Average salary Why are salaries low in Russia? Comparison of salaries by profession, region and year

06Feb

Hello! In this article we will tell you about the algorithm for calculating the average wage.

Today you will learn:

- What is meant by average wages;

- In what situations is it necessary to calculate the EWS;

- What payments are accepted for calculating the free wage and which are not;

- How is the calculation of the WFP for the month and for the day carried out.

In what situations is the calculation of the average wage required?

Average salary for calculating sick leave

When calculating sickness benefit, it is necessary to summarize the income for the two years preceding the onset of the illness, then divide by 730 (the number of days in these two years). Obtained with this calculation average daily earnings multiply by the number of sick days and get the amount of payment for the period of illness.

Calculation of average daily earnings for calculating vacation pay

When calculating vacation compensation, we must use the following formula:

SDZ= FZP (12 months) / RP / 29.3;

- SDZ - average daily earnings;

- FZP - actually accrued wage for 12 months preceding the accrual of vacation pay;

- RP - billing period, the number of months worked for this year;

- 29.3 is the average number of days in a month.

The settlement period is usually twelve months, it is used when calculating business travel, educational leave, annual paid leave. But in case of dismissal, it can be less than 12, that is, the employee has not fully completed the conditional working year.

For example, an employee was hired on March 11, 2018. Period for calculation annual leave is considered 12 months (from March 11, 2018 to March 10, 2019). If an employee leaves on February 2, 2019, then the accounting period will be considered 10 months (from March 11, 2018 to January 10, 2019)

An example of calculating vacation pay:

Worker Ivanov I.I. went on vacation by order from February 15, 2019 Before the onset of vacation Ivanov I.I. did not get sick, did not go on a business trip, did not take leave at his own expense. His salary for 12 months amounted to 45,600 rubles.

We calculate the average daily earnings: 45 600 rubles / 351.6 days. = 129.69 rubles.

The amount of payment for the vacation will be: 129.69 rubles * 28 days. = RUB 3,631.32

351.6 days Is the average number of days over 12 months. (29.3 * 12).

Upon dismissal of an employee, the accountant is obliged to issue 2-NDFL. With their help, the accountant at the next place of work will be able to calculate the WFP.

Conclusion

SZP is economic indicator, which reflects the ratio of the real income received by the employee to the real time that he worked.

In all cases when its calculation is required, the accountant must remember that the size of the SZP cannot be lower than that established in the Russian Federation.

The average wage is a rather relative concept, and, for this very reason, it seems to me rather meaningless. But in reality, this is not at all the case. Such an indicator can be widely used, due to which, it is often recognized as a basic one. This definition often arouses interest and increased discussion, due to which it is often taken into account when carrying out any calculations.

In general, this type displays the total amount of payments received. It can be calculated at different levels:

- Company level.

- Urban.

- Regional.

- Country level.

Thanks to this indicator, it is possible to determine the general level of wealth of the entire population. For example, most workers who are ready to change their place of residence for a promising position first study the level of average wages in a given area.

This indicator allows them to understand how high the promised amount of remuneration will turn out to be, and also to look at the prospect of working in this company, how much he will be able to receive in a few years, having received a higher position.

The legislative framework

The process of calculating the average wage, as well as the very procedure for using such a term, is disclosed in the current Labor Code. To begin with, it is worth paying close attention to Article 135 of this regulatory legal act, which contains comprehensive information about what is wages.

Next, you can see information about what types of payments exist in the country and how they are calculated.

The calculation algorithm is also determined by legislation, based on regulations. However, no one forbids accountants to use their own developments, only if it does not contradict the legislation. In such a situation, the main thing is that from calculations at the organization level, the employee does not find himself in a worse situation than with government calculations.

When wages are calculated

According to the legislation, the question of the need for a calculation average pay labor should be carried out in the following cases:

- If the direct employee in this moment goes on paid vacation.

- If this employee, for any significant reason, is removed from the direct performance of the assigned labor functions, but at the same time his average wage is retained for him.

- Due to downtime, the employee is sent to another place to carry out the elimination of the consequences of a man-made or natural disaster.

- When making payments on sick leave.

- Upon payment due to termination of the contract.

- Immediately upon dismissal, when the employee also needs to pay cash for unused vacation.

- When paying for downtime, if it is the employer's fault.

- During an employee's forced business trips.

- In other cases, when, according to the law, a person is entitled to receive such an amount.

In addition, each employee has the right to demand information from his employer about:

- Your employment contract.

- His average monthly salary.

How to calculate the average wage

When carrying out such a procedure, it is imperative to take into account all payments that are provided adopted system, regardless of the source through which such funds were provided.

These payments include:

- The salary itself, taking into account all kinds of allowances:

- According to the tariff.

- According to the accepted salary.

- As a percentage of revenue.

- On a deal. In addition, it is also worth taking into account all kinds of payments that are provided in non-cash form, for example, various payments for meals for workers.

- Various awards.

- Other payments.

For absolutely any type of payment, the calculation of average earnings should include the following factors:

- the total amount of all time worked;

- the total amount of accrued wages.

It is also worth remembering that when making calculations, you should subtract from them the periods when the employee:

- took a paid weekend to care for a disabled child;

- was on parental leave;

- was on sick leave;

- for any significant reasons, he was released from the performance of his labor functions while maintaining his pay.

As a rule, the calculation of such a fee is based on total amount income that has been received in the past twelve months.

- For starters it's worth sum up all amounts received for a given period. All premiums and allowances must be included in them. It is worth remembering that such payments must be deducted.

- Next step - find calendar for last year and calculate the total number of days worked. It is likely that some of them fell on various holidays.

- Further it is required all paid for given year divide the amount by the total number of days worked. The result will be the average daily earnings.

- Accordingly, if a person needs to find out his average monthly wage, then you need the resulting number is multiplied by the number of days worked in a month.

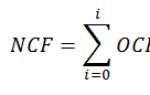

Thus, the formula for calculating the average earnings will be as follows:

Total amount received for Last year needs to be divided by the number of days actually worked.

If the employee is interested in average amount, received by him for a month, then the indicator according to the previous formula will need to be divided by the total number of days worked in a particular month.

Exceptions to the general calculation procedure

It is worth remembering that the foreseen calculation procedure may have its own established exceptions.

Here is a small list of them:

- The term for the calculation. If in the previous 12 calendar months this employee did not work for a day, for example, was on parental leave, then another twelve months should be counted when the person performed the labor functions assigned to him, and the calculation should be made based on those indicators.

- Another exception relates directly to earnings.

Remuneration is calculated based on the net salary or the current wage scale, in the following situations:

- If the payment of wages for some reason has not been carried out for the last twenty-four months.

- For all this time, not a single day has been worked out.

- If the calculation of wages is carried out for any specific month, and in this month not a single day has been worked or the due amount of money has not been paid.

Calculation example

To better understand the procedure for calculating the average wage, it is best to disassemble it with an example.

To begin with, it is worth adding up all the amounts paid during this six months, that is:

- In July, ten thousand.

- In August, twelve thousand.

- In September, twelve thousand.

- In October, ten thousand.

- Nine thousand in November.

- In December, ten thousand again.

In total, it turns out that for all six months, in general, an amount of sixty-three thousand was received.

If it is important for an employee to get his hands on a document confirming the issuance of such an amount, then a special certificate from the place of work must be drawn up for him.

Payment calculation can be carried out in two ways:

- personally;

- to the bank card.

An indicator such as the average monthly wage is extremely important in labor relations - both for the employer and for the employee himself, as well as for the employees of the accounting department and the personnel department. The calculation of the average monthly wage or average monthly earnings may be required in many situations directly related to work - and it will be easiest to calculate this indicator using simple and illustrative examples.

What is the average monthly salary - what is included in it

The concept of average monthly wages is extremely important in many aspects of the labor relationship between employer and employee. But what is this indicator? The average monthly salary is the average value of all remuneration received for the work of an employee over 12 months, recalculated for each separate month.

It should be understood, however, that the average monthly salary may include various payments, including:

- Employee salary. Regardless of the circumstances, if an employee receives a fixed salary, the salary is always included in the salary.

- Tariff payments. If a worker works according to a piece-rate system of remuneration, then all income received by him within its framework is included in the calculation.

- Interest payments. When an employment contract provides for the payment of a certain percentage of earnings to an employee or another indicator, then these payments are also included in the calculation.

- Allowances. When the legislation provides for the payment of various allowances to employees, for example, for length of service, for work in the Far North, or simply, when wages are increased to match the minimum wage, taking into account the regional coefficient.

- Bonuses and other incentive payments. All types of bonuses or other payments related to work results are considered part of the average monthly earnings and are fully involved in the calculations.

- Additional mandatory payments. Overtime pay, night work, additional pay for harmful or dangerous conditions - all these types of payments in accordance with the requirements of the law are involved in the calculation.

It should also be remembered that when calculating the average monthly salary, a number of other payments due to an employee should not be taken into account. First of all, this concerns payments that have a compensation purpose, but it also affects a number of other payments. So, the following payments do not participate and are not included in the employee's income when calculating the average monthly salary:

- Vacation compensationa. If the calculation of earnings occurs after the dismissal of the employee, then the compensation for unused vacation is not included in the calculation of the average monthly earnings.

- Vacation . Vacation payments by themselves are also not included in the average monthly earnings of employees.

- Hospital andmaternity . Compensation for temporary incapacity for work, as well as maternity payments are not included in the calculation of average monthly earnings.

- Material aid . The amounts paid to workers as material assistance are not included in the calculation of average earnings.

- Daily allowance , travel and other payments that reimburse the employee's costs. These payments are not the employee's income in principle, but are intended to compensate for the employee's expenses and, therefore, they are not included in the average monthly wage.

- Bonuses not related to the performance of labor duties. So, payments in honor of the birthday of an employee or organization, in honor of public holidays and other bonuses cannot be taken into account when calculating the average monthly earnings, since they do not in any way correlate with the employee's job function and do not act as remuneration for work.

- Other types of compensation and payments not related to the labor function. Payment for an employee's downtime or other periods during which an employee is not working is also not included in the calculations.

If the payment of wages is partially secured in kind, which the Labor Code allows, then this payment is still taken into account when calculating the average monthly earnings, and is also subject to personal income tax and insurance premiums, as well as cash payments.

Why do you need to calculate the average monthly salary

There can be many purposes for calculating the average monthly salary and the grounds for its implementation, because this indicator is used in a wide variety of situations. Therefore, the answer to the question of why an average monthly wage is needed can also vary significantly. The most common situations for which the calculation of the indicated indicator may be required are:

In some of the above situations, the average monthly earnings may not be fully utilized. For example, sick leave with a small work experience is not paid in full amount of the average salary, but maternity benefits have the minimum and maximum limits of the allowable amount of payments.

Legal regulation of average monthly wages - laws and regulations of the Labor Code of the Russian Federation

Since the average monthly salary may be required in many situations, both employees and employers, and specialists of the HR department or accounting department should know how the calculation of the average monthly salary is carried out. At the same time, in these calculations, it is necessary to rely on a certain legal basis, which is provided by labor legislation. The legal basis for calculating the average monthly wage in this case is the following regulations:

- Section 139 Labor Code RF. This article sets out the basic principles used in calculating the average monthly salary of employees.

- Resolution of the Government of the Russian Federation No. 922 dated 12.24.2007. The said government decree more broadly and specifically considers the issues of calculating the average wage of workers taking into account all possible nuances and features.

Despite the fact that the legal framework for issues related to average wages is quite small, its standards will be sufficient for every employee, accountant and employer to accurately and fully comply with the regulatory requirements of the calculation.

How to Calculate Average Monthly Wage - A Step-by-Step Guide

The procedure for calculating the average monthly wage is relatively simple, but it has its own characteristics that must be taken into account in this process. At the same time, any of the parties to the labor relationship may need to get acquainted with it. And a simple one can help with this. step-by-step instruction by calculating the average monthly salary, which looks like this:

In some situations, a different procedure for calculating the average monthly salary may be applied, for example, when maintaining a summarized accounting of working hours and with a flexible working schedule, it is also necessary to calculate the average hourly earnings of an employee.

An example of calculating the average monthly salary

The easiest way to learn how to calculate the average monthly wage is with a simple example:

Citizen Sidorova S.S. is dismissed on a staff reduction, which means that he has the right to receive severance pay. Dismissal date - 01/10/2019. At the same time, she needs to calculate the size of the average monthly wage. Accordingly, the reporting period in this case is 12 calendar months prior to the date of dismissal, not including January 2019. That is, the calculation is carried out from 01/01/2018 to 12/31/2018.

The official salary of S.S. Sidorova was 20 thousand rubles. At the same time, she was charged a monthly allowance of 4% of the official rate for harmful working conditions. In addition, twice in 2018 Sidorova S.S. received an award for outstanding work results and overfulfillment of the plan in the amount of 15 thousand rubles each. Also, she was given a special prize for her 50th birthday in the amount of 10 thousand rubles and material help upon the death of a relative in the amount of 4 thousand rubles. However, financial assistance and a bonus for 50 years cannot participate in the indicated calculation, since they are not related to work.

During this period, from 02/01/2018 to 02/14/2018, the employee was on sick leave, and from 09/01 to 09/06 she took unpaid leave for herself in connection with the death of a relative. Accordingly, in February she worked 10 working days out of 20, which halved her salary for this month, and in September - she worked 17 working days out of 20, which reduced her salary by 15%. Sidorova S.S took advantage of her paid vacation from 11/01/2018 to 11/30/2018 and actually did not work in November. Total, the salary of S.S. Sidorova for 2018 amounted to:

(20,000 * 9 + 10,000 + 17,000) * 1.04 + 15,000 + 15,000 = 245,280 rubles.

It should be borne in mind that for a certain time, S.S. Sidorova. did not work, which means that certain periods should not be taken into account in the calculation of average monthly earnings. Therefore, you first need to determine her average daily earnings as follows - subtract from 247 working days according to the production calendar for 2018 - 35 days of her absence from work on weekdays. Accordingly, her average daily earnings will be:

245280/212 = 1156.98 rubles.

After that, you should determine the average monthly earnings, taking into account the number of working days within 2 calendar months following the moment of dismissal - that is, from 02/01/2019 to 03/31/2019. In this period, 39 working days. Total severance pay should be:

1156.98 * 39 = 45122.22 rubles.

The above example uses, first of all, the average daily earnings, since, in practice, the average monthly indicators are practically not used. To calculate the average monthly earnings Sidorova S.S. in most cases, it is enough to simply divide the amount of her income for the year - 245,280 rubles by the number of months - 12, however, the actual result in the end will differ from the exact accounting amount calculated separately for each reason for calculating the average earnings.

To find out the size of the average monthly and average annual earnings in Russia, you should inquire about the historical statistics on salaries over the past decades and past centuries. Such data will help to approximately calculate pension accruals for the Pension Fund. There are calculation schemes by which you can find out your profit on accruals in the future.

To correctly calculate the average monthly income ratio, you need to calculate the ratio of pay for a specific period of time, for example, for 2001 and 2002 or the last 5 years before January 1, 2002, to the average monthly wage in Russia for a selected period on years.

The coefficient of the average salary for 30 days is equal to the salary of a person divided by the average salary per month.

Formula: КСЗ = ЗР / ЗП.

The resulting figure is used to calculate the estimated pension, a part of the amount from future payments that are earned for the entire 2002. The estimated pension is equal to the SK, multiplied by KSZ and again multiplied by 1671 - 450. So, it is clear that the higher the average salary ratio, the greater the indicators of calculations in terms of money.

For the majority of residents of Russia for the periods of 2000 and 2001, the size of the average pay is listed in the data of the Pension Fund, and there is no need to prove this in documentary form. When choosing to calculate the coefficient of the average monthly wage for 2000-2001, the KSZ is calculated by dividing the average wage salary for this entire time period by 1,495 rubles - this is the average wage in Russia for the specified number of years.

Formula: KZS = ZR / ZP = ZR / 1495.

Another example, we choose a time interval not for 2000 and 2001, but we take an earlier period, in aggregate for the last 5 years (60 months). In this case, a number of such computational actions should be carried out:

- you must first find out the average wages for a specific period;

- find statistical data (will be given below) for the specified period on average wages;

- then we calculate the value of the KZS;

- during the period of registration of the pension must be submitted to the department pension fund salary data for the last 5 years.

Country salary tables by year

The following tables of average monthly salaries were established by the Russian government in order to convert pension rights to calculate the correct pension capital.

Table: Average statistical data on wages from 1960 to 1990

| date | Payment in rubles | date | Payment in rubles | date | Payment in rubles | date | Payment in rubles | ||||||||

| 1960 | 74,0 | 1968 | 111,8 | 1976 | 152,1 | 1984 | 192,1 | ||||||||

| 1961 | 76,0 | 1969 | 114,7 | 1977 | 158,0 | 1985 | 198,3 | ||||||||

| 1962 | 81,8 | 1970 | 120,1 | 1978 | 165,3 | 1986 | 205,2 | ||||||||

| 1963 | 83,5 | 1971 | 124,5 | 1979 | 169,3 | 1987 | 213,6 | ||||||||

| 1964 | 87 | 1972 | 131,3 | 1980 | 173 | 1988 | 232,7 | ||||||||

| 1965 | 93,0 | 1973 | 135,1 | 1981 | 176,4 | 1989 | 261 | ||||||||

| 1966 | 95,1 | 1974 | 142,1 | 1982 | 183 | 1990 | 305 | ||||||||

| 1967 | 100,4 | 1975 | 147,8 | 1983 | 189,4 | ||||||||||

Table: Average statistical data from 1991 to 1997

| Periods (by month) | Dates | ||||||||||||||

| 1991 | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | |||||||||

| Payment for labor in rubles | |||||||||||||||

| January | 305 | 1425 | 15,0 | 133,6 | 300,5 | 634,7 | 809,1 | ||||||||

| February | 293 | 2000 | 19,3 | 145,9 | 317 | 675,3 | 837,1 | ||||||||

| March | 336 | 2700 | 23,6 | 162,5 | 358,4 | 768 | 900,5 | ||||||||

| April | 368 | 3049 | 30,9 | 170,3 | 383,1 | 743,4 | 900,8 | ||||||||

| May | 429 | 3684 | 37,1 | 180,2 | 427,7 | 774,2 | 906,4 | ||||||||

| June | 491 | 5099 | 47,7 | 205,9 | 468,4 | 829,1 | 962,1 | ||||||||

| July | 539 | 5423 | 59 | 230 | 487,4 | 826,5 | 1000 | ||||||||

| August | 568 | 5893 | 65,3 | 236,4 | 518,5 | 837 | 980 | ||||||||

| September | 620 | 7356 | 80,8 | 249,1 | 558,4 | 856,0 | 1038 | ||||||||

| October | 700 | 8823 | 94 | 270 | 590,4 | 839,2 | 750 | ||||||||

| November | 827 | 10496 | 100,1 | 281,6 | 608,5 | 817,9 | 764 | ||||||||

| December | 1180 | 16154 | 140,8 | 357,1 | 729,2 | 1027 | 770 | ||||||||

The indicator of average wages by industry is of interest not only to employees, but also to employers. He is the first to provide information on the correspondence of their wages to the average level in one or another professional field... Employers, on the other hand, can conclude that it is necessary to index wages if they are below the industry average.

Of course, the average wage indicator should be used with some convention. After all, the average indicator does not take into account the peculiarities of the functioning of a particular employer. Namely, the amount of remuneration of an individual employee actually depends on these specific conditions and factors.

Where to see the average salary in Russia in 2018-2019.

The national average calculates federal Service state statistics (Rosstat, formerly Goskomstat). These indicators are calculated based on the processing of static reports submitted by organizations and individual entrepreneurs... Official statistics are posted on the Rosstat website at www.gks.ru.

As of the end of 2018, from the most relevant information on wages by industry, Rosstat officially published information on the average nominal accrued wages of employees by industry. full circle organizations by type of economic activity in the Russian Federation in October 2018. At the same time, it is indicated that the average salary in all industries in October 2018 amounted to 42,332 rubles.

The first information on the average monthly salary in 2019 will appear on the Rosstat website no earlier than the end of February.

We talked about what nominal wages are in.

Average wages in the industry

We present data on the average salary of organizations by type of economic activity for October 2018 in the form of a table:

| Type of economic activity | Average salary (rub.) |

|---|---|

| Agriculture, forestry, hunting, fishing and fish farming | 29 295 |

| Mining | 77 382 |

| Manufacturing industries | 40 462 |

| Security electrical energy, gas and steam, air conditioning | 44 901 |

| Water supply, sewerage, waste collection and disposal, pollution elimination activities | 32 192 |

| Building | 38 750 |

| Wholesale and retail trade, repair vehicles and motorcycles | 34 424 |

| Transport and storage | 46 993 |

| Hotel and business activities Catering | 26 356 |

| Information and communication activities | 60 969 |

| Financial and insurance activities | 83 353 |

| Activities for transactions with real estate | 32 034 |

| Professional, scientific and technical activities | 65 471 |

| Public administration and military security, social security | 43 591 |

| Education | 34 082 |

| Activities in the field of health and social services | 39 088 |

| Activities in the field of culture, sports, leisure and entertainment | 43 061 |