Exchange rate to be. Exchange rates

Essential elements of any monetary system are the currency and the exchange rate.

CURRENCY (from Italian valuta- price, value) is a monetary unit used to measure the value of a product.

Concept "currency" applies in three ways:

a) the country's monetary unit (dollar, yen, ruble, etc.) and one or another of its types: paper, metal;

b) foreign currency- banknotes foreign countries, as well as credit and payment instruments denominated in foreign monetary units ah and used in international settlements;

c) international (regional) monetary unit of account and means of payment(SDRs issued by the IMF and EURO issued by the European System of Central Banks, headed by the European Central Bank).

Depending on the mode of use, currencies are divided into:

a) fully reversible (freely convertible),

b) partially reversible (partially convertible),

c) irreversible (inconvertible, closed).

Fully reversible the currencies of countries are called, the legislation of which practically does not have currency restrictions. These currencies can be exchanged for any other currencies without special permissions. These include the US dollar, Canadian dollar, Swiss franc, Japanese yen, and a few others.

Partially reversible are the currencies of countries in which currency restrictions remain, especially for residents 1, in relation to a certain range of foreign exchange transactions,

TO irreversible includes the currencies of those countries in which various restrictions and prohibitions apply both for residents and non-residents regarding the import and export of national and foreign currency, currency exchange, sale and purchase of currency and currency values and etc.

Currency convertibility is one of the tools by which the influence of national borders on the movement of goods, services and capital on a global market scale is neutralized.

CONVERSIBILITY, or reversibility (from Lat. Convertere- to change, transform) - the ability of the national currency freely, without restrictions, exchange for foreign currencies and vice versa without direct government intervention in the exchange process.

CURRENCY RATE is the value ratio of two currencies during their exchange, or the "price" of the monetary unit of one country, expressed in the monetary units of another country or in international means of payment. It reflects in an average form a complex set of relationships between two currencies: the ratio of their purchasing power; inflation rates in the respective countries; supply and demand of specific currencies in international foreign exchange markets and etc.

The most important element of the monetary system is currency parity - the ratio between the two currencies, established by law. Under monometallism - gold or silver - the base of the exchange rate was monetary parity - the ratio of monetary units of different countries according to their metal content. It coincided with the concept of currency parity.

The exchange rate regime is also an element of the monetary system. Differ fixed exchange rates fluctuating within narrow limits, and floating rates that change depending on market demand and supply of currency, as well as their varieties.

Under gold monometallism, the exchange rate was based on gold parity - the ratio of currencies according to their official gold content - and spontaneously fluctuated around it within the gold points. Classic movement gold points operated under two conditions: free purchase and sale of gold and its unlimited export. The limits of exchange rate fluctuations were determined by the costs associated with the transportation of gold abroad (freight, insurance, loss of interest on capital, testing costs, etc.), and in fact did not exceed ± 1% of parity. With the abolition of the gold standard, the gold dot mechanism ceased to function.

Exchange rate with irredeemable credit money, it gradually broke away from gold parity, as gold was pushed out of circulation into a treasure. This is due to the evolution of commodity production, monetary and monetary systems. For the mid-1970s. the basis of the exchange rate was the gold content of currencies - the official scale of prices and gold parities, which were fixed by the MYTH after the Second World War. The measure of the ratio of currencies was the official price of gold in credit money, which, along with commodity prices, was an indicator of the degree of depreciation of national currencies. In connection with the separation for a long time of the official price of gold fixed by the state from its value, the artificial nature of gold parity has increased.

The exchange rate has a great impact on many macroeconomic processes in the global and national economy. The level of the exchange rate, with the help of which the prices for goods and services produced in different countries are compared, determines the competitiveness of national goods in world markets, the volume of exports and imports, and, consequently, the state of the current account balance.

None of the exchange rate systems have an exceptional advantage in terms of achieving full employment and stable price levels.

The main advantage of the system of fixed exchange rates- their predictability and certainty, which has a positive effect on the volume of foreign trade and international loans. Disadvantages This system is, firstly, the impossibility of conducting an independent monetary policy and, secondly, the high probability of errors when choosing a fixed level of the exchange rate.

The main advantage of a flexible exchange rate lies in the fact that it acts as an “automatic stabilizer” contributing to the settlement of the balance of payments. At the same time, significant fluctuations in exchange rates negatively affect finances, creating uncertainty in international economic relations.

The exchange rate as a macroeconomic indicator reflecting the country's position in the system of world economic relations occupies a special place in the system of indicators used as a means of state regulation of the balance of payments. The reason is that its increase or decrease immediately and directly affects the economic situation of the country. Its foreign economic indicators, foreign exchange reserves, debt, dynamics of commodity and financial flows are changing.

There are several options for establishing exchange rate ratios between national and foreign currencies:

"floating" exchange rate - the rate of the national currency in relation to foreign ones - freely fluctuates depending on supply and demand;

adjustable, or "dirty swimming" - the exchange rate of the national currency fluctuates until the changes reach a certain limit, after which the state begins to use regulatory levers;

"Step swimming" - exchange rates fluctuate, but if certain limits are reached when “fundamental or structural changes” occur, when ordinary financial regulatory measures are insufficient, the country gets the right to devalue, that is, a one-time change in the exchange rate;

"Joint swimming", or the principle of "currency snake" - exchange rates fluctuate around some officially established parity, but at the same time their fluctuations do not leave certain fixed limits;

fixed rate - the national currency is rigidly pegged to another currency or to another parity.

Common to all cases is the use of the dynamics of changes in exchange rates (or the ratio of domestic and foreign currency) to adjust the balance of payments. These changes can be one-time or regular and take the form of devaluation (if the value of the national currency is constantly falling) or revaluation (in case of an excessive appreciation of the national currency).

Regulated or “dirty swimming”, “step swimming”, “joint swimming”, or the principle of “currency snake” - all forms of currency regulation are modified versions of two main approaches to regulating exchange rate relations: a “floating” exchange rate that freely fluctuates in depending on supply and demand, and a rigidly fixed rate. The individual elements of these two courses are combined in various combinations.

The peculiarity of a freely fluctuating exchange rate is that its fluctuations are considered, if not as the only, then at least the most important means of ensuring the regulation of the country's balance of payments. This is explained by the adjustment mechanism: an easier way to equalize the balance is to change the price of the currency that determines the relationship between prices, compared, for example, with the restructuring of the entire internal mechanism of economic relations (taxation, emission activities, etc.). Fluctuations in the price of a currency, occurring in parallel with the payment imbalance, make it possible to make adjustments less “painfully”, without attracting external sources of financing. Proponents of the floating exchange rate emphasize its ability to automatically regulate the value of exports and imports.

A “floating” exchange rate allows the export of goods for which the country has a comparative advantage, and thus optimizes its participation in the international division of labor.

The advantages of a “floating” exchange rate include the government's ability to pursue a relatively independent national economic policy (primarily aimed at providing more employment and increasing economic growth).

For example, supporters of the introduction of a "floating" US dollar rate note the need for a more independent economic policy in the context of the US dollar fulfilling the function of the world currency and the obligations arising from this.

In modern conditions, the exchange rate is influenced by many factors that cannot be taken into account by the government, the Central Bank, or any other official bodies.

It is the “floating” exchange rate that most realistically reflects these impacts and provides an effective response to them, indicating the real value of the national currency in the world market. This approach explains why in most countries completely free floating was used only for short periods of time to determine the real price of the national currency.

At the same time, the "floating" exchange rate has a drawback. Significant short-term fluctuations in it can destabilize foreign trade transactions and lead to losses due to the impossibility of fulfilling previously concluded contracts.

The listed disadvantages exclude a fixed exchange rate pegged to any stable value unit. The fixed rate allows predicting entrepreneurial activity, regulating the level of profitability of future investment programs. I Almost all entrepreneurs and bankers are in favor of a fixed rate of the national currency.

A fixed exchange rate is especially important for industries focused on a significant volume of imports (high-tech industries) with a high share of exports in total production. Such a rate means the forecasted amount of the transferred currency in the future, necessary for the development of investment programs related to a long payback period of the invested funds. The fixed rate is effective for organizations with long-term and stable relationships. It is especially beneficial for maintaining and maintaining the political "face" of the leadership and testifies to the strength and reliability economic policy government. The government undertakes to maintain the stability of the currency, and, accordingly, the country's position in the system of world economic relations. The country's leadership, as it were, confirms that there is enough confidence and financial resources at the national and international levels to maintain the stability of the national currency. At the same time, it assumes the costs of “smoothing” possible short-term fluctuations, which are especially dangerous for foreign trade transactions.

The introduction of a fixed exchange rate poses a number of problems for the national government. The most important of them is maintaining "external equilibrium", that is, balancing external settlements in order to maintain the exchange rate at a constant level.

The efficiency and expediency of using fixed or "floating" exchange rates as a means of regulating the balance of payments can be summarized as follows. As evidence of the stability and strength of the country's economic and political system, a fixed exchange rate can only exist in the context of a stable macroeconomic policy of the government. Job creation programs, tax policy - everything should be subordinated to the interests of maintaining a stable exchange rate of the national currency.

Exchange rate- the price of the monetary unit of one country, expressed in the monetary unit of another country. Determining the price of the national currency (exchange rate) is called quotation.

When carrying out foreign exchange transactions, foreign exchange market participants have claims (assets) and liabilities (liabilities) in various currencies. The ratio of claims and obligations for a specific currency of a market participant forms its currency position. She is considered open, if assets and liabilities for a given currency do not match, and closed, if they match.

Open currency positions are long and short. Long currency position means exceeding the requirements for the purchased foreign currency above obligations for the same sold currency and is indicated by a plus sign. Short a currency position, on the contrary, means an excess of obligations over requirements and is indicated by a minus sign. Any of these positions indicates exposure to risk due to changes in the exchange rate, and therefore, the possibility of a profit or loss.

In order to avoid the negative consequences of conducting risky foreign exchange transactions, the central bank sets limits for the open position in foreign currency for commercial banks in relation to their equity capital... Banks are required to monitor compliance with these limits and report on them on a daily basis. If a bank carries out speculative operations in the foreign exchange market, then its actions to open a foreign exchange position should be correlated with the movement of the exchange rate: if the currency is strengthening, it should be supported by it. long position, and if it depreciates, form a short portion on it. For example, given modern trends in the international foreign exchange market, taking into account the dynamics of the US dollar and the single European currency, banks should maintain a long position in the strengthening euro and a short position in the US dollar.

The exchange rate plays an important role in modern economy... Like the price of any asset, it is subject to fluctuations that are associated with a change demand for currency and its supply, formed under the influence of many factors. Among them are usually distinguished fundamental (economic) factors and non-economic factors. The former are determined by the main macroeconomic indicators (GDP dynamics, inflation rate, balance of payments and money market) and form long term trends in the behavior of the exchange rate. The latter are usually associated with political events(change of the country's leadership, defeat of the ruling party in the parliamentary elections, increased tension in international relations, military actions in certain regions, etc.) and cause short-term fluctuations the rate of individual currencies. Often, such fluctuations are the result of careless or ill-considered statements by certain high-ranking civil servants, especially heads of government bodies responsible for conducting financial and monetary policy.

The exchange rate is an important object of state macroeconomic policy. By changing it, the balance of payments is often settled. The exchange rate plays a significant role in the conduct of monetary policy, since maintaining a stable exchange rate of the national currency may, in some cases, require the use of gold and foreign exchange reserves countries, and in others - an increase in credit issue, which ultimately affects the monetary system of the state.

Changes in the exchange rate of the national currency affect the volume of exports and imports. All other things being equal depreciation of the national currency(her devaluation) in relation to foreign currencies reduces the cost of exports and increases the cost of imports. The competitiveness of export goods in international markets is increasing, their manufacturers are increasing their export volumes, thereby creating conditions for the formation of an active balance of payments. On the other hand, imported products that have risen in price are becoming less affordable for local consumers, the volumes of imports are decreasing and conditions are being created for the development of import-substituting production. This is precisely the picture that was observed in the Russian economy in the first years after the hardest financial crisis August 1998 The appreciation of the national currency (its revaluation) can lead to opposite results, however, the "expensive" currency is an indicator of the stability of the country's economy and makes it attractive to foreign investors.

Thus, the exchange rate affects the state of the trade and balance of payments. However, there is also a reverse effect of the country's foreign trade on the state of the exchange rate. The growth of imports inevitably leads to an increase in demand for foreign currency, which means its rise in price. With a reduction in imports, the opposite trend is observed. A country's exports also have a big impact on the state of the exchange rate. Thus, an increase in Russian exports causes an increase in demand for rubles, as exporters pay wages and pay for domestic raw materials, components, materials and equipment in rubles. And this leads to an increase in the ruble exchange rate. Moreover, the inflow of petrodollars to Russia increases their supply in the domestic foreign exchange market and leads to the depreciation of the American currency against the Russian ruble. It is this circumstance that can explain the increase in gold and foreign exchange reserves. Russian Federation from 4.8 billion dollars, in 1998 almost 600 billion dollars, in August 2008, their decline in the first half of 2009 and subsequent growth simultaneously with an increase in prices for Russian export goods. At the beginning of 2016, the volume of gold and foreign exchange resources of the Russian Federation amounted to about USD 380 billion.

Thus, when evaluating possible changes exchange rate should take into account not only the state of exports and imports, but also other factors: changes in customs tariffs and taxation systems, government regulation measures, the establishment of import and export quotas, current tasks of macroeconomic policy, general political situation in the world and in individual regions, the prevailing conjuncture international markets, interstate movement of capital, etc.

There are two main systems for regulating the exchange rate of the national currency - a system of fixed exchange rates and a system of floating (flexible) exchange rates.

With the system fixed exchange rate the country's central bank fixes the exchange rate and commits to keeping it constant. In the event of a deviation of the fixed exchange rate from its equilibrium value, the central bank carries out foreign exchange intervention (buys foreign currency in case of an increase in supply, or sells currency from its own reserves when demand for it increases) in order to maintain the announced level of the exchange rate. The system of fixed exchange rates operated in most countries, including industrialized ones, until the end of the 1970s.

With the system freely floating exchange rates the central bank does not interfere with the activity of the foreign exchange market, and the exchange rate is established as a result of the interaction of supply and demand. An increase in demand for foreign currency leads to an increase in its rate against the national currency, which in this case becomes cheaper. In turn, a decrease in demand for foreign currency leads to its reduction in price and appreciation of the national currency.

Per last years various flexible (intermediate) options for systems for regulating the exchange rate, among which are:

- - limited flexible rate, when the parity is fixed in relation to any currency, and the exchange rate can fluctuate around this parity within certain limits;

- - adjustable exchange rate, when the exchange rate adjusts more or less automatically in accordance with changes in certain economic indicators, for example, the rate of inflation;

- - manageably floating exchange rate, when the central bank sets the exchange rate and often adjusts it based on the state of the balance of payments and the volume of the country's foreign exchange reserves;

- - "Currency corridor" at which the limits of fluctuations in the exchange rate are determined, which the state undertakes to maintain. In contrast to the limited flexible exchange rate within this system, the Central Bank does not set the central rate, but simply determines the boundaries in the national currency within which the exchange rate can fluctuate;

- - "Creeping" fixation, which is a kind of mechanism of a narrow exchange rate band with a fixed official rate, the level of which is often revised.

A country's choice of a specific exchange rate system is determined by a combination of factors, including the level economic development, the scale of the economy and the degree of its diversification, the state financial markets, monetary system and the balance of payments, the volume of gold and foreign exchange reserves, etc.

Flexible exchange rate preferred for big countries with a relatively "closed" diversified economy, high level economic and financial development.

Fixed exchange rate in various variations turns out to be more preferable for small states with open economy, which are highly dependent on foreign trade with a high share of individual countries in foreign trade turnover.

At the same time, none of the systems for regulating the exchange rate can be considered optimal from the point of view of ensuring macroeconomic stability. This is largely due to the action of many factors that do not depend on a single country, in particular, the current situation in the world market and the state of the international monetary system, within which the exchange rates of national currencies move.

As a relatively isolated and developed part of international economic relations, the international monetary system took shape in the second half of the 19th century. Historically, its formation is associated with the dominance of the gold standard monetary system throughout the world, when the monetary units of individual states (dollars, marks, francs, rubles, etc.) were expressed in a certain amount of gold, were represented by gold coins, and the ratio between them was determined in proportion to the amount of gold contained in them.

A more complex and real gold standard system involves the parallel use of both gold coins and paper banknotes, which the central bank must be ready to exchange for gold at any time. Consequently, all the country's money should be valued as gold and directly expressed in the value of gold, although it does not fulfill the main function of a medium of circulation. The central bank must have gold reserves in order to exchange paper money for gold on demand. In this case, the government is deprived of the right to print money without additional gold backing.

In 1867, more than 20 countries signed an agreement in Paris on the gold standard system in international settlements. Gold was proclaimed as the universal form of world money. In 1871 Germany joined the Paris system, a little later - Holland, Norway, Sweden and the countries of the Latin Monetary Union. Russia switched to the gold standard in 1893, Japan in 1897, India in 1898, and the USA in 1900. Of the large countries, by 1914, only China adhered to the silver standard.

International settlements merged with the principles of national monetary systems. Money turnover was 60% represented by paper money, which had unlimited exchange for gold, and 40% - gold coins. The exchange rate of national currency units was equated to a certain amount of gold and was set depending on the amount of gold in circulation. The exchange rate of the national currency was rigidly fixed. When performing international trade operations, the exchange rate between the currencies of the countries participating in the transaction was determined by the ratio in monetary units of the amount of pure gold. So, in 1897 the gold content of the US dollar was 0.04 837 ounces, and one British pound sterling - 0.2354 ounces. Accordingly, the exchange rate was $ 4.866, for 1 lb. Art. The regulation of exchange rates was provided through the upper and lower limits, limited by the so-called "golden points", due to the costs associated with melting, minting, transporting gold and insuring it in transit.

The gold standard system lasted until the First World War. At its end, separate European countries and the United States tried to return to the gold standard, but this was prevented by the world economic crisis at the turn of the 1920s-1930s. And although in 1933 a group of countries adhering to the gold standard (France, Belgium, the Netherlands, Switzerland, and then Italy and Poland) formed the so-called Golden Block to preserve the existing system of international settlements, later they all introduced restrictions on the exchange of national currencies for gold. In 1936 g. Golden Block finally disintegrated. The second has begun World War, as the end of which approached, the question of the post-war development of the world economy, including the creation of a new international monetary system, began to be raised more and more often.

In 1944, in the city of Bretton Woods (USA), 44 states, including the USSR, developed an agreement on the international system monetary and financial settlements, called Bretton Woods. Based on the experience of pre-war development, it was decided to abandon free floating rates and introduce fixed rates. At the same time, the system was based on the gold standard, but the US dollar acted as a full-fledged substitute for it as a world reserve currency... Other currencies were set against the dollar at fixed parities, and the dollar had to maintain a constant price against gold ($ 35 per troy ounce (31.1 g). Countries could hold reserves in gold and dollars, and the Federal backup system(FRS) The US was obliged at the first request of the central bank of any country to convert dollars into gold. Consequently, the Bretton Woods monetary system was gold and foreign exchange standard dollar as the main reserve currency.

By the end of the 1960s. confidence in the dollar, on which the international monetary system was based, dropped markedly. Attempts to reform the Bretton Woods system in the early 1970s have failed.

In February 1973, the US dollar crisis led to the closure of the international currency market, and the 1973-1974 energy crisis. finally buried this system. In 1976, complex multilateral negotiations in Kingston (Jamaica) ended with the signing of an agreement that marked the beginning of the formation of the so-called Jamaican Monetary System, which, with minor innovations, is still in effect. First of all, changes were made to the IMF Charter, which determined new order setting exchange rates. Each country - member of the IMF has the right to independently choose any system for regulating the exchange rate. States were instructed to pursue policies aimed at growing economies at stable prices and refrain from manipulating exchange rates to gain a competitive advantage over other countries.

The transition from the gold and foreign exchange standard to multicurrency, ended in 1978. The official gold price and gold parities were abolished. From this point on, gold no longer serves as a measure of value and a reference point for exchange rates. No national currency, including the US dollar, is no longer exchanged for gold, which has ceased to function as the only universal means of payment, but has remained a special liquid asset that, in certain cases, can be traded for currency. National monetary units have become established as means of international settlements. The US dollar has partially lost its position to other freely convertible currencies: the German mark, Japanese yen, Swiss franc and others, as well as international accounting units - SDR and ECU. Currently, in the international monetary system, along with the US dollar, the collective currency of the united Europe, the euro, is gaining more and more importance.

The European monetary system began to take shape in the 1960s. Back in 1964, the EEC Monetary Committee was created, which included the heads of central banks, and joint principles were developed for regulating balances of payments and national currencies.

Subsequently, a set of measures was implemented aimed at bringing Western European countries closer together in the monetary and financial sphere. However, the decisive role in the transition of the EU to a single currency was played by the Maahstrichst Treaty, which entered into force on November 1, 1993. According to the treaty, this transition was to be carried out in three stages. At the first stage (until December 31, 1993), the formation of a single internal market was completed and work was carried out to bring the main macroeconomic indicators of the participating countries closer together. Thus, the inflation rate should not have exceeded by more than 1.5% the average inflation rate of the three countries with the lowest price increases: deficit limits state budget were set at 3% of GDP, and public debt- 60% of GDP. Interest rate should not have deviated by more than 2% from the refinancing rate in the three countries with the lowest inflation rates.

At the second stage (until December 31, 1998), the European Monetary Fund began to function (since 1994) - an organization considered as the predecessor of the European Central Bank. Rules of operation have been developed European system central banks and measures to coordinate the economic policies of the participating countries, unified systems of monetary and financial circulation.

On January 1, 1999, the third stage of the formation of the European Monetary System began. From that date, the members of the monetary union began to use the new European currency in non-cash payments - the euro. Central banks refused to issue national currencies and made the European Central Bank responsible for the formation of a joint emission policy. Preparations have begun for the transition to euro cash circulation. Everything consumer prices member countries have been converted to euros. Extensive explanatory work was carried out with the population. From January 1 to June 30, 2002, in 12 EU countries, national banknotes were completely withdrawn from circulation and replaced by cash euros in the form of banknotes uniform sample and coins, differing by country only by national symbols on the reverse side. The third stage of the formation of the European monetary system has come to an end.

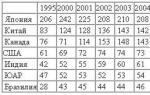

Initially, the common European currency was valued against the US dollar at $ 1.17, per 1 euro. Then the euro rate dropped to minimum value 0.87 euros for 1 dollar. However, in 2003-2015. the situation on the world foreign exchange market has changed again. The euro has become a stable currency, pushing the American currency out. Its exchange rate against the dollar has increased and fluctuates in the range of 1.10-1.12 US dollars per euro. A growing number of countries keep part of their gold and foreign exchange reserves in the common European currency.

- On January 1, 2011, the euro area includes 17 EU member states.

The formation of stable relations regarding the purchase and sale of currency and their legal consolidation have historically led to the formation of national and then world monetary systems.

National monetary system is a form of organization of a country's currency relations, determined by its currency legislation. Peculiarities NBC are determined by the degree of development and specificity of the economy, as well as foreign economic relations of a particular country.

NVS includes track. main components:

National den. unit (national currency);

Composition of official gold and foreign exchange reserves;

Parity nat. currencies and the mechanism of formation of the exchange rate;

Conditions for the reversibility of the nat. currencies;

The presence or absence of currency restrictions;

The order of the implementation of the medjunar. calculations of countries;

The regime of the national foreign exchange market and the gold market;

National bodies serving and regulating the currency relations of the country.

Very the degree of currency convertibility is important for the system, i.e. the degree of freedom of its exchange for foreign (freely convertible, partially and non-convertible (for more details, see the previous ticket). Currently, only currencies developed countries- fully convertible, in most countries - certain restrictions. Russia has already reached the convertibility of the ruble at current operations... Full convertibility of the ruble is possible only with a profound restructuring of the country's economy. The national currency is exchanged for the foreign currency of another country at parity - a certain ratio established by law. For the functioning of the monetary system, the exchange rate regime is important. 2 polar regimes: fixed (sometimes fluctuations within narrow limits ... in my opinion, the Russian ruble is in a certain corridor) and free floating (formed under the influence of supply and demand).

The national monetary system of Russia is the state-legal form of organization and regulation of its monetary, credit and financial relations with other countries. It is an integral part of the country's monetary system. This system is in the process of formation and has not yet been finally formed. However, its contours and main tendencies were revealed quite definitely. At the end of the 1990s, the Russian institutional monetary mechanism, in terms of its main parameters, practically approached the criteria inherent in Western countries.

The national monetary system of Russia was formed taking into account the structural principles of the world monetary system, since the country seeks to integrate into international financial mechanisms and joined the IMF in June 1992. The recognition of the charter of the Fund imposes on it certain obligations regarding the structure of its monetary system. Let's consider the main elements of the modern monetary system in Russia.

1... The main currency of the system is the national currency - the Russian ruble, introduced into circulation in 1993. and replaced the USSR ruble.

2.Since the beginning of the implementation of economic reforms, Russia has actually introduced internal, i.e. only for residents (legal and individuals country), convertibility of the ruble on current transactions of the balance of payments. At the same time, currency restrictions were imposed on the financial transactions of residents.

3... The ruble exchange rate is not officially pegged to any western currency and currency basket. A floating exchange rate regime has been introduced in Russia.

4. An element of the Russian monetary system is regulation international currency liquidity, those. first of all, official gold and foreign exchange reserves, which are used to ensure interstate settlements and regulate the exchange rate of the ruble.

5. Regarding next item monetary system - international credit circulation, then our country has long been guided by unified international norms that regulate the use, in particular, of bills of exchange and checks.

6. Regulation of international settlements Russia is also carried out in accordance with the Unified Rules and Customs for documentary letters of credit and collection.

8. In Russia formed domestic market gold, precious metals and precious stones.

9. In Russia a legal and institutional mechanism of regulation has been formed the activities of the national authorities for managing currency relations, the conduct of currency policy and currency regulation. This regulation is carried out in three main directions.

The main directions of foreign exchange regulation and currency control in RF:

Customs - bank control for the receipt of foreign exchange earnings from export operations;

Foreign exchange control over the validity of payments in foreign currency on imported goods;

Currency control in barter transactions;

Implementation of foreign exchange control in non-trade turnover.

Exchange rate- the ratio between 2 currencies (the price of one currency, expressed in denominations of units of another country), which is established by law or is formed on the market under the influence of supply and demand.

In theory, there are 5 systems of exchange rates:

1. free (clean) swimming ; shaft rate is formed under the influence of supply and demand for the currency.

2. guided swimming ; supply and demand also have an impact. But here the regulating power of the central banks of the countries is quite noticeable, as well as all sorts of market fluctuations.

fixed rates; The system of fixed rates was the Bretton Woods monetary system (1944 - early 70s).

3. target zones ; is a kind of fixed rate system. An example is commit Russian ruble against the US dollar in the corridor established by the Central Bank of the Russian Federation.

4. mixed system exchange rates ... - is a modern international shaft system.

Two alternative exchange rate regimes

1.fixed

2. floating.

In the process of evolution of the world monetary system, there was a transition from fixed to floating rates. Currently, each country independently chooses the regime for setting exchange rates. On this basis, the International Monetary Fund classifies currencies into one of the following three categories:

1) pegged to one or several currencies;

2) with limited flexibility;

3) increased flexibility.

In Russia use several types of exchange rates ruble:

- official rate of the Bank of Russia... In May 1996, the Bank of Russia refused to link the official ruble exchange rate to the MICEX fixing. The official exchange rate began to be determined on a daily basis, based on the supply and demand of foreign exchange in the interbank and exchange currency markets. In the context of the financial crisis, it began to be determined in the course of two-section trades in foreign currency on the MICEX;

- stock exchange rate - ruble exchange rate on stock exchanges;

- commercial banks rate(commercial banks licensed by the Bank of Russia to conduct foreign exchange transactions independently quote foreign currencies in rubles). Banks set purchase and sale rates at which they exchange foreign currencies for rubles and vice versa. Rates for cash and cashless payments;

- auction rate - this is the ruble exchange rate at currency auctions;

- black market rate;

- cross-courses - quotation of two foreign currencies, none of which is national currency a party to the transaction, or the ratio of two currencies, which follows from their rate in relation to any third currency. For example, at the rate of the Bank of Russia as of January 22, 2000, $ 1 = 28.44 rubles, 1 German. stamp = 14.79 rubles. One mute. mark = 14.79 / 28.44 = $ 0.5200

During the financial crisis, the Central Bank of the Russian Federation began to set the official course in a new way... Since October 1998, all currency exchanges of the country began to hold two sessions: in the morning - a special trading session, during which only exporters and authorized banks could sell currency; the Central Bank also took part in this session; in the afternoon - an ordinary trading session, according to the results of which the official rate was determined.

Essentially, two exchange rates were set: one for exporters and importers, one for everyone else. The Central Bank has suspended a number of large commercial banks from participation in the auctions, which have destabilized the situation in the foreign exchange market.

In 2000 the policy of the exchange rate of the Bank of Russia is carried out using the regime floating the exchange rate of the ruble against foreign currencies. The Bank of Russia did not set any specific parameters for the change in the exchange rate either for the year as a whole or in its individual periods. The main smoothing tool excessive fluctuations in the exchange rate of the ruble were interventions in the domestic foreign exchange market... One of important objectives of the Bank's policy Russia was the accumulation of gold and foreign exchange reserves and their maintenance at a level that ensures confidence in the ongoing monetary policy and the stability of the Russian monetary and financial system.

The main legislative act in the field of currency relations of the Russian Federation is the Law "On Currency Control and currency regulation", As well as other laws and regulations.

The Bank of Russia establishes and publishes official exchange rates of foreign currencies against the ruble.

Central banks carry out monetary policy to maintain the market rate of national currency units. Their role is reduced mainly to preventing sharp fluctuations in the rates of national money, to keep them within certain boundaries. The Central Bank regulates the activities of commercial banks in the conduct of foreign exchange transactions, take measures against excessive speculation in the foreign exchange markets. State through the central bank determines the norms for the sale and purchase of currencies, regulates loans in foreign currency and carries out other types of intervention in the foreign exchange transactions of banks.

22. The main types of the interbank exchange rate, the scope of their mandatory application in the Russian Federation.

For different types of conversion (exchange) transactions, there may be a different exchange rate. In countries where there are currency restrictions on currency exchange in terms of timing, types of transactions or the status of market participants, there is a plurality of exchange rates. It is customary to distinguish several types of exchange rates. Exchange rate for non-cash interbank transactions. This rate is formed as a result of interbank transactions for the sale / purchase of non-cash currency in foreign exchange markets (for freely convertible currencies - in world currency markets. For the dollar / ruble rate - in the Russian interbank market. This rate is adopted as the official one in most developed countries (for example , rate at the end of the working day). Exchange rate of currency exchanges. In those countries where currency exchanges have survived, through which the main turnover of conversion operations passes, the exchange rate set on the exchange is the main rate of the domestic foreign exchange market, and also often the official rate (Russia, China, Nigeria, etc.). Currency exchanges that have survived in a number of developed countries are subordinate to the interbank market and are mainly used to fix the rate at a certain point in time (for example, fixing (fixing the exchange rate regularly on stock exchanges) at the USD / DEM rate in Frankfurt am Main at 11-00). This fixing is a fixing of the exchange rate, which is regularly carried out on stock exchanges, serves as an official rate, but the rate itself practically does not differ from the rate of the interbank market at that moment. In Russia, the MICEX rate is set in the morning, when the interbank market is practically not functioning yet, providing banks with primary information on market trends and serving as a starting point for forming the rate for interbank transactions. It should be expected that as the volume of transactions on the currency exchange decreases, as well as the volume of interbank transactions increases from the very morning to the beginning of the exchange session, the interbank exchange rate will play the main role. Exchange rate of cash transactions... This rate is formed on the basis of supply and demand in the cash currency trading market and may differ significantly from the non-cash rate of interbank transactions. For countries with a significant share of cash in the domestic money circulation (for example, Russia), the cash exchange rate differs from the interbank non-cash exchange rate more than in countries with a developed system of non-cash payments of the population (by checks, plastic cards, etc.). IN exchange offices developed countries course cash exchange currencies are set strictly on the basis of the interbank exchange rate with a fairly narrow margin.

23. ММВБ: functions, operations, new spheres of activity. Methods and forms of foreign exchange control over exchange foreign exchange operations and transactions.

Trading in foreign currency on the MICEX takes place in the electronic trading system (SELT), which unite eight interbank currency exchanges within the framework of a single trading session (UTS). Since 1992, the Central Bank of the Russian Federation has been setting the official exchange rate of the Russian ruble, taking into account the results of foreign exchange trading on the MICEX. The exchange holds daily trades in the US dollar, euro, Ukrainian hryvnia, Kazakh tenge, Belarusian ruble, as well as transactions with currency swaps

Within the framework of the National Currency Association (NVA), the exchange participates in the development and implementation of the "Standards for Operation in the Domestic Foreign Exchange and Money Markets". Stock Exchange MICEX is an important element of the initial placement valuable papers... The MICEX is a nationwide government securities (GS) trading system that unites eight major regional financial centers in Russia. The Bank of Russia uses the MICEX trading system to conduct deposit and lending operations with credit institutions located in different regions of the Russian Federation. The MICEX is one of the leading organizers of trading on the Russian derivatives market and dominates the foreign exchange futures market. The MICEX's efforts to further develop the derivatives market are aimed at expanding the list of traded instruments, primarily by launching trading in futures and options contracts on the MICEX Index. In addition, it is planned to further expand the range of derivatives for stock, interest and foreign exchange assets, as well as to further improve the risk management system with the introduction of portfolio margin technology based on the SPAN portfolio risk analysis methodology developed by the Chicago Mercantile Exchange (CME) and used by many leading exchanges and clearing organizations of the world. Providing the maximum possible guarantees for the execution of transactions is the main principle of the exchange. The MICEX Group has an electronic trading and depository system that meets modern international standards in terms of reliability, productivity, security and business continuity. The software and hardware complex includes trading, settlement and depository systems operating in real time. The complex's telecommunication network is provided by leading network service providers and covers the entire territory of Russia. The core of the MICEX global trading network is two computing centers - the main one and the reserve one.

The main areas of activity of the MICEX: Currency - Nabirje are daily traded in the US dollar , Euro , Ukrainian hryvnia , Kazakh tenge , Belarusian ruble, as well as transactions with currency swaps . Total volume exchange transactions with foreign exchange in 2006 amounted to 25.9 trillion rubles . Stock-

The MICEX Stock Exchange is the leading stock exchange, where daily securities are traded by about 600 Russian issuers, including « blue chips "- JSC Gazprom", RAO" UES of Russia", JSC" Lukoil", JSC" MMC Norilsk Nickel", JSC" Sberbank of Russia", JSC" Rostelecom" etc. Corporate, sub-federal and municipal bonds - The MICEX Stock Exchange is the leading trading platform in Russia, organizing trading in corporate bonds of more than 300 Russian companies and banks . Currently, the MICEX trades in bonds of about 60 sub-federal and municipalities Russia. Government securities and money market- The MICEX is a nationwide government securities (GS) trading system that unites eight major regional financial centers in Russia. The international cooperation

Taking into account actively ongoing processes globalization and Russia's accession to the World Trade Organization, the MICEX Group is implementing a development strategy that provides for integration into the infrastructure of the world capital market. The number of foreign participants in the MICEX markets is growing, the share of foreign investors' transactions in the trading turnover shares on the MICEX stock exchange exceeds 20%. The sector of innovative and growing companies (IRC) - The IRC sector is intended for market access by companies with relatively small capitalization(from 100 million to 5 billion rubles). To the papers of these issuers there will be requirements for a minimum liquidity, and it will also be necessary to conclude an agreement with listing agent... This sector is focused on high-tech companies - telecommunications, internet business, software development, radio electronics and semiconductors, biotechnology and pharmaceuticals etc. Tolerance criterion issuer the sector will also see revenue growth at a rate of at least 20% per year.

It is installed the central bank countries for a certain period, for example, a day or a month. It is used in the calculation of customs payments, accounting and tax obligations.

How is the official exchange rate in the Russian Federation established?

The rules by which the Bank of Russia sets exchange rates are set out in Regulation No. 286-P. IN normative act indicated:- the market value of the dollar and the euro is determined based on the results of exchange trading on the current day. Their average cost is taken, calculated based on the results of the index session;

- quotations of other currencies are determined on the basis of cross-rates, the value of the US dollar is used as a base;

- official rates are determined every working day. They remain in effect until a new quote is determined. For example, the value of the euro set on Friday will be valid until the next working day - Monday;

- the value of currencies is rounded to four decimal places, indicated in the format "nn.nnnn";

- The Central Bank of the Russian Federation, which determines the official exchange rate, does not undertake to buy or sell currency at that price. For the purchase and sale of currency, companies and individuals must contact commercial banks.

Since 2014, a floating rate regime has been in effect in Russia, which means that the Central Bank of the Russian Federation does not interfere in setting the value of the ruble. If the market situation leads to a significant weakening, the regulator uses economic mechanism- foreign exchange interventions.

What the official course is used for

Quotes set by the Central Bank of the Russian Federation differ from the value of currencies in commercial banks... This is due to the fact that the official rate is formed on the basis of data trading session which has already ended. is determined based on retro data, i.e. the results of the trading session, which has already ended.In fact, the official rate is already outdated the moment it becomes known in the business community. Therefore, banks and cash offices use other quotes when carrying out currency exchange operations, as close as possible to those values that are set on the exchange at the current moment.

The official rate is used for the following purposes:

- serves as a guide to the current value of the ruble for business and the population;

- used in settlements between government agencies;

- applied commercial enterprises for settlements with suppliers, if they issue invoices in foreign currency;

- used to calculate tax and customs obligations of economic entities.