Maternity capital as a down payment on a mortgage: features and conditions of use in banks. How to properly arrange a mortgage for maternity capital

The Ministry of Labor proposed to extend the maternity capital program for 5 years, until 2023. According to statistics, more than 60% of families invest this money in improving housing conditions... Some use the capital to pay off mortgage debt, others spend everything on the down payment for an apartment. Let's consider which of these options is more profitable.

Terms of use

To spend maternal capital It is possible to pay off the debt on the mortgage loan taken regardless of which bank you are dealing with. But not all financial institutions agree to accept the funds allocated by the state as an initial payment, so it may be difficult to find suitable mortgage lending conditions.

If the family decided to buy expensive housing, the maternity capital may not be enough even for an initial fee, which means you have to pay extra. Since the beginning of the year, the size of the mother capital is 453 thousand rubles, and it is not worth counting on the indexation of this amount in the coming years. The initial payment on a mortgage is 20-30%, so those wishing to settle in a Moscow new building start with an amount exceeding 600 thousand. Prices for two-room apartments in the capital start at 3 million rubles, which means that even if you are lucky to find cheap housing somewhere on the outskirts, you will have to pay at least 150 thousand extra.

Immediately after replenishing the family, it will not be possible to spend maternity capital on the initial contribution. By current regulations, you can use this money in this way only when the child turns 3 years old. But they are allowed to pay off the current mortgage immediately after receiving the certificate.

Maternity capital will not help undisciplined borrowers get out of it. You cannot spend these funds on the payment of fines, commissions or penalties under loan agreements. If there is a delay, it must be repaid, and only after that it will be possible to use the certificate. The purpose of using the funds will have to be indicated not only in the statement of order, but also to be confirmed by the relevant documents.

The procedure for making maternity capital as a down payment is associated with certain additional costs. First, the bank must give the borrower a loan for an initial payment in the amount of maternity capital. Credit rate at the same time, it is equal to the Central Bank's refinancing rate (by this moment 10% per annum). The FIU will repay this loan only a couple of months after the deal is concluded, and the interest will need to be paid out of pocket. If you pay off the debt by current mortgage, then additional costs will not, so this way of using the certificate is more profitable.

Real life example

The Vasenin family took out a mortgage in the fall of 2016. They received a certificate for the mother capital in 2012, but they were in no hurry to use it. Spending this money as a down payment was, at first glance, a tempting idea, but certain difficulties arose. Firstly, in this case, the mortgage would have to be obtained through Sberbank, while the family was overpaying, since their developer cooperates with VTB 24. Secondly, why give the bank an extra 8 thousand, if this can be avoided?

Maternity capital provides great opportunity buy or expand residential property... Most large banks in Russia will accept it as an initial contribution to mortgage lending. If you are the owner of maternity capital and need to improve your living conditions, then this article will be of interest to you.

Maternity capital can be invested in a mortgage not only when buying an apartment, but also in the construction of a private house, as well as in equity construction. It's just that each case has its own nuances. But what unites them is that at the end of the payment of the mortgage debt, the property that you acquired with the help of it will need to be registered for all members of your family, including children. If this condition is violated, you may face major troubles, tk. it will be considered a violation of the law. If you plan to contribute maternity capital to lending in the role of a first installment, then it is worth considering that this will be possible only after the child, after the birth of which this capital was issued, is three years old. It was simply impossible to use it for these purposes before. The same applies to guardians who have adopted a child. The main conditions for obtaining such a mortgage are, of course, the presence of the certificate itself from the family and a permanent cash income not below average. If the family already owns a living space, then it will no longer be able to use the maternity capital in this role.On our website.

Unfortunately, maternity capital is not yet accepted in all banks as an initial contribution to a mortgage. It is more welcomed in the role of paying off an existing mortgage or its interest. Therefore, a list of banks that accept capital as a down payment will come in handy. It includes: Sberbank, VTB24, Uralsib, Otkritie Bank, DeltaCredit, Unicredit and Metcombank.

You can download it here.

Upon approval of the mortgage by the bank of your choice, you will need the following package of documents:- The passport;

- Certificate from the Pension Fund of the Russian Federation about the balance on the personal account of the MSC;

- Form 2-NDFL from the previous place of work;

- Housing purchase and sale agreement;

- Extract from the State Register;

- Co-borrowers' documents.

Currently, banks provide mortgages on different terms. Therefore, first of all, you need to consult with the leading manager of your chosen bank, who is competent in the field of mortgages. Only then will you know the exact details of the conditions for obtaining a mortgage with an investment of maternity capital.

Improving living conditions is priority area use of maternity capital. It is for this reason that a mortgage loan secured by maternity capital is very popular among those families who have received the right to state support as capital.

Areas of use of maternity capital in the framework of mortgage lending

If a family decides to use maternity capital to improve their living conditions through mortgage lending (repay the mortgage with maternity capital), then it must be remembered that there are three main options for using family capital:

- Repayment of the principal and interest on a previously issued housing loan. This is possible when working with Sberbank, DeltaCredit Bank.

- Using maternity capital as a down payment on a newly issued mortgage loan. This is possible at the Bank of Moscow, VTB24 Bank, Nomos Bank, DeltaCredit Bank.

- Increase in amount mortgage loan for the amount of capital when buying more expensive housing than income allows. This can be done at Rosbank, Izhkombank, Tver Mortgage Center, at the Mortgage Agency housing lending, at Bank UniCredit.

Features of the use of maternity capital in the framework of mortgage lending

The main features of the use of maternity capital in the framework of mortgage lending are the following:

- Firstly, maternity capital is not cash, but simply the family's right to government aid, confirmed by the corresponding certificate. Therefore, the understanding of capital as something that can act as collateral for a loan or its security is wrong.

- Secondly, not every bank accepts maternity capital in the form of payment for the principal debt and interest on the use of loans. It is all the more difficult to use maternity capital in the form of an initial payment on a mortgage loan.

- Thirdly, maternity capital can be used to purchase any housing (built, under construction, under construction), but this can only be done with direct purchase and sale or construction.

If maternity capital is used as part of mortgage lending, then the type of housing purchased is determined by the bank and the specific loan product: some banks (loan products) work only with new buildings, others, on the contrary, with secondary housing.

- Fourth In order to use the capital to repay a previously issued home loan, there is no need to wait for the child's three years or the expiration of a three-year period from the date of the child's adoption. However, in order to direct the family capital to the down payment on the mortgage loan being issued, it is necessary to wait a three-year period.

- Fifth, when purchasing housing with capital funds (or part of the funds), the residential premises must be registered in common property all family members (parents and all children).

Banks working with maternity capital

Can be called following banks who in 2014 issue mortgage loans against maternity capital (that is, accept family capital in the form of a down payment) and / or repay housing loans with maternity capital:

- DeltaCredit Bank... This bank issues a loan for housing under maternity capital with a minimum down payment of no more than 5%. Family capital funds can be used to make an initial contribution and early repayment principal and interest on the loan. The bank takes into account the solvency of the applicants, as well as the balance of the maternity capital when calculating maximum amount a loan to work with maternity capital;

- Bank UniCredit... This credit institution allows you to use maternity capital to pay off the mortgage;

- Sberbank... This bank works exclusively with finished buildings and issues loans at a rate of 14% per annum for a maximum of 30 years. Residential premises purchased using credit funds of the Bank must be registered in the ownership of the borrower / general shared ownership spouses and his / their children;

- Bank of Moscow. This banking institution does not yet accept maternity capital as an initial payment, but pays them the principal amount of the debt on mortgage loans and interest on it;

- VTB 24... In this bank, the rate is housing loans is 11% and more, and loans are issued for a period of up to 50 years. V this year VTB24 Bank provided the opportunity to use maternity capital as an initial payment on a mortgage;

- Nomos Bank. This bank relatively recently began to work with maternity capital, but was already able to offer a very profitable credit product allowing the efficient use of capital funds to improve housing conditions;

- Rosbank... This bank offers borrowers to expand their ability to purchase housing on credit by repaying debt on a loan with capital;

- Izhkombank... The bank offers loans for the purchase of residential premises and for the completion of the construction of a construction in progress;

- Tver Mortgage Center... Working with this institution will allow you to purchase more comfortable housing by increasing the loan amount without taking into account the bank's restrictions;

- ... This lending institution offers profitable mortgage loans with raising capital as an initial payment and as an amount to pay off the principal and interest on the loan.

Below is a table that differentiates the type of housing (under construction, finished, primary or secondary), with which the above banks work.

| Bank | Under construction | Finished |

|---|---|---|

| DeltaCredit Bank | + | + |

| Bank UniCredit | - | + |

| Sberbank | + | + |

| Bank of Moscow | + | + |

| VTB 24 | + | + |

| Nomos Bank | + | + |

| Rosbank | + | + |

| Izhkombank | - | + |

| Tver Mortgage Center | + | + |

| Housing Mortgage Lending Agency | + | + |

Banks' interest rates on mortgage loans with the attraction of maternity capital

Consider the interest rates of banks on loans in which it is allowed to use maternity capital. Interest rates are indicated in accordance with the terms of each loan product.

| Banks working with maternity capital | Loan products | Interest rate |

|---|---|---|

| DeltaCredit Bank | DeltaEconomy | from 13% |

| DeltaStandard | from 7% to 10% | |

| DeltaRubble | from 10% to 13% | |

| Delta Option | from 6% to 9% | |

| DeltaDream | from 11% | |

| Bank UniCredit | Loan for the purchase of an apartment or a cottage | from 12% to 13% |

| Sberbank | Acquisition of housing under construction | 12% |

| Purchase of finished housing | from 12% to 13% | |

| Bank of Moscow | Mortgage + maternity capital | from 11.9% |

| VTB 24 | Secondary housing | from 11.95% |

| New building | from 12.95% to 13.95% | |

| Nomos Bank | Apartment + Maternity capital | from 12.25% to 14.5% |

| Rosbank | Standard | from 12.35% in rubles, from 9% in dollars and euros |

| New building | from 13.3% in rubles, from 10.75% in dollars and euros | |

| country estate | from 12.6% in rubles, from 9.75% in dollars and euros | |

| Izhkombank | Maternal capital | from 8.95% to 11.95% |

| Tver Mortgage Center | Maternity capital plus | (calculated as a percentage of overpayment on a loan) - from 50% to 80% |

| Maternity capital plus + House | (calculated as a percentage of overpayment on a loan) - from 50% to 70% | |

| Housing Mortgage Lending Agency | Maternal capital | from 7.65% - when working with primary market, from 8.95% - when working with the secondary market |

Documents required when using maternity capital

Each bank will have a different package of documents. Below is a standard package of documents that any bank may need for registration mortgages when the family uses maternity capital:

- Maternity capital certificate - original and copy;

- A certificate from the local branch of the Pension Fund on the amount of the balance of family capital in the family account;

- Certificate 2-NDFL (certificate of income for the last six months);

- Copies of the last completed and submitted tax returns(mother and father);

- Documents confirming the income of close relatives (regardless of whether they will be the guarantors of the loan);

- Applicant's passport;

- All documents on the loaned dwelling.

How to use parent capital in banks: step by step instructions

To obtain a mortgage when using maternity capital in the form of a down payment, the following sequence of steps must be followed. Remember that you can use capital in this direction only after three years or more have passed since the birth or adoption of the child.

- Obtain a certificate for maternity capital, choose a dwelling to purchase it on a mortgage.

- Having received a certificate from the Pension Fund, having concluded a contract for the sale and purchase of residential premises, you need to contact the bank with a full package of documents (see above).

- The bank will consider an application for a loan and the use of capital as a down payment on a loan from several days to a month.

- After the approval of the application for a loan, the bank will issue a preliminary letter of confirmation of the loan and will notify the borrower about the time period for transferring the maternity capital funds towards the initial payment.

- Having received a preliminary letter on the issuance of a loan, the borrower must contact Pension Fund for the transfer of capital funds. This is done in order to request a certificate from the Pension Fund on the amount of the balance of capital funds (even if they have not been used at all before).

- Go to the bank and apply for a loan. Get your hands on copies of all mortgage documents.

- Apply to the Pension Fund with an application (with the attachment of a loan agreement and a mortgage agreement) to deposit capital funds into the bank account.

To repay the loan with family capital, you need to collect a package of documents and apply to the Pension Fund. In most cases, a positive decision is made, however, a refusal due to non-compliance is also possible. credit institution requirements of the law. If the Pension Fund allows the funds to be spent, the money is transferred to the bank account, which makes full or partial repayment of the debt. The ownership of housing, paid for by the maternity capital, is divided among all family members.

Maternity capital - funds allocated to a family at the birth of a second child or the adoption of a second or subsequent child. can be done in different ways. One of the most common and demanded is the repayment of the mortgage by the parent capital.

It has been established that the money received from the state can be used as an initial payment for the acquisition of real estate on a mortgage, as well as sent to pay housing loans, including the main debt and interest for use. It does not matter when the family took out the loan, since the law allows for the possibility of paying off the debt on obligations that arose before the birth of the child. Restrictions are established only in terms of the repayment of certain debts arising from the loan: penalties, fines and other sanctions associated with non-fulfillment of obligations to make payments.

Repayment of a mortgage loan by the parent capital

It is allowed to use the family capital after 3 years. To do this, you need to write an application to the Pension Fund office.

Attention! You should contact the local territorial office permanent residence... If the family lives at a different address, both spouses need to issue a temporary registration at the place of stay. Those living abroad apply directly to the Russian Pension Fund.

Real estate can be purchased under a sale and purchase agreement when the house has already been built and put into operation or it comes O secondary market, or under an agreement of participation in shared construction,. Also, maternity capital can be used to pay off the debt on a loan taken to buy a home.

Table 1. List of documents required for submission to the Pension Fund (all documents are provided in copies, while the documents must be on hand).

| P / p No. | To pay the down payment on a loan | To pay the down payment on a loan for participation in shared construction | To pay off the principal and interest on the loan | ||

| 1 | credit agreement or loan agreement | ||||

| 2 | mortgage agreement (if any) | ||||

| 3 | obligation to register real estate in common ownership (original) | ||||

| 4 | contract of sale | shared construction participation agreement | bank statement on the balances of principal and interest arrears (original) | ||

| 5 | certificate of the deposited amount and remaining debt, as well as details for the transfer of maternity capital funds (original) | certificate of registration of ownership | |||

| 6 | participation agreement in shared construction (if the apartment was purchased in this manner) | ||||

| 7 | house building permit (if the house is not in operation) | ||||

| 8 | document confirming receipt of money under a loan agreement | ||||

| 9 | a document confirming membership in the cooperative (extract from the register of members, a copy of the application or decision on admission to the cooperative) | ||||

Important! The apartment must be owned by all family members. The shares are determined by agreement. If this was not done when purchasing real estate, then a notarized commitment is submitted to the Pension Fund. The term is 6 months after the removal of the encumbrance.

In addition, originals of other documents will be required, which will need to be provided to the employee of the PF or MFC:

- family certificate or its duplicate;

- the passport;

- SNILS;

- if a representative is valid - his passport and power of attorney;

- a document confirming registration at the place of stay, if the documents are submitted not at the place of permanent residence;

- birth certificate (adoption) for all children;

- documents on the status of spouses (marriage certificate, spouse's passport, his certificate of registration at the place of stay);

- permission of the guardianship and trusteeship authorities to spend funds if the guardian or foster parent applies;

- document confirming the child's right to use funds state support(marriage certificate, permission of the guardianship and guardianship authorities or a court decision declaring the minor fully capable).

Note! The term for consideration of documents is 30 days.

Based on the results of consideration of the application and the package of documents, the Pension Fund decides on the refusal or satisfaction of the applicant's request. In case of a positive decision, the money is transferred immediately to the account of the organization that provided the loan. The term for transferring money is 10 days from the date of a positive decision.

After making a positive decision, you need to contact the bank and write a statement about full or partial repayment of the debt at the expense of the funds sent by the Pension Fund. If they fully repay the debt, then it is recommended to take a certificate of repayment of the debt, if partially - a new payment schedule.

Partial repayment of the mortgage by the parent capital

The money can be used for full or partial repayment debt. The amount of maternity capital with which the family plans to repay the loan cannot exceed the amount of debt under the loan agreement. However, in practice, such cases are units, in general, the amount of debt exceeds the amount of maternity capital.

When the bank receives funds from the Pension Fund, they are credited to the loan account and the bank recalculates the amount of the monthly payment. Credit taken for general conditions will decrease by about 15%. If, under the terms of the agreement, a moratorium on early repayment of the loan is established, then the borrower will have to pay fixed contribution... Only after the end of the moratorium will it be possible to pay off the loan ahead of schedule.

Example. A family of 4 took out a loan for 10 years for 2 million rubles. The monthly installment was 23,094.11 rubles. The family used part of the maternity capital and sent 299,731.25 rubles to pay off the debt. After offsetting this amount, the monthly payment decreased to 21,615.22 rubles.

Attention! Each of mortgage loans individual. The loan repayment procedure and subsequent relationship with the bank are based on the signed loan agreement .

Requirements for the organization that issued the loan

The requirements for the organization that issued the loan have also been established. It can be:

- a licensed bank;

- another organization that issued a loan secured by real estate.

Important! In practice, families who took out loans from agricultural consumer cooperatives faced problems due to the Pension Fund's refusal to channel maternity capital funds to repay such loans.

The refusals were due to a letter from the Deputy Chairman of the Board of the PF, which indicated that the PF had no grounds to satisfy such statements. The list includes not only agricultural cooperatives, but also microfinance organizations and consumer cooperatives that issued a loan secured by a mortgage.

In practice, there is a situation where families who received loans from agricultural cooperatives are forced to go to court, but positive judicial practice Little. To increase your chances of success, you need to check the following circumstances:

- the presence in the charter of the right to conduct activities, as well as the fact of assigning OKVED codes corresponding to this activity;

- the existence of an approved regulation on the issuance of loans for the purchase of residential real estate with mortgage security with the possibility of repayment at the expense of maternity capital;

- the deal should be aimed at improving the living conditions of the family.

If a refusal is received, it should be appealed in court and seek protection of their rights.

When the parent capital may refuse to repay a mortgage loan

The Pension Fund may refuse to satisfy the application for various reasons:

- the right to state material support has been terminated;

- the procedure for filing an application has been violated;

- the method of disposing of funds is not provided for by law;

- the amount indicated in the application exceeds the amount of maternity capital funds;

- restriction of parental rights;

- removal of the child;

- inconsistency of the organization that issued the loan with the requirements presented to it.

In addition, upon receipt of an application by the Pension Fund in mandatory checks the following circumstances:

- deprivation of parental rights in relation to a child, with the birth of which the family acquired the right to state support;

- committing a crime against a child;

- cancellation of adoption.

In practice, there are cases when the PF refuses for formal reasons. One of the cases that happened in practice is a refusal due to an application for the disposal of maternity capital along with an extract from the personal account for a deposit in the name of a spouse. The refusal was contested in court. The court recognized the family's right to use maternity capital funds, obliging the Pension Fund to make a transfer Money.

Watch the video for more information

Only a few young families manage to independently purchase their own housing, which would correspond to their desires, with money saved from wages. Of course, this can be help from relatives, their own saved money, but the most common type of funds is mortgage lending. The state is interested in ensuring that young families receive separate housing, therefore, has developed a whole system of support for young families.

Maternal housing improvement certificate

Today, maternity capital is a significant help for families with two or more children. The program has been running since 2007. It can be spent on expanding living space, including paying off part of the debt for mortgage lending, spend on paying for the services of a higher educational institution or a mother's pension. The most common way for Russian families to use such assistance is the first option. After the President signed in May 2015 FZ-131 mat. capital as a down payment on a mortgage can be used regardless of the age of birth or adoption of the second child. Since the moment of this type of state. support rules for the use of such assistance are increasingly expanding. Previously, without waiting for the child to reach 3 years of age, it was possible to use only the limited capabilities of such a certificate.

Can a maternity certificate be used today as an initial year?

The considered type of state support involves obtaining a non-cash certificate that cannot be exchanged and can be used by a family only in some cases. Since 2016, the right to contribute maternity capital as a down payment on a mortgage is legally enforceable. The basis is the Federal Law No. 131 dated May 23, 2015 .

Talking about general rules, then the maternity capital can be used both as an initial contribution and as repayment of the main credit debt... This is a great opportunity for a young family to reduce the financial burden and pay off the mortgage a little faster than the payment schedule implies.

Unfortunately, here too it is impossible without difficulties. Not every banking organization can easily arrange a mortgage with parent capital. But there are also banks that execute such transactions, providing profitable programs... As a rule, today in many organizations maximum size is 14%.

How to register?

In the event that a family plans to use maternity capital as an initial payment on a mortgage, borrowers must meet all the requirements of a banking organization. In most cases, the requirements for obtaining such a loan are practically the same as for a regular consumer loan:

1. Candidates must have a permanent place of work and work experience of at least six months. Some banks make it a mandatory requirement - at least a year over the past 5 years.

2. Previously, to calculate the mortgage offer, banking organizations took into account only the legal, confirmed income of the borrower. The "gray" salary could only act as a secondary earnings, but more often than not, they did not pay attention to it. And until now, large organizations work according to this scheme. But there is a lot of competition among financial institutions can benefit borrowers. Some banks take into account any income of a potential borrower, including unofficial. It is imperative to find out about the peculiarities of these conditions from the employees of the organization during the consultation process. Sometimes it is the indication of this amount that becomes decisive when approving a mortgage.

3. Lack of registered real estate in the property. This condition is valid only for those who wish to obtain a mortgage under preferential programs subsidized by the state.

4. When the repayment of the mortgage by the maternity capital is used, the allocation of shares to the children is mandatory.

5. In order to be able to become the owner of a mortgage on social program, the borrower must have a positive credit history.

How to get a mortgage with maternity capital?

Before initiating the procedure for transferring funds from a family certificate to repay a home loan, you must go to the Pension Fund and receive this very certificate, which will be an official confirmation of this right.

When the certificate is in hand, future borrowers must decide with which banking organization they will cooperate and where it is worth submitting documents. It is best to visit a few banking organizations and calculate a mortgage with maternity capital for all available programs. Only after a thorough analysis of the proposed loan conditions (interest rate, pre-approved amount, additional insurance etc.), you can apply for registration.

Today there is no need to wait until the child, after whose appearance the family received the right to maternity certificate, will be 3 years old. If it is necessary to use the means of the certificate, the owner (i.e., the mother of the children) must contact the territorial office of the PF RF with a corresponding application and a package of documents.

Documents for the repayment of the mortgage by the parent capital

In order to use the means of the certificate to fulfill their debt obligations, a certain package of documents will be required. Additional requirements may apply depending on the chosen organization. But, as a rule, most banks ask for the following documents to repay the mortgage with the parent capital:

- Passports of citizens of the Russian Federation and copies of documents. These are: INN, SNILS, a certified copy of the work book from the place of work. It will not be superfluous to provide a foreign passport or driving license or TCP.

- Certificate confirming the right to receive maternity capital.

- A set of documents that officially confirms the borrower's earnings: a document confirming the absence of arrears on obligatory payments, a certificate in the form of a bank about income, or the standard form 2-NDFL can be used.

- Sale and purchase agreement for an apartment or house.

- Information about the purchased object: information on the state of the BTI object, an extract from the house book, a passport with an assessment of the technical condition is required.

- Official confirmation from the Pension Fund that there really is money on the account of the potential borrower.

- Application for registration in shared ownership.

What should be included in the pension fund?

It is important to understand that a mortgage using maternity capital is not a quick procedure. Especially if the buyer does not use the services of real estate agencies and draws up the deal on his own.

After the bank has been provided with all the documents, statements and other requested documents, it is necessary to go to the Pension Fund and provide them with some papers. As a rule, these are:

- Official paper from the bank, indicating that the borrower really intends to enter into an agreement to purchase a mortgage. As a rule, this document is issued by the bank in the usual form.

- All general information about a housing object, which will become the subject of mortgage lending.

- All documents, as in the case of the bank, belonging to the borrower (passport, SNILS, TIN).

- It is imperative to write an application for the transfer of funds, indicating the bank details.

Mortgage conditions from the most popular banks

Any financial institution is interested in executing as many agreements on large loans as possible. These include mortgages for maternity capital. Banks, as practice shows, have different attitudes towards obtaining a loan, which involves accounting for family capital. Therefore, before deciding to use the checkmate. capital as a down payment on a mortgage, it is worth studying the conditions financial institutions... Experts recommend first of all to contact large organizations which are very popular among borrowers.

Mortgage with Sberbank

Perhaps this is the same bank that is ready to provide a mortgage for housing, regardless of its category. So, each borrower can draw up an agreement for the purchase of secondary housing, a private house or an apartment in a new building. It is also possible here and mortgage under the maternity capital. The main requirement of the bank is the obligatory transfer of funds from the certificate within six months after the conclusion of the transaction.

Official conditions:

- The loan is provided only in national currency.

- The mortgage lending rate is 14.5%.

- The maximum loan term is thirty years.

- The down payment must be at least 20 percent.

- The transaction value is no more than 40,000,000 rubles.

"VTB 24"

The second most popular bank, with which borrowers cooperate, applying for a mortgage. The contract can be concluded for absolutely any housing, regardless of its category. That is, it can be private ownership, secondary housing, new building. This factor is not decisive for the bank. Mortgages for maternity capital are also available here. Basic conditions for concluding an agreement with VTB 24:

- Operations for the purchase of a mortgage dwelling are carried out only in national currency;

- Average interest rate is 15.95%;

- The maximum term for a mortgage is 30 years;

- The minimum transaction fee is 20%;

- The cost of a dwelling should not exceed 30,000,000 rubles.

DeltaCreditBank

If you want to get a mortgage at Delta Credit Bank, you need to remember that registration is possible only for primary and secondary housing. Transfer of funds from the moment of conclusion of the contract is possible within a year from the date of signing.

Conditions on which you can get a mortgage using family capital funds:

- All transactions and transfers are possible only in national currency - rubles.

- The average lending rate is 15.25%.

- The entry fee is 30%.

- The maximum possible loan term should not exceed 25 years.

Down payment calculation

As a rule, not every bank provides information on what the amount of the initial payment will be. Each family wants to know in advance what conditions it can pull, and therefore wants to calculate the amount of the down payment on its own. In reality, it turns out to be not so difficult. To do this, you need to know the exact cost of housing and the part, expressed as a percentage, that the bank requires as a down payment. So, for example, if an apartment or a house costs 3,000,000 rubles, and the bank demands to pay at least 20%, it turns out 600,000 rubles. In the event that the family plans to use the mat. capital as an initial payment on a mortgage, it is quite logical that in any case it is necessary to pay an additional amount of cash to it.

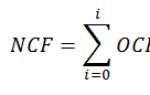

If the family relies solely on the help of the certificate, then it is possible to calculate the cost of housing for which it can apply. The formula is simple: mat size. capital x 100 / indicator of the initial contribution.

It is important to understand that maternity capital is a type of state support, so the amount that is issued in this case can be used only for specific needs. It is impossible to go and spend it whenever you want. If you plan to use a mat. capital as an initial payment on a mortgage or as a payment to pay off the principal debt, it is necessary to notify the Pension Fund about this six months before the transaction is concluded. The state budget and payments are scheduled every six months.

In the event that part of the maternity capital has already been used, then the balance cannot be used as a down payment. The only thing that can be done is to reduce the debt under the existing mortgage agreement.

Conclusion

Before contacting the bank, you need to decide for yourself which construction program to give preference to. And although the risk is several times greater with participation in shared construction, the family can win a considerable number of meters, as well as get a mortgage at a more favorable price in terms of monthly payments.