||

|

Special accounts. 100 - long-term deposit |

|||

|

Financial investments. Of these, 107 are long-term, 207 are short-term |

|||

|

Provisions for impairment of financial investments. Of these, 20 - for long-term, 42 - for short-term |

|||

|

On a loan - a debt to suppliers, on a debit - advances transferred to them |

|||

|

On debit - debt of buyers, on credit - advances received from them |

|||

|

Provision for doubtful accounts receivable |

|||

|

Short-term loans with interest on them. Debit 18 - interest overpayment |

|||

|

Long-term loans with interest on them. Of these, 2,342 - with a remaining maturity of more than 12 months, 505 - with a remaining maturity of less than 12 months, 157 - interest on all long-term loans |

|||

|

Calculations with the budget. On debit - overpayment of taxes and the amount of VAT to be refunded, on credit - debt to the budget |

|||

|

Calculations of insurance premiums. On debit - overpayment on them and the amount of compensation from the FSS, on credit - in arrears in contributions |

|||

|

Payments to personnel for wages. Debts to employees |

|||

|

Calculations with accountable persons. On debit - amounts issued for the report, on credit - debt to accountable persons for advance reports |

|||

|

Payments to personnel for other operations. 150 - short-term loan issued to an employee |

|||

|

Settlements with other debtors and creditors. On debit - interest on loans issued and VAT on advances received, on credit - debt on customer claims and deposited wages |

|||

|

Deferred tax liabilities |

|||

|

Authorized capital |

|||

|

Reserve capital |

|||

|

Undestributed profits |

|||

|

Reserves for future expenses. 972 - reserve for the payment of vacations with a period of use less than 12 months |

|||

|

Future expenses |

|||

The company's balance sheet, filled in as an example of a 2018 sample, would look like this.

|

Balance sheet sections |

The amount at the reporting date |

|

|

I. NON-CURRENT ASSETS |

||

|

Intangible assets |

||

|

Fixed assets |

||

|

Financial investments |

55 + 58 (long-term) - 59 (long-term) |

|

|

Deferred tax assets |

||

|

Total for Section I |

||

|

II. CURRENT ASSETS |

||

|

10 - 14 + 20 + 41 + 44 + 97 |

||

|

Value added tax |

||

|

Receivables |

60 + 62 - 63 + 66 + 68 + 69 + 71 + 76 |

|

|

Financial investments |

58 (short-term) - 59 (short-term) + 73 |

|

|

Cash and cash equivalents |

||

|

Total for Section II |

||

|

III. CAPITAL AND RESERVES |

||

|

Authorized capital |

||

|

Reserve capital |

||

|

Undestributed profits |

||

|

Total for Section III |

||

|

IV. LONG TERM DUTIES |

||

|

Borrowed funds |

||

|

Deferred tax liabilities |

||

|

Total for Section IV |

||

|

V. SHORT-TERM OBLIGATIONS |

||

|

Borrowed funds |

||

|

Accounts payable |

||

|

Estimated liabilities |

||

|

Total for Section V |

||

The correctness of filling out the balance sheet form 1 on the form of 2018 can be checked arithmetically. This can be done in two ways: from the total debit balances and from the total amount of credit balances.

When checking in the first way, from the total amount of debit balances on accounting accounts, it is necessary to subtract the values related to regulatory items (depreciation, reserves for impairment), that is, credit balances on accounts 02, 05, 14, 59, 63. The result should be is equal to the total of the balance sheet asset.

A similar formula is applied when checking in the second way: the values of regulatory items are deducted from the total amount of credit balances on accounting accounts (credit balances on the same accounts 02, 05, 14, 59, 63). The result should be equal to the total of the balance liability.

We check: 23 963 - 1 017 - 57 - 101 - 62 - 1 115 = 21 611.

If the above accounting data related to interim reporting, then their only difference would be the presence of data on account 99 (due to the absence of the balance sheet reformation performed only at the end of the year). In our example, the balance sheet before the reformation on account 99 had a loss of 70,000 rubles. (that is, the debit balance), and on account 84 there was a profit of previous years in the amount of 309,000 rubles, not yet reduced by the loss of the reporting year. In this case, the amount in the balance sheet arithmetically would remain the same, but the data on the line "Retained earnings" would be taken as the difference between the figures reflected in accounts 84 and 99. The total amounts of debit and credit balances in this case would be greater by the amount of the loss, and in the verification formulas, the amount of the loss would have to be additionally deducted from them.

Balance sheet form 1 on a sample form 2018, completed automatically in accounting software, you need to check. To do this, its figures are compared with the data obtained from the consolidated balance sheet for accounting accounts, formed as of the reporting date. To select data on analytics of property, financial investments, loans, additional capital, reserves, balance sheets are used for the corresponding accounting accounts. The greatest difficulty is checking the correctness of the formation of expanded balances on accounts for accounting settlements with counterparties. Here you will have to summarize both the balances of individual accounts and the debt of specific counterparties.

Balance sheet: an example of filling out in a simplified form

The balance sheet of the enterprise, filled out using the example of the 2018 sample in a simplified form, will be as follows.

|

Balance sheet lines |

The amount at the reporting date |

The formula for calculating the amount by the numbers of the accounting accounts from which the values of the balances are taken |

|

Tangible non-current assets |

||

|

Intangible, financial and other non-current assets |

04 - 05 + 09 + 55 + 58 (long-term) - 59 (long-term) |

|

|

10 - 14 + 20 + 41 + 44 + 97 |

||

|

Cash and cash equivalents |

||

|

Financial and other current assets |

19 + 58 (short-term) - 59 (short-term) + 60 + 62 - 63 + 66 + 68 + 69 + 71 + 73 + 76 |

|

|

Capital and reserves |

||

|

Long-term borrowed funds |

67 (loans with a remaining maturity of more than 12 months) |

|

|

Other long-term liabilities |

||

|

Short-term borrowed funds |

66 + 67 (loans with a remaining maturity of less than 12 months) + 67 (interest on all long-term loans) |

|

|

Accounts payable |

60 + 62 + 68 + 69 +70 + 71 + 76 |

|

|

Other short-term liabilities |

||

For submission to the state statistics authorities, the balance sheet lines must be coded in a separate column of the report. The codes used in full form are given in Appendix 4 to the order of the Ministry of Finance of the Russian Federation dated 02.07.2010 No. 66n.

In the abbreviated form of the balance sheet - the 2018 form can be downloaded for free below - the code of the indicator that makes up the majority of the amount in this indicator must be entered in the combined lines.

If earlier the balance sheet of the organization was presented to the Federal Tax Service Inspectorate in full, and then it was decided to form it in an abbreviated form, then the data for previous years should be transformed into a simplified form while maintaining their original values and in compliance with the rules of reflection in simplified reporting.

The balance sheet, compiled in accordance with the form approved by the order of the Ministry of Finance of the Russian Federation dated 02.07.2010 No. 66n, must contain, in addition to reporting data, data at the end of the two previous years. Data from previous years should match the official reporting figures for these years.

You can download the full form of the balance sheet for free from our article "Form of the balance sheet of the enterprise (download)" .

Before filling out the text section in the balance sheet located above the main balance sheet, we recommend that you pay attention to 3 things:

- the type of economic activity is indicated by the type of activity that brought the largest amount of revenue in the reporting period;

- the codes related to the organization are taken from the tax registration certificate, the letter of the state statistics body about the codes and reference books of the corresponding codes;

- a specific unit (thousands or millions of rubles) with a corresponding code must be specified as a unit of measurement.

How to make a balance sheet to a simplified person, read the article "We draw up the balance sheet under the simplified taxation system in 2017-2018" .

Outcomes

The compilation of the balance sheet is subject to a number of rules established both for all accounting records in general and specifically for the balance sheet. The balance required for delivery to the IFTS is created on the form established form... At the same time, some organizations have the right to draw up it in a simplified form.

The term "balance"(bis- twice and lanx- scales, two-sided) are used:

- speaking of the equality of totals, when the totals of records on debit and credit of accounts are equal, totals of records on analytical accounts and the corresponding synthetic account, totals of assets and liabilities of the balance sheet, etc .;

- to indicate the most important form accounting statements, showing the state of the organization's funds in monetary terms as of a certain date.

Rice. 1. Simplified balance sheet structure

In accordance with The Civil Code RF (Art. 48) an independent balance sheet is one of the signs legal entity therefore, it performs an economic and legal function.

The balance sheet has a heading, which indicates: name of the report, reporting date, name of the organization and its legal form, TIN, type of activity, unit of measure, full mailing address, date of approval, date of dispatch / acceptance. All details are accompanied by the corresponding codes from the approved classifiers.

The balance sheet must be signed by the head and the chief accountant of the organization. The signature must include: job title of the person who signed the report ( general manager, Chief Accountant joint stock company); person's own signature; transcript of the signature (surname and initials).

Depending on the purpose of compilation, the balance sheets are classified according to various criteria (Fig. 2).

By the time of compilation, the balance sheets can be:

- introductory(make up at the time the organization was founded. The balance determines the amount of values with which the organization starts its activities);

- current(compiled periodically throughout the entire existence of the organization);

- renovated(make up in cases where the organization is approaching bankruptcy in order to determine the real state of affairs in the organization);

- liquidation(make up when the organization is liquidated);

- dividing (constitute at the time of separation large organization into several smaller structural units);

- unifying(make up when merging / merging several organizations into one).

According to the form of information displayed, balances are classified as:

- static(compiled on the basis of instantaneous indicators calculated for a specific date);

- dynamic(they are made up both on a certain date and in motion - in the form of interval indicators (turnovers for the reporting period), for example, the turnover balance, the chess turnover balance).

Rice. 2. Classification of balances

According to the sources of compilation, the balances are divided into:

- inventory(compiled only on the basis of inventory / inventory of funds);

- book(compiled on the basis of a little data of current accounting / book records, without preliminary checking them by means of inventory):

- general(compiled on the basis of accounting data, which are confirmed by inventory data).

By the amount of information, the balances are subdivided into:

- single(reflect the activities of only one organization);

- summary(made up by mechanically adding up the amounts under the items of several individual balances and calculating the total totals of the asset and liability);

- consolidated balance sheet - combining the balance sheets of organizations that are legally independent, but linked by economic relations. It brings together the balance sheets of the parent organization, its affiliates and subsidiaries.

By the method of "cleaning" there can be:

- gross balances(including regulatory clauses - depreciation of fixed assets, depreciation intangible assets, provisions for depreciation of investments in securities, trade margin);

- net balances from which regulatory clauses are excluded, i.e. a "cleanup" has been carried out.

By the nature of the activity, the balance sheets can be:

- main activity(corresponding to the charter);

- non-core activities(Housing and communal services, transport facilities, etc.). According to the purposes of compilation, balances are distinguished:

- trial(make up to check the identity of the balance);

- final(are official documents);

- reporting(compiled for the reporting period on the basis of accounting data);

- forecast(compiled taking into account forecasting and planning the organization's activities for the future).

By the form of ownership, the balances of state and municipal, cooperative, public, private and joint organizations are distinguished.

Clause 10 of PBU 4/99 "Financial statements of the organization" is established. that for each numerical indicator of the financial statements (except for the report drawn up for the first reporting period), data must be provided for at least two years - the reporting one and the one preceding the reporting one. In the form of the balance sheet, approved by the order of the Ministry of Finance of the Russian Federation "On the forms of financial statements of organizations" dated July 2, 2010, this requirement has been implemented. Information is provided as of the reporting date of the current period: December 31 previous year and December 31 of the year that precedes it. Such data are more informative, comparable, comparable and will allow the user to correctly draw conclusions about the dynamics of a particular indicator.

The organization itself must make a decision on the degree of detailing of information on groups of reporting items, taking into account the requirements of paragraph 11 of PBU 4/99 "Financial statements of the organization".

Taking into account these requirements, the following can be said. If the organization, for example, has insignificant own fixed assets, it is enough to bring their residual value in one line in the balance sheet. And to detail the composition and movement of fixed assets, their initial cost, depreciation and their change over the period, you can in the explanations. In this case, the group of articles "Fixed assets" in the column "Explanations" should put a link to the number of the corresponding explanation to the balance sheet and profit and loss statement, in which the information is disclosed in detail.

If an organization owns a significant amount of fixed assets and wants to emphasize their composition on the first page of the balance sheet, it can detail the fixed assets group by item. You can specify total amount residual value fixed assets, and then indicate “including” and provide essential components that give users an idea of the organization's activities.

Types of balances

In addition to the classic balance sheet, there are:

Balance of income and expenses of the enterprise — financial and economic a document independently developed by an enterprise for a year or quarter in order to ensure the balance and consistency of the movement of material and financial resources, production and social development enterprises, most fully satisfy the interests of the team. The balance of income and expenses characterizes the financial relationship of the enterprise with creditors; contains the calculation of income, expenses, payments to the budget, distribution of net profit, formation of funds and reserves of the enterprise;

Gross balance- balance sheet, which includes regulatory items. Gross balance is used for research and development information functions balance;

Net balance- balance sheet without regulatory items. Net balance allows you to determine the real value of the property of the enterprise;

Opening balance- the first balance sheet, which is drawn up at the beginning of the enterprise. The asset of such a balance sheet reflects the composition of the property of the enterprise, received during its organization, and the liabilities - the sources of its occurrence. Usually, before drawing up the opening balance sheet, an inventory and assessment of the existing property is carried out;

Final balance- a reporting document on the production and financial activities of the enterprise for a certain period of time. The final balance sheet is compiled on the basis of verified accounting records;

Consolidated balance sheet- consolidated financial statements of activities and financial results parent and subsidiary companies in general. From consolidated balance sheet mutual turnover of subsidiaries is excluded;

Liquidation balance- balance sheet, characterizing the property status of the enterprise as of the date of termination of its existence as a legal entity. The liquidation balance sheet shows the amount and sources of funds, as well as the state of the company's settlements after the end of the liquidation period;

Turnover balance- the balance sheet, which contains data on the movement of property (debit and credit turnovers) for the reporting period, as well as balances of funds and sources of property formation at the beginning and end of the period. The turnover balance is used as an interim working document in the preparation of the opening, closing and liquidation balances;

Preliminary balance- balance sheet, drawn up in advance at the end of the reporting period, taking into account the expected changes in the composition of the property of the enterprise. This uses actual and expected data on business transactions;

Trial balance- checking the correctness of accounting for the company's funds by monthly balancing of assets and liabilities;

Interim balance- balance sheet prepared before the end of the financial year;

Interim liquidation balance sheet(v Russian Federation) - balance sheet containing the composition of the property of the liquidated legal entity; a list of claims presented by creditors and the results of their consideration. The interim liquidation balance sheet is drawn up by the liquidation commission;

Separation balance- a document according to which, when a legal entity is divided, its rights and obligations are transferred to the newly emerged legal entities. The separation balance sheet must contain provisions on legal succession for all the obligations of the reorganized legal entity in relation to all its creditors and debtors, including the obligations contested by the parties;

Balance sheet- balance sheet, which characterizes the property of an economic entity and the sources of property formation as of a certain date in monetary value. The balance sheet is compiled by calculating account balances;

Consolidated consolidated balance sheet- the balance sheet, which is compiled by combining the balance sheets of legally independent enterprises that are economically interconnected. Such balances are used by holding companies;

Consolidated balance- the balance sheet, which is compiled by combining the individual closing balance sheets. Consolidated balances are used by ministries, departments and concerns.

In practice, the following main types are distinguished balance sheets differing in their functional meaning:

1) Introductory;

2) Operational, in which there are two subspecies - intermediate (monthly, quarterly) and annual;

3) Connecting;

4) Separating;

5) Sanitized;

6) Liquidation;

7) Consolidated;

8) Consolidated;

9) Self-reliant;

10) Separate;

11) Salt;

12) Negotiable;

13) Preliminary;

14) Checking.

All these types of balances can differ both in the nomenclature of items and in the valuation methods.

1.Composition opening (organizational) balance opens, in essence, accounting in each organization. A distinction should be made between the balance sheets of newly created organizations and organizations that are successors to previously existing ones. In the first case, the balance sheet will be extremely simple, since the property mass shown in it will turn out to consist mainly of cash deposits, organizational expenses, authorized capital and settlements with founders. At the same time, organizational costs in our practice are often reflected, rolled up under the item "Intangible assets" (provided that in constituent documents these costs are defined as the contribution of one of the participants to authorized capital). In the second case, the number of balance sheet items may be greater than in the balance sheet of the newly created organization. Another difference lies in the methods of evaluating items used in compiling the balance sheet of the organization - the successor.

Opening balance (initial) – the first balance sheet drawn up on the date of registration of the organization. The asset of such a balance characterizes the composition of the property of an economic entity with which its activity begins, and in the liability - the sources of its occurrence. Opening balance sheet contains fewer items than subsequent balance sheets showing results economic activity for a certain period of time. Before drawing up the opening balance, as a rule, an inventory and an assessment of the available resources of the organization are carried out.

2.Operating (interim and annual) balance sheets, although they are drawn up according to the same form, have significant differences in the technique of forming indicators. The interim balance sheet is usually compiled on the basis of book data, while the formation of the annual balance sheet is necessarily preceded by the following seven main stages (procedures):

1) at the end of the year, an inventory of all balance sheet items must be carried out, after which the balances on the accounts of the General Ledger are adjusted in full accordance with its results and are reflected in the General Ledger of December;

2) verification of settlements with all buyers, suppliers and other market entities with which the organization has settlements is carried out. This check also causes the reversal entries and additional items to appear in the general ledger for December;

3) a revaluation (specification of the assessment) of property items of the balance sheet is carried out: movable and real estate, materials, goods, valuable papers, debts (obligations), etc .; the closing entries of December form estimated reserves, for example, allowances for doubtful debts provided for in accounting policies organization or applicable law;

4) the distribution of income and expenses, profits and losses between adjacent reporting periods (two calendar years) is specified;

5) the final financial result is revealed by summing up all the particular results; financial results accounts are closed;

6) the final turnover sheet on the accounts of the General Ledger, covering all corrective, correcting additional entries caused by the procedures described above, and providing material (account balances) for compiling the annual (final) balance sheet;

7) In accordance with the Regulations for accounting"Events after the reporting date" (PBU 7/98) and "Estimated liabilities, contingent liabilities and contingent assets"(PBU 8/2010) amendments are made to the General Ledger of December or these adjustments are reflected in explanatory note To annual report... Thus, the annual balance sheet acts already as a final one, but at the same time it becomes an introductory one, which serves as a justification for opening accounts in the General Ledger in the new year.

Final balance - a reporting document on the production and financial activities of the organization for a certain period of time. It is compiled on the basis of audited accounting records (reconciliation of turnovers and account balances, verification by an inventory of assets). The final and opening balances should be formally identical, since only under this condition is the fulfillment of one of the most important requirements for financial statements ensured - the continuity of balances.

3.Connection balance formed when two or more business entities merge into one entity. The opening balance sheet of the new economic entity will be the connecting balance sheet. It is compiled on the basis of the final (liquidation) balances of the merging organization by summing up the indicators.

4.Separation balance compiled when dividing one economic entity into a number of legal entities or when separating from a single balance sheet of the economy a certain share of capital for the formation of a new organization. Formation this balance in practice, as a rule, it is preceded by the preparation of the liquidation balance sheet.

5. Sanitized balance drawn up in cases where the organization is approaching bankruptcy. In these cases, the subject is faced with a dilemma: either to liquidate by declaring its bankruptcy, or to agree with creditors on deferring payments. Sanitized balance is drawn up, as a rule, with the involvement of an auditor even before the end of the reporting period in order to recognize the real state of affairs in the organization. Unlike the operating balance sheet, which is compiled according to book data, the formation of the balance sheet being rehabilitated, which is compiled according to book data, the formation of the balance sheet being rehabilitated necessarily involves a complete inventory of property and liabilities. If in the operating balance individual items can be considered as real, then in the balance sheet being rehabilitated these same items may not be taken into account or be subject to a significant markdown if it is found that their values do not correspond to reality (for example, availability). The revised balance sheet is drawn up with the help of an auditor even before the end of the reporting period in order to assess the real state of affairs in the enterprise.

6. Liquidation balance differs from other types of balance sheets as the measurement of its items of an asset (produced at a realized cost, in most cases lower than the original book value) and structure. Some items that are usual for the operating balance sheet may be absent in the liquidation balance sheet, for example, the distribution items "Deferred income", "Deferred expenses". On the other hand, in liquidation balance sheet there may also appear such articles that did not exist before, for example, the cost of an organization's goodwill. Liquidation balance is intended to characterize the property status of an organization as of the date of termination of its activities as a legal entity.

7 summary balance formed by combining separate closing balances. In this case, the reporting indicators for the layout are summed up and brought together in a special column in the form of a total of assets and liabilities. This balance is made by various ministries and departments.

8. Consolidated balance sheet is a consolidation of the balance sheets of organizations that are legally independent, but dependent in economically... Such a balance sheet combines the balance sheet of the parent organization, its subsidiaries and dependent societies... The peculiarity of this type of balance is that all internal turnovers are excluded from it, and then calculation is made for each balance sheet item, depending on the share of participating organizations in the capital of the group. The shares can be common shares released by the group.

9.Self balance- have only business entities endowed with the rights of a legal entity.

10.Separate balance sheet- are subdivisions of enterprises (branches, departments, workshops, representative offices). Its form is determined by the accounting policy. It is not a form of external financial statements, it is a way of decentralizing accounting and transferring credentials to the head office.

11. Balance sheet characterizes in monetary value the property of an economic entity and the sources of formation of property as of a certain date. The balance is compiled by the accounting department of the enterprise by calculating the balances (balances) of the accounts.

Balance sheet

12.Turnover balance in addition to balances and sources of property formation at the beginning and end of the period, it contains data on their movement (debit and credit turnovers) for the reporting period. By its structure, it will differ from the balance sheet.

Turnover balance

The balance sheet is of great importance as an interim working document used in the process of drawing up the opening, closing and liquidation balance sheets.

13.Preliminary (provisional) balance- balance sheet, drawn up in advance at the end of the reporting period, taking into account the expected changes in the composition of the property of the enterprise. The basis of such a balance is the actual accounting data on the state of active and passive items at the time of its compilation and the expected data on business transactions that will be completed before the end of the reporting period. Drafting a preliminary balance sheet aims to establish in advance financial position the enterprise in which it will be at the end of the reporting period.

14.Checking (statistical, trial) balance- a set of closing balances for all general ledger accounts, compiled at the end of the reporting period after all primary documents, is used in Western (Anglo-American) accounting. Serves to check the equality of the totals of debit and credit balances and the basis for the compilation of pre-reporting adjustment entries. Since in Anglo-American accounting, accounting accounts are opened for reporting items, the trial balance gives some idea of the balance sheet indicators (permanent accounts) and the statement of financial results (temporary accounts). Depending on the completeness of the assessment of individual items, a distinction is made between net and gross balances.

Balance - Gross (Rough) includes regulatory clauses; used for scientific research, improving balance information functions, etc.

Net balance (net)- balance sheet, from which regulatory items are excluded: "Depreciation of fixed assets", "Depreciation of intangible assets", etc. B modern conditions the value of the net balance has increased, since it allows one to determine the real value of the organization's assets. Currently, the net balance is the current reporting form.