Elliott wave analysis. Wave analysis Wave analysis of the forex market

By using wave analysis in the market, a trader can most accurately predict price behavior on a particular time period. This type of Forex market analysis can become one of the most important indicators of success and an effective tool for a professional trader.

How to use wave analysis?

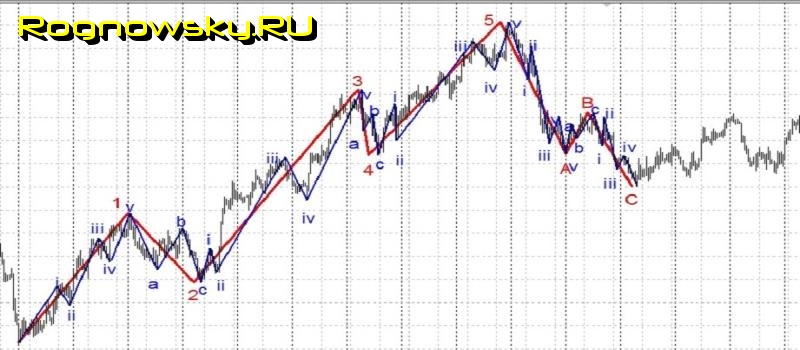

According to the Elliott wave theory, the price movement of any currency pair can be displayed on a chart in the form of waves. The waves are divided into three impulse waves, which are directed towards the main trend, and two corrective waves, which are directed against the trend. These waves are designated by the numbers 1, 2, 3, 4, 5. When the trend ends its active development, a correction of the price movement begins, displayed on the chart in three waves. Two of them are driving and one is correctional. These waves are designated A, B and C.

The essence of wave analysis is that price movement is natural, and the same pattern of price “path” is constantly repeated. Using wave analysis in the Forex market, it is possible to calculate the price behavior at a particular stage of the trend and, taking one of the waves as a profit, close the deal in time, making a profit. In order to reduce the risk of losses in the Forex market and correctly set the stop loss value, you should pay attention to the length of the waves. As a rule, the longer the impulse waves, the longer the corrective waves will be.

The main difficulty in using Elliott wave analysis is to correctly determine the type of wave. In order to correctly predict price movement, it is necessary to accurately identify which waves are impulse and which are corrective. As a rule, corrective waves are the most difficult to determine. Elliott Wave Theory is applicable to any traded financial asset– from stocks and bonds to the EUR/USD currency pair.

The main idea of wave analysis of the Forex market is that the price movement in any market is characterized by a wave-like nature, which makes it possible to predict the development of the situation in the future. Forex wave analysis from the world's leading brokers, provided to the client, helps to calculate preliminary variations in the continuation of price movement, the minimum and approximate potential of the available options, and knowing the signs of their confirmation - use any of them to make a profit, clearly understanding which wave is taken to make a profit, and lead this particular wave until it closes trading operation. There are two types of waves: impulse and corrective, since the price movement is divided into two wave groups:

- Impulses- waves that move the price either up or down (marked with numbers)

- Corrections- waves that serve for an “adequate” reaction to an impulse (marked with letters)

Identification of a wave when plotting it on a price chart

Wave analysis of the Forex market identifies several ways to determine a wave when plotting it on a chart: at the closing price, at the maximum price, at the minimum, or by its average value. For novice traders who have just started using wave analysis of the Forex market, the optimal way to plot prices on a chart is to connect the maximum price with the minimum, and vice versa, the minimum with the maximum. In this case, the wave designation becomes visible, in addition to everything, the trader quickly masters charting skills.

To reduce the risk of losses during Forex wave analysis and to correctly calculate the stop loss size, Special attention should be given to the wavelength. Forex market wave analysis experts confirm that the longer the impulse waves, the longer, respectively, the corrective ones.

Probably all traders have heard at least a little about wave analysis. Waves attract traders because they allow them to evaluate the overall picture without focusing on minor local price fluctuations. On the other hand, to become a real wave-maker you need to spend more than a year or two, and even under this condition there are no guarantees that you will succeed, this scares off many.

By wave analysis More than a dozen books have been written, where the authors, on several hundred pages, describe in detail the types of waves, the order of marking, etc. It is clear that it is impossible to do the same within the framework of one article, so we will limit ourselves to the most basic ones - just so that you can at least imagine with what you have to face. If you get interested, you can always educate yourself and go deeper into mysterious world waves

A little history of the origins of wave analysis

Ralph Nelson Elliott thought that the processes occurring in the markets are similar to the waves in the 30s of the last century. And indeed, if you zoom out, you can see “waves” on almost any chart; the price first sharply rushes in one direction, then a slight pullback follows.

This is how the idea of wave market analysis was born in his head. Of course, he didn’t do the markings by eye; it was based on the relationships between different waves. Fibo levels also help a lot when marking; with their help it is much more convenient to assess the relationship between extremes. In total, Elliott singled out 13 different types waves (differing in both amplitude and duration of formation), which were repeated in almost all markets.

If we try to very briefly describe the idea put forward by Elliott, then a trend movement consists of 5 waves, and a correctional movement consists of 3. Moreover, during a trend movement, 3 waves are directed in the direction of the trend, and 2 are corrective. The main movement occurs on the 3rd wave.

The most interesting thing is that these waves can be found on almost any time frame. If you have marked, for example, on D1, then by switching to an hourly time interval on one of the D1 waves you will be able to identify another 5-wave structure. It's a bit like nesting dolls.

A little about the sad - skeptics about wave analysis

Watch even more free lessons on our channel -

The idea itself looks very attractive - after all, waves can theoretically suggest turning points long before their formation. And while other trading participants are frantically rushing from one extreme to another, you will be calm as a boa constrictor and just wait for the ideal point to enter the market

Skeptics have several simply reinforced concrete arguments:

For some unknown reason, wave operators work mainly on large time intervals, for example, on D1 or H4. For this reason, it is very difficult, almost impossible, to verify the authenticity of the markup; you are unlikely to want to save screenshots and wait a couple of weeks;

In history, everything looks just great, the correction and driving waves look in place, and the beginner has a burning desire to quickly start learning. Remember that after drawing up the markings, the position of the waves is constantly adjusted, so do not think that the formations that you see in the history were built immediately in this position, most likely the adjustment was made after the fact;

Wave forecasters often place a stop at the base of the first wave in their forecast. But where is the confidence that the price will go exactly in the direction of the trend? Who will give such a guarantee? It turns out that when marking the schedule, they simply ignore the possibility of the situation developing in a direction unfavorable for us. One-sided thinking is obvious; other methods of analysis consider all options for price movement;

And the most important thing is subjectivity in construction. There are many variations of waves, but it is very difficult to remember them all, and don’t expect that situations will always develop in the market that are ideally suited to the patterns described in books. It just doesn’t happen that way, as a result, chart marking turns into real torture, the trader has a bunch of different types of waves on his hands and tries to figure out which one is best suited in this case. The situation gets worse after he gets acquainted with the markings of some analyst and is horrified to see that it does not coincide with his.

From all this we draw the main conclusion - wave analysis will never give you an exact entry point; do not expect that with its help you will be able to draw up a trading plan for your week or month. The maximum that can be achieved is to have an idea of the possible behavior of the market in the medium and long term.

If all this doesn’t scare you off, let’s move on to specifics and look at the basics of wave theory.

Basic principles of wave theory

As was said at the beginning of the article, there will be no delving into the wilds, otherwise we would have to release another multi-volume book on Elliott waves. Let's limit ourselves to the most basic.

Structure of the main movement

As we said, the main movement includes 5 waves, 3 of which are directed along the trend, and 2 are correctional (at their completion it is convenient to enter the market). After wave No. 5, a larger-scale correction begins for the entire movement 1-5; this rollback also occurs according to a wave pattern - a total of 3 waves, usually designated by the letters of the Latin alphabet A, B and C.

The above example is not ideal, if only because the corrective movement A - C turned out to be too weak. Ideally, point C should be located above point 4. But in general, the structure of the movement can be understood. By the way, the marking was carried out on a randomly selected section of history, hence the accuracy. The same screenshot shows that wave No. 3 is the strongest of all the waves of the trend movement. As for the fifth wave, it can be approximately equal to the 1st, because the movement is already fading, a correction is approaching, in principle, it is allowed for the fifth wave to even be shorter than the first.

Now let's look at the relationships between the waves. It is clear, of course, that for a growing market the waves should consistently rise, and for a falling market - vice versa, but there are clear relationships and if the waves correspond to them, then the value of the marking increases. So:

It is also useful to know what happens in people’s heads during the formation of waves:

The first wave - the movement is very rapid. The thing is that the first wave is, as a rule, a trend change. That is, the price manages to break through very strong resistance/support. After the breakthrough, nothing can hold it back; the stops of those who did not guess the direction of movement in the market are lost;

The second wave is the result of profit taking by those traders who managed to recognize the reversal. Against the background of the recent breakthrough of strong resistance - support, most trading participants are confident that the movement will continue in the direction of the first wave, but everyone is waiting for convenient entry points. Taking profit also gives a small smooth corrective movement. If we compare the duration and amplitude of the waves, then in terms of the duration of formation the second wave may be even longer than the first, but in terms of amplitude it is guaranteed to be much less;

When the corrective second wave reaches significant Fibonacci levels, a revival begins among waiting traders, they enter the market in the hope that the movement will continue;

This is how the third wave begins - this is exactly what followers of the wave theory of the market exist for. If you manage to catch it, then a good profit is guaranteed; in this case, you need to place a TP at least on the Fibonacci extension of 1.618 from the first wave;

The 4th wave is the most difficult to identify. The movement here may well occur in a horizontal channel. There is no pronounced correction as such, the price just takes a time out before rewriting the last extreme (the one that was set in point 3);

Wave 5 – a census of the extremum occurs, divergences are often observed on various indicators. An additional signal: towards the end of the fifth wave, volumes are growing sharply.

Structure of the corrective movement

When talking about a corrective movement, we mean a three-wave movement that occurs immediately after the main five-wave movement. For example, let's take another cycle in which waves A, B, C are more pronounced.

In the example, the waves are more pronounced and, in general, this structure is closer to ideal than the previous one. Among the shortcomings, I would highlight only:

The size of the fourth wave is too small, and in general, the fact that it formed over literally 2 candles is not very good;

Point A turned out to be on the same level as point 4, that is, the fifth wave was almost completely absorbed by the first corrective wave. This can also make the trader doubt that the growth will continue.

To assess the quality of correction movement, the following ratios can be used:

Wave A should be within the correction levels of 61.8%, 50.0% of the fifth wave. It is allowed to form point A at the same level as point 4;

Point B – located at the levels of 38.2%, 50.0% of correctional wave A;

Point C is 161.8% of wave A. If wave B was large, then point C may well not rewrite the minimum in point B.

The logic of what is happening is as follows:

Corrective wave A breaks through the support built at points 2-4. This causes a violent reaction from trading participants, which leads to a very sharp movement; usually the correction takes place much more calmly than in this case. It was the breakdown of support that caused the appearance of a candle with a very large body;

The formation of point A, that is, the completion of the correction is exactly at the level of point 4, that is, within the acceptable range. An additional signal in this case was that the price had just reached another powerful support, built through points 1 and 2. So the slowdown looks logical;

The AB wave is usually difficult to diagnose and is the weakest of the 3 corrections. It also happened in this example. The support had its effect, but trading participants did not receive confidence that the fall had slowed down, so the rebound was small and sluggish;

Although the BC wave breaks through support, this does not lead to a new wave of sales; the chart goes down as if reluctantly. This increases traders' confidence that growth is more likely, which then happens.

Waves are large, medium and small. The influence of the Fibonacci sequence on price movement

It was mentioned earlier in passing that waves can be found at any time intervals. If we develop this idea, then each of the large waves can be divided into several smaller ones, and this process can be repeated, although not indefinitely, but precisely down to the smallest time intervals.

Let's analyze the 5th wave movement, in it, as we already figured out earlier, 3 waves are trending, and 2 are corrective. The same rule will apply to them, according to which a trend movement consists of 5 waves, and a correctional one – of 3. That is, in our case, 3 medium trend waves will give 15 small waves, and 2 corrective waves will give 6 more small corrective waves. In total, we have 21 waves, that is, the standard movement presented in the screenshot above can be represented in the form of 21 small waves. On D1 they are poorly visible, but on a smaller time frame they are visible quite well.

All this looks great in the examples when you mark up the history. But when there is no chart on the right side and the trader needs to place the probable completion points of the waves, the hardest part begins. Marking a story is the same as looking at the answer instead of deciding. Judge for yourself - there is movement in front of us, we know how many waves there should be in it, hence the beautiful markings.

If you go down one more time frame, you will be able to identify even smaller waves. In this case, there will no longer be 21, but 89. If, on the contrary, we try to enlarge the time interval, that is, switch to the weekly timeframe, then instead of 5 waves we will see only 2.

As for the Fibonacci sequence and its influence on price behavior, this refers to the duration of the formation of a particular wave. Let me remind you of the beginning of the Fibonacci sequence - 1, 3, 5, 8, 13, 21, etc. You can also try to use this in trading. The trick is that if some movement is formed, for example, over 9 days, then it will most likely end on the 13th day; if this does not happen, then the next probable date is 21 days. Such reasoning seems a little far-fetched, but sometimes it works.

The main rules to remember when marking

There are several simply reinforced concrete rules that are never violated under any circumstances. Or rather, they can be violated, only in this case it is impossible to talk about a formed 5-wave structure; adjustments will have to be made. The rules are as follows:

The second wave never falls below the bottom of the first wave;

The third wave should not be the smallest of the three. If it seems to you that this is the case, then most likely you simply did the marking incorrectly and item 4 should be located in a different place;

Corrective wave 4 should not rewrite the extremum of the first wave.

In principle, these rules are enough to sketch out the markup in most cases.

Automatic wave analysis – is it worth using indicators to mark a chart?

As mentioned at the beginning of the article, the waves on the chart are marked for a reason, but in compliance with certain ratios. And even if it is too difficult to implement all the subtleties in the form of indicators, the main constructions can be automated. By the way, there are several such indicators, some of them are freely available, we will consider the most popular ones.

Elliott Wave Prophet – predictor of the future

This differs from other similar algorithms in that it does not mark the graph on history, but performs part of the construction on the nearest segment of the graph and shows with lines how it can develop in the future. A kind of oracle.

The downside is that the trader will have to determine for himself exactly how many waves are formed on this moment. This is critically important for more or less adequate marking. It is more convenient to explain this with a specific example.

Let's assume that at the moment there are 3 waves formed on the chart (as the trader thinks). In this case, he sets parameter 3 in the indicator settings and gets the following picture. By the way, the “jamb” of the indicator is immediately visible - it built wave No. 2 below the bottom of the first wave, and this is incorrect.

If you set in the settings instead of 3 formed waves 4, the picture will change dramatically.

The constructions are also imperfect, to say the least. For example, the 4th wave in this case turned out to be almost twice as large as the third.

This indicator cannot be called bad, it’s just one of those that needs to be used wisely. You can’t just add it to the chart and immediately get entry points and ideal markings. You need to have at least a basic understanding of the waves and the relationships between them, and then you can get reliable markings. Another advantage of this algorithm is that the text window displays information on the waves and the relationships between them, which saves a lot of manual labor.

Wave indicator X Wave Elliott

This indicator works based on the regular ZigZag from MT4. The work is carried out according to the following scheme:

Zigzag marks important movements on the chart by building a broken line;

The X Wave Elliott indicator itself simply indicates with numbers those extreme points that, in its opinion, are suitable for the role of waves.

There are also a number of shortcomings here. for example, it is impossible to see the markings on the history; in addition, the indicator does not even try to predict price behavior, it simply marks certain peaks with numbers. Another drawback is that the main marking rules are not followed (that the bottom of the first wave cannot be rewritten, the requirement that the third wave must be the largest, etc.).

A lot depends on the depth of market analysis (ExtDepth item in the settings). So if you decide to use it in trading, then be prepared for a long search of settings until you get something worthwhile.

Wolfe Wave Indicator

Wolfe waves are somewhat different from conventional wave analysis. But the idea itself remains the same. Only the 5-wave main movement is used, entry into the market is assumed at point No. 5, and the profit-taking level is indicated by a ray passing through points 1 and 4.

The corresponding indicator (Wolf Wavw nen) allows you to perform all the markings quite reliably without serious errors. This was achieved due to the fact that Wolfe waves do not use all that mass of variations in relationships between waves, a clear 5-wave structure is used, so there is nowhere for the indicator to make a mistake.

An example of markup is shown in the screenshot. Entering at point 5 would allow you to close the deal with a profit.

Download a selection of Wolfe Wave indicators

FX5_NeelyElliotWave – multi-timeframe marking

The algorithm used in the indicator incorporates the relationships between waves outlined in Neely’s book. Hence the name of the indicator.

After adding the indicator to the chart, the picture may scare you - you will see an interweaving of lines of different colors and thicknesses, at first glance a useless jumble. In fact, the lines display a picture that occurs on several time intervals at once (you can disable this in the indicator settings).

Unfortunately, the indicator will not do all the markings for you, so the trader will have to set up the waves independently. This cannot be called a disadvantage, just a feature of this indicator.

Conclusion: Wave analysis of the Forex market

If Elliott waves were easy to study and gave 100% results, then the market as such would no longer exist. Everyone would suddenly begin to trade profitably, and such an idyll would not last long.

A significant drawback of the wave theory is not that it is difficult to study, but that even after spending a couple of years studying, you still will not get rid of subjectivity when marking a graph. One could put up with everything else, but this is its peculiarity, the rules are too vague, there are too many of them and too much is left to the discretion of the trader.

Think about this before you plunge into the world of waves. This activity is very exciting, perhaps wave analysis will become something like your hobby, but no one can guarantee that with its help you will trade profitably. Evil tongues say that even seasoned wave traders are not able to trade profits based only on wave analysis.

Wave analysis of the Forex market is the prerogative of confident and knowledgeable currency exchange traders.

Unfortunately, more and more novice traders use other people’s mistakes and do not want to do them themselves, relying on private traders who maintain their blogs on the Internet.

In trading on foreign exchange market It is very important for every trader to be able to correctly identify market fluctuations. This is a sign of a successful and experienced trader. To do this, you can use wave analysis of the Forex market.

The history of the Elliott wave theory

Elliott wave theory was developed by Ralph Nelson Elliott in the 1920s. He discovered that market behavior previously thought to be chaotic was actually cyclical.

He also determined that such market cycles were the result of trader reactions to external events, which can also be called crowd psychology. Elliott noticed that the ups and downs of crowd behavior always resulted in the same repeating patterns, which he later called “waves.”

Market forecasts with wave analysis

Elliott made detailed market forecasts based on the unique characteristics he discovered in wave patterns. An impulsive wave that moves in the same direction as the dominant trend always shows five waves in the pattern.

On a more detailed chart, within each impulsive wave you can find five component waves. These waves are considered different stages in the Elliott Wave Principle.

In the Forex market, as in other financial markets, traders know that “every action becomes a source of positive and negative reaction,” just as a price fluctuation up or down must be followed by an opposite fluctuation. Price fluctuations are divided into trends and corrections or sideways fluctuations. Trends reflect the main directions of price movements, while adjustments fluctuate against the trend. Elliott called these impulse and corrective waves.

Forex Wave Analysis Theory Patterns

The theory of wave analysis of the Forex market is interpreted as follows on five patterns:

- Every hesitation has its consequences.

- Five waves move in the direction of the dominant trend, which is also followed by three corrective waves.

- The movement of these waves is called a 5-3 wave and completes the cycle.

- Each previous 5-3 wave oscillation becomes a component of the next higher 5-3 wave oscillation.

- The basic 5-3 wave pattern remains stable, although the time span of each pattern may change.

In order for a trader to use wave analysis of the Forex market in everyday trading, he needs to learn how to identify the main wave and then buy long position, which he will subsequently sell, or take a short position when the pattern ends and its restart is inevitable.

The mathematical basis for using wave analysis of the Forex market is provided by Fibonacci numbers. They play an important role in the design and creation of the complete market cycle, which is described using Elliott waves. Each cycle that Elliott identified consists of ranges in which the waves move, and the ranges are determined by the Fibonacci sequence of numbers.

Wave analysis is so complex that only a few professional Forex traders master it perfectly. But every successful player in the market must know its BASICS.

Why do we need the basics of wave analysis? Then, to understand and see:

- algorithm for the movement of your working currency pair;

- the point at which the currency pair is located at THIS minute during this movement;

- prospects for further movement.

Let's look at the CAD/JPY (H4) chart from the point of view of wave analysis of the MF (modification of Elliott's VA), combined with other MF tools.

Rice. 1. Price movement using the example of the CAD/JPY currency pair

Comments MasterForex-V:

Once again, carefully examine and then analyze the picture from the closed forum of the MasterForex-V Academy. We understand perfectly well that this is very, very difficult. But now you have the opportunity to make an informed choice and decide what to do next:

How much can you earn by choosing the path of study at the MF Academy?? As the experience of autocopying transactions of Academy students who use this service during training shows, on average they get from 250 to 500% per year in foreign currency and on break-even, win-win VIP accounts, allowing you to combine opportunities:

- Earnings of the trader himself (100-200% per year).

- 150% of the NordFx bonus involved in the drawdown (with a 3K deposit, you are credited with 7.5K to your account with the right to withdraw profits above this amount), or 100% of the bonus from other brokers. This bonus increases your profit by 2.5 times for every dollar invested. So, 100% of the profit from 7.5K turns into 250% of the money you invested (3K).

- and 15-20% of the profits, which are transferred to managing traders by numerous investors from Israel and the EU to the USA and China.

So is wave analysis worth learning or should you skip it? Those who answered “yes” will read further:

- In this chapter - about general outline and the differences between technical and wave analysis (the same models of trend reversal and continuation through the eyes of a “wave analyst”).

- In the next chapter - ( summary books by Frost and R. Prechter, Balan, Vozny, etc.).

- In the third chapter -.

What does wave analysis give a trader and how does it differ from classical technical analysis?

Wave analysis:

- Helps find the beginning of a trend, considering the movement currency pairs not from the point of view of reversal and trend continuation patterns, but from the position of the internal algorithm - waves of impulse (trend) or correction (flat).

Let’s compare the “head and shoulders” trend reversal pattern in classical technical trading analysis (in Fig. 2 on the left) and the same trend reversal pattern from the point of view of wave analysis. It turns out that the drop down was only a correction (rollback). Therefore, at the end of wave C, you need to open a buy deal.

Rice. 2. An example of technical and wave analysis of the same market situation

This wave marking helps to understand why there are numerous complaints about the head and shoulders figure. As soon as a trader opens a sell order, the market moves... in the opposite direction.

- Helps you CONSCIOUSLY take profit by determining in real time WHERE and on WHAT wave you open an order on the market. Wave marking more accurately suggests entry points into the market than “ ” or any other method of technical analysis.

Rice. 3. Selecting points to enter the market using wave analysis

- Shows impulse targets (138-162% and above) along the trend and in correction (38-76%).

Rice. 4. Targets of impulse 3rd and 5th trend waves

Rice. 5. Correction targets - 38-62%, or maximum 76%

Thus, Forex trader understands what levels the price tends to, where and why it is necessary to open and close transactions.

- Helps you easily find a flat ( a-b-c waves round trip).

Rice. 6. The market is flat

None of the traders like flat trading. Wave analysis helps to determine it online, when CORRECTIVE waves go both up and down (a-b-c). This means that there is a correction of the SENIOR TF, after which a strong and powerful impulse will begin.

It is better to wait out this correction while outside the market, which will always be suggested to you on the closed forum of the Academy of MF.

- Makes it possible to IDENTIFY any trend continuation figure (flag, pennant, etc.) as corrective waves.

Rice. 7. Trend continuation pattern in the form of corrective waves

Allows you to understand where to place your feet (locks, locks). Wave analysis provides a clear answer to this important question. For example, when the price is below the bottom of the first wave (the trend is canceled) or below the bottom of the wave of the older TF.

Rice. 8. End of trend

From all of the above, we can conclude: without knowing the BASICS of wave analysis, your profit on Forex can only be random.

What does a trend look like in real time (from materials from the MasterForex-V Academy)

Pay attention to clear signs of a bullish trend(Fig. 9):

- 1st bull wave(violet color) has a 5-sub-wave structure. This is a sign of momentum and a POSSIBLE trend change from bearish to;

- 2nd wave(yellow color) has CORRECTION a-b-c structure and does not break the base of a new bullish wave. When its maximum is broken, the 3rd wave, beloved by all traders, begins;

- 3rd wave(gray), also having a five-wave structure on lower timeframes (1st in the 3rd, 3rd in the 3rd, etc. with targets above 162% up from the 1st wave).

Rice. 9. Signs of a bullish trend using wave analysis

AO or MACD indicators for the 1st wave (purple background) confirm the beginning of a bullish trend. The following conditions are required:

- 1st subwave: the histogram goes above 0 in a bullish trend;

- 3rd subwave: AO histogram is above the 1st wave;

- 5th subwave: divergence. The histogram is below the top of the 3rd wave (it can go below 0).

How Bill Williams increased his trading deposit from $10 thousand to $198,977 using wave analysis

Bill Williams in his book “Trading Chaos” gave perhaps the most powerful impetus for the popularization of wave analysis of trading. In a simple and accessible form, he showed how to determine the 1st wave (point 0 on the chart). Then, in his opinion, you just need to follow the trend, opening trades in accordance with the main direction of price movement (see Fig. 10).

Rice. 10. The beginning of the first wave and the trading plan according to Bill Williams

For their part, the teachers of the MasterForex-V Academy drew up a detailed plan for capital management (money management), explaining the logic of opening and closing transactions (see Fig. 11).

Rice. 11. Money management according to the MasterForex-V Academy system

For those who are already convinced of the need to study the basics of wave analysis, we suggest that you familiarize yourself with special literature on this topic and visit the following Internet resources:

- Free illustrated magazine of traders "Exchange Leader".

For a more in-depth study of the Fundamentals of Wave Analysis, we recommend reading the following books:

- A. Frost and R. Prechter. A Complete Course on Elliott Wave Law

B. Williams “Trading Chaos.”- R. Balan Wave principle Elliott - application to the FOREX market.

- D. Vozny. Elliott code. Wave analysis of the Forex market.

- G. Neely. Mastering Elliott Wave Analysis.

- C. Miller. Study of the relationship between the theories of cycles and Elliott waves.

- R. Fisher. New Fibonacci trading methods.

- R. Fisher. Subsequence. Applications and strategies for traders.

- E. Peters. Fractal analysis financial markets. Application of chaos theory in investment and economics.

- D. Di Napoli. Trading using Di Napoli levels.

- R. Swannell. Market forecast using a new refined pattern recognition system based on the wave principle.

- A. Frost and R. Prechter. The Elliott Wave Principle is the key to understanding the market.

- T. Joseph. Simplified Elliott wave analysis. Practical application of a mechanical trading system.

- D. Murphy. Technical analysis futures markets.

- A. Cherepkov. Theory of Long Waves by N. D. Kondratiev.

- E. Nayman. Small encyclopedia trader.

- A. Kiyanitsa, L. Bratukhin (eds.). Fibonacci levels. Where the money is.

- M. Chekulaev. Fractals.

- V. Safonov. Practical use Elliott waves in trading.

You can easily find all these books by searching Yandex or Google. We recommend starting with these books:

- A. Frost and R. Prechter have truly provided the most "Complete Course on Elliott Wave Law." This is the main fundamental work on wave analysis of all areas of trading (commodity and commodity markets, stocks, futures, Forex).

- The books by D. Vozny (translator of Prechter into Russian) and Balan are the applied application of wave analysis to the Forex market.

- Bill Wilms' work "Trading Chaos" is a more popular publication for a wide range of potential traders. It provides the basics of wave analysis. The author connected them with his trading system Profitunity, consisting of indicators: Alligator, Awesome Oscillator (AO) and Fractals, as well as the bullish/bearish reversal bar pattern.

In order not to get confused in the many smart tips from these books, before reading them we strongly recommend that you study the material in our next chapter: Here you will find short summary the mentioned works.