What is vbv password. Visa VBV Card Security Technology: Verified by Visa

3d secure- protection technology bank payments new generation, using a secure encryption algorithm. In fact, it is an XML protocol for an additional level of security for conducting online payments by credit and debit cards on the site. It was first introduced by such a large payment system as Visa. Often on large Internet sites you can find the logo " Verified by Visa". Subsequently, such large players as joined this technology: American Express, MasterCard, Union Pay, etc. Let's look at what 3d Secure technology is for, how much it costs, and how to connect it for payments at Sberbank.

3-d secure two-factor authentication - an overview

As described above, this is a security protocol for online shopping with online cards. This mechanism is implemented by exchanging data between 4 communication nodes. On the one hand, the client, the cardholder, on the second, the seller of a product or service, on the third, the issuer (Visa or MasterCard), on the fourth, the acquirer is the bank serving the seller. Previously, when buying online with a card, it was not necessary to physically possess it, i.e. the owner could forget her at home. For a successful purchase, it was enough to enter the data (card number and expiration date, CVC or CVV2 code, full name, password. In fact, an attacker, knowing this data, could steal funds. Now, to access your finances, you need another phone.

With the introduction of technology in Sberbank 3d Secure for Visa or secure code for MasterCard, online shopping becomes even more secure. After entering all personal data on the seller's website, there is a redirect to the Sberbank website. At the same time, the 3d-Secure password is sent to the cardholder's phone. In case of successful and timely entry of this password, you are automatically returned to the seller's website and the transaction is approved by the bank and the payment system. Security also lies in the fact that Sberbank employees themselves do not know this 3d secure code. This 6 digit password is generated by the server and has certain period life, after which it becomes invalid.

How to find out if 3d secure technology is connected or not

At the moment, Sberbank, by default, connects all its customers, holders of credit and debit cards, to 3d secure password protection via SMS. This is done to provide increased security when making purchases online. A couple of years ago, you could connect to this two-factor authentication by writing a corresponding application.

Now, when mobile banking is disabled, the 3d secure function is not available. On the web, you can often find mentions that, in order to receive one-time passwords for payment, you can request them at an ATM by printing a check. To date, this service is no longer available to users. The only one best option is a connection mobile bank(full or economy package). The only difference between the economical package is that after payment, there will be no confirmation from the Savings Bank by SMS message.

We connect the full package of mobile banking by phone

- We enter the word "Full" in an SMS message on the phone tied to the card;

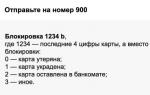

- Sending a message to a number 900 ;

- In response, you will receive an SMS with the content “To change the tariff plan to “Full” for cards “VISA ####”, send the code “#####”.

- Enter this code from SMS;

- We receive a response SMS with confirmation of the connected service.

Now, when making a payment on the seller's website, secure SMS passwords should come.

Service 3d secure for customers it is completely free, but for Sberbank this mechanism is quite expensive. A lot of money is invested in ensuring the safety of their customers.

How to pay for a product or service: detailed instructions

To pay using 3d-secure you need:

- the presence of a card;

- the seller's website must be connected to the system " Verified by Visa» and/or « MasterCard SecureCode «.

- mobile banking must be active;

- the presence of a phone tied to the card.

So, we go to the seller's website, where we need to make a payment.

Attention!

If there is no connected service Mobile bank”, the “Verified by Visa” authentication method is not available, and the payment may be denied.

Is it possible to disable 3d-secure

Sberbank, like many other large banks, does not allow you to turn off the service of increased protection of funds when paying. It is connected by default to the cardholder. But there are still many sites on the network without 3ds, so you won't receive a security code. Imagine a situation when you make a purchase on the Internet, you only need to enter your card details, amount and password. A fraudster, knowing all this data, will also not be difficult to use them and make a purchase on the Internet or make a transfer. From the point of view of responsibility, the bank in this case fulfilled its obligations to the client. This means that it will be very problematic to return the stolen funds from the Sberbank card.

Are payments 100% secure with two-factor protection?

Of course not. there can be no guarantees here. Technology does not stand still, and users do not always pay due attention to safety when shopping. Passwords and access to mobile may be lost. Also, data can be intercepted over the network. To this end, Sberbank has developed some recommendations to reduce the risk of losing personal finances.

- The client needs to keep his personal information secret;

- Do not save passwords, credit card numbers on websites when buying;

- It is advisable to set limits on debit transactions in Sberbank online;

- The phone tied to the card must also be kept in a safe place, once again do not transmit the number in messages and on websites;

- Enable phone auto-lock;

- It is advisable to frequently change the PIN code for the card and for personal account Sberbank Online";

- When personal data is compromised, it is necessary to block a credit card, change passwords, call the Sberbank support service for security advice.

Video: Online Payment Security Basics

About the existence of 3d-secure - new technology for extra protection bank cards- many have heard, but not everyone understands what it is and how it works. Previously, it was possible to connect 3d-secure to a Sberbank card by submitting a corresponding application at the branch. To date, almost all card products from the "classic" level are equipped with this technology. The service is provided free of charge.

Page content

What is 3d-secure technology

This is an additional data protection measure that is applied when making transactions via the Internet, for example, through a service or directly on the store's website. Usually, when paying for a purchase or service in an online store, to make a payment, you need to specify the card number, its expiration date and code. If it is protected by the 3d-secure system, one step is added to provide additional protection. Namely, after entering the basic data, the system automatically directs you to the Sberbank website, where you will need to enter a one-time code, which, in theory, only you should have access to. Then identification takes place, payment passes, and you are returned to the seller's website.

The meaning of this technology is that only the cardholder has access to the requested one-time code, and the code is valid for only 10 minutes. Usually a secret cipher, consisting of 6 digits, comes to the phone number that is tied to your plastic. That's why, this service relevant at .

IMPORTANT: if , a message with the code will come, but there will be no notification of the outcome of the payment (whether the money was debited from the account or not).

For a bank, the implementation of such a system costs big money, for trading floors too. Although 3d-secure is not mandatory, many online merchants connect this service to their platform to enhance the protection of buyers from fraudsters.

The technology was originally developed for payment system Visa, was called Verified by Visa. Later it was introduced into the Mastercard system. It is called 3D, because financial authorization when paying takes place using three domains - an acquirer (serving bank of the store), an issuer (this is already your bank) and a payment system domain (visa, mastercard).

IMPORTANT: they write erroneous information on the Internet that you can get one-time passwords at an ATM in the form of a printed receipt. To date, Sberbank has abandoned such codes issued by self-service devices.

This system does not guarantee 100% protection Money from fraudulent activities, but still greatly enhances it.

How to connect 3d-secure

Today, the question of how to connect 3d-secure confuses many users. Not in all banks, this function is included in the service package by default, but is connected by the client independently, and, sometimes for additional fee. But in Sberbank, all cards (except for the initial types) have built-in technology, the service is enabled by default for free, it does not need to be activated and any additional actions should be performed. When making a transaction over the Internet, whether it is buying a dress or replenishing a phone account, authentication occurs automatically.

If you received a card a long time ago and the technology does not work, in order to activate the service, you need to come to the Sberbank branch and write a corresponding application.

IMPORTANT: To check if 3d-secure works on the map, try swiping online operation through the Internet. For example, you can pay for a phone or some small purchase on the website of a large well-known store (MTS, M-video, etc.).

How to disable 3d-secure

3d-secure technology is the protection of your funds, and your bank is responsible for its functioning. Therefore, some of them do not allow you to disable this service. Sberbank is one of them. This service is connected and operates absolutely free of charge and protects your money from scammers. There is no point in turning it off.

Poll: Are you satisfied with the quality of services provided by Sberbank in general?

YesNot

There are two systems for additional confirmation of Internet transactions:

- A temporary password of 4 digits comes to the phone, which must be entered in order for the payment to go through. In this case, the responsibility for the protection system lies with trading platform on which the purchase is made.

- A 3d-secure code consisting of 6 digits comes to the phone. In this situation, the bank is responsible for security.

That is why Sberbank will not allow you to disable the service, and employees will actively convince that this technology is implemented for your own protection.

3d-secure technology does not guarantee 100% protection

Remember that for trading resources, the implementation of the system is a paid and not cheap pleasure, so not all of them support it. Payment in an online store using 3d-secure technology will only take place on those platforms that support it. In the rest, you simply either won’t be able to make a purchase with a card (there are such sites), or the payment will go through without an additional authentication step (despite the fact that your plastic supports the technology). And here lies the greatest danger, and opens up real scope for fraudulent activities. The fact is that payment via the Internet takes place using details. Get hold of this data plastic card like the number, expiration date and on its back, not difficult. On sites that do not support security technology, attackers can quite easily make purchases using your card, since there is no additional confirmation of the operation by an SMS code. With the 3d-secure function, such actions become more complicated, since you need a phone number to which an SMS message will be sent.

The 3d-secure technology does not guarantee 100% protection, but increases it many times with a serious approach and careful use of your card. The Sberbank security service recommends that bank card holders take precautionary measures: do not leave your cards unattended, do not give them to strangers, do not conduct payment transactions in dubious Internet resources. Sites that support the 3d-secure function have a special icon, so check the availability of the product before buying it. And make purchases only on trusted marketplaces.In order to ensure the safety of the cash transactions in Internet, international organizations developed special security technologies 3D-Secure. They enable customers to receive the SecureCode of Sberbank. These include MasterCard SecureCode and Verified by Visa - these systems are successfully used in Sberbank products.

The code from MasterCard should be connected to protect the funds on the card

The code from MasterCard should be connected to protect the funds on the card Fraud protection is a specially received code on the card, with which the client can make payments online. MasterCard SecureCode to Sberbank, how to get which we will consider below. First of all, you need to know that the code represents a digital combination, which is formed individually for each card. With its help, the client confirms the withdrawal (transfer, payment) of money from his account.

What is it for and why is it not suitable to use a pin code for such operations? Fraudsters can read the PIN code from a magnetic tape, peep when entering numbers at an ATM, or get it in another way. SecureCode, on the other hand, the client connects to his card on his own and, subject to security measures, fraudsters will not be able to access it. These measures include:

- do not disclose the code to outsiders;

- do not enter the code on forms or forms on the websites of unknown persons or companies;

- enter a secret combination only in the corresponding column and only for the payment confirmation function;

- do not buy goods online from little-known or new organizations;

- do not respond to letters even from well-known online stores that ask you to provide your bank details and code (scammers often use this method).

How to get a SecureCode at Sberbank?

The technology provides additional protection when making online payments using bank card

The technology provides additional protection when making online payments using bank card

There are several options for activating the system: online, at an ATM, directly at the bank.

You can activate the card protection system online in the Internet Bank. To do this, using your password, you need to log into the Internet Bank. Then do the following:

- Go to the "Maps" section.

- Select "Internet Security".

- From the list of your cards, select the one for which you want to activate the service, click the "Activation" button.

- Fill out the form, enter the invented password (you will need to repeat it to avoid errors), as well as additional security measures: a personal message (will be shown when making purchases at the time of confirmation of the operation), a secret question (select from the list) and an answer to it (think up).

- Check and save all the entered data, click the "Continue" button.

- Wait for the key to be received, use it to confirm the connection.

- Click the "Submit to Bank" button.

You can use the service after permission from the bank. You can find out the status of the service in the "Archive of applications" section. In the "Cards" subsection on this application, the "Completed" icon will appear.

The procedure for an ATM is similar to the procedure for connecting via the Internet. You must also select the appropriate sections, enter your pin code and fill out an application with passwords and security codes. After sending the application, you need to wait for a message with a code that is valid only once to confirm this particular operation. Similarly, you can connect the technology of using one-time codes using the terminal.

To connect SecureCode at Sberbank, you will need to visit its branch. You need to have a card with you, which requires the installation of a security system. The employee will perform all the necessary actions and issue a code.

Another opportunity offered by the bank is the Contact Center 8 800 555 55 00. The number provides free service. The Client needs to inform the Center's specialist of his wish to use additional protection using one-time passwords for MasterCard cards. The operator will need to provide card details: number, cvc2 or cvv2 code, expiration date. Perhaps the employee may need a secret question and answer that the client entered when concluding an agreement to open a card product. But a pin code or other secret information is not required for the procedure.

How to use SecureCode Sberbank?

Payment systems strive to secure customer funds on their cards from criminal actions of fraudsters

Payment systems strive to secure customer funds on their cards from criminal actions of fraudsters To use one-time password technology, you need to make sure that the online store where you make purchases supports it. After placing the selected items in the basket, click "Pay". Then choose use of MasterCard SecureCode, and confirm the operation by entering a secret code. It is recommended that after the transfer of money, check the balance of the card in order to clarify the write-off of the specified amount from the account.

the site is connected to the secure electronic payment system of PrivatBank, which allows you to pay for our services using any Visa and MasterCard cards issued by any foreign banks. The system of secure electronic payments is implemented on the most modern security standard - 3D Secure, which will ensure maximum security of your payments on the Internet.

3D Secure technology is part of the Visa "Verified by Visa" and MasterCard "MAsterCardSecureCode" global programs, the purpose of which is to provide and ensure safe and reliable methods of payment for goods and services on the global Internet.

More than 15 million Visa cardholders worldwide are active users of the Verified by Visa service when shopping online. Today, the 3-D Secure System is supported by more than 40,000 online stores and more than 15,000 banks around the world.

In order to provide our customers with the most advanced elements of online security, we have implemented this standard on our website. Payments by Visa and MasterCard are now as safe as possible!

MasterCard® SecureCode™ - new service MasterCard, which provides additional security when you shop online. In order to use it, you do not need to purchase new card- You can use an existing one. You choose your personal SecureCode, which will be the same for all online stores. Given password gives you additional protection against misuse of your card while shopping online.

Every time you make purchases with your card in online stores participating in the MasterCard SecureCode program, a window automatically appears asking for your personal password, you only need to enter it. This procedure is very similar to entering the PIN code of the card when you want to use it through an ATM. After a few seconds, the issuing bank will confirm your identity, allowing your purchase to be completed in a secure manner.

Verified by Visa- a new service that allows you to make purchases in real time, providing additional security for your transactions. Using a simple verification process, Verified by Visa will verify your identity when you make a purchase at participating online merchants. It is very convenient and you can use your Visa card for this. In addition to all the other benefits - Verified by Visa is very easy to use. You register the card only once and receive your password. Then, when you make purchases at participating online stores, the Verified By Visa dialog box automatically appears. You only need to enter your password and confirm your operation (click "Confirm").

Your identity will be verified and the purchase will be completed securely. To activate this Verified by Visa service for your Visa cards or to get more detailed information contact your bank.

Additional online security for your card

Confidential information about your card number, CVV2/CVC2 code is transmitted by you to the website of the PrivatBank secure electronic payment server/system in encrypted form. The SSL protocol is used for data transfer, so the security of operations is fully guaranteed.

In order to check if the connection is secure, pay attention to the page address, it starts with "https://" (unsecured pages start with "http://").

Help

Maxim Ronshin

Ukrainian startup became a partner in the acceleration program of OTP Group

“We write to them that Ukrainian solutions can drink not only in the markets of Ukraine and the neighboring countries, but also enough innovations to change the world. It became possible for our customers to steal and price our product, as well as for our partners in the incubator, NBU, 1991 Open Data Incubator and MasterCard. The key points, in which we work in the Fintech Master program, we could focus more on the needs of banks and encourage them to develop a new ecosystem and encourage an ecosystem that unites the bank, business and customers”

Quite frequently asked questions

Can I register my own valid Visa card or do I need to apply for a new one?

You have the opportunity to register any Visa card under the Verified by Visa security pool (“Installed by Visa”), if your issuing bank provides such a service. To check if this service is cheap at your issuing bank and activate the card, click here.

Can I register more than one Visa card?

Yes, you can register all your own Visa cards if your issuing bank supports the Verified by Visa service (“Installed by Visa”).

How to register a Visa card?

Press here. in order to go to the website of your issuing bank and find out how to register a card in the Verified by Visa collection (“Installed by Visa”).

We have a non-specialized card with a spouse. How will Verified by Visa work in this case?

The Verified by Visa service is cheap for both of you. Each of you will register and create a personal password. When a Visa card account is registered in the Verified by Visa collection, all cardholders need to register and create personal passwords before making purchases from the Web Stores.

Can I connect a card of a second payment system (not Visa) to the Verified by Visa service (“Installed by Visa”)?

The Verified by Visa service (“Verified by Visa”) is provided only to protect Visa cards.

How is it not too long to wait for the Verified by Visa service to be cheap after I complete my registration?

The service will be cheap after the issuing bank confirms that your registration was successful. At most banks, this happens instantly while you're shopping online, so you can immediately take advantage of the protection provided by Verified by Visa ("Installed by Visa").

How can I use the Verified by Visa service for online purchases after registration is completed?

detailed instructions, how to use Verified by Visa online shopping, cheap at Verified by Visa online shopping demo. You need to have Adobe Flash player installed on your computer to view it.

Do I need to install additional hardware or software on my own computer?

No. Enough for your

the computer was connected to the Internet and any browser was installed on it - for example MSIE. Most web browsers are compatible with Verified by Visa (“Verified by Visa”).

Can I use the Verified by Visa service from any computer?

You can use the Verified by Visa service (“Installed by Visa”) from any computer with Internet access and a browser like MSIE. Most web browsers are compatible with Verified by Visa (“Verified by Visa”).

What is a Personal Assurance Message or Personal Message (confirmation of the user's identity)?

At the time when you activate the Verified by Visa service (“Installed by Visa”), the issuing bank may ask you to verify the identity of the user. When paying online, look for this confirmation: it guarantees that your issuing bank controls your data.

Can I use the Verified by Visa service from an internet-enabled cell phone?

The Verified by Visa service ("Installed by Visa") is available from cell phones with Internet access, but not all banks issuing Visa cards provide it. Please check if your bank provides this service.

Where can I make Verified by Visa purchases?

Look for the Verified by Visa badge on the partner store's website.

How do webshops determine that my card is connected to the Verified by Visa service (“Installed by Visa”)?

Web stores - partners of the program - will automatically detect your Visa card number if it is connected to the Verified by Visa service ("Installed by Visa").

What should I do if I forgot my password?

If you have forgotten your password, please contact your issuing bank's customer support to recover your password.

What should I do if it seemed to me that my password was stolen and a purchase was made using it?

Please contact your Visa card issuer immediately.

Can I use Verified by Visa at webshops that don't support this service?

No. But every day more and more web stores provide the Verified by Visa service (“Installed by Visa”). In the event that the web store where you make purchases does not yet support Verified by Visa ("Installed by Visa"), follow the domestic recommendations for online customers online shopping tips.

Source: www.visa.com.ru

Wie registriere ich mich erstmalig für Verified by Visa?

Fascinating entries:

A selection of articles you might be interested in:

kapitalbank.ru

Visa VBV card security technology: Verified by Visa. Main overview

Verified by Visa ("Verified by Visa") is a service that provides additional security for payments when shopping online, reducing the risk of fraud using credit cards. Verified by Visa is the name of the 3-D Secure technology for Visa cards, which allows you to uniquely identify a bank customer making a payment on the Internet.

This service is completely free and can be easily activated at your bank. Verified by Visa ensures that only you can make online payments with your card.

When making an online payment, the bank verifies the client, i.e. makes sure that the operation is performed by the bank's client, and not by a third party who has gained access to the bank's card. Verification is carried out using one-time SMS passwords.

Verification with one-time password

For the VBV service to work, you need to activate the SMS-banking service. If this service is connected, then it is not required to connect it again.

When paying for goods in online stores that support the VBV program, you must enter the following information about your card:

- serial number;

- its validity period;

- name and surname of the holder (on request);

- CVV2 code (last 3 digits on the back).

All the necessary data to fill out are indicated on the card. Please note that you must enter the details of the card to which you have connected the VBV service.

After filling in the fields correctly, you will be redirected to a specialized section of your bank's website, which will contain the details of the operation. In order to make sure that it is you who is making the purchase, you must enter a dynamic code on the site.

You will receive a dynamic code via SMS from number 900, it should arrive within 1 minute. The message will contain the password, its expiration date, during which it is valid. If you enter it incorrectly or when the code expires, you will be prompted to send SMS again. Please note that the number of incorrectly entered passwords per day cannot exceed 5 times.

If the dynamic password does not arrive or the previous one has expired, click the "send again" button. After that, enter it in the appropriate field. Please note that if you requested a resend several times in a row, then you need to use the last password that came in, as the previous ones automatically become invalid.

Once again, check the details of the upcoming operation, and then enter the received code. If everything is correct, then the authentication has been successfully completed (the purchase is considered to be made by you personally) and you will return back to the website of the online store.

Operations

It is allowed to enter the code on the bank's website only if the connection is transmitted through a secure channel (in the address bar of the browser, there is an icon in the form of a closed green padlock in front of the website name).

On the website of the store, following the results of the operation, it should be indicated that the payment was successful. The purchase cannot be made if there are not enough funds on the card, its validity period has expired, the transaction limit has been reached, etc.

The VBV service provides additional security when shopping at those stores that support this program(Visa logo must be present on the store's website).

If the store does not support VBV technology, then payment will be made without verification. But at the same time, you need to enter the CVV2 code indicated on the back of the bank card. If the store supports VBV, but this service is not activated by you, then making payments is impossible.

cartoved.ru

"Mobile bank - Verified by Visa"

The promotion has expired.

- replenishment of the account of any subscriber mobile communications and payment for cable television services from your phone (the list of organizations to which payments can be made is presented on the website www.sbrf.ru and is constantly updated);

- a new level of security and confidentiality in transactions with bank cards.

To connect to the "Mobile Bank - Verified by Visa" service, you need:

- contact the MegaFon-Moscow network service office (with a passport and a card Visa of Sberbank Russia) to replace the SIM card with an identical, supporting Mobile Banking - Verified by Visa service. SIM card replacement is free.

- activate the "Mobile Bank - Verified by Visa" service in the operational department of the branch of Sberbank of Russia in Moscow, where your Visa card account (with a passport) is maintained or reconnect the existing "Mobile Bank" service to the "Mobile Bank - Verified by Visa" service, by contacting the Help Desk of Sberbank of Russia at 747–37–87 (from 09:00 to 18:00 on weekdays).

Use and cost of the service

Using the service is as easy as before. It is enough to select the "Mobile bank" item in the SIM menu of your mobile phone. The cost of a request via the SIM menu is equal to the cost of sending an SMS message in accordance with your tariff plan. For additional terms of using the service, see the Sberbank of Russia website.

Addresses of MegaFon-Moscow service offices where you can replace the SIM card with a card that supports the Mobile Bank - Verified by Visa service:

- metro station "Barrikadnaya", Novinsky blvd., 31, TDC Novinsky passage, 2nd floor

- m. "Red Gate", Myasnitskaya st., 48.

Addresses of branches of Sberbank of Russia in Moscow, where you can activate the Mobile Bank - Verified by Visa* service:

- Vernadskoe, Nikulinskaya st., 25

- Donskoye, Bolshaya Yakimanka St., 18

- Zelenogradskoye, Zelenograd, Savelkinsky pr-d, 6

- Kyiv, Bryanskaya st., 8

- Krasnopresnenskoe, Nikitsky Boulevard, 10

- Lefortovskoe, Entuziastov sh., 14

- Lublinskoye, Lublinskaya st., 38

- Maryinoroschinskoe, Cherepovetskaya st., 20

- Meshchanskoe, Sretenka st., 17

- Stromynskoye, Preobrazhenskaya sq., 7A, building 1

- Tverskoe, Sushchevskaya st., 20

- Tsaritsynske, Luhanska st., 5

- Central, Bolshaya Andronievskaya st., 6

*Subscribers whose card accounts are maintained in other branches of Sberbank can activate the Mobile Bank service in their branch of Sberbank, and then activate a new version of the service - "Mobile Bank - Verified by Visa" - by phone hotline Sberbank 747-37-87 (from 09:00 to 18:00 on weekdays). Service activation is free of charge.