Asb internet banking personal. User instructions for using the Internet banking system at JSC JSB Belarusbank

Paying a loan from Belarusbank through ERIP is very convenient if you know all the intricacies of this process. This is what we will do in this article. If you completely master this payment method, you will forget about the rest forever!

Many clients, especially those of retirement age, prefer to wait their turn at the cashier window instead of mastering more advanced methods of loan repayment. However, Belarusbank focuses on the preferences of all its customers and offers both standard and innovative payment methods.

- With the help of ERIP.

- Through mobile banking.

- Using the organization's information kiosk.

- Via the phone application.

Thus, you can repay the loan in any way convenient for you. Both in person and remotely. If you are in doubt about which one is more convenient, try them all and decide which one is best for you.

Through a single calculation and information space

Previously, ERIP (the abbreviation in the title) was used to pay for utilities. Therefore, most likely, some have already tried to use this service. But recently, payments for credit services have also come under its influence. We will talk about the loan payment system below. First, you need to register in the BB mobile bank and find the organization’s information kiosk. Then everything is simple:

- log in and find the “Financial Services” section, and then from there go to the “Banks” section;

- register Belarusbank;

- enter the details of the card from which funds will be debited;

- indicate the contract details that the system will require;

- press the “Pay” button.

Important! You can repay the loan not only at Belarusbank, but also at other organizations, which include some Russian banks (VTB, Alfa Bank) and Belarusian ones (Belinvestbank, Belagromprombank, Priorbank and others).

You can also activate the function of remembering the payment type. The system will remember all your details and will fill them in by default during further operations, even through other information kiosks.

Through your personal account

Using online banking is rapidly gaining popularity among people from different countries. There are several reasons for this. Firstly, it saves time, you don’t need to spend it on the road to the branch and standing in line; secondly, you don’t need to adjust to the branch’s opening hours; you can use Internet banking at any time of the day or night; thirdly, you have complete control over your personal account, which eliminates the risk of outsiders interfering in your affairs.

But how to register in the system? You can do this either through a branch employee or online. In the first case, you submit an application, and in return you receive a login and authorization code and a card with passwords for opening or registering your transactions. In the second case, you submit an application remotely and pay for registration in the system. A card with passwords will be sent to the mail at the specified address.

Now that you are an Internet banking user, you can take on the solution of your financial issues. So, how to deposit money on a loan through this service?

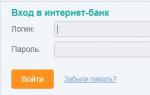

- Sign in. In the login and password fields, enter the data given to you during registration. You don't invent anything yourself!

- Next, find the “Transfers and Payments” section, and in it the “Loan Repayment” subsection.

- Immediately after clicking on the last button, an automatic list will pop up in which you will need to select an organization. In our case, this is Belarusbank.

- If this is your first time performing a transaction, the system will not be able to select a card or account by default, so click “Select the source of funds for the transaction.”

- Accordingly, select the card from which you want to transfer money and fill in the payment details: agreement or personal account number, branch number and the last three digits of your passport number.

Important! Transfers can also be made to branches of other banks (Priorbank, for example), but to do this you also need to know exactly the details of the current account, microfinance organization, agreement and loan number and individual tax code of the organization.

Let's use the information kiosk

The information kiosk is a kind of Belarusbank terminal. Therefore, his work system is the same.

- Identification. Insert your card and enter your PIN. Be extremely careful, as you can make a mistake twice, and on the third the card will be blocked.

- Selecting an operation. Go to the “Payments” section, and from there to the “Loan payment” section. Select an organization from the list.

- Loan information. Here you will need to provide information about the agreement (account number, branch number, last three digits of your passport). In addition, at this stage, you can independently indicate the payment period: current payment, closing the entire debt, or payment for a future period (if it is not possible to pay money for some reason in the future).

- Attention! You will be asked to save the data or not to save. Don't save. It's better to re-enter everything next time than to put your accounts at risk.

- Next, click “Pay” and choose whether to print a check and where to send it.

That's all! Please note that we were talking specifically about payment using a Belarusbank card.

Via smartphone app

The smartphone application is convenient because, firstly, it saves you time, and secondly, it is always at hand. Apart from this, there are some other benefits: the app processes your account transactions faster and you can perform urgent transactions at any time of the day or night.

Let's say you're waiting in a long line and still need to make it to the branch to make your monthly mortgage payment. And the bank is about to close. For such cases, various mobile banking applications have been invented.

Thus, if you have a charged phone at hand, you can always perform some monetary transactions without wasting time and effort. Agree, this is worth a lot. The algorithm of actions in this case is the same as in Internet banking, so we will not describe it in detail again!

Is it possible to pay by installment cards?

Installment cards very quickly began to gain popularity and are still gaining popularity (Magnit, for example). They allow you to make purchases quickly and conveniently and not worry about not having enough money. The above methods of interaction with the bank allow you to make transactions using these cards, for example, pay in installments or top up your account.

In order to use the function, in the section on loan payments, instead of the name of your financial organization, select “Repaying card debt...” or “Replenishing an installment card account.” The following algorithm of actions is familiar to you. Cards that fall under this category also include the Halva card and MTS.

What is the commission

Belarusbank is loyal to its clients, and most of the transactions are carried out without charging a commission. Therefore, you can be sure that any action will be completely free. However, there are some cases where a fee is still charged, and the amount depends on many factors. You can find out more about this on the bank’s website, by phone or at a branch. What are these cases?

- Making a payment without a card using the details.

- Transfer funds from one card to another.

- Request a report on transactions from a bank card.

However, in our article we were talking about closing a loan, and in this case you don’t have to worry about being charged extra money. You will say goodbye only to the amount that will be spent on paying off the debt.

The convenience of using plastic cards has not been disputed by anyone for a long time. The ability to make any banking transaction without leaving the walls of your home is priceless. However, this pricelessness is absolutely conditional: two Belarusian rubles is exactly what the card account owner needs to pay in order to gain access to Internet banking of the largest bank in Belarus. Is it worth it? Decide for yourself. We will tell you in detail about how to log into the Belarusbank Internet banking system and what preferences the use of this service gives the client.

Step 1. Registration in Internet banking

To start using banking, you need to register. This can be done at the moment when you issue a payment card at a branch of the Belarusbank ASB. To do this, you will need to fill out an application for connection - bank employees will give you the necessary login and password to work in the system, as well as a code card, without which you will not be able to get authorized.

If you are already successfully using the bank’s plastic product, then you can connect to Belarusbank’s Internet banking via the Internet. The main convenience of this method is that you do not have to waste time visiting a bank branch. A short instruction on how to do this is presented below.

2. After that, click on the “Online registration” button. We recommend that you carefully read the bank’s message to clients: it contains information about the delivery time of your session code card - up to 10 days, and also states the amount of remuneration to the bank for online registration - 2 Belarusian rubles.

For those who have any questions about this process, we encourage you to download the registration guide or view it online. The screenshot below shows how to access it:

3. After clicking “Continue”, you will be taken to a page with a public offer. This is a routine oral agreement between you and the bank, which methodically describes all the rights and obligations of each party. Please read this document carefully and agree to the terms by clicking on the appropriate button.

4. The next stage is entering personal data. You are required to indicate:

- date of birth;

- citizenship;

- type of identity document, its identification and serial number.

If you are using a document without an identification number for registration, then simply leave this field blank and click “Continue”.

5. On the next page you should enter data for the payment card you want to use. Usually this is a 16-digit card number and its expiration date.

If you have several cards at your disposal at once, you can add them using the “+” button. An important condition for this: the cards must not be blocked by the bank.

6. You are then taken to the customer details page. Double-check the information already saved and add to it. Be sure to add your mailing address: this will be used to deliver the code card required for activation to you. Also include both your mobile and home (if possible) phone number. Feel free to click “Continue” if you are convinced that all fields are filled in correctly.

7. Select a suitable login and check its availability for registration in Internet banking. It can only contain Latin letters and numbers; the allowed special characters are underscore, dot and dash. Length – from 3 to 20 characters.

To move on to the next step you will also need:

- password – from 8 to 12 characters, necessarily with at least one uppercase, lowercase letter and number;

- a secret question and its answer, which are needed if a call center operator needs to unlock an account.

Please note: when selecting a password, you cannot use three identical characters in a row.

If you have completed all this, then click “Register”.

8. You have moved to the page where you can pay for the online registration service for Internet banking “Belarusbank”. Select the card from which the funds will be debited, click “Pay” and wait for confirmation of the success of the transaction.

Step 2. Activate the code card

After receiving the session code card, you need to activate it at the nearest Belarusbank information kiosk.

Everything is very simple here:

- Enter your plastic card PIN code.

- Select the “Service Operations” section, and in it - the “Card Activation” option.

- Select the desired subsection and enter the card number you received - it can be found on the back.

- Finish working with the information kiosk - your code card is activated.

After this, the client can log into his personal online banking account at Belarusbank.

Step 3: Login

All transactions related to your payment cards are managed through your personal account.

In the future, in the settings, you can select the option of logging into the Belarusbank Internet banking system via SMS. It's very simple:

If you enter incorrect data into the login window three times, your work Internet banking account will be blocked. In order to unblock it, you need to call the contact center at number 147. Tell the operator the serial number of your passport, your full name and answer the security question that you chose during registration. After this, your personal account will become available again.

Specialists' duty hours: from 8.30 to 20.00 on weekdays, from 10.00 to 17.00 on weekends.

If you have forgotten your login, you can also clarify it with the call center operator, however, in a similar situation, you can only get a new password to log into the system by personally contacting the nearest bank branch: to do this, you need to fill out a standard application for issuing a new password, and also provide a passport or any other identification document. It is strongly recommended that you change its settings during the first successful authorization.

Do not refresh the browser page used to log into the Internet banking system. In addition, using the return buttons and other tabs will terminate the current session.

Step 4. Study the capabilities of the system

Internet banking from Belarusbank is a powerful modern tool that allows the client to perform all necessary operations with their payment cards and thereby solve the tasks they have set for themselves. For example:

1. Monitor the current balance.

2. Open a deposit account and replenish it regularly.

3. Transfer funds between your cards or from your card to the account of another individual.

4. Pay bills and services on time, repay loans from various banks.

The Internet banking interface is extremely simple:

Home page used as a home page, here you can view all system messages addressed to the client.

Payments and transfers conveniently divided into categories, which allows you to spend a minimum amount of time to pay for telephone, Internet and television, utility bills, etc.

Accounts– all information about open card accounts, managing them and the possibility of opening additional ones, working with securities, creating a custody account and purchasing bank bonds.

payment history– this section stores information about already completed transactions; if necessary, you can send any electronic receipt for printing.

One of the indisputable conveniences of working with the system is the ability to save payments already made.

You can quickly contact them in the future. And if the payment belongs to the category of regular ones - for example, payment for cable TV from your operator, then you can use the services of a scheduler: in this case, the system will remind you of the need to make a payment in accordance with the notes made.

It is very convenient to use Internet banking to pay utility bills. If, for example, you live in Vitebsk and want to pay for hot water, then you just need to go through the ERIP tree to your water utility and enter your personal account number to make the payment.

Save these payments and send them to the main page - this way you have almost instant access to them, which helps save always valuable time.

The same applies to replenishing the balance on your mobile operator account. The path to making a payment will be as follows: PAYMENTS AND TRANSFERS/TELEPHONE/MTS. You can see for yourself how elementary the operation is by carefully examining the screenshots below.

ASB Belarusbank offers clients to use Internet banking and carry out basic banking operations at any time and anywhere using the Internet.

This service allows you to significantly save time searching for the required branch and waiting in line. Let's look at how to create a personal account in Belarusbank and what opportunities it offers.

How to start working in Belarusbank Internet banking?

You can also immediately get to the login and registration page by following the link https://ibank.asb.by. A login window will open in front of you.

A new user should select the Online registration column, read the details of the procedure and click Continue.

After this, the page for concluding an agreement between the bank and the client for the use of Internet banking at JSC JSB Belarusbank will open. Read the document carefully and, if everything is satisfactory, click on the button to agree to the terms of the agreement. A registration page will open in front of you, where you need to fill in the following fields: full name, date of birth, citizenship, type of document, TIN, document number and identity card.

After filling in the information, click Continue. After that, you must pay for the use of Internet banking services using the payment card specified during registration and expect a session code card, which will be delivered to your home address within 10 business days.

Another way to register

It is possible to activate the Internet banking service in another way - contact a bank institution. To do this you need:

- have with you an identity document and a bank payment card;

- make payment for customer service using online banking;

- sign the application;

- get a login, password and session key card to use your personal account;

- activate the card in the information kiosk.

Log in to your Belarusbank personal account

Login to the Internet banking account of ASB Belarusbank is carried out on the same page where registration took place. You must select the Login button and fill in the fields.

Please note that you can enter your Belarusbank personal account using either a code from a code card or a one-time SMS code received on your mobile phone.

Login using MSI data

Belarusbank clients have the opportunity to log into their accounts using the Interbank Identification System data. To do this, select the Login via MSI section and select a convenient method - code from the card or code in an SMS message.

Fill in the required data entered when registering with MSI and click Login.

Account Security

The bank provides increased security when using Internet banking. After entering the password incorrectly three times, the account is blocked. Please note that one minute is allotted for entering the code; if you do not have time to invest this time, the system will also determine this as an unsuccessful attempt to log in.

To unblock, you need to click on “Unblock by SMS” or contact the bank operator for help at number 147. If the entrance to your personal account has been blocked 3 times in a row, you will have to contact the bank branch and fill out an application for unblocking.

To change your password, go to the Personal Settings section and select Password Settings. If you forget your Login, call 147 and provide all the required information to confirm your identity or contact the bank. To recover your password, you must also contact your bank institution. Don't forget to take your documents with you.

What does Balarusbank Internet banking provide?

By activating the service, users have the opportunity to perform the same operations as in a bank branch:

- find out information on accounts, cards, loans and deposits;

- make payments for services: mobile communications, Internet and television, housing and communal services and others;

- repay the loan;

- transfer money;

- place an order for a card;

- receive information about offers and promotions;

- connect and disconnect services;

- replenish deposits;

- view payment history;

- block or unblock a card and more.

How to pay for utilities through Belarusbank online banking?

To pay for services you must:

- pass authorization to enter your personal bank account;

- go to the Payments and transfers section;

- click on Payment system and select New payment;

- enter city, region and district;

- select Utilities and what you want to pay for;

- enter the required payment data;

- click Pay.

Bottom line

By registering for Internet banking from Belarusbank, clients will be able to appreciate the convenience of the service and perform various banking transactions online, without the need to visit the office and adjust to working hours.

Persons who have used lending services in banking organizations should know how to pay for a loan through Belarusbank Internet banking. Currently, the remote payment system has become widespread. With its help you can pay a loan, pay for the Internet, training services, utility bills, etc. Once bank clients learn that payments can be made online, remote servicing begins to be actively used.

Instructions for paying a loan via Internet banking of Belarusbank

Go to the “Payments and Transfers” section.

Select the item “Loan repayment”. In this section, you can pay for a loan from VTB Bank and other organizations through Belarusbank Internet banking.

Find a banking organization in the list provided.

Select the card with which the operation will be performed.

Press the “Continue” button.

Enter the details necessary to complete the transaction. In particular, write off the credit agreement number, the amount to be paid, and the date the loan was issued.

Click "Pay".

Users can pay by making transfers - this is the most convenient option when they have a card with credit status. In this case, you need to select the section through which the transfer is made between the accounts of one person. Here you can find information regarding all banking products, including loans.

Important! All transactions carried out using the Internet banking system are subject to commission payments. Its size is specified in the collection of rules developed by this banking organization.

After you have completed the transaction, the result will be displayed on the screen. It can be saved as an electronic receipt and subsequently printed.

press the “Payment” button;

click on the “ERIP Payments” command;

select the section in which payment transactions of national significance are carried out

Using the considered service provided by Belarusbank, you can make payment transactions for various purposes, not only lending services. This system is reliable. With its help, you can pay not only your bills, but also top up cards belonging to third parties.

Using the considered service provided by Belarusbank, you can make payment transactions for various purposes, not only lending services. This system is reliable. With its help, you can pay not only your bills, but also top up cards belonging to third parties.

The reliability of transactions is ensured due to the fact that the service takes place through secure channels. Secure Socket Layer channels ensure that your personal data is kept safe. In addition, funds in accounts are protected from illegal access by unauthorized persons. Also, the system, which ensures the safety of operations, is equipped with certificates of authenticity, which are presented in digital format. The listed options make it possible to believe that transactions made on the official website of Belarusbank will be safe.

There are many payments available in Internet banking at Belarusbank. This includes payment for home and mobile phones, Internet, utility bills, loans, Magnit cards, transfers to Belarusbank and others.

There are many payments available in Belarusbank banking that can be made from a card through the ERIP system. It all works without commission and has no restrictions on use. You can pay for any service presented in the ERIP lists. Let's figure out how to use this.

The second method of paying for utilities through Belarusbank:

If the default card is not selected, then select which card to pay from. The payer number may not be specified.

“Continue” will later appear in the same window on the Belarusbank website.

By clicking on “Print” you can print the receipt.

By clicking “Finish”, the payment operation ends.

And here is a video instruction on how to pay in Belarusbank banking.

Internet

Don't forget to log in.

The second method of paying for the Internet through Belarusbank:

Further payment steps are similar to those described above for utilities.

The video explains step by step how to pay for byfly internet through Belarusbank banking.

Home and mobile phone

To pay, find “Telephony” in the “Payments and Transfers” tab in your Belarusbank personal account.

Or on the left we open “ERIP System”, and in the tree “Republic-wide”, then “Mobile communications”.

To pay for a home phone, open “Internet, television, telephony”, and then “Beltelecom”.

Video on payment for a home phone in Belarusbank.

Loans and Magnit installment card

Using Internet banking, you can pay for loans from ASB Belarusbank, Delta Bank and repay the debt on the Magnit installment card.

Transfers to Belarusbank

Through Belarusbank banking you can transfer funds:

- To the Belarusbank ASB account of one individual (with or without choice of currency for transfer).

- Top up your deposit account with Belarusbank, Alfa Bank or BelVEB.

- Between Belarusbank cards of different persons (1.5% of the transfer amount).

- As part of the Shchodra club or Magnit installment card.

- To another card from another bank (2.5% of the transfer amount).

There are two ways to make a transfer to Belarusbank.

Other payments

After logging into Belarusbank banking, you can pay:

- School meals.

- Railway tickets for the train from Belzhd.

- Land tax.

- Payment of traffic police fines, state duty for technical inspection.

- Make a random payment (commission 1.8%, min. 0.25 Belarusian rubles).

- Social networks (VK, my world, classmates).

- Online Games.

- Make a Western Union transfer (sending, paying, viewing, withdrawing a transfer or changing data).

- All services provided in the ERIP system.

All of them are presented in the “Payments and Transfers” tab.

It is convenient to use “One-button payment”. You save frequently used payments and use them as a template. You choose the one you need and pay immediately, instead of searching for it again.

To add saved payments to the main page, which opens immediately when you log in to banking, click on the “Favorite payments” link.

Conclusion

Thanks to the ERIP system connected to Belarusbank, many payments are available for payments in banking. Moreover, the system is evolving: payments are added, changed, deleted or combined. Most services in Belarus are paid for through ERIP.