How to pay a mortgage at vtb 24?

Our readers are interested in how to properly pay a mortgage for housing in VTB 24 bank. After all, most borrowers who want to get a loan for a large amount, turn to this very place or to Sberbank, because these companies have a large margin of "strength", work experience, as well as government support.

Housing programs from VTB 24 bank

Today the company has a wide selection of mortgage offers that cover all the goals that a client may pursue. There is also a program where a large amount can be received with just 2 documents, however, in this case, you will need to make a large down payment.

What you can choose from:

- Mortgage with state support for families where the second or third child was born from January 1, 2018 - from 6% per year,

- More meters - less rate (from 8.9% per annum),

- Buying a home in the primary or secondary market - rate from 9.1%,

- Victory over formalities (by 2 documents) - from 9.6%,

- Refinancing of an existing mortgage - from 8.8%,

- For military personnel - from 9.3%,

- Providing a loan secured by existing property - from 11.1%,

- Purchase of housing pledged in a bank - from 9.9% per year.

After you have chosen the program you need, found a suitable object and settled all the nuances of real estate appraisal and insurance, you apply to the bank to sign a loan agreement.

After 30 days, you will have to make the first installment, we recommend doing this 2-3 days before the reporting date, so that the payment arrives exactly on time and there is no delay.

Debt repayment options

1. Through the lender's ATMs

At ATMs, such operations are possible as payment for services in cash, payment by bank card, replenishment of the card account, connection and payment for the SMS-notification service, opening a deposit. In this article, you will find out where such bank devices are located.

The rules for transferring funds through an ATM are as follows:

- Insert the card into the machine

- Select in the menu "Cash deposit"

- Select "Deposits and Services"

- Next "Account replenishment"

- Enter account number (12 characters long)

- Select the currency of the account to which the funds are transferred

- Enter the transfer amount.

- Take the receipt that the ATM will issue after the successful completion of the transaction (this document contains all the data on the transaction just performed).

2. In bank branches

Show the operator your passport and state the account number. You can just bring your copy of the contract with you, it contains all the necessary details.

Payment is made through the cashier without a commission, while you can use both cash and money lying in your deposit account or debit card from VTB 24 Bank. You can find a list of branches at this link.

3. Via the VTB24-Online remote service system

In this case, you need to have a debit account (card) in the bank, as well as register in the Telebank system. How you can register and enter your Personal Account, we tell you here.

Replenishment of a card or current account is made by transfer from a bank account. Fill out the repayment form, enter the payment amount, confirm the operation, confirm the temporary password that will come to your phone after payment.

Video instruction

The service of automatic payments is very convenient. That is, at a certain time, the system itself will transfer money according to the schedule you specified. This service is called auto payment.

You may not even control this process and do not constantly think about the need to make the next payment. Just make sure that there is always a sufficient amount on the card for the transfer.

4. In the branches of the "Post of Russia"

To do this, you will need a postal order form, which will indicate your details and the amount to be paid. The employee will give you a receipt for payment. This option is possible only if your mortgage loan is issued in Russian rubles. You can read more about making payments in Post offices here.

In addition, if you are going to pay through the post office, then you should visit its branch no later than 8-9 business days before the due date of the next payment. If there is a delay in payment, even through no fault of yours, it will negatively affect your credit history.

Bad CI is very difficult to fix. If for some reason you have made negative entries in the dossier, then you should not despair. There are available ways to fix everything, you can read more about them at this link.

This operation may involve additional costs in the form of a commission, the amount of which should be checked with the employee in the department.

5. By transferring from another bank account. This method means paying interest for the transfer. To do this, you will need to take a contract with you, a passport and contact any bank branch of a third-party company.

There you contact the operator, the service you need is the payment of a loan from another bank. Requisites are taken from the contract, payment can also be made in cash or by card. In this case, a commission will be charged, usually it is no more than 2% of the transfer amount.

In addition, if you have a card from another bank, then you can make a transfer from it to a credit account. For example, if you have a Sberbank debit card, then you can send money through an ATM or the Sberbank Online service, detailed instructions are given in this article.

When making a loan at VTB24 Bank, the client opens an account or issues a card to pay off the debt. More information about the cards of this credit and financial institution is presented in this article.

If you want to know how to get a loan without failure? Then walk along

If you have a bad credit history, and banks refuse you, then you should definitely read this

If you just want to get a loan on favorable terms, then click

If you want to apply for a credit card, then go to

Look for other posts on this topic

It is advisable to ask the question of how to pay a mortgage at VTB 24 before applying for a loan in order to avoid difficulties in making payments. Failure to comply with the terms of payments is fraught with delays. Therefore, it is better for borrowers to immediately ask the manager about the methods of paying for the loan, as well as about possible problems with crediting funds.

Monthly installment

When concluding a loan agreement, each borrower is given a schedule of monthly payments. It is a mandatory addition to the main document, and it must be strictly observed. The bank will definitely withhold interest or impose penalties for violation of the terms of the agreement.

There are different situations in life, and it is not always possible to deposit money through the bank's cash desk. For example, a borrower is on a business trip in a region where the VTB24 branch is located very far away. Or an even more difficult situation: the debtor is abroad and does not have time to come to repay the loan. A logical question arises: how to pay a mortgage at VTB 24?

Payment Methods

A bank employee tells the client about the methods of making payments when concluding a transaction. This is necessary so that the borrower from the possible options could choose the best one for himself. The presence of low-quality debt negatively affects the bank's performance and increases its expenses on the formation of reserves, and not only spoils the client's reputation.

It should be noted that loans can be repaid not only in cash.

It is also possible to pay for the mortgage at VTB 24 through the borrower's card. So, in order to fulfill obligations in a timely manner, the bank offers its customers to make a monthly payment:

- in any of its branches;

- via the nearest ATM or VTB 24 terminal;

- using the VTB 24-Online Internet banking system;

- by wire transfer from another bank;

- in one of the branches of the Russian Post;

- using the Contact translation system.

Each of the above methods has its own advantages and disadvantages, which are best known in advance.

Using an ATM

At VTB 24, mortgage payments by card can go through ATMs. All that is needed for this is a payment card with a balance that exceeds the monthly payment, as well as the details of the credit account. The advantage of this method:

- a wide network of VTB24 ATMs;

- promptness of money crediting;

- you can pay at any time of the day and even on weekends;

- no commission.

The disadvantages are as follows:

- you must have a sufficient amount on the card;

- ATMs, like all technical devices, can malfunction;

- not all borrowers know how to use ATMs.

In bank branches

The easiest and most common way to repay a mortgage is through the bank's cash desk. The bank employee will print a receipt with all the details of the credit account, and the client will only have to deposit money.

The advantages of this option:

- instant crediting of money to the account;

- you only need a passport or payment card. You can also call the account number.

A significant disadvantage of this method is the high probability of losing time in the queue. You also need to adapt to the working hours of the bank branch, which, as you know, coincides with the standard working hours of most enterprises.

Via VTB 24-Online

Repayment of a mortgage through VTB 24-Online is a very convenient method. To use it, you need to conclude an agreement for the provision of Internet banking services. The advantages of this method are as follows:

- You can make a payment from any place where the Internet is available, on any day, without time limits;

- using the "Automatic payment" option, the loan will be repaid by the system independently, in automatic mode;

- money is credited instantly.

There is, perhaps, only one serious drawback of this method - the presence of a commission for the service. So, for a quarter of service at the "Classic" tariff you need to pay 225 rubles. In addition, generating passwords for payments using the phone will cost 180 rubles per year.

Through the "Russian Post"

You can also make a loan payment at any branch of the Russian Post. For the transfer, you only need the account details. They can be found in any VTB 24 division or in the loan agreement.

This option is suitable for those who cannot use another method. There are no special advantages from making a monthly payment through the Russian Post. And the disadvantages are as follows:

- the need to take into account the work schedule of the department;

- more likely to stand in lines;

- not the fact that the money will be sent according to the client's details. After receiving the receipt, it is recommended to verify all the data, as errors often occur;

- availability of service fees. It depends on the size of the payment and is in the range of 2-1.2%, but not less than 40 rubles including VAT. However, the larger the payment, the lower the commission;

- the transfer must be made 8-9 business days before the maturity date - this is how much time it will take to credit the money.

Cashless transfer

If necessary, you can make a monthly payment at any Russian bank. To make a transfer, you need to correctly indicate the details for enrollment. This method may be suitable for VTB clients who, for example, receive a salary from another bank. It is easier and faster for them to make a payment at home. However, in this case, it is worth considering:

- service fee - its amount depends on the tariffs of the sender's bank;

- low speed of money crediting - the payment may arrive in a few working days, so the transfer must be made in advance.

Via terminal

Payment through the terminal is practically the same as paying through an ATM. The only difference is that the borrower does not need to look for an ATM that accepts money. To make a payment through the terminal, you must correctly indicate the details of the credit account. The advantages of this method are obvious:

- accessibility, since machines are found almost everywhere;

- you can make a payment at any time;

- lack of queues.

There are also serious disadvantages:

- the presence of a large commission;

- the transfer is credited in a few days;

- there is a possibility of failures, therefore it is not recommended to throw the check out before the money is credited to the account.

Using the Contact system

Contact is an international system for transfers and payments. To make a monthly payment, you must contact any of the banks that work with this PS, fill out an application for a transfer, in which you indicate the details of the mortgage. It is important to remember that it takes 3-4 working days for the transfer to be credited, and this service is paid.

How to avoid delays

Borrowers are well aware of the importance of meeting maturities. It remains to make sure that the money is credited on time. To do this, you need to follow simple rules:

- clearly remember the maturity date and the amount of the monthly payment;

- know all the ways to make a loan payment and take into account the time the money was credited;

- it is advisable to receive confirmation that the money has arrived. To do this, you can contact the bank by calling the hotline or call the manager who accompanies the loan.

Mortgage experience in Sberbank and VTB24: Video

How to pay a mortgage at VTB 24

VTB 24 allows both remote payment methods for mortgages and payment of mortgages in VTB 24 branches in advance.

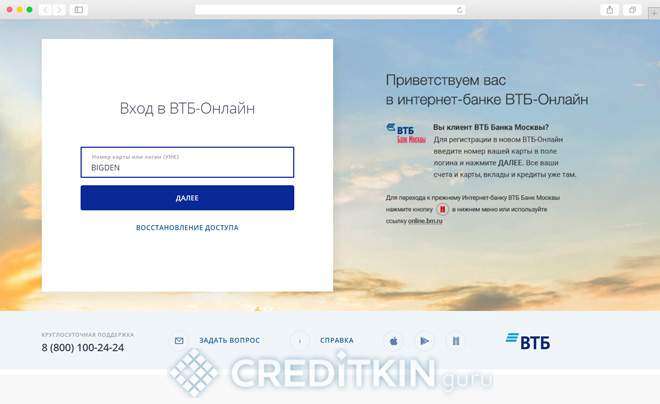

How to pay a mortgage through VTB-Online

VTB-Online service allows you to make money transfers via telecommunication networks. You can connect to it at any of the bank branches using your passport. Then you will be able to pay contributions using a PC or mobile phone.

VTB-Online allows not only repaying a loan and tracking payments, but also knowing in advance about the due date and amount of the next installment, as well as setting up automatic payments. The Internet bank will itself, without your participation, make transfers of the amounts assigned by you (payments on the VTB mortgage are annuity, constant throughout the entire loan maturity) on the day of the month you specify.

Join VTB-Online and extinguish your mortgage from your computer!

Login to VTB-Online Internet Bank - by login (card number) and password. The login button is in the upper right corner of the bank's official website.

Payment of mortgage VTB 24 via card

It is convenient to pay for a VTB mortgage through an ATM. To do this, you need to issue a VTB 24 plastic card and tie it to the mortgage agreement.

- Procedure:

- Insert the card into the ATM;

- Activate the following options in the menu in sequence: Cash deposit ⇒ Deposits and services ⇒ Account replenishment;

- Dial the 12-digit account number and define the transaction currency;

- Type in the transfer field the amount you pay to pay the mortgage;

- Take a receipt, which contains the details of the operation.

VTB ATM is ready to accept mortgage payments!

Cash to the cashier!

You can pay for a VTB loan in person at a bank branch. Have a contract and passport with you. Or just tell the teller the contract number.

Want to pay at the cashier? That way!

Funds are deposited both in cash and from a deposit.

At the post office

Repayment of the VTB loan is feasible by postal order from any post office. Inconvenience: the transfer takes a long time (up to 8-9 days), you may not get into the payment period. A minor but delay will hang on you. Will ruin your credit history.

The post office takes a commission for such transfers.

Bank to bank!

You can also pay the next mortgage payment to VTB by transferring from another bank. Commission - no more than 2%, deposit money in cash or transfer from a deposit.

previous records

Loans secured by real estate

Loans secured by real estate

Loans secured by real estate

For the convenience of customers, the bank provides the opportunity to pay the mortgage through VTB 24 online, below are instructions for working with the services of the bank's personal account.

Like any other loan, a mortgage has several key parameters:

- term of the loan agreement;

- the term for making the next payment;

- the amount of the monthly installment;

- details for transferring funds (account number, etc.).

After the merger in 2018, VTB and VTB24 are one bank.

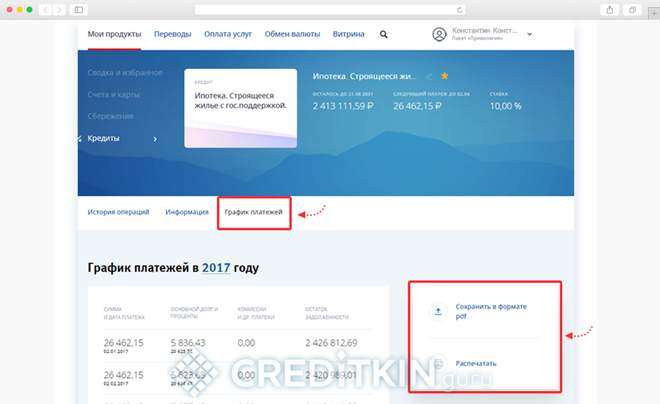

Obtaining information on mortgages through VTB Online

The above information can be obtained through the VTB Online system. Connection to the system is made at the VTB office. After the completion of the procedure, operations with accounts and other bank products, including mortgages and other loans, become available to the client.

To obtain information on mortgage debt, you must:

- enter the system with your details (login, password);

- go to the "My Products" page;

- it will have a section "Loans" with a list of all active credit products: in the section you should select the one you need and click on it, going to the information page for a specific type of loan.

Here you can see the account statement, loan parameters, history of transactions, find out the repayment schedule, the remaining debt and the amount required for the next installment.

In the section, the content can be output to a printer, and information can also be saved on a PC as a pdf document.

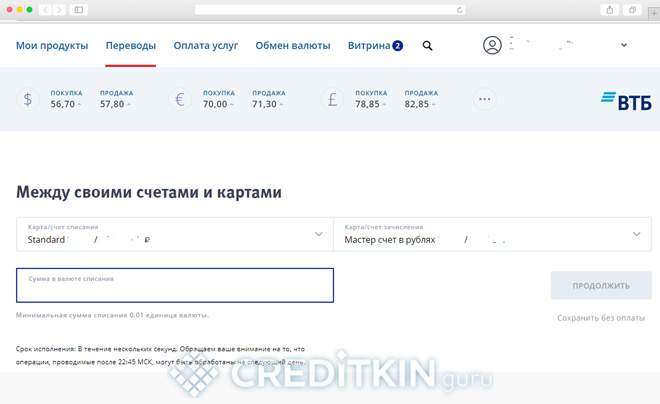

Payment instructions in your personal account

Through the online service, both regular payments and early repayment ahead of schedule are possible. To make a monthly payment, you must transfer money from one of the current accounts (including the card) to the account to which the mortgage is linked. The transfer can be made using the appropriate functionality of the online banking system in the "Transfers" - "Between your accounts and cards" section.

You should select an account for debiting and replenishment, enter the required amount and make a transfer. The system can ask for a confirmation code (if this function is enabled at the client), the code will be sent to the mobile phone linked to the system.

The second way is to find the desired product in the "My Products" - "Credits" section, click on it and press the "Replenish" button. Clicking on this button will open a dialog for transferring funds to a mortgage account.

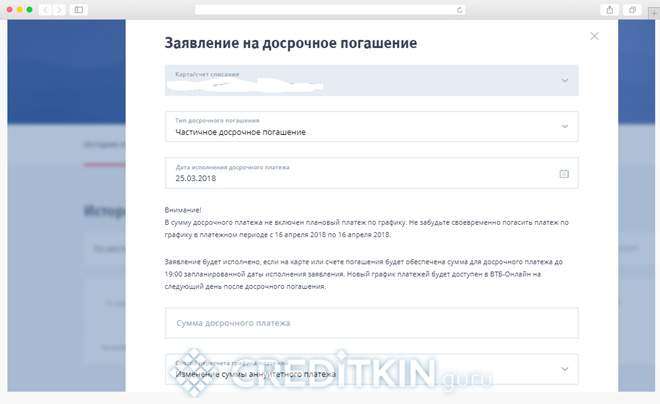

You can also repay the loan ahead of schedule, in part or in whole. To do this, the corresponding dialog is called by clicking "Redeem early":

Filling out the application, you can choose options - to reduce the term of the contract or the amount of payment.

The amount of early payment specified in the application must be available on the account on the specified date, otherwise the application will not be executed.

After such repayment, a new payment schedule will become available on the website, which can also be obtained in paper form at the bank's office.

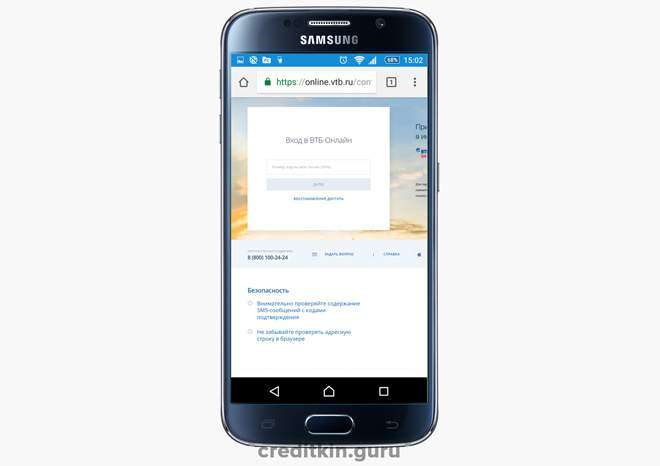

How to pay a mortgage through a mobile application

Similar functionality is available in the mobile application. Let's consider the repayment methods using the Android version as an example:

- The interface has a Products tab where you can find your current mortgage loan.

- By clicking on it, you can also pay off the debt ahead of schedule or replenish the amount of the monthly payment.

Also here you can get detailed information on the loan agreement, as in the main version of the site.