Bank 10 percent per annum. How to independently calculate interest on the annual amount

Money should make a profit, not sit idle. A deposit into a bank account will allow you to save your savings and avoid inflation. Gone are the days when money was kept in savings book, now banks offer to open a deposit account, receiving a good annual interest rate.

Conditions for deposits

Many Russian banks have the same conditions for deposits in terms of service and interest payments. There are differences in conditions when early withdrawal funds. Interest can be withdrawn monthly or at the end of the period.

Also interest rate, proposed, different banks is different:

- Selecting the deposit term.

- Monthly payment of interest on the deposit to or from the account.

- Possibility to open a deposit in favor of a third party.

- Preferential terms of termination.

- Preferential conditions are not provided.

Have you opened a deposit in favor of a third party?

openedDidn't open

Conditions for deposits

Invest money in the bank - The best decision. Open a deposit in rubles and receive additional income.

Bank offers to open at 9.35%. By opening a deposit through an online bank, with a capitalization of the deposit (interest remains on the account) 9.53% per year. You will need to draw up an agreement at a bank branch, and open the deposit in an online bank. When registering in Moscow at the bank branch itself, you will be offered a lower percentage of 9, 20% or 9.38%, depending on which the deposit will remain with interest or you will withdraw it monthly (transfer automatically to the specified details). This is for a deposit amount of 1.5 million rubles. Period from 181 days. All deposits in this bank are insured.

Deposit calculator

Deposit amount

Interest rate (%)

Deposit term (months)

Monthly interest

Reinvested withdrawn

Bank proposes to open a deposit in Moscow at 11% per annum. Offers to open a deposit under the “Orange Summer” program. Deposit amount, for example 290 thousand rubles, period 6 months. Profit of 17 thousand 432 rubles for this period, after six months the amount on your deposit will reach 307 thousand 432 rubles. This bank, in comparison with other banks, offers a maximum interest rate of 12.5% when opening a deposit of 50 thousand rubles for a period of 12 months.

Renaissance Bank offers a “Profitable” deposit at 10% per year. If you deposit 500 thousand rubles in 9 months, you will receive monthly capitalization 534 thousand 620 rubles, without monthly withdrawal 537 thousand 123 rubles. from a deposit of 500 thousand rubles on a bank deposit for 12 months will be 50 thousand 273 rubles (without interest withdrawal). They offer to open a deposit from a minimum deposit amount of 30 thousand rubles. In this case, the interest rate for a period of less than 91 days will be 9.25%. Deposit period of 181 days at 10.25%.

For clients Ivy Bank There are several types of deposits:

- "Leap year". The interest rate on the deposit will be up to 10.5%. The placement period is 184 days or 12 months. In this contribution minimum amount 20 thousand rubles. Interest payment every month. If necessary, the bank makes a partial payment, the ability to withdraw the deposit.

- "Universal - VIP." Payment of interest on the deposit monthly. Interest rate in rubles up to 11.8%. Amount from 3 million rubles. The deposit period is 12 months. Also in this type of deposit there is the possibility of partial withdrawal of the deposit.

- "Profitable". At 10.5% per year. You can deposit 10 thousand rubles into a deposit account. Bank deposit from 91 days, interest at the end of the term.

- "Summer". Deposit at 11% maximum. A deposit is opened from 10 thousand rubles. Deposit period 365 +2 days.

It is beneficial to open a deposit account; the period for investing money in a bank varies. Amount per deposit starting from average wages 10-20 thousand rubles. Most banks have deposits With the replenishment function, you can deposit additional amounts into the deposit account if desired. Wherein

22.06.2017 0

Today, banks offer many services to the population, the most popular of which are lending and deposits. The policy regarding loans and deposits is largely controlled by the Central Bank of the Russian Federation, as well as legislative acts Russia. However, banks retain the right to provide loans and place deposits under certain conditions, if this does not contradict the law.

According to statistics, every 10th Russian is a client of one bank or another. This is why the question of how annual interest on a loan or bank deposit is calculated is so important. In most cases, interest refers to the size of the bet. The total amount of the overpayment on the loan, as well as the size of the monthly payment, depends on the rate.

Annual percentage of deposits: calculation using the formula

First of all, let's look at bank deposits. The conditions are specified in the agreement at the time of opening a deposit account. Interest is charged on the deposited amount. This monetary reward, which the bank pays to the depositor for using his money.

The Civil Code of the Russian Federation provides for the opportunity for citizens to withdraw their deposit at any time along with accrued interest.

All nuances, conditions and requirements for the deposit are reflected in the agreement between the bank and the depositor. Annual interest is calculated in two ways:

Annual loan interest: calculation using formula

Today the demand for loans is huge, but the popularity of one or another credit product depends on the annual interest rate. In turn, the amount of the monthly payment depends on the interest rate.

When considering the issue of calculating interest on a loan, it is necessary to familiarize yourself with the basic definitions and features of lending in Russian banking institutions.

The annual interest rate is sum of money, which the borrower agrees to pay at the end of the year. However, interest is usually calculated on a monthly or daily basis if we're talking about about short-term loans.

No matter how attractive the loan interest rate may seem, it is worth understanding that loans are never issued free of charge. It doesn’t matter what type of loan is taken: mortgage, consumer or car loan, the bank will still be paid an amount greater than what was taken. To calculate the amount monthly payments, you must divide the annual rate by 12. In some cases, the lender sets a daily interest rate.

Example: a loan was taken out at 20% per annum. How much percentage of the loan amount is required to be paid daily? We count: 20% : 365 = 0,054% .

Before signing loan agreement It is recommended that you carefully analyze your financial position, and also make a forecast for the future. Today average rate V Russian banks is approximately 14%, so the overpayment on the loan and monthly payments can be quite large. If the borrower is unable to repay the debt, this will result in penalties, lawsuits and loss of property.

It's also worth knowing that interest rates may vary depending on your condition.:

- constant - the rate does not change and is set for the entire loan repayment period;

- floating depends on many parameters, for example, exchange rates, inflation, refinancing rates, etc.;

- multi-level - The main criterion for the rate is the amount of remaining debt.

Having familiarized yourself with the basic concepts, you can proceed to calculating the interest rate on the loan. To do this you need:

- Find out the balance at the time of settlement and the amount of debt. For example, the balance is 3000 rubles.

- Find out the cost of all loan elements by taking an extract from credit account: 30 rub.

Using the formula, divide 30 by 3000 to get 0.01. - We multiply the resulting value by 100. The result is a rate that regulates monthly payments: 0.01 x 100 = 1%.

For calculation annual rate you need to multiply 1% by 12 months: 1 x 12 = 12% per annum.

Mortgage loans are much more difficult to calculate, because include many variables. For a correct calculation, the loan amount and interest rate will not be enough. It is better to use a calculator that will help you calculate the approximate rate and amount of monthly mortgage payments.

Calculation of annual interest on a loan. Online calculator (balance by month and overpayment amount)

To determine in detail the annual interest on the loan, distribute the balance of the loan by month and year, as well as display information in the form of a graph or table, you can use the online calculator for calculating

Today, many depositors are trying to find a financial institution that would offer them the highest possible interest rate on deposits. Considering that just a few years ago 20 percent per annum on deposits was a rather attractive prospect, today you will not find such an interest rate in any bank. Most often, rates fluctuate between 5-8%, less often 9-10%. When choosing a deposit at 10 percent per annum, you should be as careful as possible, since this rate is most often offered by small financial institutions, the reliability of which should be ensured.

Yes, today there are bank deposits at 10 percent, of course, they differ in the terms of the agreement and, it is worth saying, the fewer opportunities the investor has, the higher the interest rate on such a deposit will be. And, accordingly, on the contrary, the more opportunities an investor has, namely, capitalization, replenishment options and partial withdrawal funds, the lower the rate will be. Typically, such conditions exist in almost all organizations that offer clients dividends in the form of interest for the use of their funds.

In fact, what is Bank deposit and how does this product work? This is a certain amount of money that the investor entrusts to the bank under certain conditions and for a certain period of time. During the validity period of the deposit agreement, the bank can use the client’s finances at its discretion and for this every month charges him interest at the rate specified in the agreement or on other conditions that were discussed with the depositor at the time of opening the deposit.

Important! A deposit of 10 percent per annum is a very tempting offer, which today may not come from every bank. Large financial and credit organizations generally do not offer higher than 7% per annum on deposits. This is because they have enough of their own assets and a large customer base, meaning they do not need to attract customers higher rate on deposit products. Most often, such offers come from small organizations, but you should be thoroughly convinced of their reliability.

Where do they offer high deposit rates today?

When choosing a deposit at 10 percent per annum, you should be prepared for the fact that such a product implies a fairly large an initial fee. Most often, the minimum amount is 500 thousand rubles. That is, if you have an impressive amount of money, then you may well find a good deposit option at 10%. Accordingly, if you have a small amount of money, you should only rely on the average interest rate.

Statistics show that the most attractive interest rates are offered by banks under comprehensive programs, namely, when a depositor, for example, simultaneously invests his savings in both a deposit and insurance. It is worth saying that these products can be both savings and investment. Today, deposits at 10 percent can be found in the following financial and credit organizations:

- Asia Pacific Bank, which offers up to 10.4 percent interest;

- RESO Loan offering a slightly lower rate of 10.2%;

- MTS Bank provides its clients with the opportunity to make a deposit with a rate of up to 10%.

You should not count on the fact that the largest and most popular banks will offer such a rate on deposit products. For example, Sberbank of Russia offers deposits from 5 to 8%. This is a large bank with huge assets and a huge client base, so it doesn’t need to attract clients in this way, since there are already enough of them. Therefore, he offers an average rate with favorable conditions for clients.

If you are still new to this business and are wondering what 10 percent per annum on deposits means, then you should familiarize yourself with the concept of what an interest rate is. So, the interest rate is the monetary reward that the borrower pays to the lender for providing a certain amount of money to him for temporary use. The rate level is determined by the relationship between supply and demand in the market loan capital. In this case, the interest rate is set by the bank to which the investor applied. It is very simple to calculate profit for a certain type of deposit; you just need to use the online calculator, which is available on the website of any financial institution. When choosing banks with deposits from 10 percent, you should mandatory make sure that the selected organization is listed in the register of the deposit insurance system. This will give you a guarantee that in the event of bankruptcy banking institution, you can get yours back cash.

Deposits, 10 percent

The interest rate is the first thing clients pay attention to when choosing a loan product. This is the most significant factor that determines total amount loan and the level of overpayment for the entire term. The lower the interest rate, the better offer. A loan at 10 percent per annum is one of the most attractive banking products due to the small overpayment. Most banks have such offers, however, most often they indicate minimum bid, and the final interest is calculated for each client separately, taking into account his financial characteristics.

Low interest loan terms

The following categories of citizens can apply for loans at a reduced rate:

- salary clients of the bank;

- pensioners;

- bank depositors;

- persons who have repaid loans from this bank without delays.

The final interest rate in most cases is calculated individually, taking into account the client’s solvency, availability of collateral, amount, term and other conditions. Clients with good credit can count on a trusting attitude and loyal lending conditions credit history, without debts and violations.

Where can I get a loan at 10% per annum?

The table below presents a list of banks where you can take out a loan at 10% per annum for an amount of up to 20 million rubles for a period of up to 3 years without a guarantee, but with proof of income:

To approve a loan, you will need to provide certificates confirming a sufficient level of income and several additional documents(at the request of the creditor). Take out a loan without certificates low percentage possible only in a few banks.

How to calculate a loan for 10 per annum?

You can calculate a loan at 10 percent per annum using the built-in loan calculator on the specific page banking product. In the “Loan calculation” field, you need to enter the amount and term, and then click on the “Show calculation by month” button. A table will open indicating the amount of monthly payments, the loan balance and the amount of the total overpayment. You can find out in advance how much you will pay per month, and easily select the most convenient option by changing the loan term or amount.

Procedure for obtaining a loan

Find bank offers and apply consumer loan at 10 percent per annum you can visit our website:

- In the search form columns, enter the amount and loan term. To specify specific conditions, click the More Options button. In advanced search mode you can mark additional conditions loan issuance: age, availability of collateral, length of service, etc.

- Among the offers selected by the system, select the one that is most convenient for you and click on its name. A product card will open, where detailed conditions and requirements for obtaining a loan will be indicated. To submit an online loan application, click on the appropriate button.

- The application form will open in a new window. Carefully fill out all required fields and provide current contact information.

- Expect a call loan specialist. He will inform you of the preliminary decision and instruct you on further actions.

If the decision is positive, you will be invited to the office to complete the transaction.

List available options receipt and repayment of a loan is indicated in the card of a specific loan product.

Hello, dear readers!

We recently had a very serious elderly lady in our office. Her late husband left her a substantial amount of money earned from his own business. Grandma asked how she could calculate the percentages herself. Oh, if only all old people were so attentive! Most of them, unfortunately, easily give away their last savings to scammers. I taught my grandmother. Stay informed too.

The greater the deposit, the greater the profit. You don’t have to do anything yourself.

Opening a bank deposit – passive view earnings, gaining popularity among residents of our country. Its popularity is simply explained: you invest “free” funds in a bank, wait a certain period of time and make a profit.

Of course, a bank consultant, for example, Sberbank, will be happy to tell you what is written in his booklet about banking offers: such and such a deposit, yield - up to 10 percent per annum, etc.

But what is this 10 percent? You brought real money, but they tell you about some abstract interest. Surely, you will want to know what these percentages mean in terms of real money, what will be your profit in rubles after one month, a year? Not every bank employee will be able to provide you with such information.

But you can calculate everything yourself. The calculations only seem complicated at first glance. In fact, everything is simple, they are done according to a calculation formula. This formula changes depending on the capitalization of interest: if it exists, one calculation algorithm is needed, if it is not there, another. However, even if you do not have a calculator at hand, using the formula you can accurately determine the profit from the deposit.

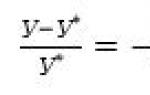

Calculating simple interest

The formula works when interest capitalization is not expected. In other words, you put money into an account and leave it there for a certain period of time.

During this period, there is no change in the interest rate or deposit amount.

Let's say the deposit is 200,000 rubles. The annual interest rate is 10 percent. How to calculate the profit that the deposit will give?

Let's apply this formula:

S = (P × I × t ÷ K) ÷ 100

Symbol S indicates the amount of accrued interest that we must receive in order to find out the profit.

P– the amount we deposited into the account.

I– annual percentage yield.

t– period (days) for which interest is accrued (usually about half the deposit term).

K– the number of days in a year (365 or 366 if the year is a leap year).

Let's count:

S = 200,000 × 10 × 184 ÷ 365 ÷ 100 = 10082 (rubles). We have received the amount of interest that will be accrued in 184 days.

Calculating compound interest

When is compound interest necessary? If capitalization of the deposit is expected.

Capitalization of the deposit means that the interest accrued per month must be added to the amount of your investment.

Thus, for the second month, to calculate interest, you should take the original deposit amount plus the interest accrued in the first month.

S = (P × I × j ÷ K) ÷ 100

S– profit (accrued interest for a certain period).

P– the amount deposited into the account initially, taking into account capitalization in subsequent months.

I– annual percentage.

J– days during which capitalization takes place.

K– number of days in a year.

First, let’s calculate what the deposit amount will be after a month.

200,000 × 10 × 30 ÷ 365 ÷ 100 = 1643 (rubles) - interest that will be accrued for the month. We add them to 200,000 rubles. To calculate interest for the second month, we take as P the amount of 201,643 rubles.

The calculation of profit for the second month, if it has 31 days, will look like this:

201,643 × 10 × 31 ÷ 365 ÷ 100 = 1712 (rubles).

If we apply this formula to each month, we will see how profits grow throughout the year.

Be careful!

Calculating compound interest rate

The compound (effective) interest rate on a deposit shows how much income the investor actually has. It turns out after carrying out operations with compound interest. This is the amount of interest for the entire period of operation of the bank with your deposit. The rate is calculated by the bank to inform potential depositors about the benefits of cooperation with a particular bank.

The effective interest rate is also determined when it comes to borrowing money. To calculate it, the borrower needs to calculate the entire amount of the debt, i.e. The amount that the bank gave him is added to the cost of the loan (interest), commissions for certain services (for example, SMS alerts, etc.), the amount of loan insurance, etc. Having received this amount, you can calculate how much contribution you will need to make monthly.

Determining your effective interest rate on your own is not easy. Banks that have an online version have calculators that can be used to calculate the compound interest rate very quickly.

About the procedure for calculating interest on deposits in the video:

How to calculate a percentage of a specific amount?

What is the algorithm for calculating the percentage of a certain amount? Let's turn to mathematics, remembering how we calculated the percentage of a number in class.

For example, you need to determine how much 60% of 1000 rubles will be.

Reasoning options:

- First way. We take 1000 rubles for 100 percent. We need to find X (60 percent of the amount in rubles). X – 60 percent. This means X = 1000 × 60% ÷ 100% = 600 rubles. We received 60 percent of 1000 rubles - that’s 600 rubles.

- The second, simpler way. 60 percent is 0.3 of the amount. Therefore, to find 60 percent of 1000 rubles, you can multiply 0.3 by 1000. It turns out 600 (rubles). The calculation is much shorter, but no less accurate than the first.

Let's solve a couple more simple examples to find simple interest:

How much in rubles will 18 percent per annum be on a deposit of 20,000 rubles?

0.18 × 20,000 = 3,600 rubles for one year.

Let's calculate 19 percent per annum for 2 years (24 months). The total percentage is 8000. The task is to find out what the initial deposit amount was.

Imagine that you are taking an exam and you come across this problem

Let's figure it out. We deposited a certain amount into the account. Let us denote it, as before, P. 19 percent of the profit is accrued per year. The deposit period is 24 months. During this time, we were the happy owners of an additional 8,000 rubles. This means P × 0.19 × 2 = 8000 (we multiplied the starting capital by the annual interest and the number of years).

P = 8000 ÷ 0, 19 ÷ 2 = 21,052 (rubles) - this was our contribution to the bank.

Let's work with another example.

500,000 is the amount deposited in a bank account at 10 percent per annum. The deposit term is 10 years.

Let's decide. 500,000 × 0.1 × 10 = 500,000 rubles interest. Those. in 10 years, our amount at an annual interest rate of 10 should double, and we will receive 1,000,000 rubles.

Let's calculate percentages using examples

The loan amount is 20,000 rubles. Annual percentage– 18.9%. The percentage is simple.

What will it be like monthly payment?

20,000 × 0.189 = 3780 is the interest for the year. The monthly interest will be 12 times less than this amount. This means it will be 315 rubles. Divide 20,000 by 12 (the number of months in a year). We get 1667 rubles. This is the share of the principal due for one month. We add 315 rubles to it. Total, 1982 rubles - monthly loan payment.

What contribution should be made today to a business that gives 15 percent of profit per year, so that after 24 months there will be 300,000 rubles?

Let's start with the fact that after 24 months we will have 300,000 rubles (this is the amount of our investment with interest on the deposit for 2 years).

We deposited a certain amount (P) into the bank account. Annual interest – 15.

Therefore, 2 × P × 0.15 + P = 300,000 rubles. P = 300,000 ÷ (0, 3 + 1) = 230,769 rubles – our initial investment.

The amount of 5000 rubles is deposited in the bank. The annual interest rate is 7.8%. What will I receive at the end of the year?

We calculate: 5000 × 0.078 + 5000 = 5390 rubles.

What if you open a deposit in the amount of 50,000 rubles at an annual interest rate of 7.6 for a period of 99 days?

In our country, the English method of interest calculation is recognized, so it is believed that there are 365 days in a year. So, 50,000 × 0.076 × 99 ÷ 365 = 1030 rubles - interest for the specified period of time (99 days). The final amount will be 51,030 rubles.

From 15,000 rubles you need to deduct 20 percent. Let's call 15,000 100 percent. 0.2 is the share of 20 percent overall. Subtract the product 0.2 × 15,000 from 15,000 to get 12,000.

Let's do one more calculation.

How much will 5% of the amount of 60,000,000 rubles be in rubles? 0.05 × 60,000,000 = 3,000,000 rubles.

Now let's determine what it will be daily percentage, if the annual is 17.9?

We reason like this: the amount we initially set aside is on the account all year, giving us a profit of 17.9 percent at the end of the year. How much profit does this amount give per month? 17.9 ÷ 12 = 1.49 percent – profit every month. And per day? 17.9 ÷ 365 = 0.049 percent is added to our deposit daily.

For example, the deposit amount is 100,000 rubles. The percentage of profit per year is 17.8. The annual interest amount will be equal to 0.178 × 100,000 = 17,800 rubles (per year). The daily interest amount is calculated by dividing annual amount at 365. We get 48 rubles - daily profit.

Finally, let's calculate 5% of the amount of 2000.

Everything is extremely simple. 2000 × 0.05 = 100.

We calculate interest on a deposit without the help of a bank consultant

It is clear to everyone that bank deposits are made to make a profit. And profit is interest. How can you immediately determine profit?

Annual deposit without replenishment

Upon registration annual deposit When it is expected to receive interest at the end of the year, calculating profit is not difficult.

Suppose 700 thousand rubles are deposited into the account. The contribution was made on July 15, 2014. The deposit period is one year. Interest rate – 9%. Consequently, on July 15, 2015, the investor returned his 700,000 rubles and received 63 thousand profits on top of them (the calculation is as follows: 700,000 × 9 ÷ 100 = 63,000).

Deposit for a period of more or less than a year without replenishment

Let's say 700 thousand rubles are deposited into a bank account, as in the previous case. But the deposit period is 180 days. The annual interest is still 9%.

The calculation in this case will be more complicated:

700,000 must be multiplied by 9, divided by 9, then by 100 and by 365. The result is 172.603. We multiply this number by 180. The result is 31,068.5.

Deposit with replenishment

Let's make the task even more difficult.

Let's say that we have opened a deposit that we can replenish whenever possible. The deposit (500,000 rubles) was opened on July 15, 2016 for following conditions: annual interest – 9%, deposit period – one year. On December 10, 2016, we replenished the account by depositing another 200 thousand rubles. The question is, what profit will we receive on July 15, 2017, i.e. upon closing the deposit?

First, let’s calculate how many days passed from 07/15/2016 to 07/9/2016 (the period when there were 500 thousand rubles on the deposit), and then how many days there were 700 thousand rubles on the deposit (from 12/10/2016 to 07/14/2017).

It turns out:

500 thousand rubles were in the account for 148 days;

700 thousand rubles - within 217 days.

To 217 we add 148. The sum is 365. This means that we have calculated everything correctly.

Let's multiply 500,000 by 9, divide the product of these numbers by 100, divide the resulting sum by 365 and multiply by 148. Total - 18,246 rubles 58 kopecks (income for the first period).

Let's multiply 700,000 by 9, divide the product of these numbers by 100, divide the resulting sum by 365 and multiply by 217.

Total – 37,454 rubles 79 kopecks (income for the period after replenishing the account).

Let's sum up the income for 2 periods: 18,246 rubles 58 kopecks + 37,454 rubles 79 kopecks = 55,701 rubles 37 kopecks.

Complex profit calculations taking into account capitalization

Capitalization of the deposit - determination of interest in each next month based on the amount previous month with the interest accrued this month added to it.

Let's say that the deposit we already know - 700 thousand rubles - is made for a year. Annual interest – 9%. Interest is calculated every month. The depositor has the right to withdraw interest monthly or capitalize his deposit. The second case implies greater profitability.

Let's do the calculation.

In the first month banking work, provided that it lasts 30 days, the deposit will increase by 5,178 rubles 8 kopecks (700,000 × 9 ÷ 100 ÷ 365 × 30 = 5,178.08).

We add this number to 700,000. It turns out 705,178.08 rubles. We multiply the amount by 9, divide by 100, then by 365 and multiply by 30. The result is 5,216.39, i.e. 5,216 rubles 39 kopecks. Let's compare it with the result of the previous calculation. The difference is 38 rubles 31 kopecks.

Let's calculate the income for the third month:

700 000 + 5 178,08 + 5 216,39 = 710394,47.

710394, multiply 47 by 9, divide by 100, then by 365 and multiply by 30.

Total – 5254.97, i.e. 5254 rubles 97 kopecks.

A deposit of three months will give such profit. The income for 5, for 10, etc. is calculated in the same way. months. Annual return will be 64,728 rubles 4 kopecks, if we assume that the number of days in a month is 30.

Keep in mind that the annual interest on a deposit without capitalization is usually higher than on a deposit with capitalization.

Before choosing a deposit, find out all the details about interest calculation. Make the calculations yourself, compare the profitability of different deposits.

Investing without capitalization can bring you greater profits than investing with it. And vice versa.

Calculation of profit when interest is accrued at the end of the deposit period

Investment for several years

A depositor opened a bank account for 10,000 rubles. The annual interest is 9%. The investment period is 24 months.

In one year:

Let's take 10,000 as 100 percent. X – the number of rubles corresponding to 9%. X = 10,000 × 9 ÷ 100 = 900. Profit for the first year – 900 rubles.

For 2 years:

The calculation is simple: multiply 900 by 2.

We receive 1800 rubles in profit from a two-year deposit.

Investment for several months

10,000 is deposited into the account for 3 months. Annual interest – 9%. For the year the profit would be 900 rubles. Profit after 90 days – X.

X = 900 × 90 ÷ 365 = 221.92 rubles.

How to calculate the income from a replenishable deposit, provided that interest is paid at the end of the term?

Accounts that can be replenished tend to have lower returns. While the agreement is in force, the refinancing rate may decrease, and the depositor's deposit will not benefit the bank. Those. payments on the deposit will begin to exceed the interest paid by debtors who took out loans. However, this does not apply to situations where the deposit rate does not depend on the refinancing rate.

So, the refinancing rate increases - the interest rate on the deposit increases; the refinancing rate decreases – the investor’s profit becomes less.

Deposit – 10,000 rubles. The period is 90 days. Annual interest – 9%. After 30 days, the depositor deposited 3 thousand rubles into the account.

900 rubles – profit for the year if the deposit had not been replenished.

For a month: 900 × 30 ÷ 365 = 73,972 rubles.

There are 13 thousand rubles on the account after 30 days.

Recalculation for the whole year: 13000 × 9 ÷ 100 = 1170 rubles.

For the last 2 months: 1170 × 60 ÷ 365 = 192.33 rubles.

As a result, profit (all accrued interest): 266,302 rubles.

Calculation of income from a deposit with capitalization

Payment of interest on the deposit can be:

- one-time, i.e. on the day when the deposit agreement is signed, terminated or terminated;

- periodic: the amount is divided and issued every month, every three months, quarterly or annually.

The choice is up to the client which of the following options to prefer:

- at the frequency specified in the agreement, visit the bank in order to withdraw interest accrued over the past period;

- or receive them on your card automatically.

Capitalizing interest means adding it to the deposit balance every month.

Imagine that you come to the bank every month on the day when interest accrues, withdraw it and replenish your deposit with the withdrawn amount.

As the deposit balance increases, interest accrues on interest. It is recommended to choose such deposits for people who do not plan to withdraw their savings before the end of the deposit period.

There are deposits with possible withdrawal of capitalized interest.

We calculate interest on a deposit with capitalization

On the first day of the year, a deposit was opened that involved capitalization of interest. The deposit amount is 10,000 rubles. Annual interest – 9%. Duration – six months, i.e. 180 days. Interest is accrued and capitalized on the 30th or 31st of each month.

10000 × (1 + 0.09 × 30 ÷ 365) 3 × (1 + 0.09 × 28 ÷ 365) × (1 + 0.09 × 31 ÷ 365) 2 = 10000 × 1.007397260273973 3 × 1.00 690410959 × 0.0076438356164384 2 = 10452.12 (rubles).

- 30 days – 3 months;

- 28 days – 1 month;

- 31 days – 2 months.

When calculating the number of days in a period, it is necessary to keep in mind that when the last day of the period is a weekend, the end of the period is postponed to the first working day after it.

Because of this, online calculators cannot provide a 100% accurate calculation. It is impossible to accurately calculate the interest on a deposit for 24 months if the approval of the production calendar is an annual matter.

We check whether interest on the deposit is accrued correctly

The equipment does not always work properly. Having an account statement in hand, you can recalculate the interest that is due for payment.

For example, on January 20 a deposit of 10,000 rubles was made. Interest is expected to be capitalized on a quarterly basis. The period for placing funds is 273 days. Annual interest – 9%. In March, on the 10th, the deposit was replenished by 30 thousand rubles. On July 15, the depositor withdrew 10 thousand rubles from the account. The 20th in April and the 20th in July are days off.

Art. 214.2 (Tax Code of the Russian Federation) says that if, when concluding an agreement or extending it for up to three years, the interest on a deposit in rubles was higher in February 2014, the refinancing rate was 5%, by interest income exceeding this value, the investor must pay a tax of 35 percent. In this case, the bank must prepare the documents.

The procedure for calculating interest on bank deposit in Excel:

How to calculate the profitability of a deposit yourself?

Many citizens of our country give their funds to banks for storage and growth. If the deposit does not exceed 700 thousand rubles, it is insured by the state. By opening a bank account, a person receives a guarantee of the return of his funds with interest added to them.

It is believed that the interest rate shows the profitability of the deposit. Is this opinion correct? Not true. It is necessary to take into account all the properties of the deposit in order to determine the profitability from it.

To predict profitability, you need to know how interest is calculated.

Having worked in a bank for a long time, I realized that most citizens do not know how to calculate interest. However, not all banks have conscientious employees. Many of them, just like clients, cannot calculate the profit from their deposit. That is why it is important to learn how to calculate the return on your deposit yourself.

200 thousand rubles were allocated for a year.

Let's remember that there are 3 types of deposits:

- with profit added to the deposit amount once a month;

- with profit accrued once a quarter;

- with profit accrued once a year.

2 formulas are used:

- to calculate simple interest;

- to calculate compound interest.

Simple interest means that the profit from the deposit is accrued before the end of the deposit period. Compound interest is due to the addition of interest to the deposit amount on certain days.

Simple interest is calculated as follows:

S = (P x I x t ÷ K) ÷ 100 (S – profit; I – annual %; t – number of days on which interest was accrued on the deposit; K – days per year; P – initial amount on the account).

Formula for calculating compound interest:

S = (P x I x j ÷ K) ÷ 100 (j is the number of days in the period at the end of which interest is capitalized; P is the amount of the deposit with accrued interest; S is the initial amount of the deposit with the addition of interest).

Example of interest capitalization once a month

The compound interest formula is used. In January S = 1189.04 rubles (100,000 x 14 x 31 ÷ 365) ÷ 100 = 1189.04).

Add the monthly interest amount to the original amount.

The result is 101,189.04 rubles.

In February S = 1086.74 rubles (101,189.04 x 14 x 28 ÷ 356) ÷ 100 = 1086.74).

January percentages are higher than February ones, because... January has more days. We add 101189.04 with 1086.74. We receive 102,275.78 rubles. This is true for each month of the deposit.

Example of interest capitalization once a quarter

There is a risk of making such a mistake (as my experience shows, it occurs often): put in the formula instead of j = 90 or 91 days j = 30 or 31, i.e. take into account the number of days in one month, not in a quarter.

The calculation is made using the compound interest formula.

In the first quarter S = 3452.05 rubles (100,000 x 14 x 90 ÷ 365) ÷ 100).

In the second quarter, instead of 100,000, we take 103,452.05. Further, I hope everything is clear.

Example of capitalization at the end of the deposit period

We need a formula to calculate simple interest.

If the deposit is 100,000 rubles, S will be 14,000 rubles (100,000 x 14 x 365 ÷ 365) ÷ 100 = 14,000).

This is where the wisdom ends.

Calculate interest, carefully study the agreement with the bank before signing it.

Be financially literate people!

Increase your money!