Home Credit: consumer credit

At the beginning of its activity, Home Credit Bank specialized in obtaining loans at points of sale. Today, a financial institution provides a full range of retail banking services. It is considered one of the leaders in consumer lending.

Features of obtaining a consumer loan in Home Credit Bank

The main advantages of consumer loans from Home Credit Bank include:

- Quick loan processing. The decision to issue a loan is made within one working day, when buying goods on credit - a maximum of 30 minutes.

- Possibility to change the payment date. The service is very convenient for customers who have more than one loan.

- The minimum package of documents.

- "Transparency" of conditions. The bank does not try to "disguise" the high rate on the loan with commissions and one-time payments.

- Issuance of a loan without a guarantor/collateral.

- There is no commission for issuing/issuing a loan.

- The loan can be repaid in various ways:

- bank cash desks;

- transfer through the Internet bank from the borrower's debit card;

- cash-in ATMs;

- transfer from a salary card;

- through cash desks of other banks (term of enrollment - 5 days);

- Qiwi payment service;

- Eleksnet terminals;

- payment system "Rapida".

8. The possibility of obtaining several consumer loans at the same time (a prerequisite is the absence of overdue / restructured debt).

9. If desired, the client can insure the goods purchased by installments through Home Credit Bank.

Important! As part of the loan agreement, the loan repayment date can only be changed once. Activation of the option takes place at the office of a financial organization or an administrative point (outlet) with a passport and filling out an application.

The disadvantages of a consumer loan are:

- High cost of credit.

- Limited amount receivable (no more than 500 thousand rubles).

Home Credit Bank "Consumer Credit": interest rate, repayment terms and loan amount *

A consumer loan in Home Credit Bank is issued under two programs: "Quick Purchases" and "Big Money".

Parameters of the loan "Quick buys":

- The method of issuance is to a Mastercard credit card.

- Amount - up to 200,000 rubles. (revolving credit limit).

- The minimum payment is 5% of the amount of the debt (the minimum contribution is 500 rubles).

- The loan rate ranges from 34.9% to 44.9% (depending on the tariff plan and the availability of documents confirming the solvency of the borrower).

Important! For cashing out funds, the bank withholds a commission - 299 rubles, so it is more profitable to use a loan to purchase goods by bank transfer

Parameters of the "Big Money" loan:

- Method of issue - in cash (money is credited to the current account of the borrowers, cashing out - at the bank's cash desk).

- The loan repayment term is up to five years.

- The estimated rate is 34.9% per annum.

The decision on the Big Money loan is made within 5 days. A prerequisite for obtaining a loan is confirmation of the financial condition of the client.

The bank issues all targeted/non-targeted loans in rubles.

Home Credit: consumer loan conditions

To obtain a loan, the borrower must meet the following requirements of the bank:

- Be a citizen of the Russian Federation.

- Have permanent registration/residence in the region where the loan is received.

- Have a stable income and a positive credit reputation.

- Be at least 18 years of age and not older than 65 years of age.

Get a loan in the amount of up to 300 thousand rubles. You can use 2 documents:

- Passport of a citizen of the Russian Federation.

- Document for the choice of a potential client:

- international passport;

- driver's license of the vehicle;

- certificate of pension insurance;

- Pensioner's ID.

Clients applying for a loan of more than 300 thousand rubles must confirm their financial condition. It is enough to attach one of the following documents to the application:

- An extract from the borrower's account (current / salary) for the last 3-6 months (at the request of the bank).

- Original PTS. The document is accepted for consideration if the car is not older than 7 years - foreign vehicles, 5 years old - domestically produced vehicles.

- CASCO insurance policy provided that:

- coverage of $5,000 or more;

- validity period - more than 3 months at the time of submitting a loan application.

4. Original passport with visas confirming travel abroad for the last year. The CIS countries are not taken into account.

5. Document on the ownership of residential/commercial real estate. The client brings a copy of the certificate and the original to the bank for verification.

6. Medical insurance policy.

Important! Men under the age of 27 must provide a military ID to the bank.

Home Credit: consumer loan calculator

The Home Credit Bank website has a loan calculator that can be used to pre-calculate the amount of monthly repayment and the total overpayment on the loan. The calculation program is located in the "Loans" - "Loan Calculator" section.

To calculate, you will need to enter two parameters: the loan amount and the loan repayment period.

For example, a client plans to take out a loan to purchase goods worth 100,000 rubles, the loan repayment period is 36 months.

Calculation procedure:

- Open the Loan Calculator.

- Enter the requested parameters (amount and period of crediting).

So, the payment will be 4127 rubles. per month, and the total cost of the loan is 48572 rubles.

If the financial condition of the borrower allows you to pay more than 4,000 rubles a month, then you can recalculate and reduce the loan repayment period. To do this, the arrow in the "Monthly payment" column must be dragged to the desired repayment amount, for example, 10,000 rubles.

The calculation shows that the overpayment on the loan has significantly decreased, which means that the second option is more preferable for the client.

Important! The calculation of the repayment schedule in the loan calculator of Home Credit Bank is carried out at a minimum interest rate of 27.9%. However, not every borrower can qualify for such conditions.

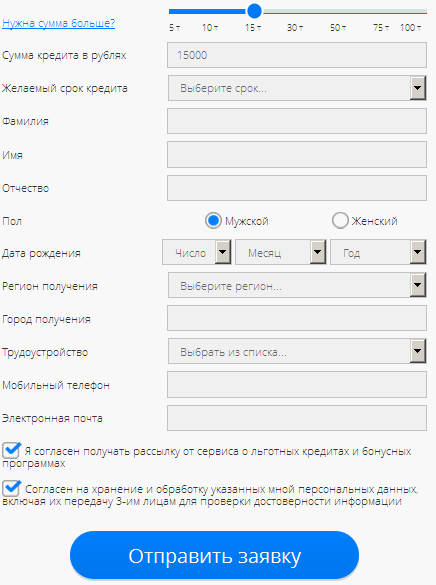

Home Credit: online application for a consumer loan

To apply for a consumer loan, it is not necessary to go to a bank branch. It is enough to have access to the Internet at hand. You can submit an abbreviated or extended application form.

When applying, you will need to enter personal information:

- date of birth;

- contact phone number and email.

When sending an extended application, you will additionally have to specify:

- method of obtaining a loan (on a card / in cash);

- desired loan parameters (amount, repayment period, optimal monthly installment);

- income information.

Important! Only customers who have received a special offer from the bank can fill out an online application. Otherwise, the system automatically issues a refusal.

How to apply for a consumer loan online at Home Credit Bank in 2 ways

Below are two options for submitting a consumer loan application.

Method 1- abbreviated application.

- Go to the official website of Home Credit Bank.

- On the main page, click on the "Online Application" button.

- In the list that opens, select "Online application for a loan".

4. Enter personal information into the form.

5. Enter the confirmation code that will be sent to the specified phone.

Method 2- Extended application.

- Go to the Home Credit Bank page - an online application processing service.

- Choose the method of obtaining a loan: in cash or on a credit card.

3. Specify the desired loan amount and click the "Next" button.

4. Enter the optimal monthly loan installment and "net" income. Go to next item.

5. Enter your full name, gender and date of birth in the form. Click "Next".

6. Enter a contact phone number and send an application for consideration.

If all the data is entered correctly, a message will appear that the application is being processed.

Home Credit: early repayment of a consumer loan

The borrower has the right to make full/partial early repayment at any time of the loan agreement. Actions of the borrower in case of early closing of a consumer loan:

- Find out the total amount of early repayment (the balance of the loan body + accrued interest at the time of closing the debt). For information, you can contact the bank branch or call the Contact Center +7 (495) 785-82-22.

- Notify the bank employee of the intention to close the loan ahead of schedule.

- Write an application for early repayment of the loan.

- Deposit money into a bank account.

- After debiting the funds (the next day), you can contact the bank for a certificate of no debt.

Important! It is better to deposit funds into the account at the branch of Home Credit Bank. In the case of payment through third-party organizations, the payment is credited within 3 to 10 business days.

Credit Home: consumer loan refinancing and "financial protection" of the client

In 2014, the program of refinancing loans in other banks was popular among Home Credit customers. The conditions for obtaining a loan favorably differed from the parameters of similar products of other financial institutions:

- loan rate - 19.9%;

- amount - up to 500,000 rubles;

- term - up to 5 years;

- registration - according to three documents.

At the moment, the refinancing program is suspended. However, if the client experiences difficulties in repaying the loan, then he can use the new banking functionality "Credit rehabilitation". In fact, this is an online application for restructuring an overdue loan.

In the section "Credit rehabilitation" you need to fill out the form:

- Enter your full name, date of birth and contact information.

- Press the "Confirm" button.

- Enter the code sent to the email address/phone number in the appropriate field.

- Briefly indicate the circumstances due to which the financial condition worsened.

- Make your proposals for changing the repayment schedule and indicate the optimal amount of the monthly installment.

- Send an application for consideration to the bank.

In April 2015, Home Credit Bank launched the Financial Protection program. The main goal is to help clients repay loans. If this option is connected to the loan agreement, the borrower receives the right to use the following services:

- Extending the loan term to reduce the monthly payment. The service is provided once for the entire loan repayment period. The interest rate remains unchanged.

- "Credit holidays" - deferred payment for 2-6 months. Activation of the service is possible only with documentary confirmation of the following situations:

- loss of the main source of income (work book);

- temporary disability (certificate from the hospital, disability certificate).

3. "Skip payment" - postponement of the next installment on the loan. You can use the service once a year.

4. "Refusal of collection" - the service can be provided in the event of force majeure.

Important! After restructuring the loan, the amount of the monthly payment should not be less than 500 rubles.

The cost of connecting the service is calculated as the product of the number of monthly payments under the agreement, the loan amount and the calculation coefficient.

Table. Determination of the calculated coefficient

Important! If the loan was issued for the purchase of goods, then the cost of connecting to the "Financial Protection" program is included in the estimated rate for the loan. The interest rate increases by 3.3-8.3 points.