Mortgage conditions for the construction of a private house in VTb 24

A mortgage for the construction of a house in VTB 24 is not provided, since a prerequisite for a mortgage is the presence of a collateral as the real estate being purchased. But there is a solution to this problem.

Home mortgage

It is quite easy to get a mortgage from VTB 24 for the purchase of an apartment, but it is more difficult to arrange for the purchase of a land plot or for the construction of a house on the existing land. There is no special loan for this program at VTB 24, but many people want to have a dacha with a land plot, or to build a cozy private house in the city, but there is no money.

VTB 24 offers other loan options that allow you to get the required amount to buy land or build a house, as well as buy a ready-made private house with a plot.

The main problem in the absence of a specific loan (a mortgage on a private house) is that when a dacha is bought outside the city or within its boundaries, the costs are enormous, and then there is a high probability that the borrower will not be able to fully pay the amount. And if such a situation can still be dealt with by providing the bank with many documents confirming a high and stable income, then this will not affect taking a loan for the purchase of land.

Selling such land will be difficult and the proceeds will not cover the costs soon.

Selling such land will be difficult and the proceeds will not cover the costs soon. When a suburban land plot is acquired by a borrower for the construction of a house, then there is no subject of the mortgage. It is not profitable for the bank to provide a loan, knowing that in case of non-payment, it will have to take a simple piece of land or a land plot with an unfinished house as a debt.

Therefore, there is no special mortgage for building a house, but there are other ways to get a loan to make your dreams come true.

Conditions and types

To build a house, you can take not a mortgage, but an ordinary non-targeted consumer loan. VTB 24 provides three types of such loans. They are more acceptable for borrowers who want to build a house on a land plot rather than buy an apartment:

- Credit "Large".

- "Inappropriate mortgage loan".

- Credit "".

The listed types of loans differ in terms of taking and repaying the debt provided by the bank. We will now consider them in more detail.

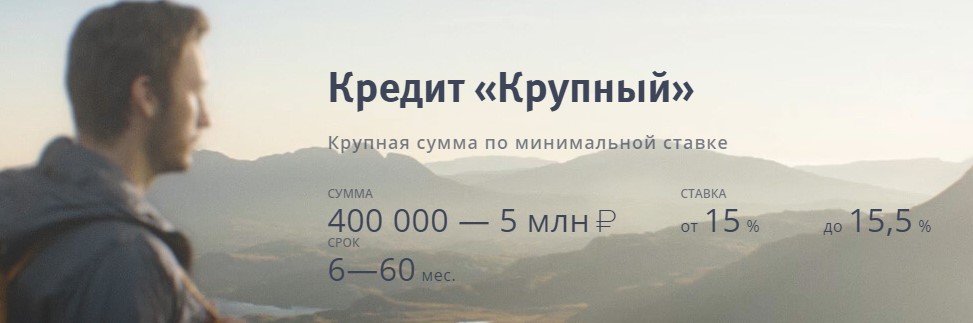

Credit "Large"

This type of loan is convenient because the borrower can take a large amount of money with a margin (after all, building materials and work services are becoming more expensive every day) without disclosing the purpose of taking borrowed funds. Such a loan has a small interest rate, and it can be reduced even by a couple of points, provided that the borrower receives a salary at VTB 24.

A person can use borrowed money at his own discretion, and if he refuses to buy land or build a house, he can buy an apartment and there will be no problem. This is a big plus of this loan program.

Inappropriate mortgage loan

An inappropriate mortgage loan is very similar to "Large", only it has certain differences in terms of taking and payments:

- Mandatory presence of collateral.

- Borrowed funds must be taken in an amount not exceeding 70% of the value of the collateral provided.

- Longer loan repayment period.

- Debt repayment can be carried out ahead of schedule without paying fines.

Such a loan is in greatest demand among people who want to build their own home.

Loan "Collateral property"

VTB 24 often takes collateralized real estate as debt repayment, after which it puts it up for sale to compensate for its losses. This group of real estate includes land plots with private houses or simply houses themselves without land (land is sometimes rented out separately from real estate).

If in the catalog of mortgage real estate, you have found a suitable housing for yourself, then you can safely take out a loan for it, and you don't even have to build anything yourself, the maxim is to remake the house for yourself.

The big advantages of such a loan are:

- Reducing the interest rate by one point when taking an insurance policy.

- The down payment on such a mortgage is only 20% of the value of the property.

- Fixed and fixed rate for the entire loan period.

- The ability to pay off debt to VTB 24 ahead of schedule and not pay fines for it.

- There are no fees for issuing money.

It is allowed to use the loan only for the purchase of certain housing as collateral, and in case of non-payment of the debt, it will be returned to the bank again.

Interest rate

It has already been mentioned that the interest rates on loans taken for the purchase of a private house or land plot are quite acceptable and do not differ much from the interest rates on mortgages for the purchase of an apartment. In addition to interest, all three of the above loans will differ in the amount of the loan, as well as the maturity. You can find out more about this data in the table.

The interest rate on the loan may vary depending on the collateral - its presence or absence, the estimated value at the time of taking out the loan, the type of real estate (apartment, house, warehouse, etc.).

Also, there are discounts for regular VTB 24 clients (especially salary ones, or those who take a loan from this bank not for the first time) and the interest rate may decrease by 1% (except for the loan "Collateral property").

An important point is the registration of insurance, most often mandatory when taking non-targeted and mortgage loans.

An important point is the registration of insurance, most often mandatory when taking non-targeted and mortgage loans.

Insurance is an additional cost, but it is also a guarantee for the bank to repay the loan, and a decrease in the interest rate on the loan for the borrower himself, which sometimes turns out to be very profitable, since insurance often does not exceed 1% of the loan amount.

Calculator

On the official website of VTB 24, you can find a special calculator that allows you to calculate overpayments, monthly payments, and also select the most optimal loan program according to the borrower's requirements.

On the official website of VTB 24, you can find a special calculator that allows you to calculate overpayments, monthly payments, and also select the most optimal loan program according to the borrower's requirements.

It is enough to indicate the loan amount and the estimated repayment period, as well as tick the boxes if you are a privileged client for one of the listed items and see all the data displayed on the right in the calculator.