Documents for a mortgage in Sberbank

Consider documents for a mortgage in Sberbank. At the first stage of registration, not so much is required.

In this case, the supporting information may be:

- Income Proofs:

We have considered everything that is connected with the main income of each citizen. However, many have additional income, the money that will go to pay the loan. How to confirm the existence of this source of income? It's simple, you should provide a certificate of form 3-NDFL with a tax stamp. If you receive income from the rental of real estate, you are required to provide a copy of the lease agreement, documents that confirm that you own the dwelling and can make transactions, as well as a tax return.

Attention! These certificates are valid for 30 days from the date of receipt. In this regard, first of all, you should deal with certificates, which will take you a long time to obtain.

The documents that we reviewed above are necessary for the approval of the transaction only at the very beginning. Once the agency makes a decision in your favor, you will have about 120 days left to select housing.

Acquired real estate acts as collateral for a mortgage. That is why the first document that should be provided is the contract of sale.

Sberbank puts forward a number of requirements for the borrower to draw up an agreement:

- the acquired property is partially paid by the bank;

- the amount of credit funds that will be received from the bank for the purchase of residential premises;

- The property will act as a collateral for the transaction as soon as the buyer purchases the apartment.

Ask for help in drawing up this contract from specialists, since it is very difficult to do it on your own.

Please note that not only the person who purchases the property, but also the person who acts as the seller is involved in the registration of the mortgage.

What must the seller provide?

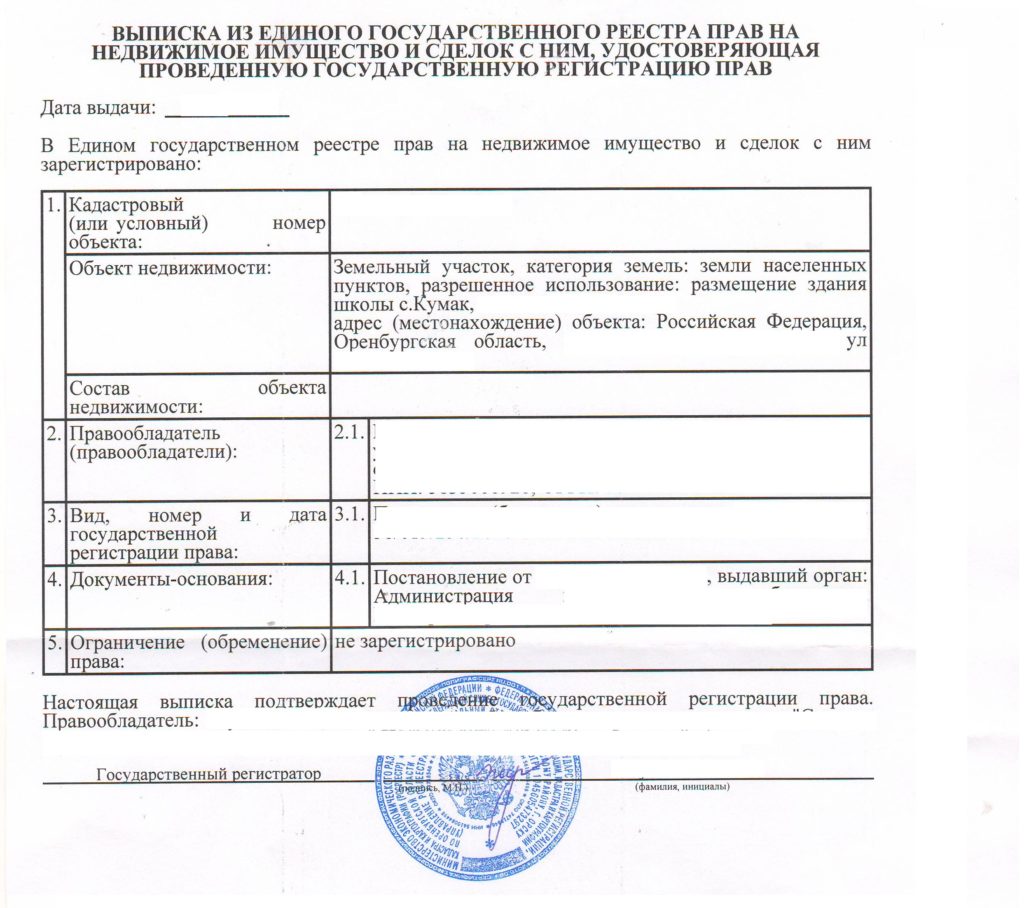

- The document on the basis of which the residential premises are sold:

- certificate confirming the right of inheritance;

- contract of sale.

Documents required by the buyer

- An independent specialist's report on the value of the market value of the acquired property. You will need to order this service from companies that have been accredited by Sberbank, otherwise you risk spending money and not getting anything in return. A list of organizations can be obtained from a loan officer. As a rule, this report is generated up to 1 month.

- Certificate confirming the availability of funds from the buyer.

- If you are married at the time of the mortgage, you need the consent of your spouse, which is certified by a notary. It should indicate that he/she has no objection to the pledge of property to the bank.

- If a person under the age of 18 participates in the transaction, the consent of the guardianship and guardianship authorities is required to conduct transactions with real estate.

Since the registration of mortgage lending is a rather lengthy process, the bank has the right to require other collateral for the period of registration of this transfer: property, vehicle, precious metal, securities, etc.

Data that must be provided within the framework of the developed special programs

Everything we talked about above is a fixed package of documents that is required to apply for a mortgage. For some categories of citizens, special programs have been developed for which additional information will be required.

Programs

"Military mortgage" It is aimed at ensuring that employees in the Russian army can purchase housing. To get into the program, certificates confirming the right to use the program are required.

"Young family" involves the provision of a certificate of marriage and the birth of children or adoption. A young family has the right to calculate the monthly repayment amount, taking into account the money that the parents receive. Therefore, it is necessary to take care of extracts confirming the existence of family ties.

"Maternity capital together with a mortgage" requires a certificate stating the grounds for obtaining maternity capital. Also, at the branch of the Pension Fund of the Russian Federation, you should take a certificate stating how much unspent funds are available under the program (valid for 30 days from the date of receipt).

In conclusion, we want to say that you start collecting first of all those documents that will take a long time to receive. Certificates that have a limited period of application are taken last.

Recommended:

Take advantage