Accounting registers are required for. Types of accounting registers in accounting

The primary documents received by the accounting department must be checked both in form (completeness and correctness of primary documents, filling in the details), and in terms of content (legality of documented operations, logical linkage of individual indicators). Then the registration and economic grouping of their data are carried out in the system of synthetic and analytical accounts. accounting... For this purpose, information on the balances of property, economic assets and the sources of their formation, as well as data on business transactions from the corresponding primary or consolidated documents are recorded in accounting registers.

- these are counting tables of a certain form, built in accordance with the economic grouping of data on property and the sources of its formation. They serve to reflect business transactions in the accounting accounts.

All available registers can be subdivided according to three criteria: purpose, generalization of data, appearance.

By appointment accounting registers can be divided into chronological, systematic and combined synchronistic. Chronological registers include registers in which the facts of economic life are recorded as they arise without any other systematization (registration logs, registers, etc.). In systematic registers, an entry is made in the context of grouping characteristics - accounts. The entries in the chronological and systematic registers must complement each other, as a result of which the sum of the turnovers of the chronological registers is always equal to the sum of the debit or credit turnovers of the systematic registers. If both chronological and systematic entries are made in the water register, then such a register will be combined (synchronic). The most typical example of such a register is Magazine-Main.

By data compilation registers are divided into integrated and differentiated. Each register can be viewed inductively - from particular to general, i.e. from primary documents to reporting, and / or deductively - from general to specific, i.e. from reporting to primary documents. In the first case, there is data integration, in the second, their differentiation.

By outward appearance all accounting registers are in the form of a book, card, free sheet or machine medium.

A book is a ledger, bound in a certain way, bound, laced and signed by the chief accountant.

A card is a form printed in the form of a table.

A blank sheet is a table placed on the form to be stitched. Free sheets are a compromise between books and cards. Loose sheets are the same cards, but printed on thin paper, their size is larger than the size of the cards. If cards are stored in card indexes, then free sheets are stored and stitched in folders. For cards and free sheets, it is necessary to maintain registers (lists of open cards and free sheets).

The main point of the register is that their presence does not allow replacing cards, and in case of loss of any of them, it is always easy to establish which card is missing.

The appearance of cards used in practice can be different, but the most common are three types: checking accounts, inventory and multicolumn cards.

Contract accounts the cards have a one-sided form, since the columns "Debit" and "Credit" are placed side by side, the presence of two parallel columns allows you to clearly see the state of the company's settlements.

Inventory cards are used for accounting material values... In this regard, a new column "Balance" is introduced, which reflects the balance of funds of this type of value after the registration of the fact of economic life, thus, in each account there are three columns: income, expense and balance. Each column is divided into two columns: quantity, amount. In the header of the card, the limit (standard) of the stock is put down; the presence of a standard makes it easy to find out whether the enterprise does not have these funds more than it needs, and if less, then to what extent.

Multicolumn the cards are designed to record the facts of economic life, highlighting their components in the columns. In particular, in cases where one fact is reflected in complex amounts, i.e. fixed, for example, the payment of various expenses of the enterprise.

Machine media differ technically and place data not on paper, but, as a rule, on magnetic media, its features dictate the order of arrangement of accounting information.

The correctness of the reflection of business transactions in the accounting registers is ensured by the persons who drew up and signed them.

When storing accounting registers, they must be protected from unauthorized corrections. Correction of an error in the accounting register must be justified and confirmed by the signature of the person who made the correction, indicating the date of the correction in accordance with Art. 10 Federal law"About accounting".

Types of accounting registers in accounting

Therefore, further we will dwell only on the characteristics of such an element as choice of accounting form as a set of information carriers used (accounting registers) and an adequate reflection of the accounting process in them.

Accounting registers are used to systematize and accumulate accounting information contained in the primary accounting documents accepted for accounting, and to reflect it on the accounts of the FHZH.

These are tables of a special form designed for accounts based on primary documents. The practice of organizing accounting is based on a combination of various accounting registers. The Federal Law "On Accounting" provides a list of possible types accounting registers in the form of paper and machine information carriers, the use of which in organizations is determined by the volume and specifics of the objects taken into account, the mass nature of business transactions, the method of registering and processing information, etc.

To understand the essence of accounting registers, it is customary to classify them according to certain criteria, the main of which are appearance. the content and nature of the entries.

In appearance, accounting registers are accounting books, cards, free sheets, computer media.

Ledgers

Accounting books - these are tables arranged in a certain way to register the facts of economic life (business transactions), depending on the specifics of the objects of accounting supervision, which must be numbered, laced, enclosed in a separate binding; on the back of the last page, the number of pages in the book is indicated, then the signatures of the chief accountant and the head and the seal of the organization are affixed. Books, as a rule, are used as accounting registers, when the list of accounted objects in the organization is insignificant. However, for some accounting objects (for example, cash transactions) all organizations keep records of registration of transactions in books ( cash book). The generalization of the movement of all accounting objects is kept in the General Ledger.

Cards

Cards - these are forms printed in table form. Cards can be easily sorted, they are clearer, more convenient, more accessible to use than books. The appearance of cards can be different, but the most common are three types: check-account, inventory, multi-column.

Contract account cards are one-sided in that the debit and credit columns are placed side by side. Such cards are used to record settlements with legal entities and individuals. The presence of parallel columns of debit and credit allows you to clearly see the status of settlements, i.e. who owes whom, for what and how much.

Inventory cards are used to account for material values. In such cards, the "Balance" column is entered, where the remainder of this type of valuables is indicated after the registration of the fact of economic life (business transaction), according to the income and expense of this type of valuables. These cards must contain three columns: income, expense and balance. Moreover, each column is divided into two columns: quantity and amount. For accounting of materials, raw materials, etc. in such cards, the limit (standard) of the stock is indicated, which allows control over the provision of the organization with these values for smooth operation.

Multi-column cards intended for accounting production costs by item by item (by items of calculation) related to the release of products, performance of works and services. The totality of data on these items makes it possible to calculate the cost of specific types of products (works, services), since these cards are kept for each type of product, work performed, and services.

Throughout the reporting year, cards are stored in special boxes. The set of cards that are homogeneous in purpose is called file cabinet. Cards in the card index are arranged according to account numbers, alphabet, stock numbers and other characteristics. The use of special separators and indicators (metal plates with the designation of letters of the alphabet, designations of accounts, etc.) makes it easier to find them quickly. Cards are mainly used for registration with analytical accounts. In order to ensure the safety of the cards, they are registered in special registers, where they are assigned serial numbers. This makes it possible to check their presence and thereby exercise control over their safety.

Free sheets

Free sheets, just like cards, they are forms with printed tables, but larger in size and the volume of information reflected in them. In accounting practice, these are mainly different statements. Such accounting registers are used to generalize homogeneous information, for example, depreciation of fixed assets, a list of shipment (release) of products, etc. In order to control the safety of these types of accounting registers, they are stored in separate folders. The use of cards and free sheets as accounting registers provides great opportunities for the division of labor of accounting workers and filling them with computer technology.

Machine media

Machine media how accounting registers place data not on paper, but on magnetic media (magnetic tapes, magnetic disks, floppy disks, etc.). The peculiarities of computer storage media dictate the order of its arrangement. When using machine media as accounting registers, the organization is obliged to make copies of such registers on paper (as well as primary documents), including at the request of the bodies exercising control in accordance with the legislation Russian Federation, courts and prosecutors.

By the nature of the entries accounting registers are divided into chronological, systematic and combined.

Chronological they call accounting registers in which information about business transactions is recorded in a sequential order of receipt and processing of primary documents. No grouping of the recorded data in these registers is performed. Examples of chronological registers are the transaction log, the sales ledger, and the purchase ledger, where invoices are recorded for shipped products and purchased values, respectively.

Systematic are called accounting registers in which the registration of business transactions is grouped according to certain (established) criteria, for example, the grouping of information directly by accounts of synthetic and analytical accounting... Examples of such registers are the list of material balances in the warehouse ( balance sheet), General ledger, which summarizes the totals for all synthetic accounts.

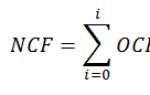

Entries in chronological and systematic accounting registers must complement each other, as a result of which the sum of the turnovers of the chronological registers is always equal to the sum of the debit or credit turnovers of the systematic accounting registers (the so-called Mendes rule):

If chronological and systematic entries are made in one register, then such a register will be called combined. Typical examples of such a register are "Magazine-Main", many magazines-orders. The use of combined accounting registers allows you to make Accounts more visual, while reducing the number of accounts.

Synthetic called the registers in which all transactions are reflected in a generalized form in a monetary meter. Information on business transactions in these accounting registers is reflected in the context of synthetic accounts. An example of such a ledger is Gchavnaya ledger.

Analytical called accounting registers, in which information is reflected in separate analytical accounts, detailing the content of the records of one or another synthetic account. Records in analytical registers should be more detailed than records in synthetic registers: an explanatory text is provided and along with value ones, natural or labor gauges, if necessary, are indicated.

Nowadays, complex accounting registers combining synthetic and analytical accounting, as well as chronological and systematic records. They are used, for example, with a journal-order form of accounting. Combining synthetic and analytical accounting provides automatic matching of the totals for synthetic and analytical accounts and frees you from the need to draw up turnover sheets for data reconciliation.

For the formation of reliable and timely information about the activities of the enterprise and its provision to users, the technique of registration is important. The recording of business transactions in the relevant accounting registers on the basis of documents is called posting transactions. These entries are made on a quotation basis (that is, an indication of the debited and credited accounts for the business transaction).

In order to exclude re-registration of information in the accounting register for the same document, a corresponding mark is made on the documents about posting the transaction in the form of a sign. " Often the page of the accounting register is indicated on the document, where the record of the submitted business transaction, drawn up by this document, is made. Marking records on the posting of transactions is also important for the subsequent verification of the correctness of the entries.

In accounting practice, they apply different ways accounts in accounting registers. Records in accounting registers are simple and copied. Copying of records is used in cases when it is necessary to have an imprint or a copy of the record.

Entries in accounting registers can be carried out using linear positional and chess methods.

The essence linear positional notation consists in the fact that debit and credit turnovers are reflected in one line, which is especially convenient for keeping records of various kinds of settlements. The use of this method of accounting ensures the monitoring of the timeliness of repayment of receivables and payables.

The advantage of using linear positional notation is that accounting registers, as a rule, combine synthetic and analytical accounting. This simplifies the accounting technique and increases its reliability.

Chess principle the entry in the accounting registers consists in the fact that the amount of the business transaction on the debit and credit of the corresponding accounts is reflected in the accounting register at one time. With this method of registration of credentials, the visibility increases and the internal content of the correspondence of the accounts is revealed. This recording order is used in the construction of many registers (order journals) in the journal-order form of accounting.

perform the functions necessary for any company: fixing, grouping, storing information about economic facts... The number of items is quite large, which is explained by the peculiarities of accounting for various objects and facts of economic activity when doing business.

Categories of ledgers and forms

Accounting registers act as a basic tool for summarizing data from primary documentation used in the future to make entries on the corresponding accounts and to form indicators financial statements... Making entries in accounting registers, the specialist not only processes the primary documentation, but also analyzes the content of the business transactions they confirm for the legality and correctness of the display of actual events.

Depending on the method of data fixation accounting registers classified:

- systematic - they allow you to collect information in relation to accounting accounts, to which, in particular, the general ledger can be attributed;

- chronological - designed for continuous recording of data in the order of receipt of documents without breakdown by areas of accounting, these include various magazines and books;

- combined - combine the ability to group data in chronological order, these include order journals and statements.

Depending on the order of the data for accounting registers the following breakdown is provided:

- filled on one or two sides of the sheet;

- chess sheets - with data located in tables at the intersection of rows (by account debit) and columns (by account credit).

By the nature and method of generalizing information, the following is distinguished list of ledgers:

- Analytical - serve to accumulate analytical information on accounts synthetic accounting companies, they help track the movement of material assets, the timeliness of settlements with partners, etc.

- Synthetic - allow you to get the final, final, not detailed data on the amounts collected on the accounts. These include the general ledger.

- Combining the functions of the above types of registers, they are characteristic of the journal-order accounting system.

If you evaluate the appearance accounting ledgers, then among them we can distinguish:

- Card blanks - are sheets with blank tables printed on them, these include checking accounts, multi-column and inventory, for example, a card for accounting for fixed assets.

- Magazines, books - bound, loose-leaf sheets in hard or paperback, on which, as a rule, the title and the period for filling out the register are indicated. Pages like accounting registers are numbered, laced up and fastened on the last sheet, where the chief accountant's signature is put.

- Large format sheets - resemble enlarged cards, these include accounting statements and some order magazines.

- Automated printed registers are created using specialized electronic accounting databases, based on the information accumulated in them.

List of the most commonly used registers

On the this moment most unified forms of accounting registers are optional. This is confirmed by the information disseminated by the Ministry of Finance of the Russian Federation dated 04.12.2012 No. PZ-10/2012 in connection with the entry into force of amendments to the Law "On Accounting" dated 06.12.2011 No. 402-FZ. However, this rule does not apply to individual forms introduced by specially authorized bodies. The only requirement for registers was the availability of a list required details in forms developed by companies.

Registers, books, cards put into effect within the company must certainly be mentioned in the accounting policy of the company, and those forms that will be used Chief Accountant and his subordinates must in mandatory be approved by the head of the organization. Companies, the source of funding of which is the state budget, as well as the main shareholder of which is the state, are obliged to use the forms in accordance with the order of the Ministry of Finance of the Russian Federation of March 30, 2015 No. 52n. Commercial organizations, in turn, quite often create their own forms on the basis of the forms from the order.

To illustrate what was written above, we give an approximate excerpt from the specified order:

|

Cards for accounting: |

|

· Fixed assets; |

|

· Groups of fixed assets; |

|

Vedomosti: |

|

· Turnover balance; |

|

· Circulating non-financial assets; |

|

· Accumulation of data. |

|

· home; Analytical accounting of deposited amounts wages. |

|

· On the accounting of transactions on various accounts; |

|

· Accounting for the movement of other property. |

|

· Cards; |

|

· Transfer of documents; |

|

· Accounting valuable papers; |

|

· Deposited amounts; |

|

· Capitalization and write-off for expenses. |

|

Cards: |

|

· Multi-line; |

|

· Accounting of funds and settlements; |

|

· Accounting of funds provided on a loan; |

|

· Control over the movement of values; |

|

· Fixation of payment documents for execution. |

|

· Inventory cards for OS accounting; |

|

· Inventory. |

|

Vedomosti: |

|

· Deviations based on the results of the inventory; |

|

· Registration of unbilled deliveries. |

How to draw up an order to approve registers - sample

To confirm the legality of the application of the forms, a order for approval of accounting registers companies. The main developer of forms and sample ledgers the chief accountant of the company acts, and they are approved by the head of the organization.

This administrative document will be required by the controllers from the Federal Tax Service when carrying out an audit. Based on those specified in the order types of accounting registers reviewers will request the forms they are interested in. Although today most of the accounting processes are carried out using electronic databases, in paragraph 6 of Art. 10 of Law No. 402-FZ contains a clear indication of the need to store registers in printed and signed form, or in digital format with the obligatory presence of a digital signature. Based on this, the forms requested by the tax authorities will have to be generated in paper form or in electronic format, but with the indispensable presence of a signature.

In most cases, the specific name of the register is indicated for each account. For this, special tables are created, which indicate the account, the name of the form and the person who is responsible for its regular execution. An example is the following version of such a table.

An example of fixing accounting registers in an order for an organization or accounting policy

***

The presence of registers that provide a comprehensive accounting of property and obligations is mandatory for the full functioning of the accounting of any organization. Without them, it will be impossible to prepare the final financial statements for all interested users. Also, this information is used to provide statistical data, management accounting and ongoing analysis of the firm's performance.

Companies that do not belong to the public and budget sector are allowed to develop their own forms of such documents. They must be approved by the head of the organization and they must contain all the mandatory details from the list established by law. State-owned companies are obliged to use for these purposes unified forms approved by the Ministry of Finance of the Russian Federation. In most cases, the latter serve as the basis for private companies to create their own accounting forms.

1. Data contained in primary accounting documents are subject to timely registration and accumulation in accounting registers.

2. Gaps or exemptions when registering accounting objects in accounting registers, registration of imaginary and feigned accounting objects in accounting registers are not allowed. For the purposes of this Federal Law, a fictitious object of accounting is understood as a non-existent object reflected in accounting only for the form (including unfulfilled expenses, non-existent obligations, facts of economic life that did not exist), a fictitious object of accounting means an object reflected in the accounting accounting instead of another object in order to cover it up (including sham transactions). Reserves, funds stipulated by the legislation of the Russian Federation, and the costs of their creation are not imaginary objects of accounting.

3. Accounting is maintained through double entry on accounting accounts, unless otherwise established by federal standards. It is not allowed to keep accounting accounts outside the accounting registers used by the economic entity.

(see text in previous edition)

4. Mandatory details of the accounting register are:

1) the name of the register;

2) the name of the economic entity that compiled the register;

3) the date of the beginning and the end of keeping the register and (or) the period for which the register was drawn up;

4) chronological and (or) systematic grouping of accounting objects;

5) the value of monetary measurement of accounting objects, indicating the unit of measurement;

6) the names of the positions of the persons responsible for maintaining the register;

7) signatures of the persons responsible for maintaining the register, indicating their surnames and initials or other details necessary to identify these persons.

5. Forms of accounting registers are approved by the head of the economic entity upon submission official responsible for accounting. Forms of accounting registers for organizations public sector are established in accordance with the budgetary legislation of the Russian Federation.

6. The accounting register is drawn up on hard copy and (or) in the form of an electronic document signed electronic signature.

7. In the event that the legislation of the Russian Federation or an agreement provides for the submission of the accounting register to another person or to a state body on paper, an economic entity is obliged, at the request of another person or a state body, to produce at its own expense on paper copies of the accounting register drawn up in the form of an electronic document.

8. Corrections in the accounting register that are not authorized by the persons responsible for maintaining the specified register are not allowed. The correction in the accounting register must contain the date of the correction, as well as the signatures of the persons responsible for maintaining of this register, indicating their surnames and initials or other details necessary to identify these persons.

9. If, in accordance with the legislation of the Russian Federation, accounting registers are withdrawn, including in the form of an electronic document, copies of the withdrawn registers made in the manner prescribed by the legislation of the Russian Federation are included in the composition of accounting documents.

Accounting registers are an integral part of the organization's accounting, which serves to systematize and save data from primary accounting documents.

Accounting registers are designed to reflect business transactions on accounting accounts. Previously, information from accounting registers was a trade secret.

Forms of accounting registers

Until 2013, the forms of accounting registers were uniform and mandatory for all business entities.

These forms were presented in the Albums of Unified Forms. Currently, the forms of accounting registers are approved by the head of the enterprise.

However, the legislation provides for a list of mandatory information contained in the registers:

- register name;

- the name of the business entity filling out the register;

- period of compilation or maintenance of the register;

- chronological or systematic classification of accounting items;

- unit of measure and currency of the transaction;

- an indication of the positions responsible for maintaining the register;

- Name and signatures of responsible persons.

Forms of accounting registers are established by law and can be taken from official sites, they can be downloaded from the Internet, search using search engines.

Classification of accounting registers

Accounting registers are classified by purpose, generalization of information and type. According to their purpose, the registers are subdivided into

- chronological,

- systematic,

- synchronic (combined).

Facts are recorded in chronological registers economic activity as they happen. Examples of chronological ledgers are ledgers and various ledgers.

Data in chronological and systematic registers complement each other

Systematic registers are filled in for certain accounts to which business transactions belong. An example of a systematic ledger is the balance sheet.

If the register includes a chronological and systematic record, then it refers to combined synchronistic registers. An example of such an accounting register is the Journal-Main.

The use of synchronic registers makes the information in them more visual.

Thus, the sum of the turnovers in the chronological registers is equal to the turnovers on the debit or credit of the systematic registers. This dependence is called Mendes' rule.

According to the generalization of information, the registers are subdivided into synthetic and analytical.

- In synthetic ledgers, transactions are recorded only with the indication of the date and amount.

- Analytical accounting registers are forms of accounting in which analytical information is systematized, that is, not only the details of the operation, but also its brief content.

Business entities also use complex accounting registers, which combine the principles of synthetic and analytical registers, as well as chronometric and systematic factors.

When using such forms, the totals for synthetic and analytical accounts are automatically the same, which frees you from additional reconciliation of turnovers for different statements.

In appearance, the registers are divided into books, cards, free sheets and machine media.

- A book is a register, which must be laced, numbered and sealed and signed by the responsible persons.

- The card is a typewritten table register.

- A blank sheet is a table-like register to be filed. To account for cards and free sheets, registers are kept in order to exclude register substitution or, if necessary, restore a lost document.

- A machine medium is an electronic document stored on a magnetic medium and certified by an electronic signature. When using machine media, information should be printed in a timely manner.

The reliability of the information reflected in the accounting registers is ensured by the responsible persons.

If an error is found in the register, the correction is made by the person in charge, indicating the date of the correction and affixed with his signature.

The correction is done by striking out the incorrect information once so that it remains readable. The above is the correct data.

For each correction in the registers, a written explanation of the person in charge must be given.

Accounting register sample document turnover scheme

Question. The procedure for the formation of accounting registers. Correction of errors in primary accounting documents and registers, their storage

The data of the primary (consolidated) accounting documents verified and accepted for accounting are systematized in chronological order (by the dates of the transactions) and (or) grouped according to the corresponding accounting accounts in a cumulative way with reflection in the accounting registers.

Gaps or exemptions are not allowed when registering accounting objects in accounting registers, registration of imaginary and feigned accounting objects in accounting registers (clause 2 of article 10 of Federal Law No. 402-FZ).

For reference: a fictitious object of accounting means a non-existent object reflected in accounting only for the form (including unfulfilled expenses, non-existent obligations, facts of economic life that did not exist), a fake object of accounting means an object reflected in accounting instead of another object in order to cover it up (including sham transactions).

Mandatory details of accounting registers are (clause 4 of article 10 of Federal Law No. 402-FZ):

Register name;

The name of the economic entity that compiled the register;

The start and end date of maintaining the register and (or) the period for which the register was drawn up;

Chronological and (or) systematic grouping of accounting objects;

The value of monetary measurement of accounting objects with indication of the unit of measurement;

Names of positions of persons responsible for maintaining the register;

Signatures of the persons responsible for maintaining the register, indicating their surnames and initials or other details necessary to identify these persons.

The list of accounting registers used by public sector institutions is approved by Order of the Ministry of Finance of the Russian Federation No. 173n.

Accounting registers are formed in the form of books, magazines, cards on paper or in the form of an electronic document (register) signed with an electronic signature. If the legislation of the Russian Federation or an agreement provides for the submission of the accounting register to another person or to a state body on paper, the institution is obliged, at the request of another person or a state body, to produce at its own expense on paper copies of the accounting register drawn up in the form of an electronic document (clause 7 Article 10 of the Federal Law No. 402-FZ). Formation of accounting registers on paper with complex automation of accounting is carried out with the frequency established within the framework of the formation accounting policies... In accordance with clause 11 of Instruction No. 157n, entries in the accounting register (transaction log) are made as transactions are performed and the primary (consolidated) accounting document is accepted for accounting, but no later than the next day after receiving the primary (consolidated) accounting document, as on the basis of separate documents, and on the basis of a group of similar documents.

Correspondence of accounts in the corresponding journal of transactions is maintained depending on the nature of transactions on the debit of one account and the credit of another account.

At the end of each reporting period (month, quarter, year), transaction logs are selected in chronological order and stitched with the corresponding primary (summary) accounting documents. The cover states:

The name of the institution;

Title and serial number folders (cases);

The period (date) for which the accounting register (transaction log) was formed, indicating the year and month (date);

The name of the accounting register (journal of operations) with an indication, if any, of its number;

The number of sheets in a folder (case).

In accordance with the frequency of formation of accounting registers (transaction logs) on paper (operational day, month, quarter) established within the framework of document flow (business day, month, quarter) according to primary (consolidated) electronic documents accepted for accounting and related to the corresponding accounting register (transaction log), register is formed electronic documents(register containing a list (register) of electronic documents), filed into a separate folder (file). At the end of the month, the account turnover data from the corresponding transaction journals is written to the general ledger. Bodies implementing cash service, financial authorities keep a journal for other transactions, data from which are recorded in the general ledger on a daily basis. At the end of the current fiscal year turnovers on accounts reflecting an increase and decrease in assets and liabilities are not transferred to the accounting registers of the next financial year.

The accounting registers are signed by the person responsible for its formation and the chief accountant (if this is provided by the form of the document).

In primary accounting documents(excluding cash registers and bank documents) it is allowed to make corrections, unless otherwise established by federal laws or regulatory legal acts organs state regulation accounting (clause 10 of Instruction No. 157n, clause 7 of article 9 of Federal Law No. 402-FZ).

Primary documents containing corrections are accepted for accounting in the case when corrections were made in agreement with the persons who drew up and (or) signed these documents, which must be confirmed by the signatures of the same persons, indicating "Believe corrected" ("Corrected") and the date of the revision.

Correction of an error in the accounting register must be justified and confirmed by the signature of the person who made the correction. In addition, the corrected document must contain the date of the correction, as well as the signatures of the persons responsible for maintaining this register, indicating their names and initials or other details necessary to identify such persons (clause 8 of article 10 of Federal Law No. 402-FZ, p. 14 of Instruction No. 157n).

According to clause 18 of Instruction No. 157n, errors found in accounting registers are corrected in next order:

Error for reporting period discovered before submission accounting statements and does not require a change in the data of the accounting register (transaction log), is corrected by crossing out the wrong amounts and text with a thin line so that you can read the crossed out text and writing the corrected text and amount over the crossed out. At the same time, in the accounting register, in which the error is being corrected, the inscription "Corrected" is made in the margins opposite the corresponding line, signed by the chief accountant;

An error discovered prior to the submission of financial statements and requiring changes to the accounting register

(transaction log), depending on its nature, is reflected on the last day of the reporting period by an additional accounting entry or an accounting entry drawn up according to the "red line" method, and an additional accounting entry;

An error found in the accounting registers for the reporting period for which the financial statements have already been submitted, depending on its nature, is reflected by the date of the error detection by an additional accounting entry or an accounting entry drawn up according to the "red storno" method and an additional accounting entry.

Additional accounting records to correct errors, as well as corrections by the "red storno" method, are drawn up by a certificate (f. 0504833) containing information on the justification for making corrections, the name of the corrected accounting register (transaction log), its number (if any), as well as the period for which a register has been drawn up.

The head of the institution is responsible for organizing the storage of primary (consolidated) accounting documents, accounting registers (clause 14 of Instruction 157n).

The storage of primary accounting documents, accounting registers in institutions is carried out within the periods established in accordance with the rules for organizing state archiving, but not less than five years after the reporting year (Article 29 of Federal Law No. 402-FZ).

If technically feasible, the institution has the right to store primary electronic documents (electronic registers) on computer media, taking into account the requirements of the legislation of the Russian Federation governing the use of electronic signatures in electronic documents.

The institution is obliged to provide not only safe storage conditions for accounting documents, but also their protection from changes. When changing the head of the institution, the transfer of accounting documents must be carried out. The procedure for such a transfer is determined by the institution independently (clauses 3, 4, article 29 of Federal Law No. 402-FZ).

In the event of the loss, destruction or damage of primary (summary) accounting documents and (or) accounting registers, the head of the institution (in the absence of his powers, the body exercising the functions and powers of the founder) appoints a commission to investigate the reasons for their loss, destruction, damage, identification guilty persons, and also takes measures to restore primary accounting documents and accounting registers. Based on the results of the work of this commission, an act is drawn up, which is approved by the head of the institution (the body that exercises the functions and powers of the founder). This act is filed in the folder (case) of the journal for other operations (clause 16 of Instruction No. 157n).

By order of the Ministry of Finance of the Russian Federation No. 52n. Order of the Ministry of Finance of the Russian Federation No. 173n from 18.06.2015 has lost its legal force.

As we have already said, in accordance with the norms of clause 3 of Instruction No. 157n, primary accounting documents received on the basis of the results are accepted for accounting. internal control committed facts of economic life for the registration of the data contained in them in the accounting registers, on the assumption of the proper compilation of primary accounting documents on the perfect facts of economic life by the persons responsible for their registration. Upon receipt of the primary accounting document, the accountant pays attention to the following points:

1) in what form the primary accounting document was drawn up (according to the form approved by Order No. 52n, or according to the form developed independently by the accounting entity);

2) for the presence of all the mandatory details named in clause 7 of Instruction No. 157n, art. 9 of the Accounting Law (if the form of the primary accounting document was developed by the accounting entity independently);

3) to fill in all columns and lines of the primary accounting document;

4) for the presence of all the necessary signatures;

5) on the date of creation of the primary accounting document (often documents arrive at the institution by mail, courier, while there is a sufficiently large time gap between the date of drawing up the document and the date of its receipt by the accounting department. Since the primary accounting document must be taken into account no later than the next day after admission to the institution, as required by clause 11 of Instruction No. 157n, it should be stamped and indicate the incoming number and the date of receipt of the document at the institution, thereby justifying the time gap between the date the document was drawn up and the date it was processed in the account).

By order of the Ministry of Finance of the Russian Federation No. 52n, the following changes are made to the forms of primary accounting documents, accounting registers and guidelines for their application:

1. Requirements have been established for the preparation, completion and storage of primary accounting documents and accounting registers in electronic form. So, from the provisions of the Order of the Ministry of Finance of the Russian Federation No. 52n it follows that primary accounting documents, accounting registers are drawn up in the form of an electronic document signed by a qualified electronic signature (hereinafter referred to as an electronic primary accounting document, an electronic register, together - electronic documents), and (or) on paper, in the absence of the possibility of their formation and storage in the form of electronic documents, and (or) in the event that federal laws or regulatory legal acts adopted in accordance with them establish the requirement for the need to draw up (store) a document exclusively on paper.

If the legislation of the Russian Federation or an agreement provides for the submission of a primary accounting document, an accounting register to another person or to a state body on paper, the institution is obliged, at the request of another person or a state body, at its own expense, to make copies of the electronic primary accounting document, the electronic register, on paper. Copies of electronic documents on paper are certified in accordance with the procedure established by the accounting entity as part of the formation of its accounting policy.

2. Subjects of accounting - institutions are given the right, if necessary, to change the formats not only of accounting registers, but also of primary accounting documents, since they are advisory in nature. In the Order of the Ministry of Finance of the Russian Federation No. 173n, such a norm was introduced only for accounting registers.

3. Certain forms of primary accounting documents and accounting registers have undergone changes.

4. Forms of primary accounting documents have been introduced, which, during the period of validity of the Order of the Ministry of Finance of the Russian Federation No. 173n, were approved by resolutions of the State Statistics Committee (contained in albums of unified forms that are not mandatory for use, according to the explanations contained in the Letter of the Ministry of Finance of the Russian Federation dated 06.06.2014 No. 02- 06-05 / 27550).

5. From the list of unified forms of primary accounting documents used by state (municipal) institutions in their work, given in Appendix 1 to Order of the Ministry of Finance of the Russian Federation No. 52n, waybills are excluded. Thus, the institutions develop the form of this primary accounting document independently, taking into account the requirements of the Order of the Ministry of Transport of the Russian Federation of September 18, 2008 No. 152 "On approval

required details and order of filling waybills". Institutions in their accounting policies can indicate that they use a waybill in their work passenger car on the 0345001 form, and apply this document in their activities.

6. Introduced clarification that the formats of primary accounting documents, accounting registers are advisory in nature and, if necessary, can be changed. In the manufacture of blank products on the basis of unified forms of primary accounting documents, accounting registers, it is permissible to change (narrow, expand) the sizes of columns and lines, taking into account the importance of indicators, as well as the inclusion of additional lines and the creation of loose sheets for the convenience of placing and processing information.

Below, in the form of a table, we present a list of primary accounting documents and accounting registers, the form of which and the procedure for filling out have undergone changes upon the entry into force of the Order of the Ministry of Finance of the Russian Federation No. 52n.

| Name of the primary document | The nature of the changes |

| Primary accounting documents | |

| Waybills of a car (f. 0345001), a truck (f. 0345004), etc. | Order of the Ministry of Finance of the Russian Federation No. 52n does not contain any mention of the form of waybills used by budgetary institutions. The form is developed and approved by the institution |

| The act of acceptance and transfer of objects non-financial assets(f. 0504101) | In the wording of the Order of the Ministry of Finance of the Russian Federation No. 173n, it was called "The act of acceptance and transfer of an object of fixed assets (except for buildings, structures)". The form of the act has undergone significant changes: - the names of the columns have changed, which reflect information about the recipient, sender, type of property; - the information reflected in the table "Information on the transferred objects of non-financial assets" has been corrected. Now it indicates: the name of the accounting object, the date of manufacture, actual term operation, passport of the object, number (inventory, register, factory, other), initial (book) cost, accrued depreciation. Residual value of the object, the cost of its acquisition, term useful use, the method of calculating depreciation is excluded from this table. This information is reflected in Sec. 3 forms "Information on the accepted objects of non-financial assets"; - contains tables in which the recipient and the sender make a mark on the deregistration of the object and its acceptance for accounting |

| Invoice for the internal movement of objects of non-financial assets (f. 0504102) | In the wording of the Order of the Ministry of Finance of the Russian Federation No. 173n, it was called "Invoice for the internal movement of fixed assets (f. 0306032)". The form itself has changed as follows: - the names of the form graph have been corrected. For example, if earlier the form column was called "Total cost of rubles", now it is called "Amount, rubles.", Or earlier the column was called "Cost of rubles. the information reflected in this form has not changed; - the form is supplemented with the column "Unit of change code by OKEI"; - a table with a cutting line is included, in which the accounting department is marked about the reflection in the accounting of the movement of the object with the signature of the executor |

| Acceptance certificate of repaired, reconstructed and modernized fixed assets (f. 0504103) | In the wording of the Order of the Ministry of Finance of the Russian Federation No. 52n, the form of the act has changed as follows: - now the form includes information about the asset holder, about the agreement concluded for renovation works;; - the information to be reflected in the table "Information on the costs associated with the repair, reconstruction, modernization of fixed assets" has been slightly changed |

| The act of writing off objects of non-financial assets (except for vehicles) (f. 0504104) | In the edition of the Order of the Ministry of Finance of the Russian Federation No. 173n, this form was called the "Act on the write-off of an object of fixed assets (except vehicles) (f. 0306003) ". The following changes have occurred in it: - in the column" Initial cost at the time of acceptance for accounting or replacement cost, rubles. "now the balance (replacement) cost is indicated; residual value indicates the correspondence of accounts that was made in accounting when writing off the property in terms of its residual value and the amount of depreciation charged on the object; - the sections "Brief individual characteristics of the object of fixed assets" and "Information on the costs associated with writing off the object of fixed assets from accounting, and on the receipt of material assets from their write-off" have been excluded; - added two tables, in one of which the accounting department makes a mark on writing off the object from the account, and the other reflects the measures for the disposal of objects and their result |

| Write-off statement vehicle(f. 0504105) | The form of the act, its name and number have undergone the following changes: - Order of the Ministry of Finance of the Russian Federation No. 52n approved the form 0504105, and earlier the budgetary institutions used the form of the act 0504104; - the form contains two sections: "Information about the vehicle" and "Technical characteristics of the vehicle and information about its technical condition" (the form as amended by the Order of the Ministry of Finance of the Russian Federation No. 173n contained three sections). Chapter " a brief description of the object of fixed assets "is excluded from the form. The information that was reflected in it is now indicated in the section" Technical characteristics of the vehicle and information about its technical condition "; - not only the names of the sections of the form have changed, but also the information reflected in them. opinion, the form has become more capacious, but at the same time concrete |

| Card (book) for accounting for the issuance of property for use (f. 0504206) | The form of this primary document was not provided for by Order of the Ministry of Finance of the Russian Federation No. 173n. This document is used to record property that is issued for personal use to an employee (employee) in the performance of his official duties. |

| Receipt order for the acceptance of material assets (non-financial assets) (f. 0504207) | The form of this primary document was absent in the Order of the Ministry of Finance of the Russian Federation No. 173n. At the same time, this document is drawn up by the institution upon receipt of material assets (in particular, fixed assets, inventories), including from third-party organizations (institutions), and serves as the basis for acceptance for accounting and reflection on the balance sheet of the institution |

| Time sheet (form 0504421) | The time sheet form 0504421, contained in the Order of the Ministry of Finance of the Russian Federation No. 52n, and the procedure for filling it out significantly differ from those approved by the Order of the Ministry of Finance of the Russian Federation No. 173n: part of the Order of the Ministry of Finance of the Russian Federation No. 52n, which contains instructions on how to fill out the forms; - the symbols used in the report card (f. 0504421) are supplemented with the indicator "Failure to appear for unclear reasons (until the circumstances are clarified) - NN"; - granted the right to independently supplement the applied conventions as part of the formation of its accounting policy; - information related to payroll calculation has been excluded; - the new form of the report card assumes the reflection of the full name. the employee, his account number, position, days of the month in which the use of working time is recorded and various cases of deviations from the normal use of working time are recorded; - the procedure for making changes to the timesheet has been established; it has been established that the periods for filling out and the deadlines for submitting the timesheet to the accounting department are determined by the act of the institution as part of the formation of the accounting policy of the institution in terms of the workflow schedule |

| Accounting registers | |

| Inventory card accounting for non-financial assets (code f. 0504031) | In the wording of the Order of the Ministry of Finance of the Russian Federation No. 173, it was called "Inventory card for accounting for fixed assets (f. 0504031)". The form of this accounting register (like the name) has undergone a change. All information in the card is divided into five sections: "Information about the object", "Cost of the object, changes book value, depreciation "," Information about the acceptance for accounting and disposal of the object "," Information about the internal movement of the object and the repair "," Brief individual characteristics of the object "(this section of the form remained unchanged). In our opinion, the information in new form cards are now placed more capaciously, but at the same time, concisely and conveniently both for the person filling out the card and for the person reading it |

| Material assets accounting card (f. 0504043) | The form of the card was previously contained in the Order of the Ministry of Finance of the Russian Federation No. 173n (it is identical to the form contained in the Order of the Ministry of Finance of the Russian Federation No. 52n), but the procedure for filling it out in this document was absent. This omission was corrected by Order of the Ministry of Finance of the Russian Federation No. 52n. From the provisions of the said document, it follows that the card for recording material assets (f. 0504043) is used for accounting in places of storage of material assets by persons responsible for their safety. Accounting in the card is carried out by financially responsible persons by name, grade and quantity of materials, finished products, soft inventory, tableware, objects of library funds using separate pages for each name of the accounting object |

| Journal of transactions of payments for labor (code f. 0504071) | In the Order of the Ministry of Finance of the Russian Federation No. 52n, it is called "Journal of Payroll Payments Transactions, monetary allowance and scholarships (f. 0504071) ". This journal is still compiled by the institution on the basis of the set of payroll (f. 0504401) (payroll (f. 0504402)) with the attachment of such primary documents as timesheets ( f. 0504421), orders (extracts) on enrollment, dismissal, relocation, vacations (for full-time employees), documents confirming the right to receive state benefits, pensions, payments, compensation. The form of the journal itself has not changed |

Task. The institution purchases a car that is subject to registration as part of especially valuable movable property. The cost of the car is 1,180,000 rubles. (including VAT - 180,000 rubles). An Act on acceptance and transfer of objects of non-financial assets (f. 0504101) was drawn up. Payment will be carried out both by means of funds targeted subsidies(900,000 rubles), and at the expense of funds from income-generating activities (280,000 rubles). It is not planned to recover the funds spent on the purchase of a car within one type of activity at the expense of another type of activity. The equipment will be used mainly in the main activities of the institution, as well as in income-generating activities - for the implementation of operations exempted from VAT.

Settlements with counterparties are carried out by transferring funds from a personal account opened with the treasury body.

Reflect transactions on accounting accounts.

Solution:

Within the meaning of the provisions of the current regulatory legal acts on account 0 210 06 000 "Settlements with the founder" of budgetary (autonomous) institutions, the total value of property is subject to reflection, which the institution cannot dispose of independently (without agreement with the founder).

During the year as a result of the acquisition of assets by institutions at the expense of funds allocated authorized bodies authorities (local government), property write-off or other cases of income, disposal of assets, the data reflected on account 0 210 06 000 lose their relevance. Consequently, they are subject to adjustment in the manner and frequency determined by the users of the financial statements: the founders and financial authorities. At present, the specialists of the Ministry of Finance of Russia point to the following minimum mandatory requirements for updating such data: once a year, based on the results of the year at the time of reporting.

Since the acquired property is not intended for use within the framework of the institution's activities subject to VAT, the amount of tax presented by suppliers and other contractors is included in the cost of the acquired property and is not accepted by the institution for deduction (clauses 23, 47, 224 of the Instructions approved by order Of the Ministry of Finance of Russia dated 01.12.2010 No. 157n, clause 2 of article 170 of the Tax Code of the Russian Federation).

In accounting records should be made:

| In a budgetary institution | V autonomous institution | Amount, rub. | Contents of operation | ||

| Debit | Credit | Debit | Credit | ||

| 5 106 21 310 | 5 302 31 730 | 5 106 21 000 | 5 302 31 000 | 900 000 | The car arrived at the institution - investments were taken into account and accounts payable to the counterparty (including VAT) * (1) |

| 2 106 21 310 | 2 302 31 730 | 2 106 21 000 | 2 302 31 000 | 280 000 | |

| 5 302 31 830 | 5 201 11 610 | 5 302 31 000 | 5 201 11 000 | 900 000 | At the expense of the funds of the targeted subsidy, the obligations to the counterparty were partially paid |

| Magnification 18 (310 KOSGU) | Magnification 18 (310 KOSGU) | ||||

| 2 302 31 830 | 2 201 11 610 | 2 302 31 000 | 2 201 11 000 | 280 000 | At the expense of funds from income-generating activities, obligations to the counterparty were partially paid |

| Magnification 18 (310 KOSGU) | Magnification 18 (310 KOSGU) | ||||

| 5 304 06 830 | 5 106 21 410 | 5 304 06 000 | 5 106 21 000 | 900 000 | Investments in property were taken into account in the framework of activities for the implementation of the state assignment |

| 2 304 06 830 | 2 106 21 410 | 2 304 06 000 | 2 106 21 000 | 280 000 | |

| 4 106 21 310 | 4 304 06 730 | 4 106 21 000 | 4 304 06 000 | 1 180 000 | |

| 4 101 25 310 | 4 106 21 310 | 4 101 25 000 | 4 106 21 000 | 1 180 000 | The car is accounted for in fixed assets at historical cost |

List of used literature

1. Tax Code of the Russian Federation.

2. Federal Law No. 402-FZ "On accounting».

3. Federal Law of November 29, 2014 No. 382-F3 "On Amendments to Parts One and Two Tax Code Russian Federation".

4. Federal Law of December 1, 2014 No. 406-FZ

"On amendments to certain legislative acts Of the Russian Federation on the issues of compulsory social insurance ”.

5. Federal Law dated 02.05.2015 No. 113-F3 "On Amendments to Part One and Part Two of the Tax Code of the Russian Federation in order to increase the responsibility of tax agents for non-compliance with the requirements of legislation on taxes and fees."

6. Federal Law No. 85-FZ dated 06.04.2015 “On Amendments to Article 219 of Part Two of the Tax Code of the Russian Federation and Article 4 of the Federal Law“ On Amendments to Parts One and Two of the Tax Code of the Russian Federation (in terms of taxation of profits of controlled foreign companies and income foreign organizations)»

7. Instructions for the use of a unified chart of accounts for accounting for state authorities (state bodies), local authorities, state governing bodies extrabudgetary funds, state academies of sciences, state (municipal) institutions № 157n.

9. Instructions for the use of the Chart of Accounts budget accounting No. 162n.

10. Instructions for the use of the chart of accounts of accounting budgetary institutions No. 174n.

11. Decree of the Government of the Russian Federation of 04.12.2014 No. 1316.

12. Resolution of the PFR Board dated January 16, 2014 No. 2p.

13. Resolution of the PFR Board dated 04.06.2015 No. 194p.

14. Resolution of the PFR Board dated 02.07.2015 No. 243p.

15. Order of the Ministry of Finance of Russia of March 30, 2015 N 52n

"On approval of the forms of primary accounting documents and accounting registers used by public authorities ( government bodies), local government bodies, governing bodies of state extra-budgetary funds, state (municipal) institutions, and Methodical instructions on their application "

16. Order of the Federal Tax Service of the Russian Federation of November 17, 2010 No. ММВ-7-3 / [email protected]"On the approval of the form of information on income individuals and recommendations for filling it out, the format of information on the income of individuals in in electronic format, reference books ".