Calculation of the absolute liquidity ratio on the balance sheet. Absolute liquidity ratio in Excel

"Absolute liquidity ratio- financial coefficient equal to the ratio Money and short term financial investments to short-term liabilities (current liabilities).

Shows the ability of the company to repay current debt exclusively with available cash or cash equivalents at a certain point in time. The larger its value, the less problems the company has with the fulfillment of its obligations to creditors.

If describe the meaning of the absolute liquidity ratio "in simple terms", then it will be something like this: "how much money the company will have for each ruble (dollar, hryvnia, tugrik) of obligations, if all creditors to whom the company owes for current obligations simultaneously present claims for payment to it."

What is normal value absolute liquidity ratio? Many sources in the literature consider it to be 0.2. However, it should be borne in mind that its actual value is highly dependent on the specifics of the industry in which a particular enterprise operates. To determine its normal level, it is necessary to take into account the turnover rate of current assets and the turnover rate of current liabilities. If the asset turnover is less than the period of possible deferment of the company's obligations, then the company's solvency (the ability to pay off its current obligations) will be normal.

Too high absolute liquidity ratio should not be regarded as very good indicator. After all, money that simply lies on a current account or is invested in financial instruments, which can be turned into money almost immediately, "do not work" for the business. That is, they are not used by the company for the purposes for which it was created. Therefore, there is an internal dualism - the greater the value of the absolute liquidity ratio, the less the company is exposed to the risks of difficulties in fulfilling current obligations and the more funds are not invested in business development.

If you are analyzing the balance sheet structure of an enterprise, then your task is to determine how the company is between the state of "low liquidity and the threat of current insolvency" to "high liquidity and irrational asset structure".

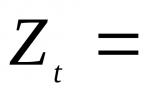

The formula for calculating the absolute liquidity ratio

Absolute liquidity ratio \u003d (Cash + Short-term financial investments) / (Short-term liabilities - Deferred income - Reserves for future expenses)

Please note that the author of this article believes that for the formula used in the Ukrainian balance sheet, lines 590 (settlements with participants) and 610 (other current liabilities) can be deducted from line 620 (balance section amount) depending on their content. Therefore, for the purposes of in-depth analysis, require decoding of these balance lines. Remember that, for these coefficients, you need the essence, not the form.

Note. Please note that different sources may give different formulas. This is due to the different approaches of the authors, what should be considered highly liquid assets and current liabilities..

Liquidity - ease of sale, sale, transformation of material or other values into cash to cover current financial obligations.

Liquidity ratios - financial indicators, calculated on the basis of the company's statements (balance sheet of the company - form No. 1) to determine the company's ability to repay current debt at the expense of existing current (current) assets. The meaning of these indicators is to compare the amount of current debts of the enterprise and its working capital who must ensure the repayment of these debts.

Consider the main liquidity ratios and formulas for their calculation:

Calculation of liquidity ratios allows you to analyze the liquidity of the enterprise, i.e. analysis of the possibility for the enterprise to cover all its financial obligations.

Note that the assets of the enterprise are reflected in the balance sheet and have different liquidity. Let's rank them in descending order, depending on the degree of their liquidity:

- cash in the accounts and cash desks of the enterprise;

- bank bills, government securities;

- current receivables, loans issued, corporate securities (shares of enterprises listed on the stock exchange, bills of exchange);

- stocks of goods and raw materials in warehouses;

- cars and equipment;

- buildings and constructions;

- Construction in progress.

Current liquidity ratio

Current liquidity ratio or Coverage ratio or General liquidity ratio - a financial ratio equal to the ratio of current (current) assets to short-term liabilities (current liabilities). The source of data is the company's balance sheet (Form No. 1). The coefficient is calculated by the formula:

Current liquidity ratio \u003d Current assets, excluding long-term accounts receivable/ Short-term liabilitiesKtl = (p. 290 - p. 230) / p. 690 or

Ktl = p. 290 / (p. 610 + p. 620 + p. 660)Ktl = line 1200 / (line 1520 + line 1510 + line 1550)

The ratio reflects the company's ability to repay current (short-term) liabilities at the expense of only current assets. The higher the indicator, the better the solvency of the enterprise. Current liquidity ratio characterize the solvency of the enterprise not only on this moment but also in case of emergency.

The normal value of the coefficient is from 1.5 to 2.5, depending on the industry. Both low and high ratios are unfavorable. A value below 1 indicates high financial risk associated with the fact that the company is not able to consistently pay current bills. A value greater than 3 may indicate an irrational capital structure. But at the same time, it must be taken into account that, depending on the field of activity, the structure and quality of assets, etc., the value of the coefficient can vary greatly.

It should be noted that this ratio does not always give a complete picture. Typically, businesses that have low inventories and easy to get money on bills payable can easily operate at a lower ratio than companies with large reserves and sales of goods on credit.

Another way to check the sufficiency of current assets is to calculate urgent liquidity. Banks, suppliers, shareholders are interested in this indicator, since the company may face circumstances in which it will immediately have to pay some unforeseen expenses. So she'll need all her cash, securities, receivables and other means of payment, ie, part of the assets that can be turned into cash.

Quick (urgent) liquidity ratio

The ratio characterizes the company's ability to repay current (short-term) liabilities at the expense of current assets. It is similar to the current liquidity ratio, but differs from it in that the working capital used for its calculation includes only highly - and medium liquid current assets (money in operating accounts, stock of liquid materials and raw materials, goods and finished products, receivables with a short maturity).

Such assets do not include work in progress, as well as inventories of special components, materials and semi-finished products. The source of data is the company's balance sheet in the same way as for current liquidity, but inventories are not taken into account as assets, since if they are forced to be sold, losses will be maximum among all current assets:

Quick liquidity ratio = (Cash + Short-term financial investments + Short-term receivables) / Current liabilities

Quick liquidity ratio = (Current assets - Stocks) / Short-term liabilities

Kbl = (p. 240 + p. 250 + p. 260) / (p. 610 + p. 620 + p. 660)

Kbl = (p. 1230 + p. 1240 + p. 1250) / (p. 1520 + p. 1510 + p. 1550)

This is one of the important financial ratios, which shows what part of the company's short-term liabilities can be immediately repaid from funds in various accounts, in short-term valuable papers ah, as well as proceeds from settlements with debtors. The higher the indicator, the better the solvency of the enterprise. The normal value of the coefficient is more than 0.8 (some analysts consider the optimal value of the coefficient 0.6-1.0), which means that cash and future receipts from current activities should cover the current debts of the organization.

To increase the level of urgent liquidity, organizations should take measures aimed at increasing their own working capital and attracting long-term loans and borrowings. On the other hand, a value of more than 3 may indicate an irrational capital structure, this may be due to the slow turnover of funds invested in inventories, the growth of receivables.

In this regard, the absolute liquidity ratio, which should be more than 0.2, can serve as a litmus test of current solvency. The absolute liquidity ratio shows what part short-term debt the organization can repay in the near future at the expense of the most liquid assets (cash and short-term securities).

Absolute liquidity ratio

A financial ratio equal to the ratio of cash and short-term financial investments to short-term liabilities (current liabilities). The source of data is the company's balance sheet in the same way as for current liquidity, but only cash and cash equivalents are taken into account as assets, the calculation formula is as follows:

Absolute liquidity ratio = (Cash + Short-term financial investments) / Current liabilities

Cab = (p. 250 + p. 260) / (p. 610 + p. 620 + p. 660)

Cab = (p. 1240 + p. 1250) / (p. 1520 + p. 1510 + p. 1550)

A coefficient value of more than 0.2 is considered normal. The higher the indicator, the better the solvency of the enterprise. On the other hand, a high indicator may indicate an irrational capital structure, an overly high share of non-performing assets in the form of cash and funds in accounts.

In other words, if the balance of funds is maintained at the level of the reporting date (mainly by ensuring a uniform receipt of payments from counterparties), short-term debt as of the reporting date can be repaid in five days. The above regulatory limitation is applied in foreign practice financial analysis. At the same time, an exact justification why, in order to maintain a normal level of liquidity Russian organizations the amount of cash should cover 20% of current liabilities, not available.

Net working capital

Net working capital is required to maintain financial stability enterprises. Net working capital is defined as the difference between current assets and short-term liabilities, including short-term borrowings, accounts payable obligations equated to it. Net working capital is part of working capital, formed at the expense of own working capital and long-term borrowed capital, including quasi-equity capital, borrowed funds and other long-term liabilities. The formula for calculating net settlement capital is:

Net Working Capital = Current Assets - Current Liabilities

Chob = p. 290 - p. 690

Chob = p. 1200 - p. 1500

Net working capital is necessary to maintain the financial stability of the enterprise, since the excess of working capital over short-term liabilities means that the enterprise can not only pay off its short-term liabilities, but also has reserves for expanding activities. Net working capital must be above zero.

The lack of working capital indicates the inability of the company to repay short-term liabilities in a timely manner. A significant excess of net working capital over the optimal need indicates the irrational use of enterprise resources.

Formulas for calculating liquidity ratios in accordance with international standards described in

The absolute liquidity ratio and the current liquidity ratio serve as the main criteria for the IFTS, which assesses the solvency of a legal entity. Consider what these indicators are and what significance is attached to the first of them.

What does liquidity show?

The concept of liquidity is applied to the process of selling property owned by a legal entity. According to the speed of this implementation, it can be divided into sold:

- Almost instantly (money and short-term investments).

- Fast (short-term receivables).

- After some time (stocks).

- Long (non-current assets).

With regard to the first three types of property that make up current assets, indicators are calculated to assess the ability of a legal entity to pay its short-term debts. These design characteristics called liquidity ratios. There are three main types of them (depending on the speed with which the property that must ensure the repayment of existing debts can be converted into money): absolute, critical and current liquidity.

All these coefficients are used in the analysis financial condition legal entity. Two of them (the first and the last) are obligatory for calculation when assessing the solvency of the taxpayer, which is performed by the Federal Tax Service Inspectorate according to the methodology contained in the order of the Ministry of Economic Development of the Russian Federation dated April 21, 2006 No. 104.

The absolute liquidity ratio, which will be discussed in our article, reflects what proportion of existing short-term debts can be repaid at the expense of the company's funds in as soon as possible, using the most easily sold property for this.

They determine the initial data for calculating the absolute liquidity ratio for the balance sheet drawn up on a specific reporting date, or for reporting for a number of dates, if you want to trace the dynamics of this indicator.

How to calculate absolute liquidity?

The absolute liquidity ratio formula is a fraction, the numerator of which is the amount of easily marketable property, and the denominator is the amount of short-term debts. It can be represented in two forms, depending on what the denominator will be:

- Equal to the entire total for section V of the balance sheet (i.e., the total amount of short-term liabilities):

KLabs = (DenSr + KrFinVl) / KrObyaz,

KrFinVl - the amount of short-term financial investments;

KrObyaz - the total amount of short-term liabilities.

- Equal to the amount of actually existing debts (i.e., the current short-term debt on borrowed funds, as well as ordinary debts to suppliers and other debts):

KLabs = (DenSr + KrFinVl) / (KrKr + KrCredZad + Prob),

Klabs - absolute liquidity ratio;

DenSr - the amount of money;

KrFinVl - the amount of short-term financial investments;

КрКр - the amount of short-term borrowed funds;

KrKrZd - the amount of short-term debt to creditors;

Prob - the amount of other short-term liabilities.

In the second formula, the denominator can also be represented as the total amount of short-term liabilities, reduced by the amount of deferred income and estimated liabilities which are not real debts. If the last two amounts are significant, they can distort the meaning of calculating the coefficient. With such a replacement of the denominator, the formula will acquire, accordingly, a different form, although the result will be the same as in the version we have given in the legend.

If in both of the above calculations the letter designations are replaced by the numbers of the corresponding lines of the balance sheet, then we will obtain algorithms for determining the absolute liquidity ratio in the balance formulas:

- From total amount short-term liabilities:

Clubs = (1250 +1240) / 1500,

Klabs - absolute liquidity ratio;

1500 - line number of the balance sheet with the total amount of short-term liabilities.

- From the amount of actually existing debts:

Clubs = (1250 + 1240) / (1510 + 1520 + 1550),

Klabs - absolute liquidity ratio;

1250 - line number of the balance sheet for cash;

1240 - line number of the balance sheet for financial investments;

1510 - line number of the balance sheet for short-term borrowings;

1520 - line number of the balance sheet for short-term debt to creditors;

1550 - line number of the balance sheet for other short-term liabilities.

Norm for coefficient

The normal value of the coefficient is considered to be in the range from 0.2 to 0.5. This means that a legal entity is able to repay from 20 to 50% of short-term debts as soon as possible at the first request of creditors. Accordingly, a higher value of the indicator indicates a higher solvency. Exceeding the value of 0.5 indicates unjustified delays in the use of highly liquid assets.

How to change the liquidity value?

An increase in the indicator results in an increase in the values indicated in the numerator of the calculation formula (money and short-term financial investments), and a decrease in the values that make up its denominator (short-term liabilities).

The financial ratio you get dividing cash and short-term financial investments into short-term liabilities. The data for the calculation is the balance sheet of the company.

It is calculated in the FinEkAnalysis program in the solvency analysis block.

Absolute liquidity ratio - what does it show

Shows what proportion of short-term debt will be covered by cash and cash equivalents in the form of marketable securities and deposits, i.е. absolutely liquid assets.

Liquidity ratios are of interest to the management of the enterprise and for external subjects of analysis:

- current liquidity ratio - for investors;

- absolute liquidity ratio- for suppliers of raw materials and materials;

- quick liquidity ratio - for banks.

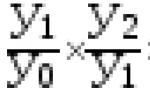

Absolute liquidity ratio - formula

The general formula for calculating the coefficient:

Calculation formula according to the old balance sheet:

where p.250, p.260, p.610, p.620, p.660- lines of the balance sheet (form No. 1)

A1 - the most liquid assets; P1 - the most urgent obligations; P2 - short-term liabilities

Calculation formula according to the new balance sheet:

Absolute liquidity ratio - value

The normative limit K al > 0.2 means that at least 20% of the company's short-term liabilities are subject to repayment every day. This regulatory limitation is applied in foreign practice of financial analysis. At the same time, there is no exact justification why, in order to maintain a normal level of liquidity of Russian companies, the amount of cash should cover 20% of current liabilities.

In Russian practice, there is a heterogeneity in the structure of current liabilities and their maturity, so the normative value is insufficient. For Russian companies, the normative value of the absolute liquidity ratio is in the range K al > 0.2-0.5.

Absolute liquidity ratio - scheme

Was the page helpful?

Synonyms

More found about absolute liquidity ratio

- Influence of assets and liabilities turnover on the solvency of the organization M V Bellendir Absolute liquidity ratio ≥ 0.2 4, s 42-43 Quick liquidity ratio of strict liquidity 0.8-1.0 Coefficient

- We determine the liquidity of the balance sheet

- Topical issues and modern experience in analyzing the financial condition of organizations - part 4 At the next stage, we calculate the financial solvency ratios represented by the coefficients of current quick and absolute liquidity

- Impact of IFRS on the results of the analysis of the financial position of PJSC Rostelecom IFRS from RAS - 1 Absolute liquidity ratio cash reserve ratio 0.20-0.25 0.811 0.074 -0.737 0.165 0.153 -0.012 2. Ratio

- Balance liquidity as one of the main directions of the financial condition Balance liquidity is determined using financial ratios - the absolute liquidity ratio is calculated as the ratio of the most liquid assets to the sum of the most urgent

- Optimization of the structure of the balance sheet as a factor in increasing the financial stability of the organization Deviation in 2014 from 2012 - Absolute liquidity ratio not less than 0.15-0.20 0.334 0.529 0.020 -0.314 Adjusted liquidity ratio not less than

- Interrelation of financial risks and indicators of the financial position of the insurance company An increase in financial investments reduced the overall turnover, that is, market risks are also inversely related to the specified indicator 5 Absolute liquidity ratio The absolute liquidity ratio was analyzed using the chain substitution method Decrease in cash

- Analysis of the financial position in dynamics L9 x x x x 1.203 Absolute liquidity ratio shows what part of short-term liabilities can be repaid immediately and is calculated as

- Financial analysis of the company - part 4 In 2004, the liquidity ratio was 0.562, which means that the company is also not solvent and its short-term liabilities far exceed current assets, but compared to 2003, the company's position has slightly improved The absolute liquidity ratio shows what part of the short-term debt the company can repay in the near future time This

- Features of financial analysis at the enterprises of the agricultural industry Considering this fact for the criterion value overall indicator liquidity can be taken as one 2 The absolute liquidity ratio characterizes the company's ability to repay current short-term liabilities at the expense of cash

- Assessment of the impact of factoring and leasing on the financial performance of transport companies This means that the value equity of the enterprise accounts for 44% of the total sources of financing The absolute liquidity ratio is below the recommended value Only 13% of the total amount of short-term liabilities transport company

- Analysis of modern methods for identifying signs of intentional bankruptcy Absolute liquidity ratio Absolute liquidity ratio shows what part of short-term liabilities can be repaid immediately and is calculated as

- Influence of estimated liabilities on liquidity indicators: problems and solutions of the Federal Financial Reporting Service of the Russian Federation, that is, this coefficient is within the permissible value

- Topical issues and modern experience in analyzing the financial condition of organizations - part 8 Coefficients characterizing the solvency of the debtor 2 Absolute liquidity ratio The absolute liquidity ratio shows what part of short-term liabilities can be repaid immediately

- Analysis of FCD to identify signs of deliberate bankruptcy of Arsenal CJSC as of 01.01.2010 compared to the situation as of 01.01.2008 showed the following 1 Absolute liquidity ratio shows what part of short-term liabilities can be repaid immediately and is calculated as

- The analysis of the arbitration manager EXAMPLE as of 01.01.2019 compared to the situation as of 01.01.2015 showed the following 1 Absolute liquidity ratio shows what part of short-term liabilities can be repaid immediately and is calculated as

- Forecasting the bankruptcy of enterprises in the transport industry K7, where K1 is the absolute liquidity ratio K2 is the period of repayment of receivables in days KZ operating cycle in

- Financial ratios for financial recovery and bankruptcy For example, the absolute liquidity ratio is calculated as the ratio of the most liquid current assets to the current liabilities of the debtor Here

- Features of auditing the liquidity of the balance sheet of commercial organizations relative indicators differing in the set of liquid funds considered as coverage of short-term obligations absolute liquidity ratio intermediate coverage ratio current liquidity ratio When calculating all these indicators, we used

- Cash liquidity ratio Synonyms absolute liquidity ratio cash ratio is calculated in the FinEkAnalysis program in the Solvency Analysis block shows the formula

Using the absolute liquidity ratio, it is determined what part of immediate debts can be repaid at the expense of cash and their analogues (securities, bank deposits etc.). That is, through highly liquid assets.

The absolute liquidity ratio, along with other liquidity indicators, is of interest not only to the management of the organization, but also to external subjects of analysis. So, this ratio is important for investors, quick liquidity - for banks; and absolute - to suppliers of raw materials and materials.

Definition and formula in Excel

Absolute liquidity shows the short-term solvency of the organization: whether the company is able to pay off its obligations (with counterparties-suppliers) through the most liquid assets (money and cash equivalents). The coefficient is calculated as the ratio financial resources to current liabilities.

The standard calculation formula looks like this:

Cubs. = (cash + short-term cash investments) / current liabilities

Cubs. = highly liquid assets / (most current liabilities + medium-term liabilities)

The data for calculating the indicator are taken from the balance sheet. Consider an example in Excel.

We circled the lines that are needed to calculate the absolute liquidity ratio. Balance formula:

Cubs. = (p. 1240 + p. 1250) / (p. 1520 + p. 1510).

Calculation example in Excel:

Just substitute the values of the corresponding cells (in the form of links) into the formula.

Absolute liquidity ratio and normative value

The normative value of the coefficient accepted in foreign practice is > 0.2. The essence of the restriction: every day the company must repay at least 20% of current liabilities. The practice of financial analysis in Russian companies adheres to the same principles. However, there is no justification for such an approach.

The structure of short-term debt in Russian practice is heterogeneous. Repayment terms vary considerably. Therefore, the figure 0.2 should be considered insufficient. For many enterprises, the coefficient rate is in the range of 0.2-0.5.

If the absolute liquidity ratio is below the norm:

- the enterprise cannot immediately settle accounts with suppliers using all types of funds (including proceeds from the sale of securities);

- economists need to further analyze solvency.

A large increase in the absolute liquidity ratio shows:

- too much non-performing assets in the form of cash in cash and bank accounts;

- further analysis of the use of capital is needed.

Thus, the higher the indicator, the higher the liquidity of the company. But excessively high values indicate the irrational use of funds: the enterprise has an impressive amount of finance that is not “invested in the business”.

Let's go back to our example.

The values of absolute liquidity in 2013 and 2015 are within the normal range. And in 2014, the company experienced difficulties with the repayment of short-term liabilities.

Let us illustrate the dynamics of the indicator and for good example display on the chart:

To make a complete analysis of the solvency of the enterprise, all indicators of the liquid current assets of the organization are calculated. This ratio is used to calculate the share of short-term liabilities that can be repaid immediately. The example shows that the value for the period 2011-2015. increased by 0.24. In 2011, 2012 and 2014 the company experienced solvency difficulties. But the situation has normalized - the company is able to fulfill its current obligations by 34%.