Procedures for closing the reporting period. Closing the month

After all the primary documents are entered into the program, it is necessary to close the period; for this, the accounting officer performs closing procedures. Everything scheduled operations are formed on the basis of correctly entered data in the "Accounting Policy" section. It contains information on accounting, data on the taxation system, and indicates the types of activities of the company. Filling in the data on the accounting policy of the organization is necessary in the "Main" section panel in the "Settings" block.

The procedure for closing the month in 1C, what is it?

It should be borne in mind that closing the month in 1C is a permanent procedure that is performed every month.

All executed documents (operations) during this procedure are regulatory, they affect:

- creating the cost of production in production;

- results, both tax and accounting.

Regulatory documents after the implementation of these procedures determine financial activity enterprises.

Where in the program is the block "Closing the period"?

In the section panel "Operations", there is a block "Closing the period", it includes five sections:

- "Closing of the month";

- "Regulatory operations";

- "References - calculations";

- "Assistant for VAT accounting";

- "Regulatory operations of VAT".

Why do you need a Month-End Helper?

Why do you need a Month-End Helper?

The assistant performs routine activities to close tax and accounting accounts, they are performed one after another, in a strictly defined sequence.

It is necessary in order to control the correct and consistent execution of all routine operations for the enterprise (organization).

Documents in the regulatory procedure are divided into four blocks:

- I (first) - includes documents (operations), which, after they are carried out in the program, take into account the expenses of the organization. All expenses of the firm must be carefully controlled to ensure that closing operations reflect complete and reliable accounting;

- II (second) - document - "Calculation of the write-off of shares indirect costs". When conducting it in the database, preliminary calculations are made on the cost accounts;

- III (third) - includes a regulatory procedure for closing accounts for the accumulation of costs and distribution costs (account 20, account 23, account 25, account 26, account 44);

- IV (fourth) - operations that determine the financial results for the period (account 90, account 91).

Within the block, regulatory documents can be executed in any order, the operations of each block must be performed sequentially. The documents of the second and subsequent blocks are posted, in the case of no erroneous completion of the posting of the documents of the previous block.

Within the block, regulatory documents can be executed in any order, the operations of each block must be performed sequentially. The documents of the second and subsequent blocks are posted, in the case of no erroneous completion of the posting of the documents of the previous block.

To carry out regulatory activities, the period is indicated and the organization is selected. These routine operations are performed by clicking on the “Closing the month” button. A separate document is created for each operation. Carrying out closing activities, quite often, an error message appears, in this case, you need to familiarize yourself with the description of the error, then correct it and then continue the procedure for closing the month again.

Be sure to carry out all closing activities in strict order so as not to waste extra time on re-identifying errors and conducting operations in the database.

If, after carrying out operations to close the month, all items acquired:

- Greenish color, it means that everything was completed successfully;

- Pale bluish color, and an error message is displayed, this means that the procedure must be rerun until all errors are corrected.

Marking documents in red means that they are not completed due to errors.

What errors occur at the end of the month?

Common mistakes:

- The nomenclature group of income for accounting or tax accounting is not indicated in the sales documents;

- Account 25 is not closed, since it is impossible to determine the basis for the distribution of expenses for some departments;

- Analytics is not indicated in documents reflecting operations on other income and expenses;

- The procedure in 1C for posting documents for closing the month in the required order was violated.

Marking regulatory documents in a greenish color does not yet mean the successful completion of all regulatory operations. In order to check whether the closing procedure is proceeding correctly, you can generate and then analyze the data in balance sheet, taking into account the verification of balances at the end of the period.

When closing the reporting (calendar) year, it is necessary to additionally carry out regulatory documents:

- Write-off of losses of previous years;

- balance reform.

When the balance sheet is reformed, tax accounts and accounting accounts, such as account 90, account 91, are closed.

If a team of employees of the accounting service and other services works in the 1C program, then it is advisable, when all errors are identified and corrected, to restart the database, and then close the editing period, in order to avoid accidental changes in the documents.

How to close the period for editing in the program 1C: "Accounting 8 edition 3.0"?

In the panel of sections "Administration" there is a block "Support and maintenance", in it we find the position "Dates of the prohibition of data changes".

The prohibition of changing data in the 1C program can be defined as for:

- specific user;

- All users.

For example: The date of the prohibition of editing documents is set to March 31 current year, then documents prior to this date will be available to users for viewing only. If the user tries to change the data in the document, a warning will appear on the computer screen. As for documents, starting from April 01 of the current year, you can not only enter and view them, but also change and retransmit them.

Do not forget that a correctly performed procedure for closing the month will show a complete and reliable result of the financial and economic activities of the organization as a whole.

Closing of the month. Regulatory actions and operations depending on the tax regime. Configuration Mapping Accounting 2.0, Manufacturing plant management 8, Integrated automation 8.

-The closing procedure of the month consists of a number of routine operations:

-depreciation, repayment of the cost of workwear and special equipment, determination of the cost of the movement of MPZ per month,

-revaluation of foreign currency, write-off to current expenses future expenses,

-determination of the actual cost of issued products and services,

-identification of deviations in estimates of income and expenses in accounting and tax accounting,

-calculation of income tax,

-calculation of VAT liabilities, etc.

-All these operations are carried out by separate procedural documents created and maintained in a certain sequences.

A general procedure was drawn up and worked out:

1)Group reconduction ("roughly"), "sequence restoration" - cleanly

2)Bring down the bank. Take out the checkout.

3)Check duplicate counterparties by sorting by TIN in the directory Counterparties, or processing the search for duplicate elements of directories.

4)Calculate OS depreciation

5)Calculate depreciation for materials in use (10.11.1 and 10.11.2) (repayment of the cost of overalls/special equipment)

6)Write-off of deferred expenses 97

7)OSV on account 00 - there should be no balances and postings

8)OSV on account 10 must contain a zero balance (as a rule, all materials write off at the end of the month/quarter) or depending on accounting policy

9)Generate SALT on account 20, 25, 26, 44. For the normal closing of the month, do not there must be an empty analytics (empty lines with amounts in circulation).

10)Generate SALT on accounts 90 and 91 For the normal closing of the month, do not an empty analytic must be present.

11)OSV on account 41, 43, 10 should not contain negative balances.

12)Check for the absence of “Operation (manual accounting”) documents for postings to accounts settlements with counterparties (all conf.) Check the absence of documents “Operation (manual accounting") Inventory and materials -10, 41, Costs -20, 26, 25 (SCP, KA).

13)Check unreasonable. Manual movement corrections (BP)

14) Restore the sequence of settlements with counterparties (UPP, KA). Sequence for the acquisition, sale, revaluation of foreign leftovers

14*) Restoration of tax sequence accounting for the simplified tax system(for USN)

15) Analysis of Subconto - Counterparties: Check the need for offsets between different contracts of the same counterparty (for example, as supplier or as a buyer).

16) Analysis of Subconto - Counterparties: By subaccounts, check the absence of Turnovers under one debit and credit agreement (62.01/62.02 and 60.01/60.02)

17) Perform posting on VAT registers (UPP, KA)

18) Perform batch posting (with batch accounting) (UPP, KA)

19) Check the compliance of the data in the "Statement of production costs" from turnovers on the 20th account. (UPP, KA).

20) Check the compliance of the data in the "Spending Statement" with turnovers of 25.26 account in total. (UPP, KA).

21) Formation of entries in the Purchase Book. Formation of Sales Book entries.

22) Writing off expenses from expense accounts (26.44 ...) to 90 accounts (if necessary manually reasonable if there is no revenue) - through "Other costs" (UPP, KA)

23) Definition of Financial Results

25) Final rerun/restoring the run sequence

documents.

After performing the routine operation of closing the month, you must:

1)OSV on accounts - there must be no balances:

a. 19

b. 26

c. 25

d. twenty*

e. 44

f. 90

g. 91

*if there is no WIP and all costs are current period costs

2)Check the correctness of the VAT calculation

a. Reconcile VAT sales amounts in VAT return = Sales book = list

cross-tab (VAT Sales)

b. Reconcile input VAT amounts on VAT return = Purchase book = list

cross table (VAT Purchases)

from. Report on availability of invoices (all) Analysis of input VAT. Analysis

accrued VAT (UPP, KA).

Those who are faced with the task of closing the month (year) in the 1C 8.2 program for the first time often have a lot of questions: in what sequence and which documents need to be done why certain accounts are not closed, why the necessary postings and VAT documents are not generated, etc.

In this article, I want to dwell on the sequence of actions when closing the month.

1 . Go to the "Account Manager" interface and in the "Regulatory Operations" menu, select " Setting the end of the month". Here you need to create a typical setting that you will use from month to month, except for the situation when you need to close the year.

2 . In the newly created setting, you must fill in its name, in the "Option" line, select your tax system and in the tab "Summary settings" select items of interest to you (documents).

IN without fail must select " Restore calculation sequence on acquisition", "Restore the sequence of settlements on sales", "", " Calculate VAT" (by clicking on the plus sign you need to select the necessary items. I recommend choosing: "! Posting documents on VAT registers", "Registration of invoices for advance payment", "Formation of purchase book entries", "Formation of sales book entries"), " Calculate the cost (BU, NU)", "SFgenerate financial results".

Go to the "Responsible" tab. for each document we assign a responsible person. It can be either the same person or different ones.

We save the setting.

3 . Next, in the menu "Scheduled operations" select the item " Monthly closing procedure". Create a new procedure, select the desired month closing, your organization, in the "Settings" window, select the setting we created, press the " Download settings". And press the "Start procedure" button.

In the upper part of the open window with the running procedure, click on the button " Scheduled Operations". In the event that you are responsible for a document in accordance with the settings for closing the month, you will see a line-by-line list of those actions that need to be performed. Each next action will appear only after you complete the previous one.

Consider what needs to be done within the framework of the points that I indicated above.

3a. Restore Sequence purchase and sale settlements. To perform this procedure, it is necessary to select the item "Restoring the sequence of calculations" in the menu "Scheduled operations". In the "Set the current state of settlements on the date" field, you can set current date or the date corresponding to the last day of the reporting period. Next, you need to tick off the items "Restoring the sequence of settlements on acquisition" and "Restoring the sequence of settlements on sales", as well as highlight your organization. Please note that in the "Revaluation start date" field opposite your organization, you can set the date from which you need to restore the sequence. In the fields to the right ("Border on acquisition" and "Border on sale") the dates are indicated - the smaller of them must be selected for setting in the "Revaluation start date" field. Next, click the "Execute" button.

After you make sure that the sequence is restored, we return to the procedure for closing the month, the "Regular Operations" button. We go to the top lines "Restore the sequence of settlements for the acquisition / sale" and click on the "Mark as completed" button.

3b. Calculate salary and insurance premiums . Here you need make sure that wages and insurance premiums for the relevant period have been accrued. If this is the case, then in Scheduled Operations in the Month Closing Procedure, you must go to the appropriate line and click the "Mark as Completed" button.

Learn more about the accrual method wages in 1C I will tell in the next article.

3c. Posting documents on VAT registers . To perform this processing, it is necessary to select the item "Posting documents through VAT registers" in the "Regulatory operations" menu. In the line "Conduct documents only for the selected period" indicate the period you are interested in, check the boxes for the necessary points of execution, select your organization and click the "Run" button. After you make sure that the execution is completed, in Scheduled Operations in the Month Closing Procedure, select the appropriate line and click the "Mark as Completed" button.

3y. Registration of advance invoices . In order to create advance invoices, you need to enter the "Accounting and Tax Accounting" interface and select the "Registration of advance invoices" item in the "VAT" menu. Here you choose the period you are interested in, your organization, press the "Fill" button. After the list is generated, click the "Execute" button. In the corresponding window, you will see how the process of generating advance invoices takes place. After this process is completed, you enter the appropriate line in Scheduled Operations in the month closing procedure and click on the "Mark as completed" button.

3d. Formation of purchase book entries . Here you just need to enter the appropriate line in the Scheduled Operations in the Month Closing Procedure and click on the "Create Documents" button (provided that the purchase book for this period was not formed earlier). Next, you go into the entered book of purchases and into topmost part of the window, click the "Fill" button, and then "OK". Now you can mark this routine operation as completed.

3e. Formation of sales book entries . All by analogy with the book of purchases, so we will not dwell in detail.

3g. Calculate the cost of "BU, NU) . We go to the corresponding line in Scheduled Operations in the procedure for closing the month, click the "Create documents" button. We go into the created document, click on the "OK" button. Next, in the scheduled operation, click the "Mark as completed" button.

And finally

3h. Generate financial result . We go to the corresponding line in Scheduled Operations in the Month Closing Procedure, click on "Create Documents", go to the created document, click "OK", then click "Mark as Completed" in the scheduled operation.

The procedure for closing the month is completed, now you can check the correctness of closing accounts using the balance sheet.

You can read about problems when closing individual accounts, for example.

To generate scheduled VAT transactions, open the section Operations - Closing the period - Scheduled VAT transactions:

Create:

- – an operation to restore VAT amounts accepted for deduction on zero rate. When creating an operation in the header, you need to specify where the tax amount will be entered - in the book of purchases or sales.

- Real estate VAT recovery– an operation to restore tax amounts on real estate objects that are put into operation and used for VAT-free operations, in accordance with paragraph 2 of Article 170 of the Tax Code of the Russian Federation.

- Calculation of VAT on construction and installation works using a household method- this operation charges VAT on construction and installation works performed by the organization itself and not taken into account for construction objects as fixed assets (according to clause 10 of article 167 of the Tax Code of the Russian Federation).

- Zero VAT rate confirmation– this transaction confirms or does not confirm the zero VAT rate for sales transactions.

- Confirmation of VAT payment to the budget- the operation registers the fact of receiving a tax mark in .

- VAT distribution– allocates VAT to taxable, non-taxable, or zero-taxable transactions for valuables written off as expenses.

- Write-off of VAT- the operation is intended to be written off as expenses for VAT, which is presented by the supplier, but cannot be accepted for deduction.

- – the transaction reflects VAT deductions for invoices that were not included in the purchase book earlier, as well as for invoices where tax is deductible in installments.

- - an operation to restore VAT from advances and reflect the amounts in the sales book.

How to find and fix VAT errors in 1C 8.3 for proper management accounting and reporting on VAT, read in.

VAT Accounting Assistant

To work with the VAT routine operations in 1C 8.3, there is an assistant. It checks the correctness and sequence of these operations for the correct filling of purchase and sales books, as well as VAT returns. The assistant is located in the section Operations - Period Closing - VAT Accounting Assistant:

In addition to the list of operations to be performed, the assistant fixes the status of each of them:

- Awaiting execution;

- Completed, up-to-date;

- Done, not relevant.

For the correct formation of the VAT declaration, all transactions must have the status Done, up-to-date:

Attention! If in 1C 8.3 VAT transactions were created in the process of work as needed, then it is recommended to use an assistant before compiling reports and repost the specified list in chronological order. How to do it .

Closing the month in 1C 8.3 Accounting step by step

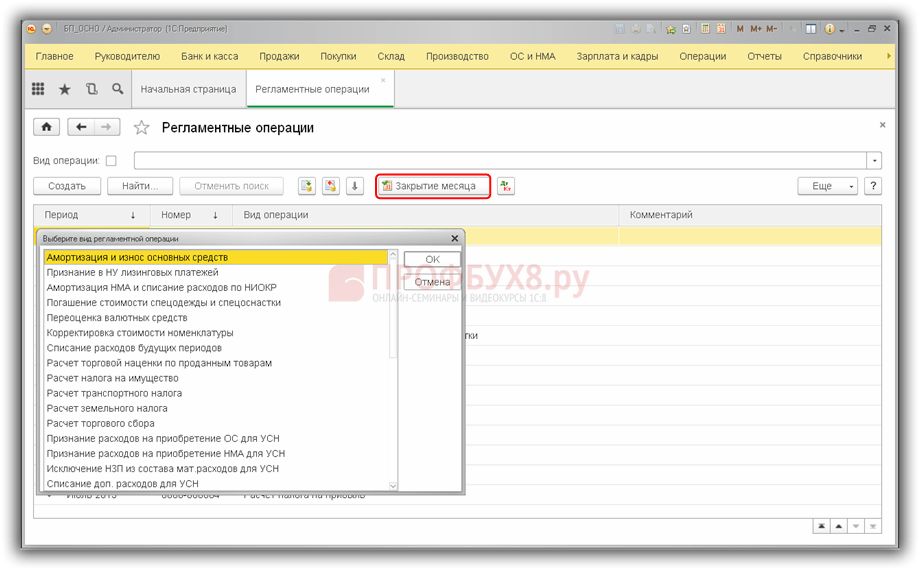

This procedure consists of routine operations. Each operation is carried out by a separate document in a certain sequence. To generate scheduled operations, open the section Operations - Period Closing - Scheduled Operations:

The list of all possible operations in the 1C 8.3 program is available by clicking the button Create. However, it is not recommended to create operations manually, 1C 8.3 itself determines required list according to the program settings, accounting policy organization and conducted primary documents:

Step 1. Setting up the month-end closing procedure

Accounting Settings

After checking the box in 1C 8.3, accounting functionality will appear special clothing, appliances, equipment.

According to the equipment for which primary documents deadline set beneficial use, at the end of the month, a settlement regulatory document will be created Repayment of the cost of overalls and special equipment.

To set up an accounting policy in 1C 8.3, open the section Main - Settings - Accounting policy:

When generating regulatory documents, the procedure for closing accounts 20, 23, 25, 26 is important. The rules for the distribution and write-off of costs are set by the user in the accounting policy settings on the tab Expenses. For example: if the organization's main activity is the performance of work or the provision of services, then it is necessary to establish the procedure for writing off costs from account 20:

By button indirect costs methods of distribution of overhead and general business expenses are established.

Step 2. Starting the month-end closing procedure

To automatically close the month and carry out the necessary routine operations in 1C 8.3, an assistant has been created Closing of the month:

1. Open the assistant section Operations - Period Closing - Month Closing or click the button Closing the month directly in the log of routine operations:

2. Install period closures:

3. If the 1C 8.3 database keeps records not for one, but for several organizations, then indicate name of company for which the closure is performed.

4. To restore the chronological sequence of entered documents, use the function Conducting documents per month. If reposting is not required, open the hyperlink and click Skip operation.

5. To start the calculation of regulatory documents, click the button Perform month-end closing.

Step 3. The sequence of closing the month in 1C 8.3

This procedure consists of 4 steps:

- Stage 1 includes settlement operations for different areas of accounting. They can be performed independently of each other as soon as they are ready, or not performed at all if accounting data is missing or settings are not enabled. For example: if there are no deferred expenses in accounting, then they will not be calculated.

- It is possible to proceed to the 2nd stage only after the calculation of all operations of the 1st stage, as they may affect the amount of expenses. The stage consists of one operation Calculation of indirect costs write-off shares, which determines the ratio of indirect costs write-offs between activities with different systems taxation.

- At the 3rd stage:

- closing production and commercial expense accounts;

- calculation of the actual cost of semi-finished products and finished products, works and services produced per month;

- cost adjustment products sold(works, services);

- distribution of expenses by type of activity for organizations on the simplified tax system and for accounting for individual entrepreneurs.

- At the 4th stage, the amount of income tax is calculated for the month. When performing scheduled operations for December, 1C 8.3 also performs the Balance Reformation operation.

The closing procedure is considered completed after all the listed operations have been completed, that is, each regulatory document must have the status Done, up-to-date. If the operation is performed with an error, then 1C 8.3 will assign it the appropriate status and suspend the closing of the month until the error is eliminated. You can find information about the error by clicking on the name of the operation.

To cancel the period closing procedure as a whole, use the button Cancel month end. To cancel a separate scheduled operation, press the button Cancel operation, while all subsequent operations will acquire the status Completed, outdated:

To get a brief report on the operations performed in 1C 8.3, use the button Report on the execution of operations.

Step 4. Reports on the closing operations of the month

You can get information about the purpose of each operation by clicking the button. Open Help in the journal Scheduled Operations:

Step 5. Postings and registers

After the completion of the procedure for each operation in 1C 8.3, accounting entries and registers. To open the records for viewing, click on the name of the operation and press the button

Instructions for closing the month in 1C 8

You can close the month using a special mechanism for closing the month (from the accounting interface - routine operations - Closing the month) or without (in this case, all documents for the end of the month must be entered manually). Before starting the mechanism, you must select the "Setting the closing of the month" from a special directory.

Then, click the "Start procedure" button.

On the “Scheme” tab, you can see which month-end closing operation should be carried out at the current moment (highlighted with a red dotted line). You have to double click on it. A scheduled operation responsible for a particular document/processing will appear.

If the operation is responsible for posting documents, then you need to create documents and post them (these buttons are on the command bar), then click on the “mark as completed” button. If the operation is responsible for processing, then you need to start the corresponding processing (Restoring batch accounting, restoring the state of settlements), then click on the "mark as completed" button. Then there is a transition to next operation in the process diagram "Closing the month". If you want to cancel a scheduled operation, then right-click on the desired operation on the “Month-end closing” process diagram and select cancel execution. In this case, the operation and all subsequent ones will be canceled. If you want to mark an operation as completed without checks (for example, registering invoices for advances during a period when there were no advances from buyers in the usual way it is impossible to mark the operation as completed), then you need to enter this operation from the menu

All operations in order.

- Restore the sequence of purchase settlements. You need to start the appropriate processing (from the accounting interface - documents - additionally - restore the sequence of calculations). Specify the date of the end of the month, select relevant organizations and install all the checkboxes, then execute. In the case when the current settlement date is less than the start date of the month being closed, you need to move this date to the beginning of the month (the processing is in the list of external processing "Settlement boundary shift").

- Restore the sequence of calculations for implementation. Same as point 1.

- Calculate OS depreciation. In a routine operation, use the mechanism for the formation and holding of documents. Depreciation postings are set up in the Depreciation expense reflection methods reference book.

The method is indicated in the document “Acceptance for OS accounting” or “Entering initial balances OS".

- Calculate the depreciation of intangible assets. Working with the operation is similar to the operation for the OS.

- Pay off the cost of clothing. Enter the scheduled operation (double-click on desired operation from the monthly closing chart). Create documents, conduct. Mark as completed.

- Write off RBP (deferred expenses). Enter the scheduled operation (by double-clicking on the required operation from the month closing scheme). Create documents, conduct. Mark as completed. As a result, the document “Write-off of RBP” will make postings, Dt of which is taken from the RBP reference book Kt 97.

- Calculate insurance costs. Enter the scheduled operation (by double-clicking on the required operation from the month closing scheme). Create documents, conduct. Mark as completed. As a result, the document "Expenses for voluntary insurance» will make postings, Dt of which is taken from the directory Deferred expenses with the type of RBP insurance Kt 97.

- overestimate currency funds. Enter the scheduled operation (by double-clicking on the required operation from the month closing scheme). Create documents, conduct. Mark as completed.

- Calculate wages and UST. The operation can be marked as performed without creating the documents “Payroll to employees of organizations” and “Calculation of UST”.

- Registration of advance invoices. From the accounting interface - VAT - registration of invoices for advances. Start processing - fill in, then execute. The tabular part is filled with all advances received from buyers, i.e. turnover Kt60.02, 60.22, 60.32 accounts accounting plan accounts.

- Registration of invoices for amount differences. From the accounting interface - VAT - registration of invoices for amount differences. Start processing - fill in, then execute.

- Formation of purchase book entries. The scheduled operation creates, fills in and posts the document "Formation of purchase book entries". The document is filled in according to the balances of the savings register "VAT Presented".

- Formation of sales book entries. The scheduled operation creates, fills in and posts the document "Formation of Sales Book Entries". The document is filled in according to the balances of the accumulation register "VAT accrued".

- To carry out the distribution of expenses by type of activity, the rationing of expenses. The scheduled operation creates and posts the document "Regulatory operations of tax accounting". The document is usually used to rate the costs of tax accounting(Register of accounting "Tax").

- Calculate the cost price (BU, NU). The scheduled operation creates and posts the documents "Cost calculation" with reflection in accounting and tax accounting (Interface "accounting and tax" -> Documents -> Scheduled operations -> Cost calculation).

- Generate financial results. The scheduled operation creates and posts the document “Definition financial results". Accounts 90 and 91 are closed for 99 in accounting and tax accounting.

- Calculate income tax. The scheduled operation creates and posts the document "Calculations for income tax". When using PBU18/2, the document generates deferred and permanent tax assets/liabilities. The document also calculates income tax. Typical postings when posting a document for accounting are listed below.

Postings on deferred tax assets and liabilities are formed according to the turnover of the tax chart of accounts according to the type of accounting "BP" (temporary differences) of accounts up to 90, multiplied by the income tax rate.