How to find out the details of the bank of Moscow for transfer to the card

Bank of Moscow is one of the most popular banks offering quality services to its clients. In this bank, you can open a deposit, take out a loan, and receive wages. But sometimes it may be necessary to transfer funds to the card to another client of the organization. In this case, the question arises of how to find out the details of the Bank of Moscow for transfer to the card.

How to find out the details of the Bank of Moscow for transferring to the card of an individual

If you need to transfer funds, you need the details of the organization, but where can I get them? This information can be found on the official website of the Bank of Moscow. When translating, you must indicate the following:

- TIN 7702070139;

- KPP 770943002;

- BIK 044525411;

- correspondent account No. 30101810145250000411.

When transferring funds to another client of the bank, it is necessary to indicate the name of the recipient and the number of the recipient's card in the purpose of payment. All information is available to absolutely every user for free on the official resource.

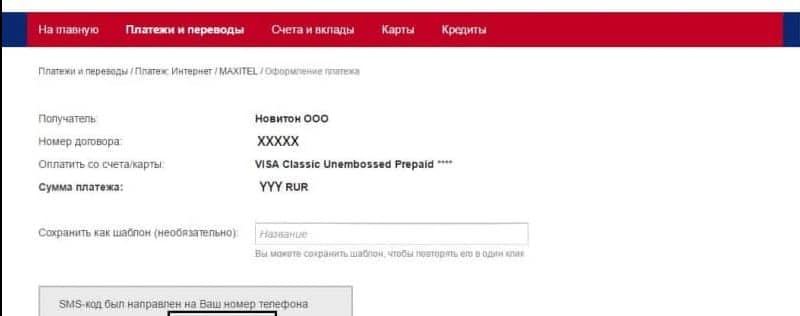

Another way to get the data you need is to use internet banking. To do this, you need to register with the bank and log in. Currently, this is considered, perhaps, the most convenient and accessible way to obtain information.

After that, you need to follow the instructions:

This information can also be obtained completely free of charge.

Other ways to obtain data

If it is not possible to access the Internet, then in this case the client can call the hotline at 8 800 200 23 26 ... The manager will provide the desired information free of charge. To identify the person, it will be necessary to provide the information requested by the manager. This can be the series or number of the passport, the mother's maiden name, the card number or the cell phone number to which the plastic is attached.

Another option is to use an ATM of the Bank of Moscow. Other ATMs will not be able to provide classified information. To do this, the plastic must be inserted into the ATM, enter the information required for authorization and get the desired data on the screen. If desired, the client can print the details on the check. When printing checks, this information is always issued, which is why it is recommended to take all checks with you.