How to replenish the account of an expired VTB card. How to top up a VTB24 card account

Bank cards have become an integral part of everyday life, wages have long been paid to many not in the accounting department, but by transfer to a bank account. Cash is gradually leaving the usual form of circulation and is only needed to replenish the card and make payments between individuals.

The methods of replenishing a VTB 24 bank card are known to many customers, as they have not changed over the past fifteen years, during which many are so accustomed to paying for goods and services with a card that they can hardly do without plastic in their wallet.

Replenishment of VTB 24 card without commission

- Through any ATM of VTB Group;

- At the cash desk of a bank branch;

- Through online banking.

Unfortunately, you can replenish your card account for free only at an ATM with a cash-in function, or at the cash desk of the nearest bank branch. There are no other options, if you want to transfer money from a Sberbank card or another bank, you will have to pay a commission. Another option, you can transfer money for free between your VTB24 cards in an online bank. This method is not convenient for a few, if you need to put cash on a card, it is better to use an ATM of PJSC VTB 24. Do not try to find an ATM of another bank, they all charge their own commission, since VTB24 did not enter into agreements for cooperation on depositing money with third-party financial organizations. With withdrawal, the situation is reversed - you can withdraw money from a VTB 24 card at someone else's ATM without a commission.

Replenishment of the VTB 24 card with a commission

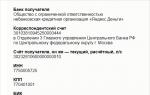

If you decide to replenish the card in another bank, here are the details for transferring money in rubles to your card account:

- Name of the Beneficiary's Bank - Branch No. 7701 of VTB Bank (Public Joint Stock Company) in Moscow;

- Address - 107031, st. Kuznetsky most, 17 building 1;

- TIN - 7702070139;

- BIC - 044525745;

- C/C - 30101810345250000745;

- Recipient - "Account for replenishment / debiting from bank cards";

- Beneficiary's account with the Beneficiary's Bank – 30232810481100000009;

- Purpose of payment - To be credited to the card No 000000000000000;

- Name - full name of the recipient, resident or non-resident.

Instead of 16 zeros in the penultimate line, indicate the number of your personal card. With the details, you can replenish the card at any financial institution, check the information about the commission at the replenishment point. With a commission, you can deposit money not only through an outside bank, but also through CONTACT money transfer systems, from a Qiwi wallet, Yandex Money, Webmoney. The commission depends on the amount and internal rules of the payment system, get acquainted with them before making the operation. For replenishment questions, please contact

The need to be constantly in touch makes Russians choose the simplest and most convenient ways to recharge their mobile device. Several options are available to VTB 24 bank customers on how to put money from a bank credit or debit card to a phone.

Balance replenishment methods

If you are still frantically looking for the office of your mobile operator or a free payment terminal for replenishing your mobile balance, you will like the presented selection of options:

- in an Internet or mobile bank with a VTB 24 card, you can put money on the phone of any telecom operator;

- through payment devices of various modifications and bank branches;

- via SMS;

- on the websites of telecom operators.

In internet bank

Top up your phone balance without leaving your home.To replenish your mobile phone using the VTB-Online system, you must:

- Log in to your personal account (enter your credit card number or login and password).

- Select the "Payment for Services" tab.

- Select the one you need from the list of available carriers.

- Enter number.

- Decide on the size of the upcoming payment.

- Select an account to debit (if there are several).

- Confirm the payment transaction using a one-time security code (sent via SMS to the mobile phone identified in connection with the bank card).

Using Internet banking allows you to instantly replenish your account without commission and additional expenses.

In mobile banking

Use the possibilities of the VTB Online application to the maximum!

Use the possibilities of the VTB Online application to the maximum! To fully use the capabilities of the mobile bank, you must first download the VTB-Online application through the AppStore or the Play Market. The application is designed to be installed on the following devices:

- iPhone;

- iPad;

- iPod touch;

- mobile devices on the Android platform.

To replenish the balance of your cell phone from the card, you will need to perform a number of simple steps:

- Download and install the app on your device.

- Log in to the mobile bank using the login and password received during registration in the VTB-Online system.

- In the "Payments and transfers" menu, select the "Payment for services" section.

- Click on the "Cellular" tab and select a carrier.

- Enter the number for crediting funds and the amount of payment.

- Select a bank account to debit the payment.

- Click on the "Pay" button.

Mobile banking does not require confirmation of the payment transaction. Therefore, before pressing the payment button, make sure that the data entered is correct.

At the terminal and ATM

When paying for cellular communications at an ATM, do not forget to keep your receipt.

When paying for cellular communications at an ATM, do not forget to keep your receipt. You can top up your phone account at payment terminals and ATMs of VTB 24.

- Insert the card into the device and enter the pin code.

- In the menu, select the "Deposits and transfers" section.

- Click the "Pay for services" button.

- Select the desired carrier.

- Enter your cell number and the amount to recharge.

- Some payment devices require authorization of the credit card holder and for this purpose they send an SMS with a confirmation code to the linked number, you need to enter it in the window that appears and click the "Next" button.

- Pay and take a check (you need to keep the payment document until the funds are credited to the balance of the mobile phone).

At the VTB24 office

You can regain the joy of communication with a zero phone balance if you have a bank card and there is a VTB 24 office nearby. Two options are available to customers:

- Contact the cashier-operator and voice your desire to transfer money from a bank card to a mobile phone account. The client will be required to provide a passport, card, mobile phone number.

- If you do not have a credit card with you, but you are ready to tell the bank employee its number (16 digits on the front side of the card) and the expiration date, as well as present your passport, the payment transaction will be successfully completed.

Via SMS service

If the cell phone is tied to one of the bank cards, you can top up its account by sending a simple ussd command. The message must include:

- the payment system to which the card belongs (Visa or MasterCard);

- credit card number;

- payment amount.

Example of a prepared message: Visa/MasterCard space 16-digit card number space amount.

When replenishing the balance of a mobile phone from a VTB card via SMS, no commission is charged, and the receipt of funds occurs instantly.

On the site of the mobile operator

Haven't set up a VTB Online personal account yet? Top up the balance on the operator's website.

Haven't set up a VTB Online personal account yet? Top up the balance on the operator's website. Having an active VTB 24 credit or debit card, you can also top up your phone balance on the official website of a particular mobile operator. Consider how to put money on a phone from a card using the Megafon telecom operator as an example.

- Go to the website of the operator in the region where you live.

- In the horizontal menu, select the "Payment" tab.

- Decide on a convenient payment method (in our case, specify a card).

- Enter the phone number and the amount of the payment that will be debited from the VTB 24 card account.

- The system will redirect the user to the payment page, where you will need to enter a 16-digit card number, expiration date, and cvc code (3 digits on the back of the credit card).

- Press the "Replenish" button.

- Wait for an SMS with a one-time security code.

- Enter the code in a special field and click "Continue".

Limits and commissions

There are no restrictions if the client wants to pay for the phone with a VTB card. In some cases, a minimum amount for transfer may be set:

- at ATMs and payment terminals (the restriction is related to the minimum denomination of a paper bill);

- on the websites of operators (most often the minimum replenishment amount is 100 rubles).

When transferring funds from a bank account to a phone within the VTB system (Internet banking, own ATMs, etc.), no commission is charged.

Payment Security

Despite the fact that the VTB payment system is configured to ensure maximum security when making transactions, a lot depends on the cardholders themselves.

Rules for remote account management:

- use of proven services for downloading mobile applications;

- the presence of a strong password on a mobile device or computer;

- remembering the PIN code, as well as the login and password for entering the Internet bank or application (it is not allowed to use records, as well as storing them in close proximity to the card);

- attentiveness and strict adherence to instructions when conducting payment transactions;

- contacting the bank via the hotline in case of suspicion during the implementation of any payment transaction.

Video: How to link a card to a Beeline phone and replenish its balance.

Conclusion

In the turbulent age of modern technology, many citizens still do not know the answers to some questions. What is remote account replenishment, how to replenish the phone balance from a VTB card and other important and useful information remains beyond the understanding of the average Russian.

We hope that our article will be the first step towards opening a wide range of possibilities for using your bank card.

Many people think that you can top up your phone balance only in public places: banks, ATMs, in the offices of a mobile operator. In fact, there are many more opportunities to do this. You can deposit money into your mobile phone account in the following ways:

- using an ATM or terminal

- from a mobile operator

- via SMS

- using internet banking

- via mobile app

If everything is clear with the first two, since they are standard, then other points raise questions.

SMS replenishment

In order to pay for the services of your mobile operator using a VTB 24 card, you can use the Telebank service.

Send an SMS request to a special number. For each cellular operator, it is individual:

- Megaphone - 2269

- Beeline - 2689

- MTS - 2222

After entering this number, you will receive a template in which the step-by-step procedure is indicated.

This procedure is simple, just follow the instructions sent.

It is also possible to pay for mobile services and other operators. Their short numbers can be found at the branch of VTB 24 Bank.

Via internet banking

To carry out this procedure, you must have activated the VTB24-Online service. The bank branch will help you do this.

To replenish your account through Internet banking, you need to have a device with the ability to access the Internet (computer, tablet):

- go to the official website of VTB 24

- enter your personal account and enter the data given by the bank employee (login and password)

- select item Payment for services, then - cellular

- choose your carrier

- fill in the fields with the need to enter details: phone number, the amount you are going to deposit to the account, and the card number

- enter the code that you will receive in an SMS message

Before entering VTB24-Online:

- make sure that the connection is established with the system website at https://online.vtb24.ru

- make sure that the connection is established in secure mode, i.e. the address bar in the browser starts with https:// and is highlighted in color

- do not use the autocomplete feature in your browser settings. This will help not to save data (user password, username, etc.) in the browser's memory, which will prevent third parties from using the data

Using the VTB24-Online mobile application

If you have chosen this method, then first you need to download a special application (it exists for all mobile operating systems - Windows, Android, Apple).

Further, the process is carried out in exactly the same way as when using Internet banking. The only difference is that you do not need to wait for a confirmation code from SMS. After entering all the requested data, just press Continue, and the operation will be completed.

Be sure to remember and follow the following guidelines:

- use only licensed software

- do not install applications from unknown sources, applications must be installed only through official stores: Google Play, Apple Store and Windows Store

- to enter the official store, do not use external links from other resources, enter only through the icon of the store in your mobile phone

- if you find that your SIM card is blocked without your knowledge, immediately block access to VTB24-Online by contacting support by phone 8 (495) 777–24–24, 8 (800) 100–24–24

There is no fee for using any of these options. It is also convenient that you do not have to look for an ATM - you can replenish your mobile account online.

For most subscribers of mobile operators there are no problems with replenishing their balance. Now you can do it without even leaving your home. For example, you can top up your phone balance from a VTB card using any of the convenient methods. Just a few minutes are enough and the money will be credited to the account.

Is it possible to replenish the balance of the phone with a VTB card

Almost all major banks in Russia offer their customers the opportunity to pay for mobile communications with a card. And VTB24 is no exception. Credit card holders can use any transfer method. The main thing is to take into account the commission, limits and other rules of the bank. Before sending funds, you need to check the amount of money on the card. This can be done using the USSD command *124#.

With a VTB card, you can replenish the balance of a mobile phone. The owner of the plastic can easily transfer the required amount to another user's card. The bank provides an opportunity to make payments online.

Methods of paying for a phone with a VTB card

Paying for the services of Beeline, MTS or any other operator from a bank card is very simple. You just need to use any of the following methods:

- sending via SMS;

- Internet banking;

- payment through an ATM or terminal.

You can replenish not only your cell phone number, but also any other subscriber.

How to pay for a phone with a VTB 24 card via the Internet

You can make a payment online. All you need is a computer and internet access. Of course, the client must have the Telebank service activated, then the transaction will be carried out free of charge. To make a payment, the client must do the following:

The commission is not charged, so only the specified amount will be transferred from the account. Money is credited very quickly, literally within a few minutes. If there is no access to the bank's website, you can go to the operator's official page. Then open the section "Payment for services" and specify all the necessary information.

Telebank: registration

Internet banking - one one of the most convenient ways to carry out all financial bank card transactions. Therefore, VTB clients are trying to get access to Telebank. But in order to use this service, you first need to contact the nearest bank branch and get a login with a password.

You can do this immediately when issuing a card. Next, you just need to register on the site using the data received. After logging into your account, you can change the necessary profile settings, specify the details of your cards, and much more.

Use of ATMs and terminals

Replenishment with a VTB24 card is possible without the Internet. For example, you can use a VTB ATM for this. This method has many advantages. To pay for mobile wow connection from the card through an ATM, you must:

- Find the right device. VTB ATMs can be found even in a small village.

- Next, you need to insert the plastic and enter your pin code.

- A menu will open where you need to select the "Payment for communication services" section.

- You must specify the standard payment details.

- Enter the confirmation code that will come via SMS.

- Press the "Pay" button.

- Take your card and receipt.

Money is credited to the recipient's balance almost immediately.

How to replenish the balance of the phone from the VTB 24 card through the phone

Another way to make a transfer is the VTB24 client phone. You need to download and install a special application, and you will also need access to the Internet. In extreme cases, you can go through the smartphone browser, but using the application to carry out financial transactions is much more convenient.

The algorithm of actions is approximately the same as when translating on the site. You need to log in to the application, and then fill out a standard form. It also indicates the mobile phone number, amount and credit card from which the funds should be transferred.

Help: the only difference is that you don't need to enter a verification code.

How to top up a phone account from a VTB 24 card via SMS

If you do not have access to the Internet and the ability to use an ATM to pay, you can top up your phone using SMS. But VTB24 does not provide such a service as some other banks. For example, in Sberbank, you can transfer money from a bank card to a phone using number 900. To pay a phone bill from a VTB24 card via SMS, you need:

- A Megafon subscriber needs to send a message to 2269.

- MTS user - to number 2222.

- Beeline subscriber must send SMS to 2689.

In the response message, you will receive instructions that must be followed to replenish.

How to top up a VTB 24 card from a VTB 24 card

A VTB24 client can fully manage his money on a card account, including transferring it to other users. The bank provides several ways to make such a transfer:

- bank branch;

- Internet banking.

Becoming a payer is very easy. You just need to visit the nearest VTB24 branch and do the following:

- Provide the cashier with personal documents. It is advisable to bring your passport with you. Also, the sender must have a bank card with him.

- Fill out an application. The full name of the recipient, his bank details and his personal data are indicated.

- The document, along with your credit card, must be given to the cashier.

After that, the funds are credited. The main thing is that the sender must provide accurate information, otherwise the payment will either be rejected, or the money will go to an outsider. As for the term for crediting money, they arrive at the recipient's account a few minutes after sending. There is no limit for ruble transfers, and the commission will be 1% of the amount.

If the user has access to the Internet, then the procedure for sending funds can be simplified. For this you need:

- Go to the Telebank website and go to your Personal Account.

- Select the appropriate section (“Transfer to card”).

- Fill out the provided form. The information is standard - full name of the recipient, his card number, amount.

- Confirm transaction. To do this, the bank specifically sends an SMS with a code. It should be entered in the appropriate window.

- After that, the transaction is carried out.

Money, as usual, is credited quickly. But do not forget, the bank reserves the right to carry out financial transactions within 3 working days. The commission in this case will be 0.1% of the transferred amount. There is no limit for paying an invoice in rubles, but for a currency transaction it is 5,000 euros or dollars.

Other ways to replenish the card

The VTB24 card can be replenished very easily using electronic payment systems. It can be Qiwi, WebMoney or Yandex. Money. Payment for all services is approximately the same:

- First you need to log in to the site.

- Then you need to open the corresponding section. For example, "Transfer to card".

- Fill out the form with payment details. If the card is linked to the wallet, then you will only need to enter the amount.

- You need to confirm the transaction.

Each payment system has its own commission, the amount of which depends on the transfer method, card and other transaction conditions.

Advantages of the VTB24 card

Bank customers always take into account all the advantages and disadvantages of their financial institution. The advantages of VTB payment cards (for example, MIR) can be called:

- no commission when withdrawing or replenishing through an ATM;

- owners can participate in various bonus programs;

- maintenance of payroll cards is undertaken by the employer;

- commission is not charged even for intrabank transfers;

- you can bind to plastic not only a ruble, but also a foreign currency account;

- You can pay by card in stores.

Transferring money from a VTB card, like from any other credit card, is easy. If necessary, you can top up your phone account, and the operator does not matter. If you need to send a certain amount to another user's card, the client should not have any problems with this.

It is very convenient to pay for services, purchases, obligations with a bank card. A plastic carrier issued by a reliable bank allows the holder to concentrate financial resources and minimize the need for cash for everyday settlements. An essential nuance is that there should always be money on the card. Otherwise, its intended use will be very problematic. It is noteworthy that many citizens of the Russian Federation use the card instruments of VTB Bank - both debit and credit. Clients of this institution often need to credit their own funds to the card. The question is how to replenish the VTB 24 card. There are several available ways to solve this simple task - both free and with the payment of the prescribed commission.

How to choose the right method of replenishing a bank card

The practice of VTB Bank has developed a number of options for replenishing cards of its own issue:

- payment through the cash desk of the institution;

- depositing cash using an ATM that supports the option of accepting paper banknotes;

- money transfer from a card carrier issued by another bank;

- online banking;

- transfers from electronic wallets via the Internet;

- through a special application for cell phones (smartphones);

- money transfer through the Golden Crown - a system of remote payments;

- remote transfer of funds through the payment service Contact (Contact);

- replenishment through the provider (operator) of mobile communications.

You can replenish the VTB 24 card in different ways

The client has the right to choose any method of replenishing the VTB card from the above options. Bank plastic holders in this case are guided by considerations of convenience, accessibility, profitability, efficiency, and also the speed of receipt of funds sent. A separate issue is the replenishment of the VTB 24 card without commission. You can transfer funds to the plastic carrier of this bank free of charge using one of the following methods:

- visit the office of the issuing institution (VTB) and make a cash payment through its cash desk;

- use any VTB ATM located within walking distance;

- transfer money through VTB online banking or using a mobile application specially developed by the issuing bank.

Other options for replenishing a VTB card, including ATMs and cards of other financial institutions, involve charging a set commission from the payer. Paid methods of transferring funds to a bank card can also be considered by the owner of the plastic. The choice of the preferred method will depend on the client's priorities and specific circumstances. It also happens that the use of a certain method is a forced step (for example, in a situation where there is not much choice).

Crediting funds to payment plastic through a VTB ATM

Practice shows that many VTB customers prefer to replenish their card account balance through ATMs of this financial institution. This approach can be considered the most appropriate for the following reasons:

- The ATM network of this bank is very extensive. It will not be difficult for the client to find a similar device that provides the option of accepting cash.

- The commission for transferring funds in this way is not charged from the payer.

- The method is very easy to use, intuitive, convenient. Its implementation does not require much time. Menu prompts on the screen of the device will effectively help inexperienced users to cope with this task.

You can top up the card without commission through a VTB ATM

How to top up a VTB card through an ATM of the issuing institution? The procedure is performed in this order:

- Find a suitable device operating in the system of the desired bank. The equipment must accept paper money.

- Check if the ATM you are using is working properly.

- Place the plastic media to be replenished into the machine's slot (for cards).

- Log in with a secret PIN.

- In the menu that appears on the screen, select the option of accepting cash.

- Enter the required amount into the ATM slot designed to accept paper bills.

- Confirm intention. Take from the machine a check certifying the fact of depositing money on the card.

Funds will be credited to the card balance within 5-7 minutes. Sometimes the process can take up to two or three business days.

Replenishment of the card through the online banking of the issuing institution

Replenishment of payment plastic via the Internet is a modern and very convenient option for users who have a computer or, alternatively, a mobile phone. The VTB online banking service allows you to conduct a variety of card transactions using an Internet connection.

Only current consumers of the services of this bank can transfer money to a VTB card using online banking.

To become such a client and connect to the Internet bank, a citizen must apply to the office of a financial institution with a corresponding application and present a passport.

You can top up your card via internet banking.

If the cardholder already has access to VTB online banking, he should implement the following algorithm:

- Visit your personal account on the relevant website.

- Log in to the online banking system by entering the necessary identifiers (personal login, secret password).

- Go to the section for managing your own accounts.

- Select the card from which the funds will be transferred.

- Specify the plastic carrier to be replenished (the card to which the money will be transferred).

- Indicate the amount of replenishment (transfer).

- Confirm transaction.

After a while, you should make sure that money is debited and credited by checking the balances of your own cards. Usually, funds are received from another card within two to three hours, or, alternatively, the next day. The commission from the paying client is not charged by the financial institution - the issuer of the replenished plastic.

Money transfer through the cash desk at any office of the issuing bank

This option is considered conservative, time-consuming, but very reliable. You can use the services of the cash desk at the VTB office to replenish the card of this bank. However, this will be advisable only if other methods of crediting funds are not suitable for the client for one reason or another. As you know, long queues at bank branches sometimes take too much time. This circumstance often rejects customers. A favorable moment is the absence of a commission for the bank to perform this operation.

Replenishment of the balance of a personal plastic card using a cash desk in the office of the issuing bank is carried out as follows:

- Contact the operator of the bank cash desk, waiting for your own queue.

- Present your passport (identity card).

- Indicate the amount of crediting, indicate the necessary data (details) of the replenished card.

- Give the money to the bank employee.

- Confirm intention. Get a receipt from the cashier confirming the fact of the transaction.