Included in the payroll. What does the payroll include? Terms of formation of the wage fund

The payroll includes the following accrued by enterprises:

- · The amount of remuneration in cash and in kind for the worked and unworked time;

- · Compensation payments related to the work schedule and working conditions;

- · Incentive surcharges and allowances;

- · Bonuses, one-time incentive payments;

- · Payment for food, housing, fuel, which is systematic.

Salaries are divided into basic and additional.

Under basic wages it is customary to understand:

- · Payments for hours worked, for the quantity and quality of work performed with time-based, piecework and progressive payment;

- · Additional payments due to deviations from normal working conditions, for overtime work, for work at night and on holidays, etc.;

- · Payment of downtime through no fault of the employee; bonuses, premium allowances, etc.

Additional salary includes:

- · Payments for unworked time stipulated by labor legislation and collective agreements;

- · Payment of vacation time;

- · Payment for the performance of state and public duties;

- · Payment for breaks in the work of nursing mothers;

- · Payment of preferential hours for adolescents;

- Severance pay upon dismissal, etc.

Pay for hours worked includes: wages accrued at tariff rates and salaries, at piece rates, as a percentage of proceeds for products sold; the cost of products issued as payment in kind; bonuses and remuneration that are of a regular or periodic nature, regardless of the source of their payment; stimulating additional payments and allowances to tariff rates and salaries (for professional skill, combination of profession, etc.); compensation payments and additional payments related to the work schedule and working conditions (work in harmful or dangerous conditions, work at night, overtime work, etc.) and other payments. This also includes the remuneration of persons employed part-time, and the remuneration of employees of the unscheduled composition. In statistical reporting, the salary of the unselected staff is not included in the payroll of the payroll and is shown separately.

Remuneration for unworked time is various kinds of payments, which include both the remuneration of the unworked hours within the working day and the remuneration of the unworked man-days, including: payment for study leave and payment for periods of professional retraining of employees; remuneration of workers involved in the performance of state and public duties; payment of preferential hours for adolescents, amounts paid to employees at the expense of enterprises who were forced to work part-time on the initiative of the administration; payment of downtime through no fault of the employee and other payments.

One-time incentive payments include one-time (one-time) bonuses, bonuses based on the results of work for the year and length of service, compensation for unused vacation, additional payments when granting leave, the cost of shares issued free of charge to employees as an incentive, and other payments.

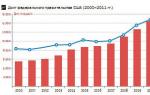

The wage fund is calculated for a month, quarter, year. The annual payroll is equal to the sum of the monthly funds. Based on the wage fund, the level of average wages is determined both for enterprises and organizations, and for the industry and the economy as a whole.

The wage fund at individual enterprises is accounted for by individual categories of personnel. The structure of the wage fund for individual categories of workers is different, which supports its analysis both for personnel in general and for its individual categories in various sectors of economic activity.

When analyzing the wage fund by categories of workers, the funds of hourly, daily and monthly wages are distinguished. By the dynamics of the hourly, daily and monthly funds and the ratio between them, one can judge the organization of production and the use of working time at the enterprise. The increase in the growth rate of the hourly wage fund over the growth rate of the daily fund indicates the effective use of the working day, that the growth of wages is due to payments directly related to the release of products.

and social payments.

In accordance with the instructions on the composition of the payroll, the organization's expenses related to wages and other payments to employees are divided into three parts:

salary fund;

social payments character;

expenses not related to the payroll and social payments. character.

The payroll includes:

remuneration for hours worked, including the remuneration of persons hired for part-time work, as well as remuneration of employees of the pension structure;

payment for unworked time (payment for annual vacations and additional vacations, preferential hours for adolescents, downtime through no fault of workers, etc.);

one-time incentive payments (one-time bonuses, remuneration based on the results of work for the year and annual remuneration for length of service (length of service), material assistance, additional payments when granting annual leave, monetary compensation for not using the vacation, the cost of purchase of shares and other one-time incentives, including the cost of gifts);

payments for food, housing, fuel.

Social payments character- compensation and social benefits provided to employees, excluding social benefits. benefits from state and non-state budget funds - a supplement to the pensions of employees in an organization, one-time benefits to retiring labor veterans, payment of vouchers for employees and their families for treatment, recreation, excursions, travel at the expense of the organization, expenses for repayment of loans issued to employees organizations, the amounts provided to employees for an initial payment or for repayment of a housing loan.

Expenses not related to the payroll and social benefits. character. These costs include:

income from shares and other income from participation of employees in the ownership of the organization (dividends, interest, payments on equity shares).

insurance contributions to the Pension Fund of the Russian Federation, Social Fund insurance of the Russian Federation, compulsory medical insurance funds of the Russian Federation, the State Employment Fund of the Russian Federation and contributions from funds to non-state pension funds;

payments from off-budget (state and non-state) funds, as well as under contracts of personal, property and other insurance;

the cost of branded clothing issued free of charge, uniforms remaining in personal permanent use, or the amount of benefits in connection with their sale at reduced prices;

travel expenses;

expenses paid in exchange for daily subsistence allowance, etc.

The amounts accrued for annual and additional vacations are included in the payroll of the next month only in the amount attributable to vacation days in the reporting month. Amounts due for vacation days in the next month are included in the payroll of the next month.

Data on the payroll for the corresponding period of the last year, when compiling reports on labor, are shown in the methodology and structure of the reporting period of the current year.

With in-kind wages and the provision of social services. payments in labor reports include amounts based on the calculation at market prices prevailing in the region at the time of accrual. If goods or products were provided at reduced prices, the difference between their full value and the amount paid by employees is included.

Composition of labor costs included in the cost of production.

The amounts of payments accrued to employees should be divided into four parts:

labor costs attributable directly to production costs, as well as operating costs of non-industrial farms that are on the balance sheet of the organization's core activities;

labor costs for operations related to the procurement and purchase of inventories, equipment and installation, capital investments;

payments in cash and in kind at the expense of the remaining part of the profit and consumption funds at the enterprise;

income paid to employees on contributions to the organization's property and securities.

In accordance with the Regulation on the composition of costs, the cost of production includes the main and additional wages of the main production personnel.

In the accounts of production and circulation costs, payments of a stimulating and compensatory nature are also reflected (bonuses for production results, high achievements in labor, payments due to regional regulation of wages).

They do not include in the cost of production, but are attributed to a decrease in the profit remaining at the disposal of the organization and other targeted receipts, the following payments to employees of the organization in cash and in kind, as well as the costs associated with their maintenance: bonuses paid out of special funds. destination and earmarked receipts; material assistance; an interest-free loan for improving housing conditions, acquiring additional farming and other social services. needs; allowances to pensions, lump sum benefits to retiring labor veterans and other similar payments and costs not directly related to labor remuneration.

Accounting for payroll settlements with personnel.

Accounting for wages and other charges is carried out on passive account 70 "Payments with personnel for wages".

On the debit account 70 reflect the paid amounts of wages, bonuses, benefits, pensions, etc., as well as the amount of taxes withheld from salaries; amounts withheld under writ of execution; amounts withheld for marriage, for compensation for material damage, for repayment of accountable amounts and other deductions.

On the credit, account 70 reflects the amount of payroll, the amount of bonuses at the expense of the FMP, the amount of accrued benefits due to contributions to the state social services. insurance, pensions and other similar amounts.

The amount of accrued wages is included in the cost of products, works, services. The balance on account 70 is the wage arrears of the enterprise to its employees.

Synthetic accounting of payments for labor.

Synthetic accounting of settlements with personnel on remuneration, as well as on the payment of income on shares and other securities of this enterprise is carried out on account 70 "Payments to personnel on remuneration". This account is passive. On the credit, the accounts reflect the accruals for wages, benefits from contributions to state social insurance, pensions and other similar amounts, as well as income from participation in the enterprise, and on debit - deductions from the accrued amount of wages and income, the issuance of amounts due to employees and unpaid wages and incomes on time. The balance of this account is in credit and shows the debts of the enterprise to its workers and employees for wages and other payments.

The operation for calculating and distributing wages, included in the costs of production and circulation, is drawn up with the following accounting entry:

D t 20, 23, 25, 29, other accounts, K t 70.

The accrual of wages for operations related to the procurement and purchase of inventories, equipment for installation and the implementation of capital investments is reflected at D t 07.08, 10, 11, 12, 15, and K t 70.

The accrued amounts of bonuses, material assistance, benefits, remuneration for work carried out at the expense of targeted financing are reflected in the debit of accounts 86, 96 and the credit of account 70.

Accruals of income to employees of the organization on shares and contributions to its property are drawn up with the following accounting entry: D t 81 K t 70.

In case of insufficient profit for the payment of dividends, as well as in the presence of other liabilities not covered by profit, income is accrued at the expense of the reserve capital and drawn up with the following accounting entry: D t 82 K t 70, 75.

In some organizations, due to the seasonality of production, leave is provided to employees unevenly throughout the year. Therefore, for a more correct determination of the cost of production, the amounts paid to employees for vacations are attributed to production costs throughout the year in equal proportions, regardless of the month in which these amounts will be paid. This creates a reserve for the payment of employee vacations. An entity may create a provision for seniority benefits.

The reserved amounts are credited to the same accounts of production costs to which the initial salary of employees is attributed, and to the credit of account 89.

As workers leave on vacation, the amounts actually accrued to them for the vacation period are written off to reduce the created reserve. In this case, the following accounting entry is made:

D t 89 K t 70.

The same entry is used to draw up the benefits accrued to employees for the length of service.

When calculating the amounts of annual and additional vacations, it should be borne in mind that the accrued amounts of vacations are included in the wages fund of the reporting month only in the amount falling on the days of vacation in the reporting month. In the event of the transfer of part of the vacation to the next month, the amount of vacation pay paid to employees for these days is reflected in the reporting month as an advance paid:

D t 70 K t 50.

In the next month, this amount is included in the payroll and is usually reflected by a posting entry for the accrual of vacation amounts: D t 89 K t 70.

In the case of payment in kind, i.e. issuance of finished products, goods, etc. to employees as payment for labor, make up the following accounting records:

D t 20, 23, 25, 26 K t 70.

D t 70 K t 46, 48.

D t 46.48 K t 40, 41, 10.

Deductions from the amounts of accrued wages are written off from the credit of the corresponding accounts to the debit of account 70.

The issuance of the amounts of wages and benefits is drawn up with the following accounting entry: D t 70 K t 50.

The salary not received on time is drawn up with the following accounting entry: D t 70 K t 76.

The remainder of the salary not issued on time after 3 days must be deposited on the current account. In this case, the following accounting entry is made: D t 51 K t 50.

Accounts of settlements with depositors are kept in the ledger of deposited wages, filled in according to the data of the register of unissued wages. The book is opened for a year. For each depositor, a separate line is allocated in it, in which the depositor's personnel number, his last name, first name, patronymic, the deposited amount and marks of its issuance are indicated. The amounts remaining unpaid at the end of the year are transferred to a new book, which is also opened for the year.

The subsequent payment of the deposited wages is carried out on an expense cash order and reflect: D t 76 K t 50.

Entrepreneurs, managers, heads of state and municipal enterprises devote a significant amount of work to fulfilling obligations related to the calculation and payment of labor compensation to employees. This process involves the formation of a separate category of expenses in the form of a wage fund. What is its possible structure?

Purpose of the payroll

The payroll fund is one of the key items of expenditure in any enterprise. The process of releasing industrial products or providing services is accompanied by the need to regularly pay compensation to the company's employees.

The composition of the payroll at Russian enterprises can be represented by such items as:

- payment of actual labor compensation (in the form of salaries, allowances, bonuses);

- calculation and payment of personal income tax to the budget;

- transfer of contributions to state funds;

- expenses related to the fulfillment of the employer's social obligations;

- training and retraining costs.

According to one of the common classifications, the structure of the payroll can be represented by 3 main groups of costs:

- labor compensation;

- social payments;

- other money transfers.

Regarding the costs of financial support for employees of the enterprise that are borne by state structures - in particular, the FSS - when paying sick leave and maternity leave. They are generally not included in the payroll. However, the possible costs associated with the company's performance of the functions of a tax agent may well be included in the structure of the FZP.

The calculation of the payroll, its analysis and presentation in the form of statistics can be based on criteria that are adopted at the level of legal acts or have developed in the practice of business communications in a particular industry. Let us consider in more detail the essence of the respective approaches.

FZP in bylaws

First, we can study how the composition of the wage fund is determined in bylaws. Above, we noted that they can fix the norms governing the methodology of the statistical presentation of the wage bill. Among such legal acts is the letter of the Ministry of Telecom and Mass Communications No. NN-P14-4332 dated 03.19.2015, establishing the procedure for submitting statistical reporting for telecommunication organizations to state bodies.

So, this document includes provisions according to which the payroll should include:

- the amount of compensation in cash and other forms;

- payments related to special working conditions, as well as the working hours of employees;

- various additional payments, allowances, bonuses, as well as incentive payments;

- compensation for food, housing costs, if it is systematic.

Provided by the letter of the Ministry of Telecom and Mass Communications in question, the form of statistical reporting should include the accrued monetary amounts - taking into account personal income tax and other deductions provided for by the legislation of the Russian Federation, regardless of their specific sources of origin, items of expenses and tax benefits.

The letter also contains a provision according to which the amounts accrued for employee vacations should be included in the payroll only in those values that correspond to the vacation days in the corresponding month. Another noteworthy provision of the letter in question is an indication that the structure of social benefits should include money, which is associated with the benefits provided to the company's employees - for treatment, travel, recreation or employment. Benefits from state funds, in particular the FSS, are not considered by the Ministry of Telecom and Mass Communications as part of the wages fund. In this sense, the department adheres to the methodology that we talked about at the beginning of the article.

It can be noted that such a legal category as the wage bill was introduced into wide legal practice by Decree of the State Statistics Committee No. 89 of July 10, 1995. The methodology for calculating the corresponding compensation contained in this document was considered fundamental for both state-owned enterprises and private businesses. But in 2003, the specified source of law was canceled. Thus, Russian organizations were able to calculate the payroll, its necessary analysis and presentation in the form of statistical data, based on the internal methodology. At the same time, in government departments, the relevant approaches could begin to be approved in the form of by-laws. Above, we considered an example of a corresponding source of law.

Legislative acts at the federal level, which would give a definition to the concept of "payroll", have not yet been adopted in the Russian Federation. At the same time, the Tax Code of the Russian Federation contains article 255, which is called “Labor costs”. Its provisions, according to many lawyers, may well be used as a tool for interpreting the term in question. Let us study the relevant legal act in more detail.

Labor costs in the RF Tax Code

So, the wage fund as an independent legal category after the abolition of the above-mentioned Goskomstat resolution was not subsequently enshrined in legislation at the federal level. However, Article 255 of the Tax Code of the Russian Federation contains provisions that establish the structure of labor costs. Their composition, if you follow the specified legal act, should include:

- any compensation in cash or otherwise;

- incentive allowances;

- charges that are associated with special working conditions;

- awards;

- incentive accruals;

- costs associated with the employer's need to comply with labor laws or contractual provisions with employees.

The wages fund of workers, based on the provisions of Article 255 of the Tax Code of the Russian Federation, also includes:

- amounts that are accrued on official salaries, various tariff rates, piece rates, or as a share of proceeds in accordance with local salary systems;

- bonuses for results achieved in production;

- accruals to tariff rates for demonstrated skill, significant achievements in labor;

- allowances for special working conditions, including the performance of work duties at night, within the framework of multi-shift work, when combining professions, overtime work, work duties on weekends and holidays;

- the cost of compensation for utilities, food for employees;

- expenses for the purchase or order in the workshop of workwear, uniforms;

- average earnings that should be retained for employees during the period of their state or social duties;

- the costs of paying for the travel of employees to the settlements in which they spend their vacation, compensation for unused vacation days;

- payments to employees who are dismissed from the enterprise - including in connection with the procedures of reorganization, liquidation of the company, reduction of staff;

- seniority payments;

- allowances due to regional and other coefficients approved in the legislation;

- allowances for work in the regions of the Far North, as well as in territories equated to them;

- the costs of maintaining the average earnings during the employee's study leave, as well as paying for the employee's travel to the place of study;

- compensation for work during the period of forced absenteeism or forced performance of low-paid work.

The provisions of Article 255 of the Tax Code of the Russian Federation also establish that the structure of the wage fund should include payments to state funds. Let's consider this aspect in more detail.

Contributions to government funds as part of wages

The use of the payroll by an enterprise may be associated with the fulfillment of obligations to transfer the necessary contributions to state structures - the Pension Fund of the Russian Federation, FSS, FFOMS. With regard to payments to the FIU, they can be classified into mandatory and voluntary. In the second scenario, labor costs are correlated with contracts: insurance, non-state pension provision. Also, employers can make additional contributions aimed at increasing the funded pension of employees, or those payments that are related to insurance contracts.

Other wage fund items

What other items of expenditure can be included in the payroll of employees by virtue of the provisions of Article 255 of the Civil Code of the Russian Federation? Among those:

- amounts that correspond to the size of the salary or the tariff rate, which are established in the collective labor agreement, for the period when the employee is on duty;

- the amounts that are listed as compensation for the work of individuals hired in accordance with special agreements between the employer and government agencies;

- compensation for training employees of the enterprise associated with separation from the workplace;

- the costs of maintaining the earnings of donor workers during periods of their absence from work associated with their stay in medical institutions and rest after the relevant procedures;

- payments under civil law contracts;

- accruals for military personnel who serve in state enterprises;

- additional payments to citizens with disabilities;

- deductions of funds to the reserve, which is formed for the purpose of subsequent compensation for employee vacations, or the accrual of annual employee benefits for seniority;

- costs associated with the compensation of interest on mortgage loans, which are issued by the company's employees.

Goskomstat methodology

So, we examined how the payroll fund is interpreted in the current sources of law of the Russian Federation. At the same time, the methodology laid down in the Resolution of Goskomstat No. 89, which we mentioned above, continues to be actively used to this day. The analysis of the payroll, the formation of certain statistical data in many organizations, mainly private ones, are based on the principles contained in the specified source of law. Therefore, it will be useful to consider the key provisions of Goskomstat - although they are informal in nature.

The classification of the expenses of the enterprise, which form the corresponding payroll (wages), presupposes, first of all, the allocation of wages for hours worked into a separate category. These costs, in accordance with the provisions of the State Statistics Committee, should include:

- salary, which is accrued at tariff rates, piece rates, salaries or as a percentage of proceeds;

- compensation in the form of natural products, bonuses, remuneration, incentive bonuses;

- additional payments for special working conditions, performance of work duties at night, work on weekends and holidays, overtime work.

- payment of vacations granted on an annual basis;

- compensation for study leave for employees;

- payments related to the passage of training and professional training by the company's employees;

- compensation for forced downtime, absenteeism, payments to donor workers.

- one-time bonuses;

- remuneration based on the results of performance of labor duties for the year;

- seniority payments;

- material assistance to employees;

- payments in excess of vacation pay;

- compensation for employees who did not take leave;

- the cost of shares or benefits associated with their acquisition.

Another category of expenses according to Goskomstat is payments related to compensation for food, housing costs, and fuel. Also, the noted legal act provides for various money transfers of a social nature. Among those - allowances to the pensions of employees working in the company, one-time benefits to labor veterans who retire - if we are talking about the company's own funds.

Classification of payroll funds

Now we know what are the basic legislative standards that define the essence of the payroll and the classification of items of expenditure that are specific to it. At the same time, a number of approaches have been established in the Russian expert community related to the classification of the funds in question. Researchers distinguish the following types of funds: direct, hourly, daily, monthly, quarterly and annual. Let's consider their essence in more detail.

Direct payroll funds

The direct payroll is characterized by the fact that its value correlates with the quantity, quality, and also the results of labor activities of the company's employees. The corresponding payments include time-based compensation to employees in accordance with approved salaries and tariffs, that is, for the actual time employees fulfill their obligations.

Hourly payroll

The specificity of this fund is that it is calculated based on the hours actually worked by the employee. It may also include allowances - for performing duties at night or for work in special working conditions, on weekends and holidays. The structure of the watch fund may include allowances for professional skill, performance of labor duties on the basis of combination

Day fund

The fund in question takes into account, in turn, the days that the employee actually worked. As a rule, it includes indicators of the hourly fund, as well as surcharges for those periods that are inactive, but must be compensated by law. The daily fund may include additional payments to underage employees for shorter working hours, compensations for nursing mothers, as well as payments for forced downtime.

Annual, quarterly and monthly funds

The funds under consideration include, in turn, all those that we considered above for the corresponding period. Also, in their structure, there may be payments in the form of coefficients, premiums for seniority, as well as bonuses, which are provided for by legislation or local regulations of the enterprise.

Russian enterprises that carry out the formation and analysis of the wage fund can use as the basis for solving the relevant problems both those criteria that are fixed in the legal acts we have considered, and those that have developed in practice in the business community. In the case of state organizations, in most cases they are obliged to follow the prescriptions of legal acts adopted at one level or another.

Summary

The composition of the payroll at Russian enterprises has a complex structure. This can be predetermined by the specifics of the regulatory legislation or standards adopted in a particular organization. The relevant costs include not only the actual wages. The Pension Fund, Social Insurance Fund, MHIF and other recipients of payments provided for by law also become objects of calculation of costs included in the structure of wage funds. The enterprise can issue local regulations, on the basis of which the analysis and interpretation of the corresponding costs are carried out. Many firms, analyzing such data, determine the average payroll. Or, conversely, they provide a detailed breakdown of expenses for certain items.

To determine the effectiveness of the use of funds in the enterprise for payments to employees, the calculation of the wage fund is used. It includes the sum of all funds that the staff of the organization receives for their work.

Briefly about the wage fund

The wage fund should be understood as all those funds that go to the wages of employees of an enterprise, firm or organization. All allowances, compensations and bonuses can be attributed to their number, from whatever source they are not charged.

This indicator helps to analyze the salary costs of the personnel of the enterprise by structural division. This makes it possible to optimize spending, change in one direction or another, or rates. The amount of the wage fund becomes a guideline when calculating pensions and insurance premiums. The payroll becomes a very important element for the correct allocation of funds within the organization, which helps to stimulate employees to better perform their duties.

The structure of the payroll - what does it include?

To calculate the total cost of the enterprise for the payment of wages to employees, payroll is calculated (payroll). To determine this number, you need to include the following data:

- staff salaries, depending on their responsibilities;

- if earnings are accrued to employees in the form of goods manufactured at the enterprise, then the cost of these products must be included;

- all types and types of incentives that are issued in cash;

- compensation for the harmfulness of work, the degree of its difficulty, payments for overtime work;

- if the company provides employees with free meals, then the funds allocated for it should also be taken into account when calculating the payroll;

- different types of allowances, including for continuous work, and for length of service;

- compensation for sick leave, absenteeism (without an employee's vein);

- allowances for those employees who were transferred to a position that is considered lower than he had before;

- money for travel, payment of accommodation for those employees who work on a rotational basis;

- money to pay third-party employees;

- funds for the payment of pensions, if the employee had to go to it in a special case.

The following amounts do not need to be included in the payroll:

- dividends;

- loans that are issued free of charge;

- social assistance benefits, the issuance of which comes from the state budget of the country (this includes state compensation);

- awards that are given for excellent work throughout the year;

- material assistance to the personnel of the enterprise (regardless of its type);

- monetary compensation for price increases.

The payroll calculation does not take into account one-off, or those that are not permanent. Also, you do not need to take into account the funds that are paid to employees from insurance funds.

Difference from FZP

The wage fund is a certain amount of funds that is distributed at the enterprise among all employees, in accordance with the work that was performed by them. When calculating, wage rates, salaries or labor rates are taken into account.

The FZP includes:

- any form of remuneration for employees;

- bonuses, various additional payments and allowances;

- compensation that is paid for difficult working conditions.

Social payments are not included in the PPF. At the same time, the wage fund is a broader concept that includes all the funds that are accrued to the employees of the enterprise, including the wage bill.

The wage fund differs from the payroll precisely in that it includes only those amounts that the employee must receive for the time worked or the work done (depending on the method of remuneration), including only those bonuses that are directly related to wages.

Calculation period

The periods for calculating the payroll are divided into several subspecies:

- annual - for its calculation, data for the past calendar year is used, with its help, the full amount of the wage fund is determined;

- monthly - calculated mainly for reporting for a certain period of operation of the enterprise;

- day - used for in-depth analysis of spending on salaries for employees, they are used very rarely;

- hourly - used only at those enterprises that have chosen hourly form for remuneration of employees.

The calculation and analysis of the payroll is necessary to get acquainted with the reasons for salary expenses from those that were planned. The result of such an analysis is the implementation of measures that are aimed at correcting errors in the use of payroll.

In order to correctly analyze the salary fund of an enterprise, wages are divided into two types:

- constant, which includes the salary itself and;

- a variable that includes the cost of remuneration of employees under the transaction.

An analysis of the payroll is carried out in order to find out the reasons for deviations in the planning of wage payments.

How to calculate the annual payroll?

Employees of the enterprise responsible for calculating the payroll should be familiar with the rules for this calculation. It is very important to understand that the payment system that exists in the company influences its level most of all. To do this, you need to take into account the following factors:

- the size of the salary;

- piece rate rates;

- various kinds of bonuses and allowances.

To obtain all the necessary information, it is worth using payroll.

The calculation of the annual payroll is based on the following information:

- Salary statements at the enterprise for the year. These papers must indicate the amount of all payments that were made to employees.

- Documents that depict time tracking (timesheets). They are needed to calculate the number of hours worked by an employee at the enterprise. To fill them out, there is a certain person who monitors the correctness of the specified data.

- timetable. This document contains all the information about salaries, tariff rates. There you can also find a list of all employees of the company.

There is no standard formula for calculating the annual payroll. But there are two ways to do this.

With the first method, the calculation formula will look like this:

FOT = Z * H * 12, where

- Payroll - wage fund;

- С - average for a certain period (in this case - a year);

- H - the number of employees in accordance with the lists of the organization.

Getting the average wage number is pretty straightforward. All payments that are allocated to employees should be divided by 12.

The second method involves using this formula:

FOT = (З + Д) * К, where

- Payroll - wage fund;

- З - the salary that was accrued to employees for the year;

- D - all additional payments and other incentives for employees;

- K is the established coefficient for those organizations that operate in the Far North or areas close to it.

How to find a monthly payroll?

You need to understand that when using a time-based wage method, you need to take into account the tariff rate per hour of work. To calculate the planned payments to employees, you need to multiply this number by the number of hours worked per month.

If the bonus system is used, then the resulting number must also be multiplied by the coefficient of such a premium. For example, if the rate is 50 rubles, and the month has 20 working days, the coefficient is 1.5, then the employee's salary will be 12 thousand rubles. If the salary is calculated as planned, then to calculate the monthly coefficient, you will simply need to multiply the salary amount by the bonus coefficient.

After determining the salaries of all employees for the month, together with bonuses, they need to be summed up. But this is not the whole process in determining the average monthly payroll.

You also need to take into account the additional funds that are paid to employees. This category may include allowances, surcharges and others of a different nature.

In addition, the firm may have in its staff and those employees who combine the position with work in any other organization. Their salaries should also be taken into account when calculating the payroll. After summing up all these indicators, the total amount of the payroll is obtained. The calculation of the daily payroll is carried out in a similar way.

The wage fund is an indicator that contains all payments of money to employees, including those related to the social sphere. The organization and calculation of the payroll takes place on the basis of the regulations and rules adopted in the organization.

In contact with