Risk accumulative. Insurance risks

Traveling the world or working in hazardous industries, we are faced with many unforeseen circumstances, often risking our lives. In such cases, a service is provided that everyone can use.

Risk insurance is a contract concluded by a citizen or an enterprise with an insurance company for a specified period, in case possible risk for life. The most common risk is an accident.

An accident is an unforeseen event, as a result of which the insured person received some kind of injury, acquired a disability or lost his life. Such incidents include: traffic accident, fire, drowning, falling from a height, bite of poisonous insects, etc.

Exists three types of risk insurance: individual, group and compulsory.

The individual form of insurance allows a citizen, at his discretion, to insure his life for a certain period, by making the required amount to the account of the insurance company, depending on the perceived risk.

If during the period the insured person experiences an accident stipulated in the contract, then Insurance Company is obliged to pay compensation to the victim, depending on the damage caused to his health. In case of temporary disability, a percentage of the insured amount specified in the contract is paid daily, when the insured person receives a disability of group I, 80% to 100% of the sum insured is paid, disability group II - 40% - 60%, disability group III - 20% - thirty%. In the event of the death of the policyholder, the entire insurance amount is received by the beneficiary, that is, the authorized person specified in the contract.

There are exceptions when insurance payments are not produced. This happens when it is proven that the accident occurred through the fault of a citizen. it has been proven that the accident was the fault of a citizen. For example, if he deliberately caused damage to his health or unreasonably put his life in danger or died in a car accident while driving vehicle in a state of drug or alcohol intoxication.

Firms with employees or firms whose activities are related to possible risk for the life and health of employees, conclude a group risk insurance contract, as well as insurance of the property of legal entities. Group risk insurance policies take into account possible accidents that may occur to workers at work, and the road that the worker makes from home to work and back is also included in the policy.

The third type - compulsory risk life insurance, applies to such categories of citizens as: passengers, employees government agencies, military personnel, employees tax police, internal affairs bodies, etc. A feature of compulsory risk insurance is that it is carried out automatically, on the basis of a provision prescribed by law, without requiring the consent of the policyholder.

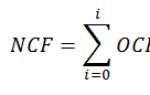

The main task of any type of insurance is insurance cover.

Accordingly, life insurance includes those types of insurance where “the object of insurance is a property interest associated

- with the survival of citizens to certain ages or the date or the occurrence of other events in the life of citizens,

- and also with their death. "

(Clause 1 of Article 4 of the Law of 27.11.1992 N 4015-1 "On the organization of insurance business in Russian Federation"(as amended on 02/09/2016)).

The purpose of life insurance can be:

and weakening financial implications such adverse events in life as the death of loved ones, and,

regardless of the circumstances, the ability to accumulate a certain amount of money by a specified date.

For example, there are such purposes of life insurance as:

- insurance of children for marriage (wedding insurance),

- insurance to the age of majority of children,

- insurance for higher education,

- insurance for the purchase of housing at a certain age,

- insurance for retirement or receiving a pension, etc.

Life insurance claims may vary as well. It all depends on the insurance contract and the type of insurance (Art. 421 "Freedom of contract" Civil Code RF).

And in this respect, accumulative and risk life insurance differ significantly from each other.

Differences between risk and endowment life insurance

Risk life insurance

Risk life insurance implies insurance coverage against risk. Risk life insurance contracts may additionally include:

insurance against accidents and illnesses,

disability insurance or

insurance against deadly diseases.

The risk life insurance contract is valid for a certain period... If an insured event occurs during this period, then the insured (beneficiary) receives a premium from the insurance company.

No savings are generated under a risk life insurance contract.

If during the term of the risk life insurance contract insured event did not happen, the insurance company does not pay anything and does not return the money to the policyholder.

The main type of risk life insurance is term life insurance in case of death.

For example, when traveling abroad:

- while traveling or

- at the time of sending to the hot spot.

If we add to such standard conditions of risk life insurance:

the possibility of accumulating funds and

receiving guaranteed amounts at the end of the life insurance contract, then this will already apply to the cumulative type of life insurance.

Endowment life insurance

Endowment life insurance is a combination of standard life insurance with a program for the accumulation, preservation and increase of capital.

During the conclusion of the insurance contract endowment insurance life, the policyholder himself chooses exactly how much money and for what period he wants to save. A cumulative life insurance contract is concluded with an insurance company (insurer), as a rule, for a long (or even life) period.

The insured (policyholder) regularly makes payments for this insurance contract to the insurance company. Wherein insurance premiums are divided into two parts:

one part of which goes to life insurance, and

second part accumulates on the account of the policyholder.

The insurance company invests the accumulated money in various financial instruments, annually charging the insured a certain percentage (guaranteed income), which also consists of two parts:

Firstly, this is the income that the insurance company guarantees.

Usually it is about 3-4 percent per annum;

Secondly, this is additional investment income, which will directly depend on the results investment activities insurance company.

It can be either 6 or 12 percent per annum, and it can also be 0 if the insurance company invested money unsuccessfully.

At the end of the term of the endowment life insurance contract, if nothing happens to the policyholder, he / she receives the amount stipulated by the endowment life insurance contract with accrued interest.

Since accumulative life insurance is combined with a risk component, the insurance policy actually insures the life of the insured. In the event of a sudden occurrence of an insured event, the insured person is immediately paid the entire sum insured on the principle of risk life insurance. In this case, the payment is carried out regardless of how many insurance premiums he managed to make.

Important! The main task of endowment life insurance is not income, but protection and creation of an airbag.

Endowment life insurance is one of the most conservative investment instruments, which gives a relatively small profitability, but at the same time GUARANTEES the safety of the insured's funds, and also provides him with PROTECTION against the risk of adverse life situations.

The conclusion of a cumulative life insurance contract with an insurance company usually takes up to 2 months, since it is often necessary to go through medical examination.

In the presence of serious diseases insurance companies usually refuse to enter into such a contract. There are, however, in the domestic insurance market endowment life insurance programs that do not require medical examination. But we will talk about this in the following materials.

Abstract: The main fundamental difference between accumulative and risk life insurance is that the accumulative life insurance program not only guarantees receiving compensation in the event of an insured event, but also provides an increase insurance compensation.

In the case of ordinary risk life insurance, the amount of insurance compensation is negotiated in advance and consists solely of the insured's premiums.

The main differences between risk and endowment life insurance

| Risk insurance | Accumulative insurance |

| Insurance is concluded for a short period | Insurance is concluded for tens of years (life insurance) |

| Has only risk protection function | Protects against risk and at the same time allows you to make savings |

| Does not imply periodic payments after the end of insurance and return of money | Guaranteed accrual of profitability on savings under the agreement; allows you to pick up all the accumulated money immediately at the time of the end of the contract |

| If the client remains alive during the validity period of the insurance, his money becomes the property of the insurance company | At the end of the contract, the client receives the agreed amount with interest, if nothing happens to him |

Benefits of one type of life insurance over another

Endowment life insurance always includes a risk component that provides protection in the event of death.

Upon the occurrence of an insured event, the insured (beneficiary) receives a payment stipulated by the insurance contract, equal to the insured amount, according to the principle of risk insurance. Its value is known in advance and does not depend on how long the policyholder pays insurance premiums and how much he has already paid;

on the other hand, insurance premiums are accumulated by the insurance company and upon the expiration of the life insurance policy, the insured (beneficiary) receives the accumulated amount, taking into account a fixed (guaranteed) rate of return.

At the same time, with risky life insurance, it is impossible to receive the invested money after the expiration of the life insurance contract, if, for example, an insured event has not occurred with the insured. His money just goes to the insurance company.

Despite a number of advantages that accumulative life insurance has, it also has a number of disadvantages. Yet endowment life insurance is a very long postponed obligation. There is always a certain risk that the income of the insured may decrease, and it is necessary to pay the same amount annually under the endowment life insurance policy.

At early termination of a cumulative life insurance agreement, the redemption amount may differ significantly from that which should have accumulated on the account during the term of the cumulative life insurance agreement.

In the presence of such a danger, it is more profitable and convenient for the policyholder to conclude a risk life insurance contract.

Quite often, enterprises in their activities use such a method as risk insurance. Risk insurance - it is the protection of the property interests of the enterprise in the event of an insured event (insured event) by special insurance companies (insurers). Insurance is carried out at the expense of funds formed by them by receiving insurance premiums (insurance premiums) from the policyholders.

In the process of insurance, the company is provided with insurance coverage for all the main types of its risks, both systemic and non-systemic. At the same time, the amount of compensation for the negative consequences of risks by insurers is not limited - it is determined by the value of the insurance object (the size of its insurance assessment), the insured amount and the amount of the paid insurance premium.

When resorting to the services of insurers, the company must first of all determine the object of insurance - the types of risks for which it intends to provide external insurance protection.

The composition of such risks is determined by a number of conditions:

insured risk. When determining the possibilities of insuring its risks, the company must find out the possibility of insuring them, taking into account the insurance products offered by the market;

the existence of an insurance interest for the company. It is characterized by the interest of the enterprise in insuring certain types of its risks. Such interest is determined by the composition of the enterprise's risks, the possibility of neutralizing them through internal mechanisms, the level of likelihood of a risk event, the amount of possible damage for individual risks and a number of other factors;

inability to fully compensate for risk losses at the expense of own resources... The company must provide full or partial insurance for all types of insured catastrophic risks inherent in its activities;

high probability of risk occurrence. This condition determines the need for insurance coverage for individual risks of their admissible and critical groups, if the possibilities of their neutralization are not fully ensured due to its internal mechanisms;

unpredictability and unregulated risk by the enterprise. Lack of experience or sufficient information base sometimes they do not allow within the enterprise to determine the degree of probability of the occurrence of a risk event for individual risks or to calculate the possible amount of damage for them. In this case, it is better to use the risk insurance system;

acceptable cost of insurance coverage at risk. If the cost of insurance coverage does not correspond to the level of risk or financial capabilities of the enterprise, it should be abandoned by strengthening the appropriate measures to neutralize it through internal mechanisms.

Offered on the market insurance services, providing insurance of the risks of the enterprise, are classified by forms, objects, volumes, types.

The forms are divided into compulsory and voluntary insurance.

Compulsory insurance is a form of insurance based on the legal obligation of its implementation for both the policyholder and the insurer.

Voluntary insurance is a form of insurance based only on a voluntarily concluded agreement between the policyholder and the insurer based on the insurable interest of each of them. The principle of voluntariness applies to both the company and the insurer, allowing the latter to evade insurance of dangerous or unfavorable risks for it.

The objects distinguish property insurance, liability insurance and personnel insurance.

Property insurance e covers all major types of material and intangible assets enterprises.

Liability Insurance - insurance, the object of which is the liability of the company and its personnel to third parties who may incur losses as a result of any action or inaction of the policyholder.

Personnel insurance covers the life insurance of its employees by the company, as well as possible incidents of disability, etc.

In terms of volume, insurance is divided into full and partial.

Full insurance provides insurance coverage of the company against the negative consequences of risks in the event of an insured event.

Partial insurance limits the insurance coverage of an enterprise against the negative consequences of risks both by certain insurance amounts and by the system of specific conditions for the occurrence of an insured event.

By types, property insurance, insurance of credit risks, deposit risks, investment risks, indirect risks, financial guarantees and other types of risks are distinguished.

Property (assets) insurance covers all tangible and intangible assets of the enterprise. It can be carried out in the amount of their real market value if there is an appropriate expert assessment. Insurance of various types of these assets can be carried out with several (rather than one) insurers, which guarantees a more durable degree of reliability of insurance coverage.

Credit risk (or settlement risk) insurance- this is insurance, in which the object is the risk of non-payment (late payment) on the part of buyers of products when providing them with a commodity (commercial) credit or when supplying them with products on terms of subsequent payment.

Deposit risk insurance is made in the process of making short-term and long-term financial investments by the enterprise using various deposit instruments. The object of insurance is the risk that the bank will not return the principal and interest on deposits and certificates of deposit in the event of bankruptcy.

Investment risk insurance- this is insurance, the object of which is various risks of real investment (risks of untimely completion of design work on an investment project, untimely completion of construction and installation work on it, failure to reach the planned design production capacity, etc.).

Indirect risks insurance- this is insurance, which includes insurance of estimated profit, insurance of lost profits, insurance of exceeding the established budget for capital or current costs, insurance of lease payments, etc.

Financial guarantee insurance- the object of insurance is the risk of non-return (untimely return) of the principal amount and non-payment (untimely payment of the established amount of interest). Financial guarantee insurance assumes that certain obligations of the company related to raising borrowed capital will be fulfilled in accordance with the terms of the loan agreement.

Other types of risk insurance- the object is other types of risks that are not included in the traditional types of insurance.

According to the insurance systems used, insurance is distinguished at the actual value of property, insurance according to the proportional liability system, insurance according to the "first risk" system, insurance with the use of a deductible.

Insurance at the actual value of the property is used in property insurance and provides insurance coverage in full amount of damage caused to the insured types of the company's assets. Thus, under this insurance system, the insurance indemnity can be paid in the full amount of the financial damage incurred.

Proportional liability insurance provides partial insurance coverage for certain types risks. In this case, the insurance compensation for the amount of damage incurred is carried out in proportion to the insurance coefficient (the ratio of the insured amount determined by the insurance contract and the size of the insurance assessment of the insurance object).

Insurance under the "first risk" system. The "first risk" means the damage incurred by the policyholder upon the occurrence of the insured event, which was previously estimated when drawing up the insurance contract as the amount of the insured amount indicated in it. If the actual damage has exceeded the stipulated sum insured (insured first risk), it is reimbursed under this insurance system only within the limits of the sum insured previously agreed by the parties.

Insurance using an unconditional deductible. Franchise- this is the minimum part of the damage incurred by the policyholder that is not compensated by the insurer. When insuring with the use of an unconditional deductible, the insurer in all insured events pays the policyholder the amount of insurance compensation minus the amount of the deductible, keeping it with himself.

Insurance with a conditional deductible. Under this insurance system, the insurer is not liable for damage incurred by the company as a result of the occurrence of an insured event, if the amount of this damage does not exceed the amount of the agreed deductible. If the amount of damage has exceeded the amount of the deductible, then it is reimbursed to the company in full as part of the insurance compensation paid to it (i.e., without deducting the amount of the deductible in this case).

With such a concept as life insurance, to one degree or another, most of our citizens are familiar. Many ignore similar offers- insurance is an unpopular tool in Russia. And for those who nevertheless decide to insure, another question arises: what kind of insurance to choose? Natalia Smirnova, head of the consulting company "Personal Adviser", spoke about what types of life insurance exist, and whether it is worth abandoning them.

Types of insurance

There are two main types of life insurance: risk and accumulative.

By risk insurance payments are made in case of risk of death. In addition, if additional options have been selected, the insurance is paid also in case of disability, making a certain diagnosis from the list, in case of hospitalization, surgery and injury.

At accumulative insurance payments are also made in the event of death and other types of risks selected during registration. However, unlike risk insurance, it also provides payments for the risk of survival. This means that by living up to the end of the insurance period, you are guaranteed to receive a certain amount plus the investment income that the insurance company has earned.

Thus, in addition to the protective function, accumulative insurance also carries accumulative insurance. It will cost you more than a risky one, according to which money is not returned after survival. Risk insurance is not only cheaper, but also more flexible - if you decide to remove protection, you just need to stop making payments. At the same time, if you terminate the endowment insurance contract, you will lose the guaranteed amount due to you at the end of the contract. In the best case, you will be able to get back part of the contributions, and if you interrupt payments within the first two years of the contract, you will not receive anything.

Which insurance is better

Risk insurance can come in handy in the following cases:

1. The amount of your savings is not enough to pay for treatment in the event of a serious illness, to ensure your existence and achievement, which have not lost their importance (child's education,). At the same time, your income does not allow you to achieve the same goals using endowment insurance.

2. You have enough savings for life, treatment and realization in case of health problems, but a significant part of the capital is invested in instruments, in case of unscheduled withdrawal of funds from which losses are likely, or funds are placed in illiquid assets (for example, real estate) that are difficult quickly realize at an affordable price. In this case, risk insurance will be justified.

3. You have not yet decided on your plans for life: you have not chosen priority goals, you want to change your country of residence or field of activity, you are going to start your own business, etc. In cases where you have inconsistent earnings, you do not know in which country you will live and work in the future, did not delve into especially tax legislation of this country and others important points, to issue long-term and low-liquid accumulative insurance is irrational. In the future, you may find a more effective program in your new place of residence. At the same time, financial protection is necessary, because there are always risks of unforeseen expenses, and an unstable financial situation makes them especially dangerous. Therefore, risk insurance would be the most appropriate option.

4. You are a young investor with more than 10 years of time left to achieve serious financial goals such as retirement and education for children. Required capital you have not saved yet, and success in implementation financial plan largely depends on your ability to work. In this case, it is reasonable to take out risk insurance and start compiling with a high expected return. Investments will help you save for your goals, and risk insurance will protect you from unforeseen situations: in the event of a loss of working capacity, payments will help pay for treatment and compensate for the gap in implementation investment strategy, which can form due to illness.

Endowment insurance should be chosen in the following cases:

1. You have financial goals that must be met, no matter the circumstances, and should not be exposed to market risks. In this case, you have already decided on the host country, amount and currency. These goals primarily include pension savings and teaching children. At least part of the required amount can be provided with the help of accumulative insurance, because the money will be with you at the right time, even if you lose your ability to work or incur losses while implementing an aggressive strategy to achieve the same goals.

2. There is a risk of divorce and foreclosure on property. Then you can save your savings by signing an endowment insurance contract. However, if you need to secure your savings for a period of less than 7 years, it is better to use investment insurance life.

3. You have a poorly developed self-discipline, you cannot save for goals, you have no experience in investments and you are not ready to take risks. If you prefer deposits and other instruments with minimal risk and at the same time have a stable source of income, use accumulative insurance to achieve your most important goals.

Thus, life insurance can be done, perhaps, only by the owners of solid capital, stored in reliable liquid instruments, and protection against divorce and foreclosure from them is provided in other ways (for example, with the help of family funds). If you do not belong to this category, you should think about which type of insurance to choose.

Insurance risk- 1) an assumed probable event or a set of events, in the event of the occurrence of which insurance is carried out (insurance risk - theft); 2) a specific object of insurance (insurance risk - a ship); 3) insurance appraisal, by which it is necessary to understand the value of the object, taken into account in insurance; 4) the probability of occurrence of an insured event (insurance risk is the probability of occurrence of an insured event, i.e. the occurrence of damage, equal to 0.02).

Insurance event- an event specified in the insurance contract, about the occurrence of which the contract was concluded.

Insurance case- an accomplished event, prescribed by law(at compulsory insurance) or an insurance contract (in case of voluntary insurance), upon the occurrence of which and compliance with the terms of the contract, the insurer is obliged to make an insurance payment.

Risk management theory

Risk management- is a set of measures aimed at reducing the likelihood of a risk or compensation for the consequences of its implementation. The risk management process consists of several sequential stages:

- Risk analysis.

- The choice of methods of influencing the risk when assessing their comparative effectiveness.

- Decision-making.

- Impact on risk.

- Monitoring and evaluating the results of the management process

Risk management stages:

1. Risk analysis It is expressed in the preliminary understanding of the risk by business entities or an individual and its subsequent assessment - determining its seriousness from the standpoint of the likelihood and magnitude of possible damage. At this stage, the necessary information about the structure, properties of the object and the existing risks is collected, as well as possible consequences realization of risks. The information collected should be sufficient to make adequate decisions at subsequent stages. Assessment is a quantitative description of the identified risks, during which such characteristics as the likelihood and amount of possible damage are determined. The calculation of the probability of the occurrence of damage, depending on its size.

2. Choice of methods of influence on risk... This stage aims to minimize possible damage in the future. As a rule, each type of risk allows several ways to reduce it, so it is necessary to compare the effectiveness of methods of influencing the risk to choose the best one. Comparison can be made based on various criteria, including economic ones.

3. Making a decision In practice, there are four main methods of risk management: abolition, loss prevention and control, insurance, takeover, and it is also possible to use various combinations of these methods.

- Abolition... The first method of risk management is to try to eliminate risk, that is, to reduce its probability to zero (for example, refuse to invest funds, not conclude a contract at all, not fly an airplane, etc.). Elimination of risk makes it possible to avoid probable losses. But eliminating risk can also bring profits to zero.

- Loss prevention and control... The method implies the practical exclusion of accidents and limiting the amount of losses in the event that a loss does occur.

- Insurance... Insurance refers to the process by which a group of individuals and legal entities, exposed to the same type of risk, contributes funds to the insurance fund, whose members receive compensation in case of losses. The main purpose of insurance is to distribute losses among a large number of participants. insurance fund(insured).

- Absorption... The content of this risk management method is the recognition of the possibility of damage and its acceptance. In fact, this method is self-insurance, that is, losses are covered at the expense of independently created reserve funds.

4. Impact on risk. Implies the application of the selected method from the above. If, for example, insurance is the chosen risk management method, then the next step is to conclude an insurance contract. If the chosen method is not insurance, then it is possible to develop a program for the prevention and control of losses, etc.

5. Monitoring and evaluation of results... It is made on the basis of information about the losses that have occurred and measures taken to minimize them. This makes it possible to identify new circumstances affecting the level of risk and to revise the data on the effectiveness of the measures used to manage risks.

All risk management activities can be divided into two groups:

- pre-event;

- post-event.

The first group includes various measures to reduce the likelihood of risk (preventive measures) and the severity of possible damage in advance. And the second group of measures aims to compensate for the consequences of the already realized risk.

Sometimes it is extremely difficult to eliminate a risk or reduce its likelihood due to the variety of forms of risk manifestation. Scientific and technological progress creates the preconditions for the emergence of new risks. In such cases, the most effective way impact on risk is its transfer, that is, insurance, which is a mechanism for compensation for damage, but does not affect the very fact of the occurrence of risk. Through insurance, any human activity in the knowledge of nature and in the process of social production is protected from accidents.

From the standpoint of insurance, all risks are divided into insurance (risks that can be insured) and non-insurance (not subject to insurance for a number of reasons). Insurance allows you to minimize the uncertainty in the actions of business entities in a risk situation.

The Company uses various measures that allow it to predict with a certain reliability the likelihood of a risk, which makes it possible to reduce its negative consequences, i.e. damage. Risk management is a process that has as its ultimate goal to reduce (compensate) damage in the event of adverse events.

Risk management is carried out according to the following scheme:- risk analysis;

- the choice of methods of influencing the risk when assessing their comparative effectiveness;

- decision-making;

- direct impact on risk;

- control and correction of the results of the management process.

Impact on risk implies next choice: risk reduction, risk retention (absorption) or risk transfer. One of the options for transferring risk is to insure it, thus, for a certain fee, partial or full responsibility for the risk is borne by the insurance company.

Classification and types of risks

There are many different classifications of risks based on the characteristics of certain risks.

By the nature of the danger:

- technogenic risks. For reasons of occurrence, these risks are associated with human activities (fire risks, accidents, theft, pollution environment etc.);

- natural risks. The occurrence of risks does not depend on human activity and is not subject to control. These are mainly the risks of natural disasters: earthquakes, hurricanes, lightning strikes, volcanic eruptions, etc.

By the nature of the activity:

- financial and commercial risks (for example, inflationary risks, currency risks, investment risks, risks of lost profits, non-fulfillment of contractual obligations, credit risks etc.);

- political risks (various changes in the conditions of the entity's activities for reasons determined by the activities of the government controlled, illegal actions from the point of view of international law);

- professional risks (risks arising when subjects perform their professional duties);

- transport risks (risks arising from the transportation of goods and transportation of passengers by sea, air and land);

- environmental risks (risks associated with environmental pollution), etc.

For objects at which the risk is directed:

- risks of damage to the life and health of citizens (illness, disability, death, accident, etc.);

- property risks (fire, theft, property damage, etc.);

- risks of civil liability (liability arising in the event of harm to the life, health or property of third parties).

In terms of insurance opportunities:

- insurance risks;

- non-insurance risks.

Insurance and non-insurance risks

Necessary and a prerequisite, without which it is impossible insurance relationship, is the presence of an insurable interest, that is, the material interest of a person in insurance. The concept of insurable interest is closely related to the concept of property interest. This is reflected in the main purpose of insurance - to protect property interests. . V regulatory documents the interests, the insurance of which is allowed, and the interests, the insurance of which is not allowed, are determined.

The presence of an insurable interest is due to the awareness of the risk and possible damage in the event of a risk realization. However, not all risks can be insured. From the standpoint of insurance, risks are divided into two groups: risks that are subject to insurance (insurance risks); risks that are not subject to insurance (non-insurance risks).

An insurance organization performs many functions and operations. The most difficult is the assessment and forecasting of risk. In order for the risk to become insured, it must meet the following requirements:1. The risk must be probable(the possibility of an insured event should be assessed).

2. The risk must be random(Neither the place of the accident, nor the specific time of occurrence of the insured event, nor the amount of probable damage should be known in advance).

It is impossible to insure against an event that we know will definitely happen, since in this case there is no risk and uncertainty of losses. The frequency and severity of any risk must be completely beyond the control of the policyholder.

In the case of most risks, their randomness is obvious, but with life insurance one can argue with this, since there is no uncertainty about the fact of death. The fact that sooner or later we will die is one of those that represent a certainty for everyone. Nevertheless, life insurance also has an element of uncertainty about future events, namely, the date of death is something that is beyond the control of the person who bought the policy. This is not a true statement in the case of suicide, which is why most policies do not cover death by suicide until a certain period of time has elapsed from the date of the policy's entry into force, i.e. the insurance company must make sure that the suicide was not planned, at least for some period. time from the start of insurance.

3. The risk should not be isolated... To calculate the probability of an insured event occurring, statistical data on the patterns of occurrence of similar risks are required.

Before a risk can be insured, there must be sufficient a large number of similar homogeneous manifestations of risk. There are two reasons for this. First, measuring risk by means of its probability and statistical data implies that a sufficient number of such events have already occurred in the past. Secondly, if in the past there were only three or four similar events, then each insurance participant will have to make a very big contribution, since the payment will be made from these contributions. On the other hand, if there were thousands of similar events, then the contribution will be relatively small, since only a few are unlucky enough to incur losses and demand compensation for their losses from common fund... Insurance of the contents of apartments against fire is an example of a homogeneous manifestation of risk.

4. The risk must entail a financially measurable loss... It is very important to remember that insurance is only appropriate in situations where a loss entails monetary compensation... The consequences of the insurance risk are easy to predetermine, for example, when property damage occurs, where the amount of compensation can be compared with the cost of repairs. In life insurance it is much more difficult to say that financial loss, which will be borne by the wife in the event of the death of her husband, is expressed in a certain sum of money... We can only talk about the amount of compensation that will be paid in case of death, if it occurs during the period specified by the policy conditions.

Risks, the result of which can be assessed in monetary units are called financial. Financial risks are mainly subject to insurance, and non-financial (the consequences of which are not amenable to financial assessment) - are not subject.

5. The insured event must not have the character of a catastrophic disaster (disastrous or fundamental risks).

Before talking about the fundamental risks themselves, it would be useful to consider their fundamental basis. They are defined as fundamental, since the reason for their occurrence is the very essence of society. We live in a certain environment, the physical essence of which is beyond human control. Examples of such risks are wars, strikes, social unrest, riots, inflation, changes in customs and traditions, typhoons, tsunamis. The first six are a kind of offspring of the society in which we live, and the last two are attributes of some physical phenomena. The causes of such risks are beyond the control of any person or group of people; these are uncontrollable and all-encompassing risks, usually the entire society bears responsibility for the consequences of such risks. In general, catastrophic (fundamental) risks are not suitable for insurance, but recently insurers increasingly include them in the scope of liability under certain conditions.

The opposite of fundamental risks are private risks. Risk having private entity, is rooted in individual events, and the impact of these risks is felt locally. Theft of property, accident, injury - they all have a personal impact on a particular person, for example, a boiler explosion is an example of a private risk. Private risks are usually suitable for insurance.

Changes in classificationsOver time, our views on risk change, and the classification of risks changes accordingly. The most common is the transition of risks from the class of private to the class of fundamental, and this fact gives rise to reflections on why we generally classify risks. Before answering this question, let's look at two examples of changes in classification.

At one time, unemployment was seen as an individual problem only. A person may become unemployed due to his laziness, lack of qualifications or other reasons, but they are all private. Over the years, societal attitudes have changed, and today most people agree that unemployment arises from some malfunctioning economic system... Thus, the risk changed its nature and became fundamental, it is inherent not to one single person, but spread throughout society as a whole. This example explains why it is necessary to divide risks into private and fundamental.

6. The fact of the occurrence of the insured event should not be associated with the will of the policyholder or other interested persons (beneficiaries). Insurance of risks associated with the intent of the policyholder is not allowed. Risks, the outcome of which may be a gain for the policyholder (beneficiary), are called speculative and are not subject to insurance (betting, playing in a casino, lottery, etc.). The risks that exclude such a possibility are called clean(fire, theft, injury, illness, etc.). For the most part, net risks are insured.

Example:Considering a loss situation, we can imagine two different outcomes.

The first outcome- this is a case when a risky situation can materialize at a loss or remain at the break-even point ("at its"). Driving is an example of such a situation. Every time you take a road, you are exposed to risk, that is, there is an uncertainty of loss. You can damage your car or other property, be held responsible for damage caused to others. At the same time, you can return home without having an accident, in other words, you will remain in the same financial situation that and leaving the house.

Second outcome- this is when you can incur losses, stay with your own people or make a profit. A good example of this risk would be playing on the stock exchange to buy shares. You can buy shares for 25 rubles. each, in a year the price may drop to 20 rubles. On the other hand, the price may not change. However, you were hoping that the price would rise and then you could sell them for income.

These two options for the implementation of a risky situation are defined as pure and speculative, respectively. Net risk implies loss or no loss (zero outcome), while speculative risk implies possible future gain, loss or zero outcome.

V entrepreneurial activity speculative risks are quite common. Entering a new market, launching new products, setting the selling price are all forms of speculative risk, since in all these examples there are three possible outcomes: profit, loss, or break-even. Pure risks are also common. The plant can burn out, as a result of a fire, profit can be lost, money can be stolen, etc. These situations imply the possibility of loss, but at the same time, it is possible that the situation will remain the status quo. It is very important to understand that the factory does not gain anything, if the fire does not happen, the profit will not be lost due to the fire, and the money will not be stolen, in these cases the status quo will simply be preserved.

Thus, the risk assessment is based on the likelihood of its occurrence and the severity of the damage. Financial, clean, non-catastrophic risks are accepted for insurance.