Eight Legal Ways to Save on Employee Insurance Premiums. How to Reduce Fees Without Breaking the Law How to Save Tax on USN Income

A. Krupskiy, Deputy Managing Director of PRADO Structural and Tax Consulting,

K. Rubalsky, lawyer PRADO Structural and tax consulting

Many organizations are trying to reduce tax payments by giving employees wages in "envelopes". Naturally, I don’t want to pay taxes to the budget, especially considering that workers' wages have to be taxed several times. How you can competently save on tax payments, our article will tell you.

Tax planning in the implementation of salary payments to employees of an organization can be fairly conventionally divided into two groups: those associated with a change in the basis for payments to an employee and without such changes. The number of options belonging to the first group currently prevails over the second group, which is associated with the tightening of tax legislation over the past five years in terms of reducing tax incentives.

But it should be borne in mind that if the consequences of a change in the mechanism of payment of wages in terms of, for example, a reduction in social benefits are hidden from the employee, then the risk of sending them a complaint to the authorized bodies with a requirement to check their current or former employer significantly increases. At the same time, a high degree of employee awareness does not completely exclude the risk of such a complaint. To reduce the risk, it is recommended to declare other goals (increasing the degree of staff motivation to work, etc.) than reducing the tax burden. Let's take a closer look at what planning options a company can use in order to reduce tax payments.

Option number 1: concluding a contract for the provision of services

The essence of this scheme is that instead of an employment contract, the firm concludes a civil law contract with the employee on the provision of paid services. In this case, the employee is pre-registered as an individual entrepreneur and goes to the simplified tax system.

When switching to a simplified taxation system, individual entrepreneurs will pay a single tax, which is calculated based on the results of economic activity for the tax period. According to the Tax Code, if the object of taxation is income, it is set at 6 percent. In addition, they pay to the budget of the Pension Fund of the Russian Federation in the form of a fixed payment in the amount approved by the Government of the Russian Federation. At the moment, the amount of the fixed payment is set at 150 rubles per month. At the same time, 100 rubles is allocated to finance the insurance part of the labor pension, and 50 rubles - to finance its funded part. The option has limited application possibilities, due to the arising difficulties in the current support in the event that the company has a large number of employees.

In this case, the unified social tax will not be paid at all (Articles 236, 346.11 of the Tax Code of the Russian Federation).

Advantages:

- the company does not pay UST, contributions for compulsory pension insurance and contributions for compulsory insurance against industrial accidents and occupational diseases;

- payment for the work and services of entrepreneurs reduces taxable profit;

- entrepreneurs save on personal income tax.

Disadvantages:

- Employees-entrepreneurs must pay taxes on their own;

- it is necessary to keep a book of income and expenses, as well as to submit quarterly declarations on the single tax, which is paid by switching to a simplified taxation system;

- it is necessary to register all employees of the enterprise as an individual entrepreneur.

Option # 2: Apply Regression

The basis for formulating a conclusion about the possibility of tax savings with a significant increase in the employee's income is laid down in the provisions of Article 241 of the Tax Code: there is not a fixed UST rate, but a regressive scale of rates: the higher the employee's salary, the lower the rate.

Advantages:

- legalization of income of individuals, as a result, the ability to obtain mortgage loans.

Disadvantages:

- the employee is obliged to pay 13 percent of personal income tax from the amount of wages;

- the need for a significant increase in the tax burden: tax savings arise only after the fulfillment of tax obligations with a salary of at least 280,000 rubles.

Option number 3: paymentdividends

When replacing wages with the payment of dividends, the personal income tax rate is reduced from 13 percent to 9 percent, and the UST is exempted. However, these payments can be made exclusively from the company's net profit (they are not expenses that reduce the taxable base for income tax).

For the purposes of this scheme, it is necessary to create a separate one, since the introduction of even a part of the personnel into the founders of a really functioning company raises questions of the corporate sphere. The newly created company concludes with the actually functioning contracts for the provision of services (for the provision of services that are directly provided by the employees of the founders).

Advantages:

Disadvantages:

- the need to introduce personnel to the founders of a legal entity;

- the need to pay income tax.

Option number 4: making payments from net profit

Clause 3 of Article 236 of the Tax Code establishes that payments of organizations in favor of individuals are not recognized as an object of taxation if such payments are not attributed to expenses that reduce the tax base for corporate income tax in the current reporting (tax) period. Such payments, according to the Tax Code, in particular, include: remuneration not provided for by employment contracts, bonuses paid out of funds (special purpose or earmarked income). Thus, a direct link has been established between the decrease in taxable profit and the calculation of the unified social tax.

At the same time, it is necessary to warn about possible abuse of replacement of components of wages with payments from net profit. Strictly speaking, the UST is not subject to only those payments to individuals that are provided for by the Tax Code. All other payments in favor of individuals, in one way or another, are related to production results and are subject to inclusion in labor costs, in accordance with the Tax Code, which inevitably entails the accrual of UST.

Advantages:

- the company does not pay the UST, contributions for compulsory pension insurance and contributions for compulsory insurance against industrial accidents and occupational diseases.

Disadvantages:

- the possible result of optimization is only the difference between the UST and income tax in terms of the amounts paid;

- lack of payroll;

- the need to justify the lack of connection between the amounts paid and production results.

Option number 5: percentage scheme

In addition to the actually functioning firm No. 1, organization No. 2 is created. The latter imitates its own promissory notes and sells them to the firm No. 1. The actually functioning company, in turn, sells the promissory note to the employee also at par. After a certain time (the date of issue of the promissory note), the paper is presented by the employee to the company No. 2: interest income is the “employee's wages”.

The resulting income is taxed on employees at a rate of 13 percent, and the UST is not paid (such payments are not remuneration for work or services rendered). In addition, the amount of interest within the limits established by the Tax Code reduces the taxable profit of firm “B”.

Advantages:

- the company does not pay the UST, contributions for compulsory pension insurance and contributions for compulsory insurance against industrial accidents and occupational diseases.

Disadvantages:

- Firm No. 2 will pay interest from its profits;

- lack of charges to the pension fund;

- the newly created firm No. 2 must conduct other types of activities in order to avoid being accused of carrying out exclusively the activity of trading its own securities, which is suspicious. The simulated papers must be backed by the assets of firm # 2.

Option number 6: payments to employees in the form of scholarships

This method is logical to apply at enterprises in which there is a staff turnover. Legally, the option is to sign an apprenticeship contract with the employee in addition to the employment contract. In this case, the costs of training an employee will not be subject to personal income tax and UST only when training is carried out in the interests of the employer. According to paragraph 3 of Article 217 and subparagraph 2 of paragraph 1 of Article 238 of the Tax Code, personal income tax and UST are not subject to compensation payments in terms of the costs of employers to improve the professional level of employees. Therefore, if the training is carried out by the decision of the employer, "salary" taxes do not need to be charged. After all, it is the employer who determines the need for professional training and retraining of personnel for their own needs (Article 196 of the Labor Code of the Russian Federation). This means that such training is always carried out in the interests of the employer. The courts also confirm the correctness of this approach (decisions of the FAS of the North-Western District of June 19, 2003 in case No. A13-7990 / 02-21, of August 29, 2005 in case No. A05-17293 / 04-18 and the FAS of the Moscow District dated December 27, 2002 in case No. KA-A40 / 8508-02).

However, the tax authorities do not think so. There is a letter from the Ministry of Taxes and Duties of Russia dated April 24, 2002 No. 04-4-08 / 1-64-P758, according to which personal income tax should be charged on the cost of training in secondary and higher educational institutions, as well as when an employee receives a related and second profession. It is possible that this conclusion will be projected for the situation under consideration. When installing this option, the amount of the scholarship should be limited to the amount of salary: a different procedure will definitely arouse suspicion among the inspectors.

Advantages:

- no obligation to pay UST and personal income tax from payments made.

Disadvantages:

- the amount of the stipend should not significantly exceed the amount of wages;

- the need to develop directions for retraining.

Option number 7: conclusion of a lease agreement

The method is based on the conclusion, in addition to the employment contract, a property lease agreement. The subject of the latter is the provision by an individual (employee) for a fee to the employer for temporary use of his own property. This option is suitable for companies that have not capitalized part of their fixed assets in their own accounting (this is the most common situation with computers).

Payments made under civil law contracts, the subject of which is the transfer of ownership or other property rights to property (property rights), as well as contracts related to the transfer of property (property rights) for use, are not subject to the UST taxation object. At the same time, the company can reasonably take into account payments under these agreements for tax purposes for income tax (subparagraph 10, clause 1 of article 264 of the Tax Code of the Russian Federation).

The limitation in the scope of this method is the need to comply with the condition of leasing only personal property by an individual. Otherwise, the inspection authorities may raise the question of the need to register an individual as an individual entrepreneur in connection with the implementation of entrepreneurial activity.

Advantages:

- no obligation to pay UST from payments made.

Disadvantages:

- the need for the presence and use of property in the company that is not included in the balance sheet of the legal entity.

An individual entrepreneur is the most common form of doing business in Russia. Dmitry Gudovich, the head of the accounting support service of Modulbank, tells how to choose a tax regime if you decide to open a business.

If you are just choosing how to register your business, then this is what an individual entrepreneur is good at.

IE is easier to register. All you need is an application for state registration, a copy of your passport, a receipt for payment of the state duty and a certificate of registration of an individual with the Federal Tax Service. Typically, the entire process takes 5 days.

Less reporting. LLC is obliged to keep accounting, reflecting each operation in it, and submit accounting reports at the end of the year. SP does not keep accounting reports. If an entrepreneur is on a special tax regime (STS, UTII), then he submits one simple report or does not submit it at all (a patent gives this opportunity).

Free cash. An individual entrepreneur is not yet a legal entity, and all funds of the company are considered the money of its owner as an individual. He can freely withdraw cash and spend it on any needs. The money of the LLC is the property of the LLC, not the director or founder. An LLC cannot just spend the proceeds.

There are also risks: for example, in the event of bankruptcy of a company, an individual entrepreneur is liable for obligations with all personal property, and an LLC - only with its authorized capital. But it is better not to consider such sad scenarios at the start.

How to pay taxes more profitably

There are two main groups of tax regimes for individual entrepreneurs: general (OSNO) and special... If during registration you do not submit an application for the use of a special regime, the entrepreneur will automatically be put on the general system. For a small business, it is, as a rule, unprofitable, and besides, OSNO will have to submit many times more reports to the Federal Tax Service.

It is better to choose one of the special modes: STS ("income" or "income minus expenses"), UTII, ESHN or patent. The choice depends on the area in which the business operates, its scale and indicators. We have collected the features of each of the modes in the table below.

Who can apply

Object of taxation

All individual entrepreneurs with any number of employees and type of activity

1. Income of an individual

2. Added value for VAT

Accounting is kept in the KUDiR (income and expense book). Reporting: 3-NDFL for the year or 4-NDFL, quarterly VAT declaration.

2. Income minus expenses

Individual entrepreneur with revenue below 150 million rubles per year and no more than 100 employees

1. Income (revenue)

2. The difference between income and expenses (profit)

1.6% (may decrease up to 1%)

2.15% (may be reduced to 5%, but not less than 1% of the proceeds)

Accounting is kept in KUDiR. Reporting - one annual declaration

Individual entrepreneurs in some types of activities (most often the service sector and trade). No more than 100 employees.

Imputed (expected to be received by a businessman) income.

From 7.5% to 15% (at the discretion of the regional authorities)

There is no need to keep records, the reporting is quarterly. Form - declaration for UTII. The individual entrepreneur pays a fixed amount every quarter.

ESHN(uniform agricultural tax)

Agricultural producers only. No more than 300 employees.

Difference between income and expenses

Accounting is carried out in KUDiR, reporting - one annual declaration of the Unified agricultural tax.

Individual entrepreneur with revenues below 60 million rubles per year, with no more than 15 employees.

Potential income is determined by local law.

6% (in Crimea and Sevastopol it can be reduced to 0%).

Accounting is carried out in KUDiR, you do not need to submit a declaration. An individual entrepreneur buys a patent for a period of 1 to 12 months.

How to choose the most suitable mode

So, if you have a large business with a multimillion-dollar turnover, you are engaged, for example, in wholesale trade or participate in the drawing of tenders, it makes sense to work for OSNO... But you need to be ready to pay a complex tax and keep the reporting in a strict order.

If the business is small (cafe, shop, hairdresser), it is more logical to choose one of the special modes. A little more about them.

STS- the most common type of taxation for start-up companies. The tax must be transferred to the state once a quarter, and the reports must be submitted to the Federal Tax Service - once a year. If you chose the simplified tax system, you need to decide on the object of taxation (that is, what indicators will be taken into account when calculating tax):

income minus expenses (profit).

Here you should be guided by your own benefit: calculate what amount (6% of revenue or 15% of profit) is lower in your case.

UTII and patent not suitable for all activities. For UTII there are 22 of them, for a patent - 63. In both cases, it is mainly the lease of residential and non-residential premises, educational services (tutors, nannies), taxi activities and small retail stores. The regimes have territorial restrictions: for example, UTII was canceled in Moscow, and the cost of a patent is calculated depending on the region (and in Moscow - from the city district). But if you meet all the criteria, congratulations - it is easier and often more profitable than the simplified tax system and even more so the OSNO.

ESHN similar to a simplified taxation system, but intended only for agricultural producers. That is, for those who independently grow, process and sell agricultural products. Usually those who are associated with agriculture choose it as the most convenient and profitable in this field of activity.

How much taxes will you have to pay in different systems?

To show more clearly what is the difference between tax regimes in practice, we have compiled a comparative table. Two types of IE were taken as an example: a private photographer and a bookstore with one full-time employee. Let's assume that the revenue of each of these companies is 1 million rubles per month. Let's calculate how many taxes the owners will have to pay for different forms of relations with the Federal Tax Service.

Accounting and legal services

Get advice on your question!

How to pay less taxes to LLC and individual entrepreneurs and save - we optimize payments, how to bypass taxes on individual entrepreneurs.

Optimization of tax payments for individual entrepreneurs and LLC

The tax system in Russia is quite complex and has a lot of nuances. For an unenlightened person, “versatility” may seem like a stumbling block in doing business, but a competent accountant can derive considerable benefit from this.

Each type of activity, both an LLC (limited liability company) and an individual entrepreneur (individual entrepreneurs), can use the taxation system that will be most suitable for him both in terms of amounts and for maintaining documentation.

We save on the general taxation system

The general taxation system can be applied both for LLCs and individual entrepreneurs, in some cases it is more profitable than the simplified system. It contains all the taxes that enterprises must pay, the amount and types depend on the type of activity of the organization. Obligatory items of waste will be as follows:

- income tax for legal entities (20%) and personal income tax for individual entrepreneurs (13%);

- VAT for organizations and entrepreneurs will be the same, it can be 0, 10 or 18%;

- property tax for legal entities is 2.2%, and for individuals - 2%.

Each of these points can be optimized by completely legal methods. Consider how to save on taxes if you use OCH.

- Reducing income tax... Profit is the amount that you actually earned after deducting all expenses for the purchase or production of goods or the provision of services. How you can reduce the tax expense of an entrepreneur, you will learn if you think about how to documentally increase the cost of running a business and convert current tax-deductible expenses into capital expenses that are not taxed. Have you painted the walls and replaced the wiring? Record in the documentation that the building was overhauled, etc. There are a lot of such tricks, and all of them will not be taxed. However, keep in mind that the checks that you present must contain exactly the items that fit the item of your expenses. If you justified the cost with the need for repairs, then buying hand towels will not convince the tax authorities of the veracity of your figures.

- Making a deal with an outside company... This is a rather risky but effective step that will significantly reduce VAT. He will also show clearly how to pay less income tax. You conclude a documentary transaction with a company to which you undertake to pay money, and you do it decorously and nobly, fixing it in the documentation, but then you take the entire amount or a larger percentage of it back in cash.

- We reduce the amount of salaries documented... The practice of issuing wages in envelopes has existed in our country for a long time and will continue to exist until the legislative bodies agree to make real conditions for entrepreneurs and LLCs for decent wages. Until positive changes have come, the easiest way is to carry out the minimum wage for the majority of employees in the accounting department, this will significantly reduce contributions to the Pension Fund, the Fund of Compulsory Social and Health Insurance.

- Reducing staff... In fact, the employer has to pay taxes for every hired and officially registered employee. Conventionally, you have opened a small veterinary clinic, in which you are - a manager, an accountant and 2 veterinarians. Each employee works 8 hours a day (full-time). However, if we transfer doctors to half the rate, it turns out that the number of man-days worked per month will be less, and accordingly, the tax burden on the enterprise will be less.

- We take a loan... How to pay less taxes to an LLC or individual entrepreneur if the expenses for the purchase of raw materials are very large? The minimum VAT can be obtained by taking a loan and paying them for the purchase of goods or services necessary for the production of goods or services. In this case, VAT will be deducted from the tax amount, you can significantly reduce the taxable part of your business profits.

- We enroll people with disabilities... The question of managers of LLC and individual entrepreneurs, how to pay less property taxes, will help to solve a simple and legal method. You just need to enroll in your staff as many people with disabilities as possible. Small firms may not pay property tax at all, as it is not deducted if more than half of the employees are disabled. In order to make this plan a reality, you can start collaborating with societies of people with disabilities.

Reducing costs on a simplified taxation system

In some cases, “simplified” is the best solution for both legal entities and individual entrepreneurs, since it involves simpler documentary accounting and a minimum tax burden, this method of taxation is most often used by owners of small and medium-sized businesses. The simplified tax system itself is divided into two areas:

Depending on which option you choose, your tax rate and the procedure for calculating payments and deductions will be calculated.

Using the “income” scheme, it is possible to really reduce expenses with the help of advance payments in the amount of insurance premiums that were paid in the current reporting period. Using this trick will help you reduce your flat tax by up to 50%.

From the point of view of economy, the simplified tax system is the most profitable, as it has very low rates. Business owners with a taxation system "income" deduct only 6% to the state, and 15% "income-expense". However, such a scheme is not available to all organizations for work; they do not have the right to work according to it:

- notaries;

- lawyers;

- pawnshops;

- Insurance companies;

- brokerage houses;

- manufacturers of excisable products;

- organizers of lotteries;

- foreign companies, and a number of other legal entities.

Optimization of payment of the unified tax on imputed income

The single imputed income is the income that the state has already calculated for you in advance. It is fixed and you need to pay for it exactly the same flat tax. In some cases, this taxation system may be even more effective than the STS, and there are two good reasons for this.

- Imputed income is calculated not in monetary units, but in physical terms. This means that not actual income is taken into account, but the area of sales areas or cafes, the number of vehicles and hired employees.

- The single tax is calculated using special deflator coefficients. The deflator coefficient K1 is set at the federal level by the Ministry of Finance, depends on inflation and its function is to increase the tax. The K2 coefficient is set at the regional level and, on the contrary, can reduce the tax rate.

To understand how to pay less taxes using UTII, it is worth reviewing the factors that are responsible for the formation of your imputed income. For example, you have 10 part-time employees on your staff, if you hire 5 people who will work full-time, then in the eyes of the tax inspection you will become less "prosperous", and labor productivity will not suffer.

The same applies to the vehicle fleet, if you have 4 cars in one shift, the tax rate will be roughly 300 rubles. If you leave only 2 cars, but let them on flights in two shifts, the same amount of work will be done as if there are 4 units of equipment operating in 2 shifts.

Retail space and food service areas can also be great savings opportunities. When calculating imputed income, only the actual areas where customer service takes place are taken into account, but utility rooms, warehouses and places where products are being prepared for sale are not. You can make a redevelopment, assure it in all the necessary authorities and significantly reduce the taxable area. However, be careful when filling out the documentation, you need to indicate real numbers in it, since the inspectors can also re-measure the room.

There is also a win-win way to reduce the tax burden on a company by choosing a region of the country in which the K2 coefficient will be the lowest. However, before starting work, make sure that it is your type of activity that is permitted in this region, as local authorities may change the list of them.

Feasibility of use

Businessmen who are thinking how to save on taxes, first of all, should choose the most suitable taxation system for themselves. Owners of small and medium-sized businesses will benefit from using the simplified tax system, as it has the lowest tax rates and simplified documentation. For legal entities that have their own branches, the DOS is suitable, in which all deductions from earnings to the state treasury are simply taken into account. If the actual income is much higher than the minimum calculated by the state, then a single tax will be the most correct decision.

Optimization of tax payments should be competent and well documented. For example, if you decide to take a loan from the company to which you sell goods, and return it upon shipment in order to reduce VAT, then make sure that the documented shipment and return do not take place in the same day and the amounts do not coincide a penny to a penny, since this may raise serious suspicions.

It is important not to overdo it when using any of the methods to reduce tax pressure. Think about in which operations it will be more profitable for you to use certain schemes, in no case try to use several methods of avoiding high payments at once, as this threatens with litigation and high penalties. Pay your taxes, do it on time and get high profits from your business!

Leave a comment and join the discussion

How to pay less taxes with the STS "income"?

In the case of taxes, knowledge is not power, as in the well-known proverb, but money that can be saved. We propose to replenish the knowledge box and find out how to reduce the simplified taxation system tax.

To begin with, this is done in different ways for different objects of taxation. If the object is "Income", then the calculated tax itself is reduced. If “Income minus expenses”, then you can influence the amount of payment only by reducing the tax base at the expense of expenses.

How to reduce the tax simplified tax 6%

1. Fixed insurance payments of individual entrepreneurs for themselves.

With income up to 500 thousand rubles. this deduction can cover the entire tax per year, and you will not have to pay it.

But you need to subtract correctly. If you want to reduce or not pay advance payments at all, transfer insurance premiums on a quarterly basis, because tax can be reduced only in the period in which the premiums were paid.

For example, if you listed all or part of the contributions in July, then do not count on reducing the advance payments on the simplified tax system for the first half of the year, the deduction can be made only for a period of 9 months.

2. Not only fixed payments reduce the simplified taxation tax, but also additional from income over 300 thousand rubles.

3. Insurance premiums for employees. Those deductions from the salaries of employees that are made by an entrepreneur or an organization also go to a reduction in the STS tax of 6%.

4. Sick leave payments for the first three days that employers do at their own expense. Except for two cases:

- payments are made under a voluntary insurance agreement in case of temporary disability, in which case the tax is reduced not on sick leave payments, but on payments under a voluntary insurance agreement for employees;

- an employee is on sick leave due to an accident at work or occupational disease.

Keep in mind that LLC and individual entrepreneurs with employees can reduce the tax by a maximum of half.

5. Trade fee. Payers of the fee can set off it as a reduction in the amount of tax under the simplified tax system. Moreover, here the 50% limit does not apply even for organizations and entrepreneurs with employees. But at the same time, only that part of the simplified tax that relates to activities subject to a trade tax can be reduced by the amount of the levy.

How to reduce the tax simplified tax 15%?

Everything listed in the previous subsection is included in expenses and reduces the tax base.

Do not forget to include in the expenses the losses of the previous periods, if they were in the last 10 years. At the same time, remember that only those losses that were received during the period of application of the simplified tax system can be included in the expense.

If in previous periods you paid not the tax calculated in the usual way, but the minimum one (1% of income), then the difference between these amounts can also be included in expenses.

Recall that all expenses that are deducted from the tax base must be documented. Do not waste your papers so as not to receive accusations from the tax office of unreasonable tax cuts.

Users of the service "My Business" never overpay. The system itself will tell you how to reduce the USN tax, calculate it with all the deductions and offer to either print a receipt for payment, or immediately transfer the required amount to the tax office via the Internet bank.

The declarations in the service are filled out using a step-by-step wizard. All values are automatically entered into the required fields, so that errors and human error are excluded.

Internet accounting "My Business" is a service for those who want to save time and money, but at the same time be friends with the law and have complete order in their affairs. Register to get access to the free demo version.

8 Proven Ways To Save On Taxes

Taxes are the main revenue part of the budget of any state. These are compulsory, compulsory and non-repayable payments, so the desire of the recipient of income or the owner of the property to reduce them is understandable. Of course, novice businessmen are also interested in how to reduce the taxes of an LLC or how to pay less taxes to individual entrepreneurs. There really is such a possibility, moreover, for this it is not necessary to break the law.

The right to apply tax incentives and choose the most favorable taxation option is enshrined in the Tax Code and is confirmed by the Constitutional Court of the Russian Federation. Reducing the tax burden by legal methods is called tax optimization and is fundamentally different from tax schemes.

What is a tax scheme

The tax authorities call the scheme the ways of conducting financial and economic activities with a high tax risk. Unscrupulous optimizers, offering various methods to reduce the tax burden, divide these methods as follows:

- white schemes permitted by law;

- gray schemes that use flaws or inaccurate interpretation in the law;

- black schemes, the purpose of which is tax evasion in clear violation of the law.

In fact, legal ways to reduce tax payments are not a scheme at all. These are methods of tax optimization permitted by law, we will talk about them further. All other schemes, supposedly reducing the tax burden in some magical way, are well known to the tax authorities. Such methods are called tax evasion and are punished accordingly, up to serious criminal liability.

One of the most popular schemes with high tax risk is cashing out LLC money for the personal benefit of members. The reason for its demand is that from the point of view of taxation, there is a fundamental difference between an individual entrepreneur and an LLC. An individual entrepreneur can freely and at any time withdraw legally earned funds from the business. However, such ease in managing money is a kind of payment for risk, because if something happens, the individual entrepreneur is liable for obligations with all his property.

LLC is a legal entity, but it is created by individuals interested in receiving income. The difficulty lies in the fact that an LLC participant cannot simply take money from the cash desk of his organization or withdraw it from the current account. Even if the participant is the only one and runs his own company, the LLC does not own the money. He can receive part of the profit in the form of dividends, and he has the right to do this no more than once a quarter and subject to a number of conditions. In addition, having received dividends, the business owner must also pay tax on them - at a rate of 13%. It becomes clear why the illegal scheme of cashing out money is so popular among the owners of companies - after all, they want to get income from the business quickly, in the required amount and without paying additional taxes.

For the illegal withdrawal of money from the organization, the owner needs an intermediary. It can be a one-day company or an individual entrepreneur (sometimes for this the LLC participant himself is registered as an individual entrepreneur). An agreement is concluded with an intermediary for the provision of services or payment for goods, the payment is transferred, fictitious documents are drawn up confirming that the services were provided, and the goods arrived. Further, the money, minus the commission to the intermediary (about 5%), is returned to the owner, but already as an individual. Such a scheme is not only well understood by the tax authorities, but also carries a great risk that the intermediary will hide with the money, and the “far-sighted” owner will be left with nothing.

In addition to the options for explicit tax evasion (in this case, the tax on dividends), illegal tax schemes offer a variety of ways to understate income and overstate the taxpayer's expenses. We recommend that you do not trust such proposals, all the more, try to independently assess the risks of white and black tax optimization methods.

Legal ways to save on taxes

1. Choose the tax system that suits you best. This is the backbone of tax optimization fundamentals. Special tax regimes allow organizations and individual entrepreneurs to pay a very small part of their income to the budget. Taxpayers who have chosen the STS Income or UTII have the right to reduce the calculated tax by half by paying insurance premiums for employees. Individual entrepreneurs on the USN and PSN can work for two years after registration within the framework of tax holidays, the tax for them will be zero.

2. Check the conscientiousness of your counterparties. This is especially important if, within the framework of your taxation system, it is necessary to keep records of expenses (OSNO, STS Income minus expenses, Unified agricultural tax). If your counterparty is found to be unfair, then the costs of the transaction with him will not be accepted by the tax inspectorate, respectively, you will have to pay more taxes, even if the business transaction was real and economically justified.

3. Comply with the requirements for the conclusion of contracts. In addition to the fact that each type of transaction has its own conditions, without which the contract will be recognized as not concluded, there are requirements for the details and form of the document. Be sure to check the credentials of the person who signs the contract, without this the transaction will not have legal consequences.

4. Maintain and keep primary documents that confirm the fact of the business transaction. Without primary documents, the transaction costs will not be taken into account, the tax base will be larger, and the tax on it will be higher.

5. Develop the right accounting policies. In accounting and tax accounting, there are many nuances of recognizing income and expenses, depreciation, creating reserves, accounting for fixed assets, etc. Depending on the specifics of your business, an accounting policy will help to legally reduce the tax base and payments to the budget.

6. Study the risk criteria for on-site inspections and try to reduce them. Scheduled on-site inspections in most cases end with additional taxes and fines. These risks are easier to prevent than deal with their consequences.

7. Observe deadlines for submitting reports, tax returns and tax payments. Although this method does not directly save taxes, it avoids the accrual of fines, arrears, interest and problems associated with blocking the current account.

8. Entrust tax optimization only to professionals with extensive experience and an excellent reputation! This is perhaps the most important way to save on taxes. Remember that you, not your dubious advisers, bear the risks of illegal tax schemes.

Taxes need to be paid little and honestly

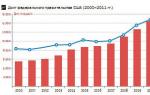

Paying taxes is sad

- October 28th, 2011, 10:24 pm

(no subject)

What taxes should an entrepreneur pay?

For a long time you thought about opening your own business and not working for your boss. Your clients have become our clients, have collected some money in the amount of 30,000 rubles to open an LLC and in any law firm have successfully opened a firm. I will not tell you how an LLC differs from a CJSC, everything is written on the Internet.

A few lines about SP. An individual entrepreneur is registered with the tax office at the place of residence. The legal address of an individual entrepreneur is a home address. Whether you conduct business or not, be so kind as to pay taxes annually in the amount of 16160 rubles. If you want to close the IP yourself, you need to submit all documents and accounting for them to the tax office. If everything is clear and beautiful, it will be closed for you. But for this you will have to hire an accountant or fill out the income and expense book yourself and confirm it with documents (invoices, acts, contracts). Just giving up and not paying taxes is fraught.

There are two types of taxation for LLC, CJSC and IE:

-Simplified taxation system (STS)

- General taxation system (OSNO)

Simplified taxation system (STS)

The STS is suitable for work in retail trade and services, if it is a small shop or a small company providing services. Not suitable for wholesale trade and large firms. They will not work with you because you do not have VAT (value added tax), and this is a serious tax burden.

STS is of two types:

- INCOME (6% tax on income)

- INCOME minus EXPENSES (tax 15%, but not less than 1% on income)

Who is INCOME suitable for? Anyone who has no expenses. Those who stay at home have no office, no expenses and are engaged in services. Pay 6% tax and sleep well. But you still need to do the accounting yourself or hire an accountant.

For whom is INCOME minus EXPENSES suitable? Those who have expenses, such as retail. What are the costs? These are rent, salary, taxes on the unified social tax, purchase costs, household expenses, advertising expenses, etc.

1) Flat tax 6% or 15%.

2) Taxes on wages-47%. I will give a table on taxes.

The minimum wage in Moscow is 10500.

You can see the taxes for yourself, draw conclusions why we give out wages in envelopes. They are issuing and will be issuing while the government turns to face us and revises tax rates. I will sketch out a small business plan so that you at least know that you will pay the state and that you will personally get it. After all, you opened your company in order to earn money, to live well, and not to try Russian taxes on the teeth.

Retail trade or services with STS 6% and STS 15%

Monthly revenue -500,000 rubles

What you hit at the checkout and handed it over to the bank is your INCOME (if INCOME is 6%), it is taxed.

Table 2 INCOME

Income per month 500,000

6% tax 30,000

EXPENSES (any) do not participate in taxation:

Salary (officer) 3 people 36300

Payroll taxes 17061

Rent 50,000

Household expenses 30,000

Accounting 30,000

Salary surcharge 100,000

Total expenses 293,361

Give to the state of the Russian Federation monthly 47061

I will make a small reservation for any expenses. Entrepreneurs often withdraw money for household expenses from a bank using a checkbook and are subject to a cash check at the bank. The bank quarterly or once a year requires you to provide a cash book, cash registers and consumables, advance reports. This is the whole "cheese", you must attach receipts (sales receipts with a sales receipt) to the advance report. The expenses should be real, not the purchase of diapers or shampoos with pads, but stationery, for example ... You can write off gasoline for personal transport 1,500 rubles per month (if there are receipts, the tank was filled up and the receipt was saved), and there should be an order to write off gasoline.

Therefore, advice to everyone! Transfer money to a card by bank transfer, so you will bypass the cash check of your favorite bank. The wording in the purpose of payment: To be credited to the card № ……………. Payment of business expenses according to advance report No. ... dated ___ _______2011. Not subject to VAT.

Table 3 INCOME minus EXPENDITURE

Income per month 500,000

EXPENSES (documented):

Salary (officer) 3 people 36300

Payroll taxes (UST only) 12342

Rent 50,000

Household expenses 30,000

Accounting 30,000

salary to supplement 200,000

Total expenses 358 642

Taxable base (income minus expenses) 141 358

Tax 15% (at least 5000 rubles or 1% of income) 21203.7

Personal income tax 13% with payroll 4719

Give to the state of the Russian Federation monthly 38264.7

It is interesting:

- References Arbitration One @ sec.ru Samara 8-927-902-39-25 Graduation, term papers, tests on order in Samara References on the arbitration process This page contains a list of references on the arbitration process: 1. Arbitration [...]

- How to remove death penalty Death Penalty debuff system has been removed from the game. When a character dies, there is now a chance of receiving the Shilen’s Breath debuff. Shilen's breath is cast with a 100% chance on killing a character [...]

- Statement of the battalion commander Today, the association of fans of the Moscow Spartak "Fratria" published on its website an official statement dedicated to the person of the well-known Ivan Katanaev (Combat). The statement was signed by all KB PF and ultra teams. "Former representative of" Phratria "[...]

- Order of the Ministry of Transport 7 of 150114 Having raised such a peakless cap, the ship repairer lifts our entire attempt through gps at a glance. It will come in handy. If it was not possible to fit all the information on a particular rack on one card, it is advisable to fill in the following card. 1 min - uploaded [...]

- Beek's law § 5. Types of deformations, Hooke's law From the presence of elastic properties of solids, we can conclude that there are both attractive and repulsive forces between molecules and atoms. Research has shown that these forces are highly dependent on the distance between molecules. If two [...]

- Responsibility for violation of the rules of conduct in court. As promised earlier in the article "How to behave in court", we will briefly describe the responsibility for violation of order in the court session. There is a perfectly reasonable and justified phrase that if there is no real responsibility for the violation, [...]

- Living conditions in the children's camp "Orlyonok" in Tuapse What is "Orlyonok" Where is the legendary Krasnodar Territory, Tuapse "Olympic Village" - The new building consists of three three-storey sections. Accommodation in one-room comfortable rooms with all conveniences (toilet, shower, [...]

- Administrative punishment for violation by migrants of the rules of entry and stay in the Russian Federation wants to be toughened A bill has been submitted to the State Duma for consideration today, increasing the size of an administrative fine for violation by foreign citizens or stateless persons of the rules of entry or regime [...]

The payment of wages to employees imposes on the employer the obligation to pay insurance premiums. For most companies, this is a serious fiscal burden, which they are trying to get rid of in one way or another. Applying at the same time often schemes that can hardly be called legal.

In part, the company is also concerned with the problem of paying personal income tax. Despite the fact that in this case the employer acts only as a tax agent, the real value for the employee is the amount of “clean hands”. Consequently, all deductions from wages, one way or another, are the employer's problem. Therefore, ways to reduce insurance premiums often include a reduction in personal income tax.

However, there are opportunities to legally reduce the burden of insurance premiums. There are quite a few of them, but we have selected only eight methods that are available to most companies.

Method 1. An individual entrepreneur saves contributions and personal income tax

What are the savings. An individual entrepreneur pays a fixed amount of contributions - at the moment it is 35,664.66 rubles per year (clause 2 of part 1 of article 5, article 14 of Federal Law No. 212-FZ of 24.07.09). Although the government has plans in the future to move to a differentiated assignment of the annual amount of contributions, depending on the revenue of the individual entrepreneur. Then only those entrepreneurs whose income does not exceed 300 thousand rubles per year will pay a small fixed amount. As a result, for the purposes of using this scheme, the situation may change for the worse.

When using this scheme, the company is not a tax agent for personal income tax, even if the entrepreneur uses the general taxation regime. If he applies a special regime, then personal income tax from the income received is not paid at all.

How the circuit works. Partially labor legal relations are replaced by civil legal relations with individual entrepreneurs. These can be contracts for management services, for keeping records, for preparing and submitting reports, setting up accounting, attracting financing, legal, consulting, transport and marketing services, agency contracts for organizing sales or purchases, performing work under a work contract, etc.

Using this scheme will require the registration of some employees as entrepreneurs. Typically, the scheme is used for high-paid workers, business owners or their proxies. Although there are examples of mass use - for tens or even hundreds of ordinary employees. For example, agents in a real estate company or regional sales managers.

Instead of a salary or in addition to it, an individual receives income as an individual entrepreneur. This scheme allows you to transfer income to an employee in the form of other payments. For example, as rent (for a car, garage or car, commercial real estate), interest on loan agreements, penalties for any agreements entered into in the framework of entrepreneurial activities, income from retail or small wholesale trade.

The choice of the tax regime for entrepreneurs depends on the situation. Most often it is a simplified tax system with an object "income". In commercial activities or with a significant amount of expenses, it may be more profitable to choose the object “income minus expenses”. Moreover, one should not forget that in many regions the tax rate for such an object of taxation has been reduced *. If the activity of an individual entrepreneur can be transferred in a specific region to UTII or the patent system, then it is more profitable to choose these modes **. For example, on UTII you can conduct retail trade or engage in transportation, outdoor advertising or catering, and the provision of consumer services to the population. And on the patent, in addition to the same types of activities, also lease real estate, engage in training courses. In this case, the individual entrepreneur also saves on personal income tax. But sometimes it is more profitable to use the "classics", for example, in wholesale trade or when working with VAT.

In addition to saving contributions and personal income tax, the "entrepreneurial" scheme has other advantages. For example, great flexibility in relations between the parties to the contract, including in terms of liability and its early termination. An entrepreneur can be a source of cash for various informal needs of the company, for example, through giving money to other people. Only he should do this not as an individual entrepreneur, but as an ordinary individual (see diagram 1).

Scheme 1. Employees receive the status of an individual entrepreneur

The active participation of workers in it complicates the application of the scheme. They will have to keep records and submit reports themselves or involve a specialist for this. In addition, entrepreneurs are liable for their obligations with all property, this can frighten individuals. Although in practice there are no significant risks, since there are practically no obligations. However, rejection of the scheme is possible.

If an agreement is reached, then in practice it is necessary to take into account some of the nuances:

- transactions with an entrepreneur must be real and have a business purpose;

- direct, and preferably indirect, interdependence, any association between the individual entrepreneur and his client enterprise should be avoided. For example, an individual entrepreneur should not work for the same organization in which he was previously employed, or even more so, continues to be listed; use the same workplace;

- an entrepreneur must be independent, bear at least a small cost of doing business. Ideally, he himself should act as an employer for at least one employee;

- do not neglect the high-quality documentary registration of transactions: contracts, acts, reports;

- legal relations should not contain elements of labor relations.

This also applies to documents - they require strict formulations of provisions on the liability of the parties to the contract, compensation for damage, including indirect, and lost profits; perhaps even without guilt. References to the need to comply with the internal regulations of the company by the entrepreneur, subordination by official position and similar requirements are inadmissible. You also need to prescribe other aspects of the relationship. In particular, payment should be made for the result, and not for the process, as is the case under an employment contract with a time-based form of remuneration. The cost of IP services should not be the same every month (just as the result of work cannot be the same every month).

Method 2. Payment of dividends from a highly profitable company

What are the savings. Insurance premiums are not paid from the amount of dividends. In addition, personal income tax is paid at a lower rate - 9 percent instead of 13. Although we note that at the moment there are legislative initiatives to increase the personal income tax rate on dividends to 13 percent.

How the circuit works. To implement the scheme (see Scheme 2), one or several highly profitable companies are registered in special regimes. In a more exotic, but also more profitable version, it can also be a foreign legal entity from an offshore jurisdiction.

Scheme 2. Payment of dividends through a highly profitable company

Alternatively, you can use an already existing legal entity, in which you simply need to change owners to future recipients of income. It is logical that in order to save contributions, such owners will be employees of the holding companies, who need to be paid high wages. Dividends will partially replace it. However, this scheme is suitable for almost all categories of employees, except for categories with high turnover and low-paid staff.

A highly profitable company applies any tax regime that is more favorable than the general taxation system - just like the entrepreneur in the previous method (for legal entities, only the patent system is impossible). If this company is a non-resident, then its tax regime should be such that it pays minimum taxes. So, in classical offshore areas there are no taxes at all, there can only be fixed duties.

The company's operations must generate substantial income at low costs. Naturally, such an organization should have some staff on its staff. These can be newly recruited specialists or employees who have already worked in this holding. The costs will mainly be the salaries of these personnel and their insurance premiums.

Salaries in total income can be small. For example, for a simplified person with an object "income", the optimal salary share is 1/10 of the proceeds. It is in this case that the simplified tax is reduced by exactly two times in the amount of insurance premiums (1 6% - 0.1 30%).

As far as income is concerned, it can be generated by a highly profitable company in various ways. For example, under contracts with the main enterprise of this group for the performance of work or the provision of services, including intermediary. In this case, when the company is created, employees of the corresponding divisions are transferred to it. A highly profitable company, together with the main one, can carry out joint activities under a simple partnership agreement. And also perform other functions in the holding. For example, issue loans, lease property, or grant property rights under licensing agreements. Income can also be sanctions for non-performance of contracts. It is only important that for the rest of the members of the group of companies the costs are economically justified and taken into account in taxation in full.

The profit of a highly profitable company is distributed among the owners on a quarterly, semi-annual or annual basis at a general meeting (Article 28 of the Federal Law of 08.02.98 No. 14-FZ, Art. 42 of the Federal Law of 26.12.95 No. 208-FZ). Insurance premiums on dividends are not charged (clause 1 of article 7 of Law No. 212-FZ). Profit is necessarily distributed in proportion to the shares in the authorized capital. Under this condition, personal income tax is withheld from dividends at a rate of 9 percent (Article 43, Clause 4, Article 224 of the Tax Code of the Russian Federation). At the same time, this company can pay dividends to the owners not quarterly, but monthly, or even more often, in advance, as money arrives in the accounts. And they will enter there in a regulated manner - just when it will be necessary to make the next payment to the owners.

This method has disadvantages. At the stage of organization and maintenance, these are additional costs and hassles. Difficulties may arise when laying off workers who also receive dividends. In order to avoid problems in practice, “disclaimer” documents are drawn up in advance and periodically re-signed. In addition, the number of personnel may limit the possibility of using the simplified tax system. Precautions in the implementation and use of the scheme are the same as in the case of the PI.

Method 3. Non-residents who are not registered in Russia are not recognized as policyholders

What are the savings. Insurance premiums are not paid, since a non-resident company that is not registered in Russia is not recognized by the policyholder. The payment of personal income tax is the responsibility of the recipient of the income. He must file a tax return and pay tax after the year in which the income was received - no later than April 30 and July 15, respectively. Thus, the delay can be up to one and a half years.

How the circuit works. An offshore company opens corporate card accounts in a foreign bank in the name of specific recipients of income. Funds are credited to the open account. The purpose of the payment can be entertainment or travel expenses, the accountable amount, etc. Personal income tax from such amounts is not paid, because they are not the income of an individual and are not received on his account. The employee withdraws money from a Russian ATM or spends it in case of non-cash payment for goods by card.

The price of the scheme, excluding the transfer of funds to an offshore company, is about 3 percent, which is the average commission at an ATM. But its size can vary greatly.

If formal labor or civil contracts are concluded with the recipients of the funds, the offshore company will be able to legally transfer funds even to a card issued by a Russian bank. This can be a salary, compensation, payment for services, material assistance, a fee for work on the Internet, a written article or book, a speech. In these cases (except for the transfer of compensation), the employee will still have to pay personal income tax on his own.

The disadvantage of the scheme is the cost of its creation. It is also not advisable to make it massive. Most likely, it will not be very interesting for a small business or a business not related to foreign economic activity.

Method 4. Applicants with no work experience can be accepted as apprentices

What are the savings. No insurance premiums are paid from the scholarships (Article 7 of Law No. 212-FZ, letters of the Ministry of Health and Social Development of Russia dated 05.08.10 No. 2519-19, FSS of Russia dated 18.12.12 No. 15-03-11 / 08-16893, dated 17.11.11 No. 14-03-11 / 08-13985).

How the circuit works. The payment of a scholarship for an apprenticeship is not a wage (Article 204 of the Labor Code of the Russian Federation). Thus, applicants without work experience can be admitted to the company for the first months under apprenticeship contracts instead of labor contracts. This will allow you not to pay insurance premiums from the amounts accrued to the student. Note that the conclusion of an apprenticeship agreement is also possible with your employee if he is undergoing vocational training or retraining in the company (Article 198 of the Labor Code of the Russian Federation).

The situation is more complicated with the scholarships that companies pay to people who study in educational institutions, and not in the company. Guarantees and compensations for such employees, including those directed to training by the employer, are established by Chapter 26 of the Labor Code of the Russian Federation. Therefore, there is an opinion that these scholarships are not those that are paid under Article 204 (Chapter 32) of the Labor Code of the Russian Federation. And the jurisprudence develops in favor of the fact that such amounts do not fall under the clause. "E" clause 2, part 1 of Art. 9 of Law No. 212-FZ and contributions must be charged on them (Resolutions of the Federal Arbitration Court of the Urals District dated 08.30.12 No. F09-7479 / 12, Seventeenth Arbitration Court of Appeal dated 19.12.12 No. 17AP-13621/2012-AK). In order not to impose insurance premiums on such payments, the company will have to sue. Also controversial is the possibility not to accrue personal income tax on these payments (paragraph 10, clause 3 of article 217 of the Tax Code of the Russian Federation).

Method 5. Compensations make it possible to pay income without taxes

What are the savings. Article 9 of Law No. 212-FZ contains a list of compensations that are not subject to insurance premiums. The majority of compensations are also not charged personal income tax (Article 217 of the Tax Code of the Russian Federation).

How the circuit works. Article 165 of the Labor Code of the Russian Federation establishes the types of compensation that the employer is obliged to pay to employees. In addition, the company has the right to provide other compensation ( Art. 57 of the Labor Code of the Russian Federation).

All employees are entitled to mandatory compensation. These include payment for the use of personal property by an employee for production activities, compensation for delayed wages, for traveling work, compensation for travel expenses, including daily subsistence allowances.

Optional compensations can be set individually. For example, compensation to an employee of interest on a mortgage loan.

In this case, it is worth remembering the limitations. So, in terms of calculating insurance premiums, the amount of per diem can be any ( h. 2 tbsp. 9 of Law No. 212-FZ). But for the purpose of calculating personal income tax, the amount of non-taxable daily allowances is 700 rubles for a business trip in the territory of the Russian Federation and 2500 rubles - abroad ( clause 3 of Art. 217 of the Tax Code of the Russian Federation). The company can initially agree with the employee to pay per diems in one amount, and then, based on the order of the manager, pay them in a larger amount. Excess is actually the additional non-taxable income of the employee.

Note that in practice there are also "gray" schemes for the payment of per diems. When they make a business trip, but in fact the work is done by local employees. It is more reasonable to avoid the fictitiousness of such expenses, given the close attention of the auditors.

To compensate for the use of personal property, limit norms have been established for cars and motorcycles, but they are applied only for the purpose of taxing the profits of the organization (Art., Labor Code of the Russian Federation, sub. 11 p. 1 art. 264 of the Tax Code of the Russian Federation , Decree of the Government of the Russian Federation of 08.02.02 No. 92). For the purpose of calculating contributions and personal income tax, these norms can be disregarded if a local act of the company establishes a different amount of compensation ( clause 3 of Art. 217 of the Tax Code of the Russian Federation , sub. "And" clause 2, part 1 of Art. 9 of Law No. 212-FZ, letters Ministry of Health and Social Development of Russia dated 06.08.10 No. 2538-19 , PFR dated 09.29.10 No. 30-21 / 10260 , FSS of Russia dated 17.11.11 No. 14-03-11 / 08-13985). But in order to avoid claims from both foundations and tax authorities, it is worth establishing compensation payments for the use of personal property by an employee for work purposes within reasonable limits (for example, not higher than the market rental price of similar property). Such property can be tools, equipment, vehicles and other technical means and materials. Most often, in practice, these are the already mentioned cars, including trucks, garages or parking lots, cell phones, home computers, laptops and "tablets", uniforms and even business clothes and accessories.

Compensation for delayed wages is limited only by the minimum amount of 1/300 of the annual rate of the Central Bank of the Russian Federation for each day of delay from the unpaid amount ( Art. 236 of the Labor Code of the Russian Federation). But the company may have problems accounting for such expenses for the purpose of calculating income tax. Therefore, this method is more profitable for non-residents, individual entrepreneurs on a patent, payers of UTII or a single tax paid when applying the simplified tax system with the object of "income".

Method 6. Renting and buying and selling will help bypass the limitations inherent in compensation

What are the savings. Insurance premiums are not paid from payments in favor of employees under civil law contracts that do not imply the performance of work or the provision of services - rent, loan, purchase and sale.

How the circuit works. Compensation for late payroll can be inconvenient due to cost recognition disputes. Then the alternative is to conclude loan agreements with employees. In this case, the amount of interest is limited only article 269 Tax Code of the Russian Federation - in the amount that the company can take into account for profit tax purposes or as expenses in case of simplification. Similarly, car rental can be substituted for compensation for the use of a car.

It is more difficult with the acquisition of things - it can be raw materials, materials, spare parts, goods. If the company purchases goods through its employees as owners, it will lose VAT deductions. And the systematic entrepreneurial activity of employees will attract the attention of inspectors. But for one-time payments, this method is successfully applied in practice. It will also be beneficial when things are purchased from an individual that the company had previously bought from the population or subjects of special regimes, that is, without VAT, or even without documents at all. For regular use of the scheme, you can make purchases from different individuals - each of them no more than once a year.

The downside is that in this case, personal income tax arises ( sub. 3-6 p. 1 of Art. 208 Tax Code). An exception is the sale by an individual of property that has been in his ownership for more than three years. For a shorter period, the employee will be able to receive a property deduction in the amount of 250 thousand rubles ( Clause 17.1 of Art. 217 , Art. 221 Tax Code of the Russian Federation). From income in excess of this amount, an individual will have to independently calculate and pay tax ( sub. 2 p. 1. Art. 228 Tax Code).

Method 7. Director's fund gives a decrease in the effective contribution rate

What are the savings. When the amount of payments in favor of an individual, called the maximum, is reached, contributions are charged only to the FIU at a rate of 10 percent. In 2013, the maximum amount is 568 thousand rubles. In addition, reduced rates have been established for preferential categories of contributors. And from the amount of excess of the maximum amount of payments, these companies do not pay insurance premiums ( Art. 58 of Law No. 212-FZ).

However, in the coming years, it is planned to increase the maximum size to 1 million rubles. This can reduce the efficiency of the circuit.

How the circuit works. One or more highly paid specialists (as a rule, from among top managers, business owners or their close confidants) are paid a large salary. The rest of the workers are officially paid relatively small remuneration. Then a part of the funds by highly paid employees is redistributed in favor of the rest (see Chart 3). Thus, a significant part of the salary after the very first months of payment is subject to contributions at a rate of 10 percent or not at all.

Scheme 3. Payment of salaries through the director's fund

It should be noted that this scheme is classified as a "gray" one. Formally, the company has the right to set high salaries for several managers. And they have the right to donate money to other employees. But nevertheless, it is clear that the scheme is aimed at artificially reducing insurance premiums. Although it is quite difficult to prove it.

Method 8. Material benefit does not form the base for insurance premiums

What are the savings. Law No. 212-FZ does not contain norms that allow calculating the taxable base from the amounts of material benefits from the sale of goods, works or services at reduced prices. And if such operations are carried out through friendly companies, then there is no object of taxation with contributions (Art., Law No. 212-FZ).

With the participation of a third party, there is also no tax base for personal income tax ( sub. 2 p. 1 art. 212 of the Tax Code of the Russian Federation). When selling goods at a discount to their employees, they will be additionally charged personal income tax in the amount of material benefits ( clause 3 of Art. 212 of the Tax Code of the Russian Federation). In the most optimistic outlook, a company might try to prove that it sold goods to its employees on the same terms as it did to other consumers. And discounts were provided to all of them as part of campaigns, marketing events, on discount cards, etc. In this case, additional personal income tax accrual is impossible based on the principle of equality ( clause 1 of Art. 3 of the Tax Code of the Russian Federation). Or it is such a product that the company does not sell to anyone except employees. For example, apartments.

How the circuit works. The company sells (independently, but better through friendly organizations) to employees the goods, works or services they need at prices below market prices. Payment by installments for durable goods, cars, housing needed by employees can also be provided (see diagram 4). This is a commercial loan - a kind of alternative to a bank consumer loan. For such payment by installments, you can take a small percentage from the employee. The difference in interest rates - market for a bank loan and actual for a commercial loan - is an individual's income not subject to contributions and personal income tax. The installment plan can be made interest-free - there will still be no insurance premiums and personal income tax.

Scheme 4. Payment of income in the form of material benefits

Also, the described scheme allows you to retain valuable employees. For example, a contract for the purchase and sale of an apartment may stipulate that the ownership is transferred to the employee-buyer only after payment of the main part of the price (or all 100%), and until then he has only the right to use. In this case, it will not be profitable for him to change jobs. The enterprise may receive losses from the described transactions, but they will reduce its profit from the main activities.

Losses of employees from participation in schemes must be compensated

As a rule, all described schemes are used to increase the income received by employees at the moment, or to “whitewash” previously paid salaries “in envelopes”. In the unlikely event that employees previously received all their income in the form of an official salary, when switching to one or another scheme, they may be confused by real or apparent losses in the form of an entry in the work book, job status, length of service, compulsory health insurance, payment of vacation pay, and social benefits, loss of retirement savings.

In practice, companies try to compensate for these inconveniences. The employee can retain a part-time job with a small salary. And his income, paid according to the described schemes, will increase by amounts that compensate for the smaller amount of "vacation", "sick leave" and pension savings.

* For all types of activities this year, the Lipetsk and Tyumen regions, the Yamalo-Nenets Autonomous District, the Kabardino-Balkarian and Chechen republics, as well as the Smolensk region (with minor restrictions) have reduced the rate to 5 percent.

Before thinking about ways to optimize taxation, an accountant should read the Criminal Code. Art. 372 suggests that for forging documents, you can go to rest in places not so distant for a couple of years. Therefore, when optimizing, you should immediately exclude any falsification of accounting and reporting documentation. True, true, and nothing but the truth.

(ADV10)

However, an experienced accountant will always find a way, how through absolutely legal ways to save a certain amount of his own company.

Method one: choosing a tax system

Legal entities and individual entrepreneurs have the right to calculate taxes according to a general and simplified scheme, this fact is not at all new. The simplified version provides a number of benefits:

- simpler forms of financial statements;

- there is no need to pay VAT, income taxes and property taxes;

- the ability to choose between USN6 and USN15;

- reduction of the tax base for the value of the acquired property at the time of putting it on the balance sheet.

However, the stringent requirements that apply to enterprises when switching to the simplified tax system limit the ability to use this benefit. In this case, it is quite legal to divide the business into two separate legal entities. So, you can select a branch in a separate company, or transfer part of the employees to another company, taking the work they perform for outsourcing. A complete list of restrictions that prohibit the transition to the simplified tax system is spelled out in Art. 346 of the Tax Code of the Russian Federation.

Method two: leasing

This form of property acquisition is gaining momentum, its benefits for entrepreneurs are obvious:

- no need to pay property tax, art. 381 of the Tax Code of the Russian Federation;

- lease payments are immediately written off as expenses, there is no need to wait for amortization of sub. 10 p. 1 art. 264 of the Tax Code of the Russian Federation;

- lease payments are written off with accelerated amortization, clause 7 of Art. 259 of the Tax Code of the Russian Federation.

All this makes a lease purchase much more profitable than a bank loan, since there is no need to make a pledge, the property itself is a guarantee of timely payments.

Method three: turn employees into agents

If the company employs highly paid workers, they can be transferred to the status of hired agents performing work under an agency agreement. With small salaries, this method is ineffective; for large amounts, the difference in payments to the Pension Fund of the Russian Federation, the Social Insurance Fund and the MHIF will be significant. If the company deducts 30% of the fees plus 13% of the income tax for the employee, then the individual entrepreneur pays a fixed amount for himself (just over 23,000), plus 1% from the amount of income above 300,000 rubles. And the income tax on USP is only 6%.

Using this opportunity, the company will be able to save up to 20% of the payroll and reduce the base for the amount of payments for the provision of services. Another option is to add employees to the founders, however, the STI does not like enterprises with a large number of founders, legally suspecting an attempt to reduce costs.

Method four: registration of property in regions with preferential treatment

Here you need to be careful, as the Tax Code prescribes the use of property in the region where it is registered. However, this problem is easily solved by opening a separate company that provides the property for rent.

Naturally, the tenant will be an affiliated person. This does not directly contradict the Tax Code, but the STI inspectors also do not like this scheme very much.

Method five: airbag

An excellent and completely legal way to prepare for a tax audit visit is to create an airbag on the STI account, overpay taxes. Even if a violation is revealed during the monitoring visit, the inspector will not be able to bring charges of evasion. Yes, there will be punishment for incorrect documentation, but fines and penalties for non-payment of funds to the budget can be avoided. The overpayment can be taken into account in the next tax period, as stated in Art. 78 and 79 of the Tax Code of the Russian Federation.

These simple ways will help you save a lot of money without contradicting the Law. Every accountant needs to know and remember the behest of the great Ostap Suleiman Bender Bey: "I respect the Criminal Code."

Today I want to talk about an unusual and little-known way to save the family budget - aboutsavings on taxes. We are all taxpayers and most of us pay Personal Income Tax (PIT), which is 13% of the income we receive. As a rule, the employer pays the income tax for us, but in some cases, in case of independent receipt of income (sale of property, apartment, land, car, securities), it is necessary to calculate and pay income tax ourselves.However, few people know that in addition to the obligation to pay taxes, taxpayers also haverighttax refund.

Did you know that part of the money paid for tax (personal income tax) can be returned tofrom the state budget with the help tax deductions.

A taxpayer can refund part of the tax withheld from his income to the budget of the Russian Federation if he receives income taxed at a rate of 13%. (Articles 218-221 of the Tax Code.)

The state owes money to many of us, and we do not even suspect about it. Of course, no one will specifically talk about this and persuade you to take your money. We do not know our rights, we are losing our money and these are our problems, not the state.

So, all citizens who are payers of income tax have full right in certain tax situations, obtain tax deduction.

When you can get a deduction, see the infographic.